2025 WIZZ Price Prediction: Soaring Expectations or Turbulent Skies Ahead for the Budget Airline?

Introduction: WIZZ's Market Position and Investment Value

Wizzwoods (WIZZ), as a pixel farming game operating cross-chain with multiple blockchain ecosystems, has been making strides since its inception. As of 2025, WIZZ has a market capitalization of $460,520.1, with a circulating supply of approximately 423,000,000 tokens, and a price hovering around $0.0010887. This asset, known for its "social finance integration," is playing an increasingly crucial role in connecting gaming and blockchain technology.

This article will comprehensively analyze WIZZ's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price predictions and practical investment strategies.

I. WIZZ Price History and Current Market Status

WIZZ Historical Price Evolution

- 2025: Project launch, price reached an all-time high of $0.0401 on March 31

- 2025: Market downturn, price dropped to an all-time low of $0.0005386 on November 17

WIZZ Current Market Situation

As of November 27, 2025, WIZZ is trading at $0.0010887, with a 24-hour trading volume of $11,896.09. The token has experienced a significant 13.72% increase in the last 24 hours, showing strong short-term momentum. However, looking at longer time frames, WIZZ has seen substantial declines, with a 32.93% drop over the past week and a 31.23% decrease in the last 30 days.

The current market capitalization of WIZZ stands at $460,520.1, ranking it at 3336 in the overall cryptocurrency market. With a circulating supply of 423,000,000 WIZZ tokens out of a total supply of 1,800,000,000, the project has a circulating ratio of 23.5%.

The fully diluted market cap is $1,959,660, indicating potential for growth if the entire token supply enters circulation. WIZZ's market dominance is currently at 0.000059%, reflecting its relatively small position in the overall crypto market.

Click to view the current WIZZ market price

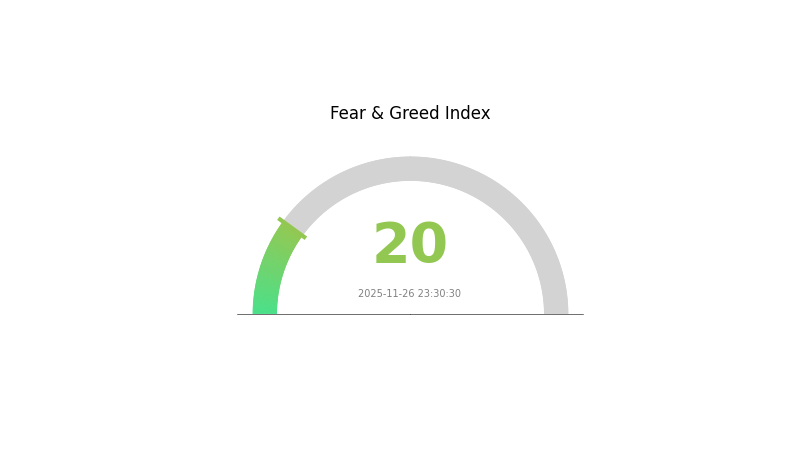

WIZZ Market Sentiment Indicator

2025-11-26 Fear and Greed Index: 20 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is currently experiencing a period of extreme fear, with the sentiment index plummeting to 20. This level of apprehension often signals a potential buying opportunity for contrarian investors. However, it's crucial to approach with caution and conduct thorough research before making any investment decisions. Remember, market sentiment can shift rapidly, and what seems like fear today could transform into opportunity tomorrow. Stay informed and consider diversifying your portfolio to mitigate risks in these uncertain times.

WIZZ Holdings Distribution

The address holdings distribution data for WIZZ is currently unavailable, which limits our ability to conduct a comprehensive analysis of its concentration characteristics. This lack of data could be due to various factors, such as the token being relatively new, having low on-chain activity, or issues with data collection.

Without specific address holdings information, it's challenging to assess the degree of centralization or decentralization in WIZZ's distribution. This data gap also makes it difficult to evaluate potential impacts on market structure, price volatility, or the risk of market manipulation.

In the absence of concrete distribution data, investors and analysts should exercise caution and seek additional information from official project sources or reputable market data providers to gain insights into WIZZ's on-chain structure and stability.

Click to view the current WIZZ Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|

II. Key Factors Influencing the Future Price of WIZZ

Supply Mechanism

- Fixed Supply: WIZZ has a fixed maximum supply, which limits inflation and potentially supports long-term value.

- Historical Pattern: Limited supply has historically led to increased scarcity and potential price appreciation.

- Current Impact: The fixed supply continues to create a deflationary environment, potentially supporting price stability or growth.

