2025 MINA Price Prediction: Analyzing Future Growth Potential and Market Factors for this Promising Cryptocurrency

Introduction: MINA's Market Position and Investment Value

MINA (MINA), as one of the world's lightest blockchain protocols, has achieved significant milestones since its inception in 2021. As of 2025, MINA's market capitalization has reached $207,001,873, with a circulating supply of approximately 1,253,793,335 tokens, and a price hovering around $0.1651. This asset, dubbed the "world's lightest blockchain," is playing an increasingly crucial role in creating a private gateway between the real world and cryptocurrency.

This article will comprehensively analyze MINA's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic environment to provide investors with professional price predictions and practical investment strategies.

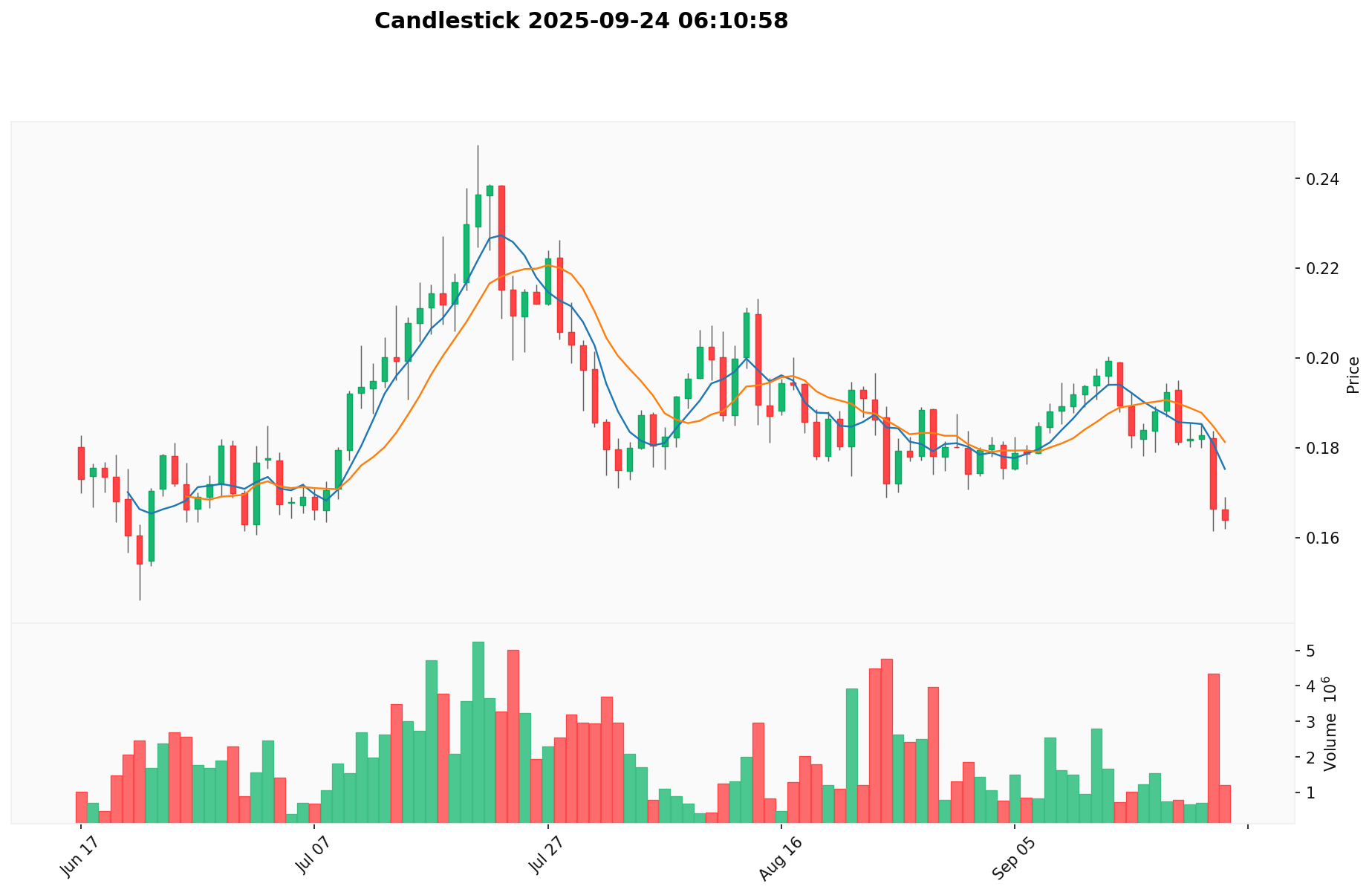

I. MINA Price History Review and Current Market Status

MINA Historical Price Evolution

- 2021: MINA launched, reaching an all-time high of $9.09 on June 1

- 2022: Market downturn, price declined significantly

- 2025: Price hit an all-time low of $0.147567 on June 23

MINA Current Market Situation

As of September 24, 2025, MINA is trading at $0.1651. The cryptocurrency has experienced a 0.18% increase in the past 24 hours, with a trading volume of $225,582.35. MINA's market capitalization stands at $207,001,279, ranking it 289th in the overall crypto market. The current price represents a 98.18% decrease from its all-time high and a 11.88% increase from its all-time low. The circulating supply is 1,253,793,335.84 MINA, which is 99.99% of the total supply. The market sentiment for MINA is currently in the "Fear" zone, with a VIX index of 44.

