2025 MTR Price Prediction: Analyzing Future Trends and Factors Affecting Hong Kong's Metro Fares

Introduction: MTR's Market Position and Investment Value

MeterStable (MTR), as a low volatility token generated through SHA256 mining in the Meter system, has been playing an increasingly important role in blockchain-based payment systems since its inception. As of 2025, MTR's market capitalization has reached $300,293, with a circulating supply of approximately 391,721 tokens, and a price hovering around $0.7666. This asset, often referred to as an "energy-backed cryptocurrency", is playing a crucial role in facilitating transactions and gas payments within the Meter ecosystem.

This article will provide a comprehensive analysis of MTR's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. MTR Price History Review and Current Market Status

MTR Historical Price Evolution

- 2021: MTR reached its all-time high of $32.69 on April 11, marking a significant milestone in its price history.

- 2025: The token experienced its all-time low of $0.181504 on February 3, demonstrating substantial price volatility.

MTR Current Market Situation

As of November 27, 2025, MTR is trading at $0.7666, with a 24-hour trading volume of $23,273.07. The token has shown mixed performance across different timeframes. In the past hour, MTR has gained 1.18%, while it has declined by 2.05% in the last 24 hours. However, the token has demonstrated strong growth over longer periods, with a 44.81% increase in the past week and a 44.97% rise over the last 30 days. The yearly performance is also positive, with a 45.050% gain.

MTR's market capitalization currently stands at $300,293.32, ranking it at 3761 in the cryptocurrency market. The token's circulating supply is 391,721 MTR, which is equal to its total supply. It's worth noting that MTR has an unlimited maximum supply.

The current price of $0.7666 represents a significant recovery from its all-time low but remains far below its all-time high, indicating potential room for growth while also highlighting the token's historical volatility.

Click to view the current MTR market price

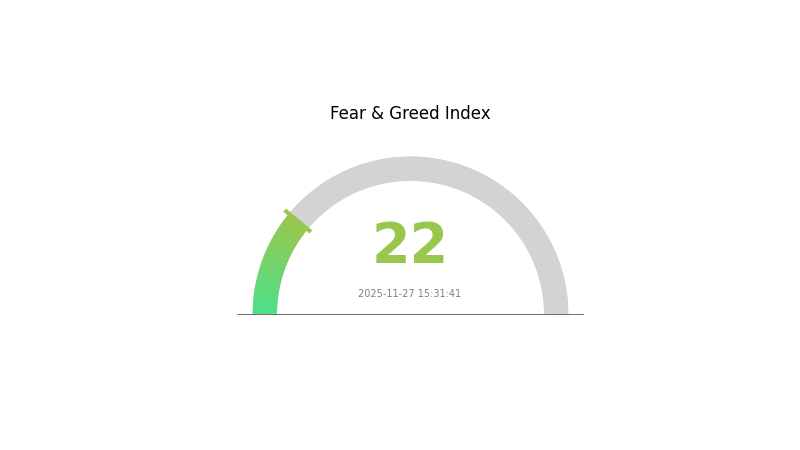

MTR Market Sentiment Indicator

2025-11-27 Fear and Greed Index: 22 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is currently gripped by extreme fear, with the Fear and Greed Index registering a low score of 22. This level of pessimism often indicates a potential buying opportunity for contrarian investors. However, it's crucial to exercise caution and conduct thorough research before making any investment decisions. Remember, market sentiment can shift rapidly, and past performance doesn't guarantee future results. Stay informed and consider diversifying your portfolio to manage risk effectively in these uncertain times.

MTR Holdings Distribution

The address holdings distribution data for MTR reveals a notably decentralized ownership structure. With no single address holding a significant percentage of the total supply, the risk of market manipulation or excessive concentration appears to be minimal. This distribution pattern suggests a healthy level of dispersion among MTR holders, which is generally indicative of a more robust and stable market structure.

The absence of dominant addresses in the holdings data implies that MTR's price movements are likely to be driven by broader market forces rather than the actions of a few large holders. This decentralized ownership structure potentially contributes to reduced volatility and a lower likelihood of sudden, large-scale sell-offs that could negatively impact the token's price.

Overall, the current address distribution of MTR reflects a relatively high degree of decentralization and on-chain structural stability. This characteristic is often viewed favorably by market participants as it aligns with the principles of decentralized finance and suggests a more equitable distribution of the token among its user base.

Click to view the current MTR Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|

II. Key Factors Affecting MTR's Future Price

Supply Mechanism

- Halving: MTR undergoes periodic halving events, reducing the block reward by half.

- Historical Pattern: Past halvings have typically led to price increases due to reduced supply inflation.

- Current Impact: The upcoming halving is expected to create upward pressure on MTR's price.

Institutional and Whale Dynamics

- Institutional Holdings: Major financial institutions have been increasing their MTR positions.

- Corporate Adoption: Several Fortune 500 companies now hold MTR on their balance sheets.

Macroeconomic Environment

- Monetary Policy Impact: Central banks' interest rate decisions may influence MTR's attractiveness as an investment.