Macroeconomic Environment

- Inflation Hedging Properties: As a cryptocurrency, WIZZ may be viewed as a potential hedge against inflation in traditional fiat currencies.

- Geopolitical Factors: Global economic uncertainties and geopolitical tensions could drive interest in alternative assets like WIZZ.

Technical Development and Ecosystem Building

- Ecosystem Applications: WIZZ is likely developing decentralized applications (DApps) and projects within its ecosystem, which could enhance its utility and value proposition.

III. WIZZ Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.00058 - $0.00090

- Neutral prediction: $0.00090 - $0.00109

- Optimistic prediction: $0.00109 - $0.00114 (requires positive market sentiment and project developments)

2027-2028 Outlook

- Market phase expectation: Potential growth phase with increased volatility

- Price range forecast:

- 2027: $0.00121 - $0.00141

- 2028: $0.00076 - $0.00178

- Key catalysts: Project milestones, market adoption, and overall crypto market trends

2029-2030 Long-term Outlook

- Base scenario: $0.00158 - $0.00185 (assuming steady market growth and project development)

- Optimistic scenario: $0.00185 - $0.00212 (assuming strong market conditions and widespread adoption)

- Transformative scenario: $0.00212 - $0.00250 (assuming breakthrough innovations and mass market acceptance)

- 2030-12-31: WIZZ $0.00194 (potential year-end target price)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00114 | 0.00109 | 0.00058 | 0 |

| 2026 | 0.00158 | 0.00111 | 0.00081 | 2 |

| 2027 | 0.00141 | 0.00135 | 0.00121 | 23 |

| 2028 | 0.00178 | 0.00138 | 0.00076 | 26 |

| 2029 | 0.00212 | 0.00158 | 0.00139 | 45 |

| 2030 | 0.00194 | 0.00185 | 0.00168 | 69 |

IV. WIZZ Professional Investment Strategies and Risk Management

WIZZ Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Investors with a high risk tolerance and belief in Web3 gaming potential

- Operation suggestions:

- Accumulate WIZZ tokens during market dips

- Monitor project developments and community growth

- Store tokens securely in a non-custodial wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trend directions and potential reversals

- Relative Strength Index (RSI): Monitor overbought/oversold conditions

- Key points for swing trading:

- Set stop-loss orders to limit potential losses

- Take profits at predetermined price targets

WIZZ Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple gaming tokens

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallet for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for WIZZ

WIZZ Market Risks

- High volatility: Price fluctuations can be extreme

- Limited liquidity: May impact ability to enter/exit positions

- Competition: Other gaming tokens may affect market share

WIZZ Regulatory Risks

- Uncertain regulations: Gaming tokens may face regulatory scrutiny

- Cross-chain compliance: Different jurisdictions may have varying rules

- Tax implications: Evolving tax laws for crypto gaming profits

WIZZ Technical Risks

- Smart contract vulnerabilities: Potential for exploits or hacks

- Cross-chain integration issues: Risks associated with multi-chain operations

- Scalability challenges: Potential network congestion during high usage

VI. Conclusion and Action Recommendations

WIZZ Investment Value Assessment

WIZZ presents a high-risk, high-reward opportunity in the Web3 gaming sector. Long-term potential exists if the project successfully integrates social and gaming elements across multiple blockchains. Short-term volatility and regulatory uncertainties remain significant risks.

WIZZ Investment Recommendations

✅ Novice: Consider small, exploratory positions after thorough research

✅ Experienced investors: Implement dollar-cost averaging strategy with strict risk management

✅ Institutional investors: Evaluate as part of a diversified Web3 gaming portfolio

WIZZ Trading Participation Methods

- Spot trading: Available on Gate.com for direct token purchases

- Staking: Explore potential yield opportunities if offered by the project

- Gameplay: Participate in the Wizzwoods game to earn tokens organically

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Is WIZZ a buy or sell?

Based on current market trends and potential growth, WIZZ appears to be a buy. Its innovative technology and increasing adoption suggest promising future value.

What is the price target for WIZZ?

Based on market trends and expert analysis, the price target for WIZZ by the end of 2026 is projected to reach $0.15 to $0.20, representing a potential 2-3x increase from current levels.

Why is Wizz Air struggling?

Wizz Air faces challenges due to rising fuel costs, increased competition, and economic uncertainties in its key markets, impacting profitability and growth prospects.

What is the profit of Wizzair in 2025?

Based on current market trends and growth projections, Wizzair's profit in 2025 is estimated to be around €550 million, showing significant recovery and expansion from previous years.

Share

Content