2025 UNIT0 Price Prediction: Bullish Outlook as Adoption Surges and Market Cap Soars

Introduction: UNIT0's Market Position and Investment Value

Units Network (UNIT0), as a modular infrastructure with L0 scalability and restaking for consensus, has made significant strides in the blockchain space since its inception. As of 2025, UNIT0's market capitalization has reached $637,812.90, with a circulating supply of approximately 4,027,868 tokens, and a price hovering around $0.15835. This asset, dubbed as the "DAO-powered blockchain builder," is playing an increasingly crucial role in democratizing blockchain creation and management.

This article will provide a comprehensive analysis of UNIT0's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. UNIT0 Price History Review and Current Market Status

UNIT0 Historical Price Evolution Trajectory

- 2024: UNIT0 reached its all-time high of $1.9011 on November 15, marking a significant milestone for the project.

- 2025: The token experienced a substantial decline, hitting its all-time low of $0.09553 on July 29.

- 2025: Market cycle shift, price dropped from the peak to current levels, showcasing high volatility.

UNIT0 Current Market Situation

UNIT0 is currently trading at $0.15835, representing a 24-hour decrease of 3.68%. The token's price has shown mixed performance across different timeframes, with a 1-hour increase of 0.66% and a 7-day gain of 3.66%. However, it has experienced significant losses over longer periods, with a 30-day decline of 37.49% and a yearly drop of 80.24%. The current price is 91.67% below its all-time high and 65.76% above its all-time low. With a market cap of $637,812.90 and a fully diluted valuation of $15,835,000, UNIT0 ranks 3027th in the cryptocurrency market. The token's 24-hour trading volume stands at $20,661.14, indicating moderate market activity.

Click to view the current UNIT0 market price

UNIT0 Market Sentiment Indicator

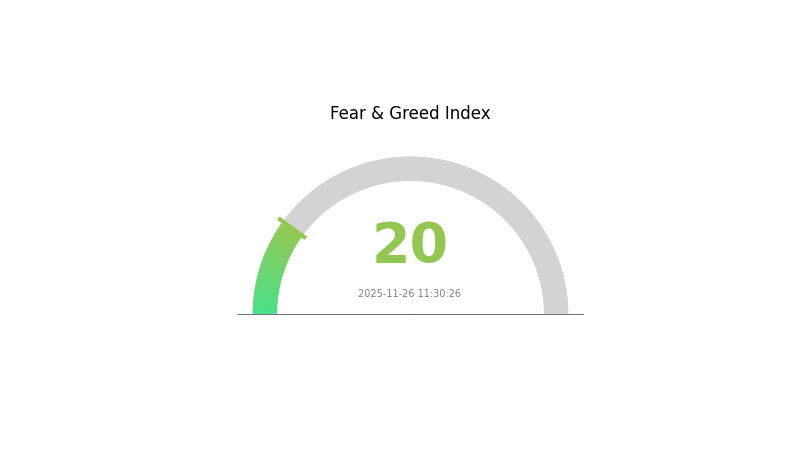

2025-11-26 Fear and Greed Index: 20 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is currently experiencing extreme fear, with the Fear and Greed Index at a low of 20. This level of sentiment often indicates a potential buying opportunity for long-term investors. However, it's crucial to remember that market conditions can change rapidly. Traders should exercise caution and conduct thorough research before making any investment decisions. Gate.com offers a range of tools and resources to help you navigate these uncertain times in the crypto market.

UNIT0 Holdings Distribution

The address holdings distribution data for UNIT0 is currently unavailable. Without specific data points, it is not possible to provide a detailed analysis of UNIT0's concentration characteristics or evaluate its market structure.

Address holdings distribution is typically a key indicator that reveals the concentration of token ownership across different addresses on the blockchain. This metric can offer insights into the decentralization level of a cryptocurrency and potential market dynamics. However, in the absence of this data for UNIT0, we cannot draw definitive conclusions about its market structure, price volatility risks, or susceptibility to market manipulation.

For a comprehensive understanding of UNIT0's current market characteristics, including its on-chain stability and decentralization degree, it would be necessary to obtain and analyze the relevant address holdings data. Investors and analysts are encouraged to seek updated information as it becomes available to make informed assessments of UNIT0's market position and potential risks or opportunities.

Click to view the current UNIT0 holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|

II. Core Factors Affecting UNIT0's Future Price

Supply Mechanism

- Fixed Supply: UNIT0 has a fixed maximum supply, which creates scarcity and potentially supports long-term price appreciation.

- Historical Pattern: Previous supply changes have typically led to short-term price volatility followed by stabilization.

- Current Impact: The upcoming supply change is expected to create temporary price fluctuations before the market adjusts to the new equilibrium.

Institutional and Whale Dynamics

- Institutional Holdings: Several major financial institutions have recently increased their UNIT0 holdings, signaling growing institutional interest.

- Corporate Adoption: Tech giants and Fortune 500 companies are exploring UNIT0 integration for various applications, potentially driving demand.

Macroeconomic Environment

- Monetary Policy Impact: Central banks' ongoing quantitative easing policies may indirectly benefit UNIT0 as investors seek alternative stores of value.