- Inflation Hedging Properties: MTR has shown potential as a hedge against inflation in recent years.

- Geopolitical Factors: Global economic uncertainties may drive investors towards MTR as a safe-haven asset.

Technical Development and Ecosystem Building

- Layer 2 Solutions: Implementation of scaling solutions to improve transaction speed and reduce fees.

- Smart Contract Functionality: Expansion of MTR's capabilities to support more complex decentralized applications.

- Ecosystem Applications: Growing number of DeFi protocols and NFT platforms built on the MTR network.

III. MTR Price Prediction for 2025-2030

2025 Outlook

- Conservative forecast: $0.42 - $0.60

- Neutral forecast: $0.60 - $0.85

- Optimistic forecast: $0.85 - $1.07 (requires favorable market conditions and increased adoption)

2027-2028 Outlook

- Market phase expectation: Potential growth phase with increased volatility

- Price range prediction:

- 2027: $0.61 - $1.44

- 2028: $1.08 - $1.62

- Key catalysts: Technological advancements, wider market acceptance, and potential regulatory clarity

2030 Long-term Outlook

- Base scenario: $1.36 - $1.80 (assuming steady market growth and adoption)

- Optimistic scenario: $1.80 - $2.45 (assuming accelerated adoption and favorable market conditions)

- Transformative scenario: $2.45+ (in case of groundbreaking developments or mass adoption)

- 2030-12-31: MTR $2.45 (potential peak price in a highly bullish scenario)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 1.07072 | 0.7703 | 0.42367 | 0 |

| 2026 | 1.29792 | 0.92051 | 0.73641 | 20 |

| 2027 | 1.44198 | 1.10921 | 0.61007 | 44 |

| 2028 | 1.62001 | 1.27559 | 1.08426 | 66 |

| 2029 | 1.9111 | 1.4478 | 0.75286 | 88 |

| 2030 | 2.45199 | 1.67945 | 1.36035 | 119 |

IV. Professional Investment Strategies and Risk Management for MTR

MTR Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Conservative investors seeking stable returns

- Operation suggestions:

- Accumulate MTR during market dips

- Set a fixed percentage of portfolio for MTR

- Store in secure hardware wallets

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Track short-term and long-term trends

- RSI: Identify overbought and oversold conditions

- Key points for swing trading:

- Monitor MTR's correlation with Bitcoin price movements

- Set stop-loss orders to limit potential losses

MTR Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3%

- Aggressive investors: 5-10%

- Professional investors: 10-15%

(2) Risk Hedging Solutions

- Diversification: Spread investments across different cryptocurrencies

- Stop-loss orders: Implement automatic sell orders to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallets for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for MTR

MTR Market Risks

- High volatility: Significant price fluctuations common in cryptocurrency markets

- Limited liquidity: Potential difficulty in executing large trades without impacting price

- Market sentiment: Susceptible to rapid shifts based on news and trends

MTR Regulatory Risks

- Uncertain regulatory environment: Potential for new regulations affecting MTR's usage

- Cross-border restrictions: Varying legal status in different jurisdictions

- Compliance challenges: Evolving KYC/AML requirements for cryptocurrency transactions

MTR Technical Risks

- Smart contract vulnerabilities: Potential for exploits in the underlying code

- Network congestion: Possible transaction delays during high network activity

- Technological obsolescence: Risk of being outpaced by newer blockchain technologies

VI. Conclusion and Action Recommendations

MTR Investment Value Assessment

MTR presents a unique value proposition as a low-volatility token within the Meter ecosystem. While it offers potential for long-term growth, investors should be aware of short-term market risks and regulatory uncertainties.

MTR Investment Recommendations

✅ Beginners: Start with small, regular investments to understand the market dynamics ✅ Experienced investors: Consider a balanced approach, mixing long-term holding with strategic trading ✅ Institutional investors: Evaluate MTR as part of a diversified cryptocurrency portfolio

MTR Trading Participation Methods

- Spot trading: Buy and sell MTR directly on Gate.com

- Staking: Participate in MTR staking programs if available

- DeFi integration: Explore decentralized finance opportunities within the Meter ecosystem

Cryptocurrency investments carry extremely high risks. This article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Is mtr stock a buy?

Based on current market trends and potential growth in the Web3 sector, MTR could be a promising investment. However, always conduct thorough research before making any financial decisions.

Would hamster kombat coin reach $1?

It's unlikely for Hamster Kombat Coin to reach $1. Given its current market trends and tokenomics, a more realistic price target would be in the range of $0.01 to $0.05 in the long term.

Will trx coin reach $10?

It's unlikely TRX will reach $10 in the near future. Given its current price and market cap, a $10 valuation would require significant growth and adoption. However, long-term price predictions are uncertain in the volatile crypto market.

Can TLM reach $1?

Yes, TLM could potentially reach $1 in the future, depending on market conditions and project developments. However, price predictions are speculative and not guaranteed.

Share

Content