Is Novastro (XNL) a good investment?: Analyzing the potential of this crypto asset in the current market

Introduction: Investment Status and Market Prospects of Novastro (XNL)

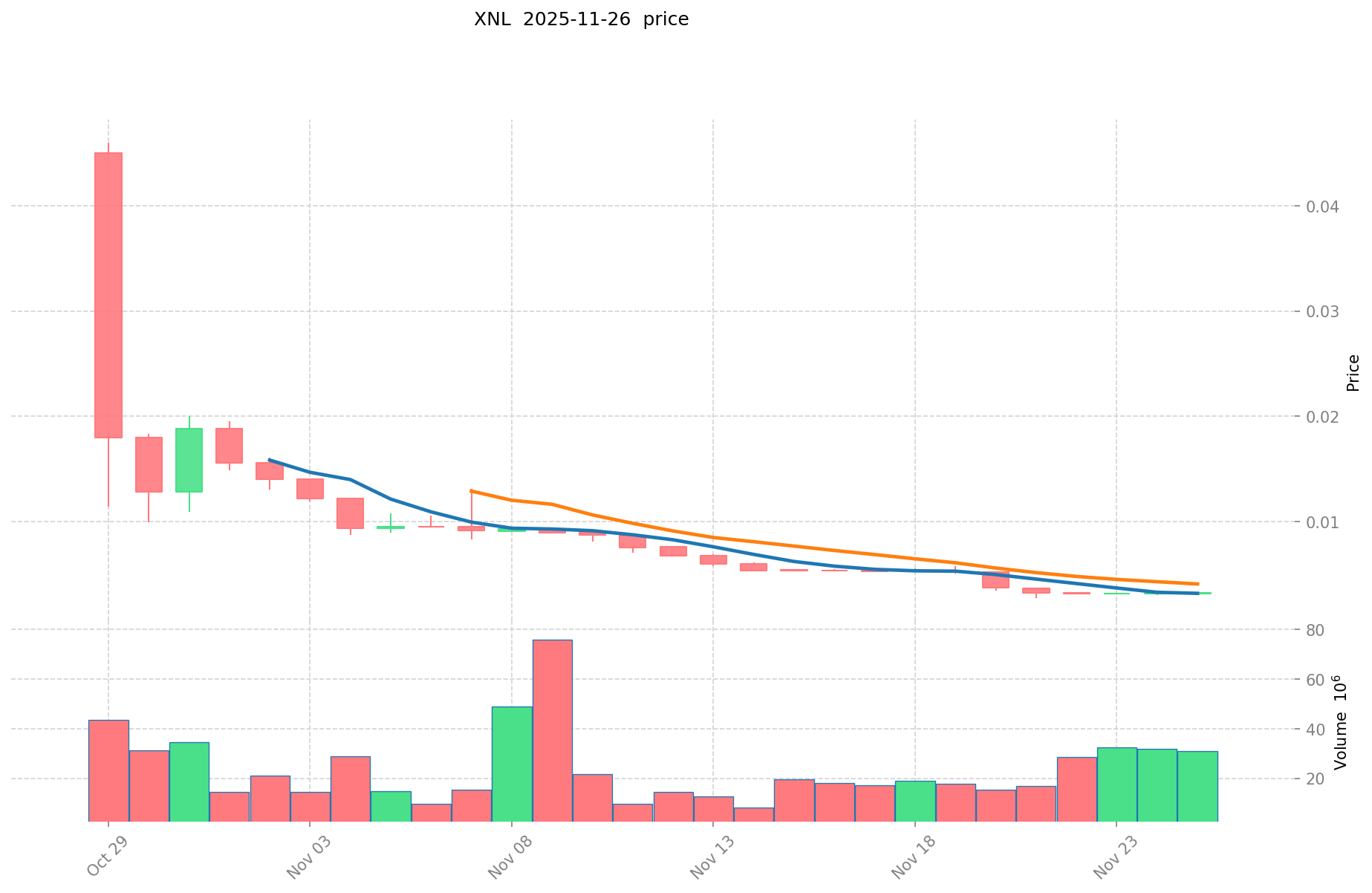

XNL is a significant asset in the cryptocurrency domain, having made notable achievements in the field of Real-World Asset (RWA) tokenization since its inception. As of 2025, Novastro's market capitalization stands at $3,230,000, with a circulating supply of approximately 200,000,020 XNL tokens, and a current price hovering around $0.00323. Positioned as a "cross-chain RWA platform," Novastro is increasingly becoming a focal point for investors pondering, "Is Novastro (XNL) a good investment?" This article will comprehensively analyze Novastro's investment value, historical trends, future price predictions, and investment risks, providing reference for investors.

I. Novastro (XNL) Price History Review and Current Investment Value

XNL Historical Price Trends and Investment Returns (Novastro(XNL) investment performance)

- 2025: Launch → Initial price discovery phase

Current XNL Investment Market Status (November 2025)

- XNL current price: $0.00323

- Market sentiment: Neutral

- 24-hour trading volume: $107,765.33

- Institutional investor holdings: Data not available

Click to view real-time XNL market price

II. Key Factors Affecting Whether Novastro (XNL) is a Good Investment

XNL investment scarcity

- Total supply of 1,000,000,000 XNL with 200,000,020 currently in circulation → Influences price and investment value

- Historical pattern: Supply changes have driven XNL price movements

- Investment significance: Scarcity is key to supporting long-term investment

Institutional investment in XNL

- Institutional holding trend: Data not available

- Adoption by well-known companies → Could enhance investment value

- Impact of national policies on XNL investment prospects

Macroeconomic environment's impact on XNL investment

- Monetary policy and interest rate changes → Alter investment attractiveness

- Hedging role in inflationary environments → Potential "digital gold" positioning

