Bitcoin Price Prediction: BTC Could Soar 170% to $305,000 by 2026

Preface

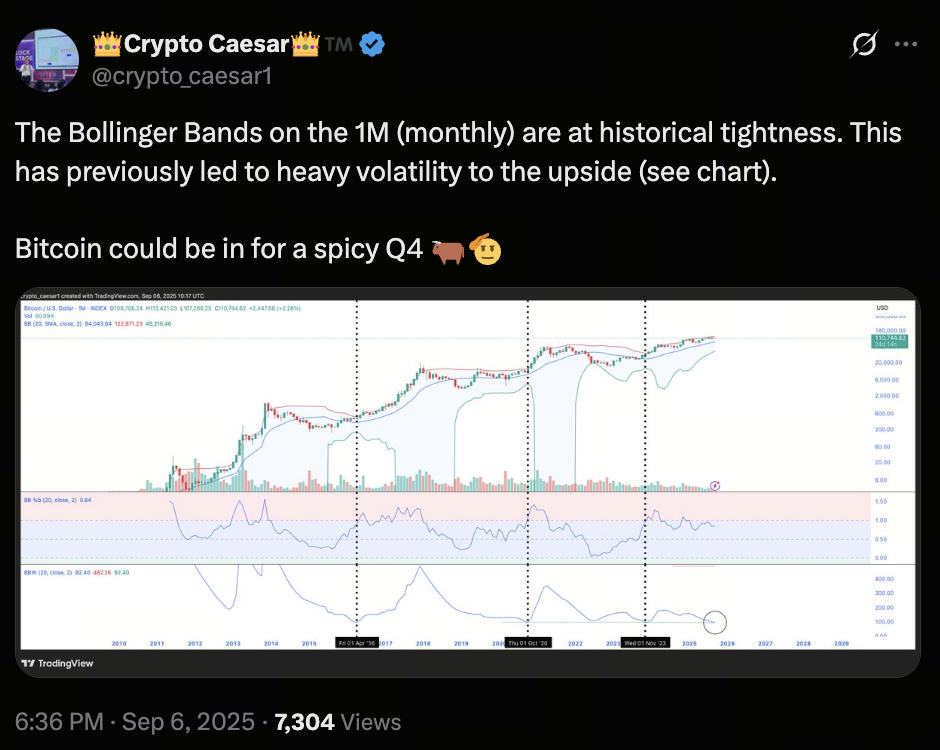

Recently, Bitcoin (BTC) technical indicators have delivered a key signal that the market may be primed for significant volatility. Traders and analysts are closely monitoring changes in the Bollinger Bands, which have now narrowed to their tightest range since 2009—a historic compression that often precedes major price swings.

Bollinger Band Signals

Analyst Matthew Hyland observes that Bitcoin’s monthly Bollinger Bands are showing a level of constriction never seen before. Crypto trader Crypto Ceasar concurs, noting that similar patterns in the past have typically led to dramatic upward moves, with the fourth quarter potentially marking a pivotal turning point for Bitcoin. Previous contractions in 2012, 2016, and 2020 were followed by explosive price rallies. Investor Giannis Andreou adds that today’s Bollinger Band compression is even more pronounced than in prior cycles, indicating the possibility of an unprecedented Bitcoin surge.

(Source: crypto_caesar1)

Technical Pattern

Technically, in November 2024, Bitcoin broke above the $69,000 cup-and-handle breakout point and continues to confirm this breakout. If momentum persists, analysts set a theoretical target at $305,000—a potential gain of more than 170% from current prices. However, not every cup-and-handle pattern reaches its full target. Analyst Thomas Bulkowski’s research shows that about 61% of these patterns ultimately achieve their intended price levels.

ETF Flows and Macro Tailwinds

In addition to technical signals, several fundamental factors are boosting Bitcoin’s bullish prospects:

- Anticipated Federal Reserve rate cuts could spark renewed appetite for risk assets.

- Robust on-chain metrics show sustained buying strength.

- ETF inflows are recovering as spot Bitcoin ETFs draw renewed interest from institutions and corporations. This trend is accelerating capital inflows into the market.

Analytics firm Santiment notes that while retail investors have temporarily stepped back, institutional inflows have surged—historically a precursor to large market moves.

For those interested in trading, BTC spot markets are available at: https://www.gate.com/trade/BTC_USDT

Conclusion

Bitcoin is at a decisive moment, where converging factors—including compressed Bollinger Bands, a cup-and-handle breakout, renewed ETF flows, and supportive macro conditions—are establishing a bullish setup. If these elements align, a BTC rally toward $305,000 between 2025 and 2026 is entirely possible.

Related Articles

2025 BTC Price Prediction: BTC Trend Forecast Based on Technical and Macroeconomic Data

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

Pi Coin Transaction Guide: How to Transfer to Gate.com

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

What is N2: An AI-Driven Layer 2 Solution