A Discounted Cash Flow Valuation of HyperLiquid’s $HYPE

Hyperliquid has matured into a cash-flowing, crypto-native exchange where the majority of net fees are routed programmatically to tokenholders via the Assistance Fund (AF). That design makes $HYPE a rare token you can value on cash flows. To date most Hyperliquid valuations rely on traditional multiples based approaches, comparing the protocol to established financial platforms like Coinbase and Robinhood using EBITDA or revenue multiples.

Unlike traditional corporate equities where management retains and reinvests earnings at their discretion, Hyperliquid systematically returns 93% of trading fees directly to token holders through its Assistance Fund. This creates predictable, quantifiable cash flows that are ideally suited for fine grained discounted cash flow (DCF) analysis rather than static multiple comparisons.

Our approach begins by establishing a cost of capital for $HYPE. We then reverse the current market price to determine what future earnings the market is implicitly pricing in. Finally, we apply growth projections to these earnings streams and compare the resulting intrinsic value to today’s market price, revealing the valuation gap between current pricing and fundamental value.

Why DCF over multiples

While other valuations compare Hyperliquid to Coinbase and Robinhood using EBITDA multiples, these comparisons have limitations:

- Corporate vs. Token Structure: Coinbase and Robinhood are corporate equities with board-directed capital allocation. Their earnings are retained and reinvested at management’s discretion.

- Direct Cash Flows: Hyperliquid systematically returns 93% of trading fees directly to token holders through its Assistance Fund (AF), creating predictable cash flows easily modeled in DCF analysis.

- Growth and Risk Profile: DCF allows us to explicitly model different growth scenarios and risk adjustments rather than relying on static multiples that may not reflect growth and risk dynamics.

Determining the Appropriate Discount Rate

To establish our cost of equity, we start with public market proxies and adjust for crypto-specific risks:

Cost of equity (r) ≈ Risk-free rate + β × Market risk premium + crypto/illiquidity premium

Beta Analysis

Regressions against the S&P 500:

- Robinhood (HOOD): Beta of 2.5, implying 15.6% cost of equity

- Coinbase (COIN): Beta of 2.0, implying 13.6% cost of equity

- Hyperliquid (HYPE): Beta of 1.38, implying 10.5% cost of equity

At first glance, we could say $HYPE has a lower beta and therefore cost of equity than both Robinhood and Coinbase.

However, the R-squared values reveal an important limitation:

- HOOD: 50% of returns explained by S&P 500

- COIN: 34% of returns explained by S&P 500

- HYPE: Only 5% of returns explained by S&P 500

The low R² for HYPE indicates that traditional equity market factors don’t adequately explain its price movements. It requires crypto-native risk factors.

Risk Assessment

Despite HYPE’s lower beta, we bump it from 10.5% to a 13% discount rate (conservative relative to COIN’s 13.6% and HOOD’s 15.6%) based on:

- Lower governance risk: Direct, programmatic distribution of 93% of fees reduces corporate governance concerns. Neither COIN and HOOD are returning any earnings back to shareholders and capital allocation is management directed.

- Higher market risk: Crypto-native asset with additional regulatory and technical uncertainties

- Liquidity considerations: Token markets are generally less liquid than established equities

Getting the Market Implied Price (MIP)