Click to view the current MINA market price

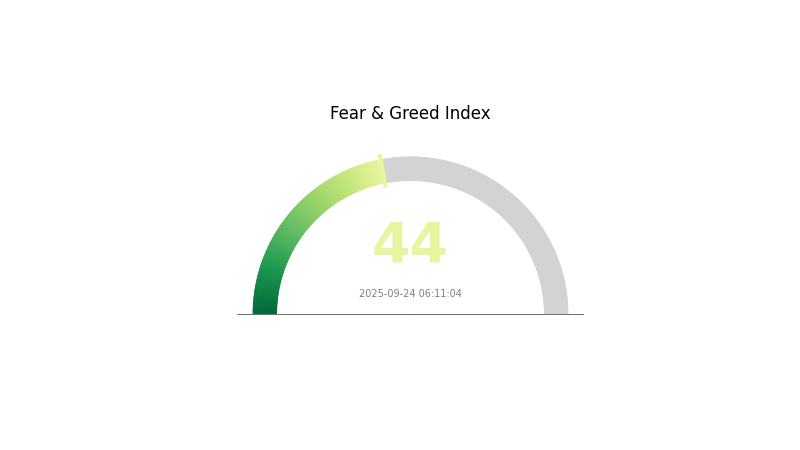

MINA Market Sentiment Indicator

2025-09-24 Fear and Greed Index: 44 (Fear)

Click to view the current Fear & Greed Index

The crypto market sentiment for MINA is currently in a state of fear, with the Fear and Greed Index registering at 44. This indicates a cautious mood among investors, potentially presenting buying opportunities for those with a long-term perspective. However, it's crucial to conduct thorough research and exercise prudence in investment decisions. Gate.com offers comprehensive market data to help traders navigate these uncertain times. Remember, market sentiment can shift rapidly, so stay informed and adjust your strategy accordingly.

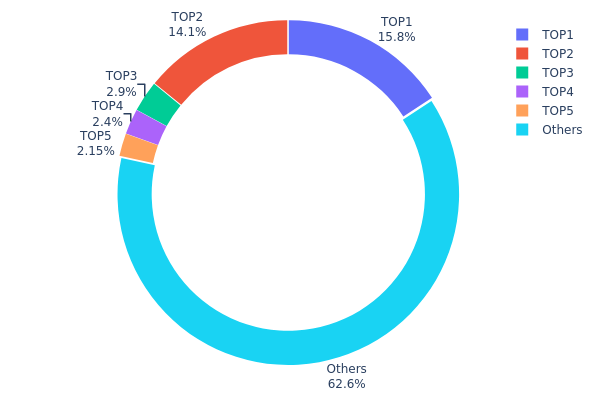

MINA Holdings Distribution

The address holdings distribution data for MINA reveals a significant concentration of tokens among the top addresses. The top two addresses hold 15.82% and 14.14% of the total supply respectively, accounting for nearly 30% of all MINA tokens. The next three largest holders possess between 2-3% each, bringing the cumulative holdings of the top 5 addresses to approximately 37.4% of the total supply.

This concentration pattern suggests a relatively centralized distribution of MINA tokens, which could have implications for market dynamics. The presence of large token holders, often referred to as "whales," may potentially influence price movements and liquidity. However, it's worth noting that 62.6% of the tokens are distributed among other addresses, indicating some level of broader participation in the network.

The current distribution structure may impact MINA's market stability and susceptibility to volatility. Large holders have the potential to exert significant influence on the market through their trading activities. While this concentration doesn't necessarily imply market manipulation, it does highlight the importance of monitoring large address movements for potential market impacts.