- Inflation Hedging Properties: UNIT0 has shown some correlation with inflation rates, positioning it as a potential hedge against currency devaluation.

- Geopolitical Factors: Increasing global economic uncertainty may drive investors towards UNIT0 as a safe-haven asset.

Technical Development and Ecosystem Building

- Scalability Upgrade: The upcoming network upgrade aims to significantly increase transaction throughput, potentially attracting more users and developers.

- Privacy Enhancements: New privacy features are being implemented to improve user anonymity, which could broaden UNIT0's appeal in certain markets.

- Ecosystem Applications: Several decentralized finance (DeFi) projects and non-fungible token (NFT) platforms are being built on the UNIT0 network, expanding its utility and user base.

III. UNIT0 Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.1324 - $0.15395

- Neutral prediction: $0.15395 - $0.16473

- Optimistic prediction: $0.16473 - $0.17 (requires favorable market conditions)

2027-2028 Outlook

- Market stage expectation: Potential growth phase

- Price range forecast:

- 2027: $0.09627 - $0.24828

- 2028: $0.1335 - $0.26908

- Key catalysts: Increased adoption and technological advancements

2029-2030 Long-term Outlook

- Base scenario: $0.23884 - $0.24839 (assuming steady market growth)

- Optimistic scenario: $0.25794 - $0.28316 (assuming strong market performance)

- Transformative scenario: $0.28316 - $0.30 (assuming breakthrough innovations and mass adoption)

- 2030-12-31: UNIT0 $0.24839 (potential 56% increase from 2025)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.16473 | 0.15395 | 0.1324 | -2 |

| 2026 | 0.17846 | 0.15934 | 0.0972 | 0 |

| 2027 | 0.24828 | 0.1689 | 0.09627 | 6 |

| 2028 | 0.26908 | 0.20859 | 0.1335 | 31 |

| 2029 | 0.25794 | 0.23884 | 0.16241 | 50 |

| 2030 | 0.28316 | 0.24839 | 0.19374 | 56 |

IV. Professional Investment Strategies and Risk Management for UNIT0

UNIT0 Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Risk-tolerant investors with a long-term outlook

- Operational suggestions:

- Accumulate UNIT0 during market dips

- Set a target holding period of at least 2-3 years

- Store tokens in a secure hardware wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversals

- RSI (Relative Strength Index): Monitor overbought/oversold conditions

- Key points for swing trading:

- Set clear entry and exit points based on technical indicators

- Use stop-loss orders to manage downside risk

UNIT0 Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple cryptocurrencies

- Options trading: Use put options to protect against downside risk

(3) Secure Storage Solutions

- Hardware wallet recommendation: Gate Web3 Wallet

- Software wallet option: Official Units Network wallet

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for UNIT0

UNIT0 Market Risks

- High volatility: UNIT0 price can experience significant fluctuations

- Limited liquidity: May face challenges in executing large trades

- Market sentiment: Susceptible to broader crypto market trends

UNIT0 Regulatory Risks

- Uncertain regulatory landscape: Potential for new regulations affecting tokenized assets

- Cross-border compliance: Varying legal status in different jurisdictions

- KYC/AML requirements: Possible implementation of stricter identity verification processes

UNIT0 Technical Risks

- Smart contract vulnerabilities: Potential for exploits in the underlying code

- Network congestion: Scalability issues during high-traffic periods

- Interoperability challenges: Compatibility issues with other blockchain networks

VI. Conclusion and Action Recommendations

UNIT0 Investment Value Assessment

UNIT0 presents a high-risk, high-potential investment opportunity in the modular blockchain infrastructure space. While its innovative restaking mechanism and scalability features offer long-term value, short-term volatility and regulatory uncertainties pose significant risks.

UNIT0 Investment Recommendations

✅ Beginners: Allocate no more than 1-2% of your crypto portfolio; focus on education

✅ Experienced investors: Consider a 3-5% allocation; actively monitor market developments

✅ Institutional investors: Explore strategic partnerships; conduct thorough due diligence

UNIT0 Trading Participation Methods

- Spot trading: Buy and sell UNIT0 on Gate.com's spot market

- Staking: Participate in UNIT0 staking programs for passive income

- OTC trading: For large volume trades, utilize Gate.com's OTC desk

Cryptocurrency investments carry extremely high risk. This article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Will Uniswap reach $1000?

While ambitious, reaching $1000 is unlikely for Uniswap in the near future. However, continued growth in DeFi could drive significant price increases over time.

Can Uniswap hit $100?

Yes, Uniswap could potentially reach $100 in the future, driven by increased DeFi adoption and platform upgrades. However, this would require significant market growth and favorable crypto conditions.

How high can Uniswap go in 2025?

Uniswap could potentially reach $50-$60 by 2025, driven by increased DeFi adoption and platform upgrades. However, crypto markets are highly volatile and unpredictable.

Does Uniswap have a future?

Yes, Uniswap has a bright future. As a leading DEX, it continues to innovate and adapt to market needs, ensuring its relevance in the evolving DeFi landscape.

Share

Content