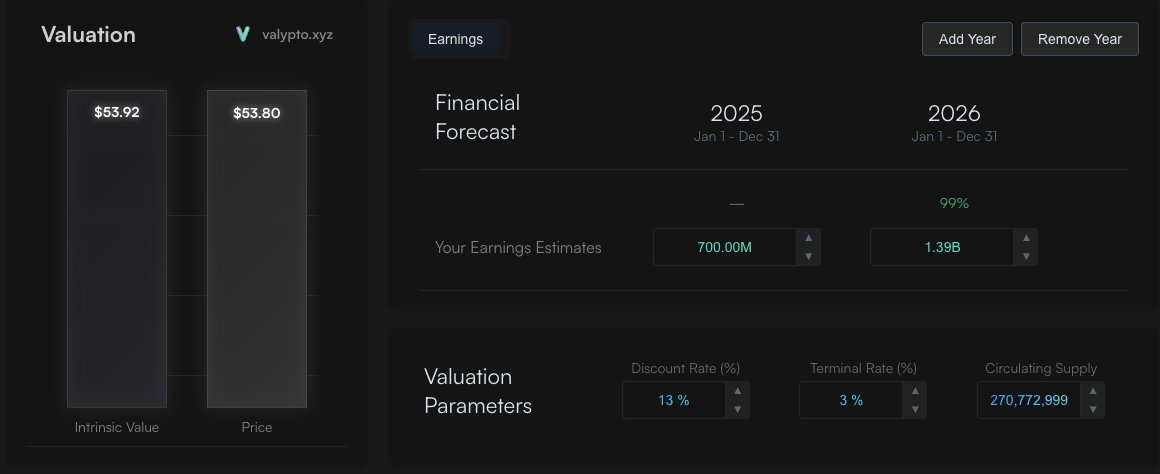

Using our 13% discount rate, we can reverse-engineer what earnings the market is currently pricing in at ~$54 per HYPE token:

Current Market Expectations

- 2025: $700 million in total earnings

- 2026: $1.4 billion in total earnings

- Terminal growth: 3% perpetual growth thereafter

These assumptions yield an intrinsic value of approximately $54, matching current market prices. This suggests the market is pricing in modest growth from current fee levels.

At this point we ask, does the MIP reflect the future cash flows?