Click to view the current MINA Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | B62qrQ...6g1ny9 | 198347.45K | 15.82% |

| 2 | B62qjs...6f7npr | 177324.72K | 14.14% |

| 3 | B62qp3...x8CxV3 | 36407.06K | 2.90% |

| 4 | B62qmj...SVovgT | 30101.92K | 2.40% |

| 5 | B62qiW...CSCVt5 | 26949.69K | 2.14% |

| - | Others | 784643.79K | 62.6% |

II. Key Factors Affecting MINA's Future Price

Supply Mechanism

- Deflationary Model: Regular token burning mechanism continuously reduces supply

- Historical Pattern: Supply contraction has historically led to price increases

- Current Impact: Continued supply reduction is expected to support price growth

Institutional and Whale Dynamics

- Enterprise Adoption: Traditional financial institutions like Franklin Templeton entering the market have positively impacted MINA's price

Macroeconomic Environment

- Inflation Hedging Properties: MINA has shown potential as a hedge against inflation in certain market conditions

Technological Development and Ecosystem Building

- Mesa Upgrade: Recent upgrade acting as a catalyst for price movement

- Ecosystem Applications: Growing demand from BNB Chain ecosystem, with TVL reaching $7.75 billion, a three-year high

III. MINA Price Prediction 2025-2030

2025 Outlook

- Conservative forecast: $0.08761 - $0.1653

- Neutral forecast: $0.1653 - $0.19505

- Optimistic forecast: $0.19505 - $0.22 (requires strong market sentiment and project developments)

2027-2028 Outlook

- Market phase expectation: Potential growth phase with increasing adoption

- Price range forecast:

- 2027: $0.13722 - $0.26436

- 2028: $0.18879 - $0.25172

- Key catalysts: Technological advancements, increased partnerships, and broader market trends

2029-2030 Long-term Outlook

- Base scenario: $0.24240 - $0.27997 (assuming steady growth and adoption)

- Optimistic scenario: $0.31754 - $0.39756 (with significant ecosystem expansion and market dominance)

- Transformative scenario: $0.40 - $0.50 (breakthrough technology implementation and mainstream adoption)

- 2030-12-31: MINA $0.39756 (potential peak based on optimistic projections)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.19505 | 0.1653 | 0.08761 | 0 |

| 2026 | 0.22342 | 0.18018 | 0.13513 | 9 |

| 2027 | 0.26436 | 0.2018 | 0.13722 | 22 |

| 2028 | 0.25172 | 0.23308 | 0.18879 | 41 |

| 2029 | 0.31754 | 0.2424 | 0.21331 | 46 |

| 2030 | 0.39756 | 0.27997 | 0.20158 | 69 |

IV. MINA Professional Investment Strategies and Risk Management

MINA Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors seeking exposure to blockchain innovation

- Operation suggestions:

- Accumulate MINA during market dips

- Hold for at least 2-3 years to capture potential growth

- Store in a secure non-custodial wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use 50-day and 200-day MAs to identify trends

- RSI: Monitor overbought/oversold conditions

- Key points for swing trading:

- Set stop-loss orders to manage downside risk

- Take partial profits on significant price increases

MINA Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Balance MINA with other crypto assets

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hardware wallet recommendation: Gate Web3 Wallet

- Software wallet option: Official Mina wallet

- Security precautions: Enable 2FA, use strong passwords, backup private keys

V. MINA Potential Risks and Challenges

MINA Market Risks

- High volatility: Price can fluctuate dramatically

- Limited adoption: May impact long-term value proposition

- Competition: Other lightweight blockchain projects may emerge

MINA Regulatory Risks

- Uncertain regulatory environment: Potential for unfavorable regulations

- Compliance challenges: May face scrutiny from financial regulators

- Legal status: Classification as a security could impact trading

MINA Technical Risks

- Network security: Potential vulnerabilities in the protocol

- Scalability issues: May face challenges as network usage grows

- Development delays: Could impact planned feature releases

VI. Conclusion and Action Recommendations

MINA Investment Value Assessment

MINA offers a unique value proposition as a lightweight blockchain with privacy features. Long-term potential exists, but short-term volatility and adoption challenges present significant risks.

MINA Investment Recommendations

✅ Beginners: Consider small, long-term positions with thorough research ✅ Experienced investors: Implement dollar-cost averaging strategy ✅ Institutional investors: Evaluate for inclusion in diversified crypto portfolios

MINA Trading Participation Methods

- Spot trading: Available on Gate.com and other exchanges

- Staking: Participate in network security and earn rewards

- DeFi applications: Explore emerging Mina-based DApps as they develop

Cryptocurrency investments carry extremely high risks. This article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Does Mina Coin have a future?

Yes, Mina Coin has a promising future. Its innovative technology and potential collaborations with Arbitrum and Cardano in 2024 position it for growth and increased adoption in the Web3 ecosystem.

How high can Mina go?

Mina could reach $0.19 by end of 2025. Long-term forecasts suggest further growth potential based on market trends.

Is Mina a good buy?

Yes, Mina could be a good buy. Its innovative technology and potential for growth make it an attractive investment in the crypto market.

What is the price prediction for Decentraland Mana coin in 2030?

Based on expert forecasts, Decentraland (MANA) is predicted to reach between $5.15 and $6.17 by 2030.

Share

Content