Bitcoin Price Prediction: Corporate Holdings Surpass 1M BTC, Eyeing $124,450 Highs

Corporate Bitcoin Holdings Surpass One Million Milestone

Recently, Bitcoin reached a major milestone: publicly traded companies now collectively hold over 1,000,000 BTC, with a total market value of approximately $111 billion. This milestone further establishes Bitcoin as a corporate reserve asset.

MicroStrategy, led by Michael Saylor, remains the largest corporate holder with 638,460 BTC—far ahead of all competitors. Other leading holders include Marathon Digital Holdings (52,477 BTC), along with emerging players XXI (43,514 BTC) and Bitcoin Standard Treasury (30,021 BTC).

Supply Squeeze Risks Intensify

With just 5.2% of Bitcoin’s total supply left to be mined, heightened corporate demand is intensifying concerns about a potential supply shock. If demand continues to rise, Bitcoin’s price could once again test a new all-time high. Last month, Bitcoin hit an all-time high of $124,450. ETF inflows and increased corporate allocation drove this move.

Global Enterprises Accelerate BTC Adoption

Outside the U.S., more than 120 publicly listed companies now hold BTC worldwide, including in Canada, the United Kingdom, Hong Kong, Mexico, South Africa, and Bahrain. Additionally, Japan’s Metaplanet and U.S.-based Semler Scientific have set notably higher targets. Metaplanet aims to hold 210,000 BTC by 2027, which is 10 times its current holdings. Semler Scientific is targeting 105,000 BTC by 2027, 20 times its present holdings.

Market Divergence and Risk Warnings

Some analysts question the sustainability of the corporate accumulation trend. James Check, an analyst at Glassnode, warns that as the market matures, it will become harder for new corporate entrants to realize easy gains. Matthew Sigel, Head of Digital Asset Research at VanEck, also expressed concerns about some companies’ corporate Bitcoin strategies, cautioning that these financial models may face significant challenges ahead.

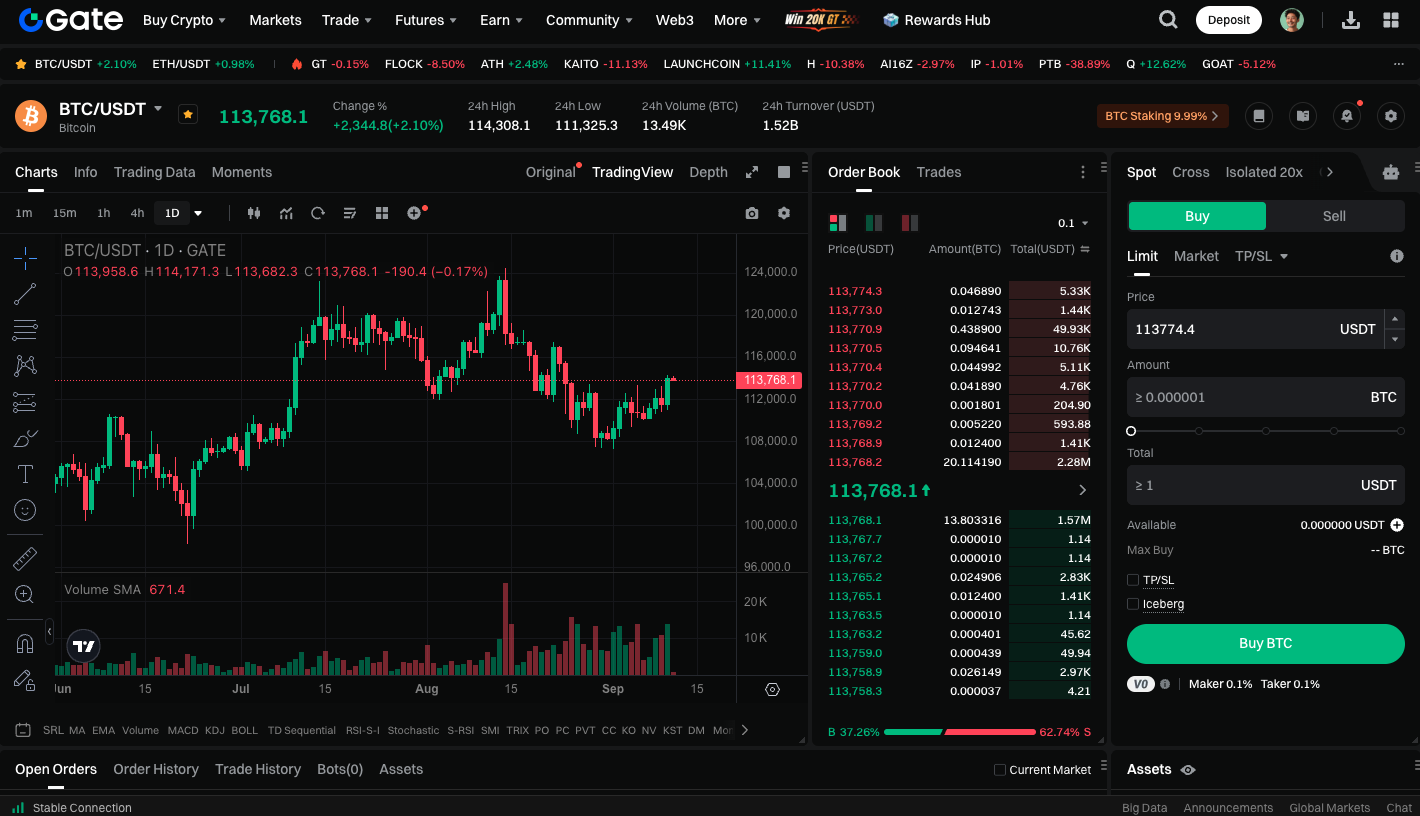

You can access BTC spot trading here: https://www.gate.com/trade/BTC_USDT

Conclusion

Corporate BTC holdings surpassing the one million mark have renewed long-term market confidence. However, as supply becomes scarcer and prices revisit the $124,450 peak, investors should remain alert to underlying risks and possible market overheating.

Related Articles

2025 BTC Price Prediction: BTC Trend Forecast Based on Technical and Macroeconomic Data

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

Pi Coin Transaction Guide: How to Transfer to Gate.com

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

What is N2: An AI-Driven Layer 2 Solution