Alternative Growth Scenarios

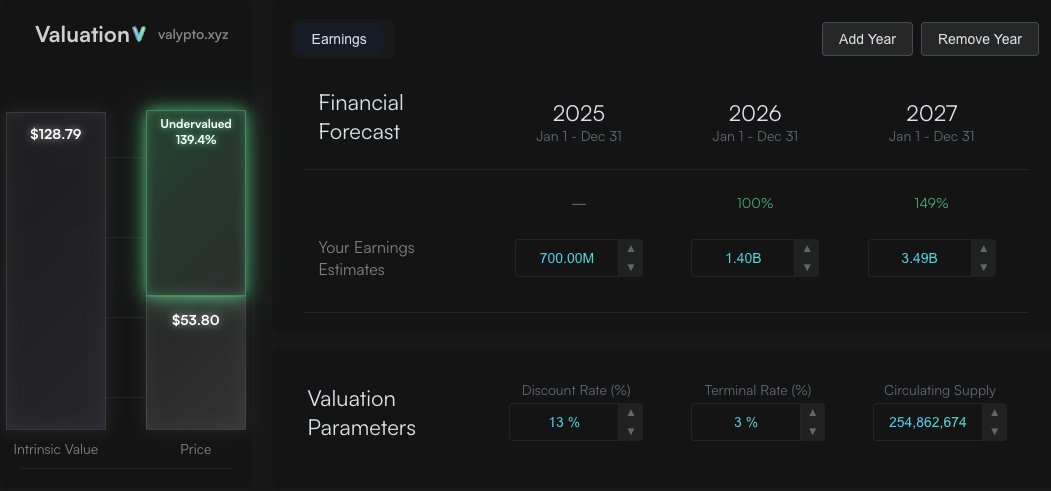

Two-Year Bull Case

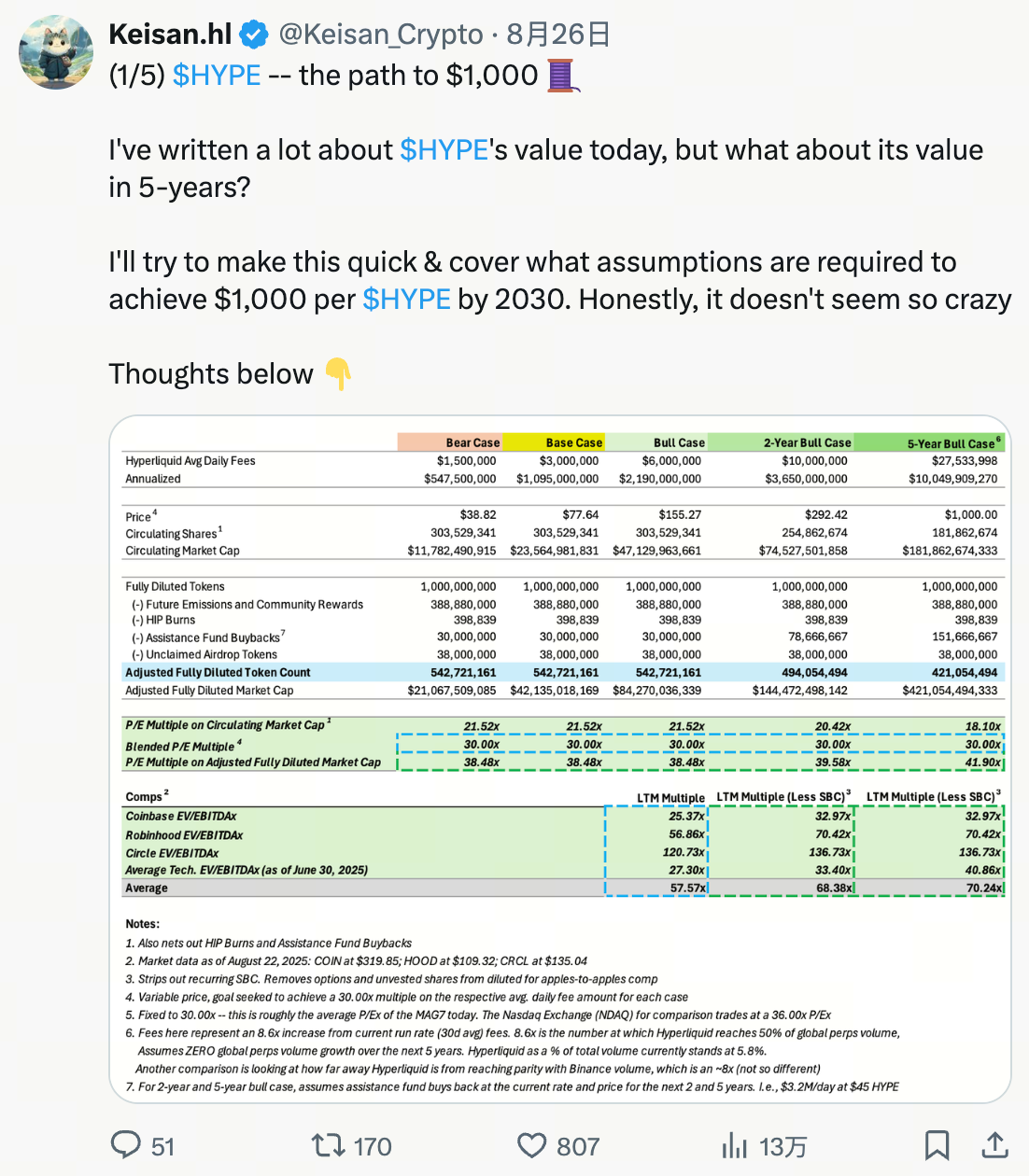

Based on analysis by @ Keisan_Crypto, if Hyperliquid achieves:

- Annualized fees: $3.6 billion

- AF earnings: $3.35 billion (93% of fees)

Result: Intrinsic value of $128 per HYPE (140% undervalued at current prices)