- Geopolitical uncertainties → May increase demand for XNL investment

Technology & Ecosystem for XNL investment

- Cross-chain RWA platform: Enables tokenization of tangible assets → Enhances investment appeal

- AI-powered yield optimization: Dynamically compounds returns → Supports long-term value

- DeFi, NFT, and payment applications driving investment value through real-world asset integration

III. XNL Future Investment Forecast and Price Outlook (Is Novastro(XNL) worth investing in 2025-2030)

Short-term XNL investment outlook (2025)

- Conservative forecast: $0.00256039 - $0.00323

- Neutral forecast: $0.00323 - $0.003241

- Optimistic forecast: $0.003241 - $0.00408366

Mid-term Novastro(XNL) investment forecast (2026-2027)

- Market phase expectation: Gradual growth and stabilization

- Investment return forecast:

- 2026: $0.0023072679 - $0.004028563

- 2027: $0.00284563041 - $0.004652990265

- Key catalysts: Increased adoption of RWA tokenization, AI-driven yield optimization improvements

Long-term investment outlook (Is Novastro a good long-term investment?)

- Base scenario: $0.004504001516714 - $0.006868602312989 (Assuming steady growth in RWA tokenization market)

- Optimistic scenario: $0.006868602312989 - $0.008 (Widespread adoption of Novastro's cross-chain RWA platform)

- Risk scenario: $0.00256039 - $0.004504001516714 (Regulatory challenges or competition in the RWA space)

Click to view XNL long-term investment and price prediction: Price Prediction

2025-11-26 - 2030 Long-term Outlook

- Base scenario: $0.004504001516714 - $0.006868602312989 (Corresponding to steady progress and gradual improvement in mainstream applications)

- Optimistic scenario: $0.006868602312989 - $0.008 (Corresponding to large-scale adoption and favorable market conditions)

- Transformative scenario: Above $0.008 (In case of breakthrough progress in the ecosystem and mainstream popularization)

- 2030-12-31 Predicted high: $0.006868602312989 (Based on optimistic development assumptions)

Disclaimer

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00408366 | 0.003241 | 0.00256039 | 0 |

| 2026 | 0.004028563 | 0.00366233 | 0.0023072679 | 13 |

| 2027 | 0.004652990265 | 0.0038454465 | 0.00284563041 | 19 |

| 2028 | 0.00603389010315 | 0.0042492183825 | 0.0028894685001 | 31 |

| 2029 | 0.006118449548961 | 0.005141554242825 | 0.003136348088123 | 59 |

| 2030 | 0.006868602312989 | 0.005630001895893 | 0.004504001516714 | 74 |

IV. How to invest in Novastro (XNL)

Novastro (XNL) investment strategy

- Long-term holding (HODL XNL): Suitable for conservative investors

- Active trading: Relies on technical analysis and swing trading

Risk management for Novastro (XNL) investment

- Asset allocation ratio: Conservative / Aggressive / Professional investors

- Risk hedging strategies: Multi-asset portfolio + hedging tools

- Secure storage: Hot and cold wallets + recommended hardware wallets

V. Risks of investing in Novastro (XNL)

- Market risks: High volatility, price manipulation

- Regulatory risks: Policy uncertainties in different countries

- Technical risks: Network security vulnerabilities, upgrade failures

VI. Conclusion: Is Novastro (XNL) a Good Investment?

- Investment value summary: Novastro (XNL) shows significant long-term investment potential, but experiences severe short-term price fluctuations.

- Investor recommendations: ✅ Beginners: Dollar-cost averaging + secure wallet storage ✅ Experienced investors: Swing trading + portfolio allocation ✅ Institutional investors: Strategic long-term allocation

⚠️ Note: Cryptocurrency investment carries high risks. This article is for reference only and does not constitute investment advice.

VII. FAQ

Q1: What is Novastro (XNL) and how does it differ from other cryptocurrencies? A: Novastro (XNL) is a cryptocurrency that functions as a cross-chain Real-World Asset (RWA) platform. It differentiates itself by focusing on the tokenization of tangible assets and utilizing AI-powered yield optimization, which sets it apart from many other digital currencies.

Q2: What is the current market status of Novastro (XNL)? A: As of November 2025, Novastro's market capitalization is $3,230,000, with a circulating supply of approximately 200,000,020 XNL tokens. The current price is around $0.00323, and the 24-hour trading volume is $107,765.33.

Q3: What are the key factors affecting Novastro's investment potential? A: The main factors include XNL's scarcity (total supply vs. circulating supply), institutional investment trends, macroeconomic conditions, and the development of Novastro's technology and ecosystem, particularly its cross-chain RWA platform and AI-powered yield optimization.

Q4: What is the long-term price outlook for Novastro (XNL)? A: The long-term outlook for XNL by 2030 ranges from a base scenario of $0.004504001516714 - $0.006868602312989 to an optimistic scenario of $0.006868602312989 - $0.008, with a predicted high of $0.006868602312989 by December 31, 2030.

Q5: How can I invest in Novastro (XNL)? A: You can invest in XNL through long-term holding (HODL) or active trading. Long-term holding is suitable for conservative investors, while active trading relies on technical analysis and swing trading strategies.

Q6: What are the main risks associated with investing in Novastro (XNL)? A: The primary risks include market volatility, potential price manipulation, regulatory uncertainties in different countries, and technical risks such as network security vulnerabilities or upgrade failures.

Q7: Is Novastro (XNL) considered a good investment? A: Novastro shows significant long-term investment potential but experiences severe short-term price fluctuations. It may be suitable for different types of investors, but it's crucial to understand the risks and use appropriate strategies based on your investment experience and risk tolerance.

Share

Content