Bitcoin Price Prediction: BTC Drops Below $100K Amid $797M ETF Outflows but Long-Term Outlook Remains Bullish

Bitcoin ETFs Mark Fifth Straight Day of Outflows

The U.S. market is once again grappling with renewed panic. Data from SoSoValue shows that U.S. spot Bitcoin and Ethereum ETFs recorded a combined net outflow of $797 million on Tuesday—the largest institutional retreat in nearly two months. Spot Bitcoin ETFs led the outflows with $578 million, the highest single-day amount since August 1.

Fidelity’s FBTC saw $357 million exit, Ark & 21Shares’ ARKB shed $128 million, and Grayscale’s GBTC lost $48.9 million. In total, seven Bitcoin funds have posted net outflows for five consecutive days, amounting to $1.9 billion.

Institutional Capital Repositioning

BTC Markets analyst Rachael Lucas emphasized that five days of outflows signal institutional rebalancing rather than a market pause, driven by macroeconomic pressures. She highlighted that Fed Chair Jerome Powell’s hawkish stance last month dashed hopes for a December rate cut, pushing the U.S. Dollar Index (DXY) back above 100 and heightening risk aversion. With tech stocks and crypto closely linked, corrections in the AI sector have further amplified Bitcoin’s volatility.

The Fear & Greed Index plunged to 21 (Extreme Fear) on Tuesday, down from 42 just a day prior. Derek Lim, Head of Research at Caladan, noted that ETF outflows intensified this fear, while escalating U.S. government shutdown risks compounded market uncertainty.

Market Correction Retains Healthy Structure

Despite short-term pressure, Lim maintains that the overall structure reflects a healthy correction. Although postponing rate cuts is a short-term headwind for risk assets, the broader macro outlook remains intact. The market is nearing the end of quantitative tightening (QT), and rate reductions are inevitable. Bitcoin has retraced about 21.5% from its $125,000 peak to $99,000—a moderate pullback compared to the 31% correction in Q1. Lim characterizes this phase as a necessary shakeout.

Short-Term Bitcoin Price Outlook

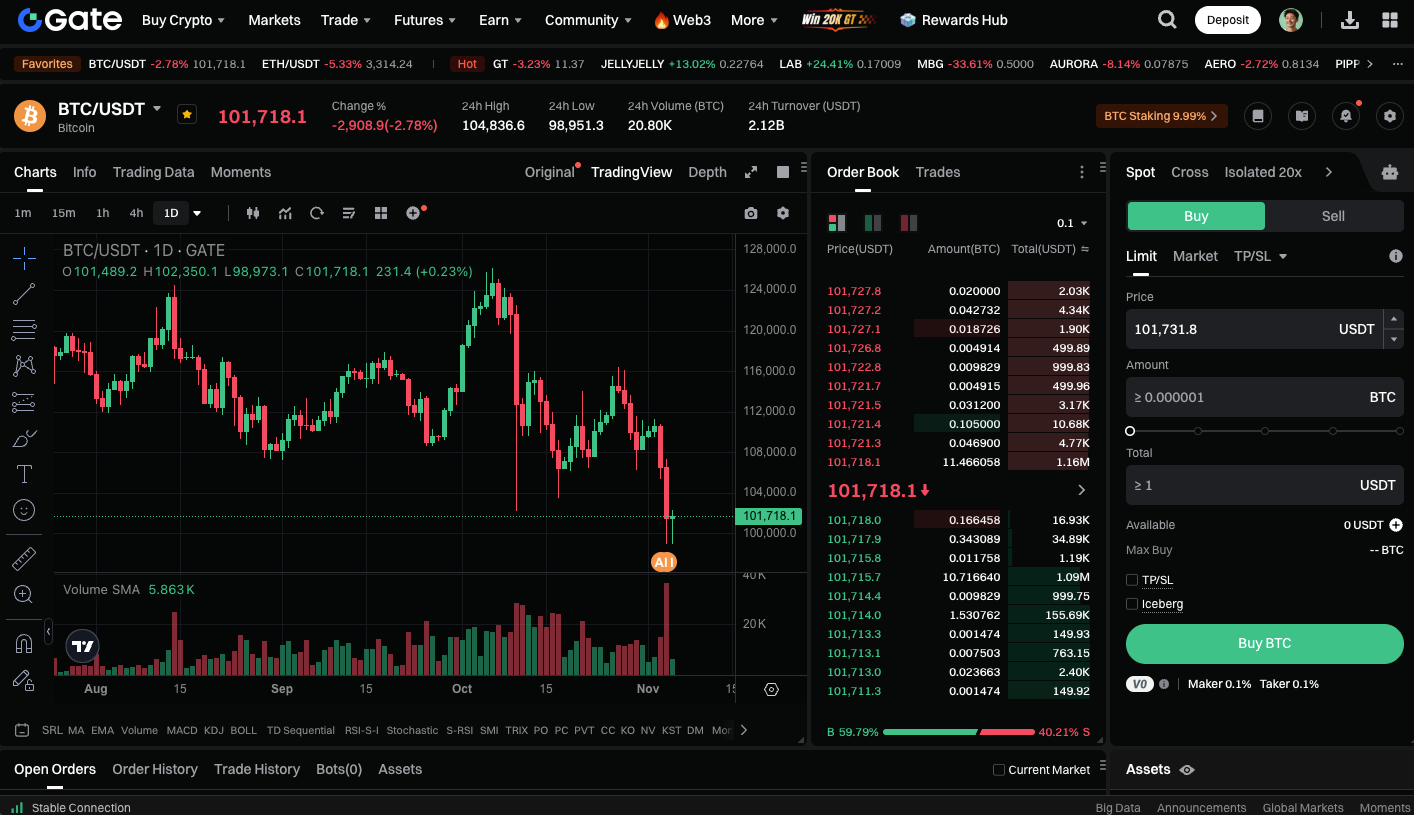

At the time of writing, Bitcoin had dropped roughly 6.5% in the past 24 hours to around $99,000 before rebounding. Technically, if BTC breaks below the $99,000 support again, it could retest the $95,000 zone. A stable base here may pave the way for Bitcoin to challenge the $110,000–$115,000 range as sentiment improves.

Start trading BTC spot instantly: https://www.gate.com/trade/BTC_USDT

Conclusion

This downturn reflects institutional capital rotation and evolving macro policy expectations—not a long-term trend reversal. As the Fed’s monetary stance gradually eases and dollar strength moderates, Bitcoin remains poised to resume its uptrend. For long-term investors, this volatility could present a strategic entry point.

Related Articles

2025 BTC Price Prediction: BTC Trend Forecast Based on Technical and Macroeconomic Data

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

Pi Coin Transaction Guide: How to Transfer to Gate.com

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

What is N2: An AI-Driven Layer 2 Solution