https://valypto.xyz/project/hyperliquid/S4XzHCHE

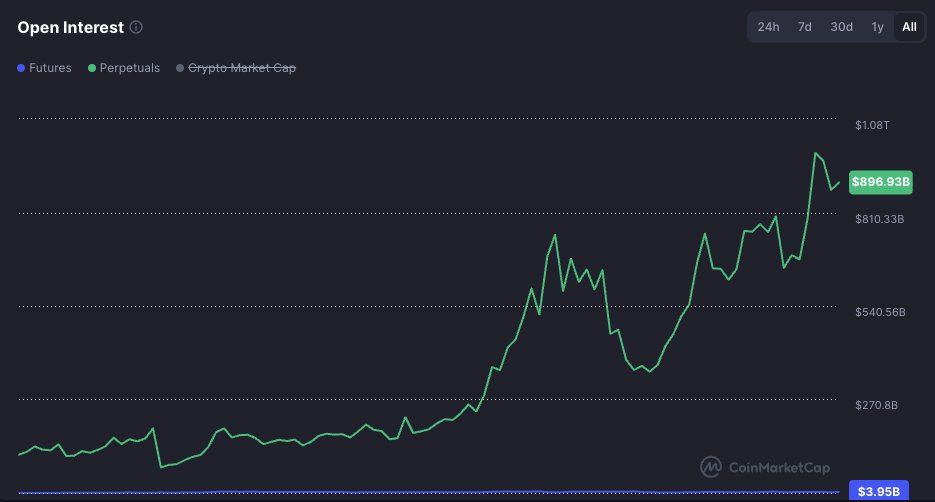

In the 5 year bull case (https://valypto.xyz/project/hyperliquid/GWs1CJpm) he projects fees hitting $10B per year which is $9.3B accrued to $HYPE. He assumes that Hyperliquid will need to reach 50% of global volume by 2030 from it’s current share of 5%. Even if 50% share is not reached these numbers could be achievable at a smaller percentage share of volume if the global volume continues to grow.

Five-Year Bull Case

- Annual fees: $10 billion

- AF earnings: $9.3 billion

Result: Intrinsic value of $385 per HYPE (600% undervalued at current prices)。

https://valypto.xyz/project/hyperliquid/GWs1CJpm

This is less than Keisan’s $1000 target, the difference comes us assuming earnings growth will normalize to 3% each year after while Keisan’s model uses a multiple on cash flow.

The issue we see with using a multiple on cash flows so far out is that market multiples are fickle and are subject to big changes over years. In addition multiples have an assumption of earnings growth in them and using a similar multiple on cash flows 5 years out as 1-2 years out is assuming the same level of growth going forward from 2030 as from 2026/7. For this reason multiples are better suited for pricing assets in near term. That said, in both models $HYPE is still undervalued so this is a bit of splitting hairs.

Additional Value Driver: USDH

Under Native Market’s USDH will direct 50% of the stablecoin’s revenue into assistance fund like buybacks. As a result, $HYPE could see an incremental $100 million per year (50% of $200 million) in free cash flow.

Going out 5 years, if USDH can grow into a market cap of $25 Billion, which is still 1/3rd of USDC today and an even smaller slice of the total stablecoin market size in 5 years, it’s revenue could reach $1 Billion per year, which with the same same 50% allocation model would come out to $500 million per year of additional FCF for the assistance fund. This pushes per token value to above $400.

Excluded Value Drivers: HIP-3 and HyperEVM

This DCF analysis intentionally excludes two significant potential value drivers that are not well suited for cash flow modeling. It goes without saying they will provide additional incremental value, so they can be valued separately using a different method and then summed with this valuation.

Wrapping up

Our DCF analysis suggests $HYPE is significantly undervalued if Hyperliquid can maintain its growth trajectory and market position. The token’s unique characteristic of programmatic fee distribution makes it particularly suitable for cash flow-based valuation methods.

Methodology Notes

This analysis builds on work by @ Keisan_Crypto and @ GLC_Research. The DCF model is open-source and available for modification at https://valypto.xyz/project/hyperliquid/oNQraQIg. Market data and projections are subject to change, and models should be updated as new information becomes available.

Disclaimer:

- This article is reprinted from [RyskyGeronimo]. All copyrights belong to the original author [RyskyGeronimo]. If there are objections to this reprint, please contact the Gate Learn team, and they will handle it promptly.

- Liability Disclaimer: The views and opinions expressed in this article are solely those of the author and do not constitute any investment advice.

- Translations of the article into other languages are done by the Gate Learn team. Unless mentioned, copying, distributing, or plagiarizing the translated articles is prohibited.

Related Articles

Solana Need L2s And Appchains?

The Future of Cross-Chain Bridges: Full-Chain Interoperability Becomes Inevitable, Liquidity Bridges Will Decline

Sui: How are users leveraging its speed, security, & scalability?

Navigating the Zero Knowledge Landscape

What is Tronscan and How Can You Use it in 2025?