2025 GTBTCPrice Prediction: Analyzing Market Trends and Potential Growth Factors for GTBTC in the Post-Halving Era

Introduction: GTBTC's Market Position and Investment Value

Gate Wrapped BTC (GTBTC), as an on-chain BTC yield-generating asset issued by Gate Web3, has been making significant strides since its inception. As of 2025, GTBTC's market capitalization has reached $339,101,759, with a circulating supply of approximately 3,001.72 tokens, and a price hovering around $112,969. This asset, known as a "BTC yield-generating token," is playing an increasingly crucial role in both CeFi and DeFi scenarios.

This article will provide a comprehensive analysis of GTBTC's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. GTBTC Price History Review and Current Market Status

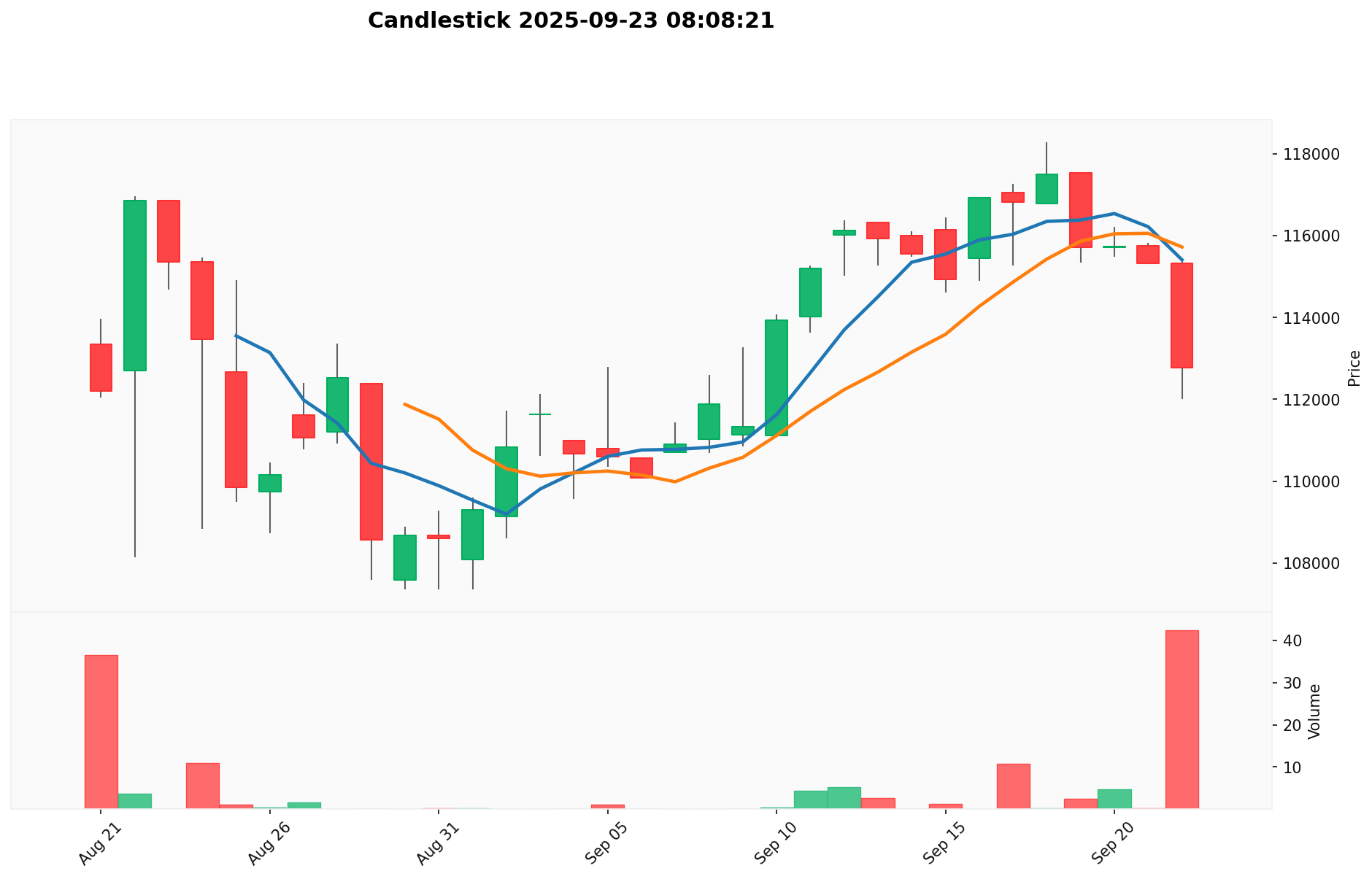

GTBTC Historical Price Evolution

- 2025: GTBTC launched by Gate Web3, price starting at around $107,351.9

- September 2025: Reached all-time high of $118,284.3, showing strong initial market interest

- Late September 2025: Price correction, stabilizing around $112,969

GTBTC Current Market Situation

As of September 23, 2025, GTBTC is trading at $112,969, with a 24-hour trading volume of $4,042,893.66. The token has experienced a 0.35% increase in the last 24 hours, indicating a slight upward momentum. However, it's worth noting that GTBTC is down 2.42% over the past week and 1.81% over the last 30 days, suggesting some short-term bearish pressure.

The current market capitalization of GTBTC stands at $339,101,759.13, ranking it 224th in the overall cryptocurrency market. With a circulating supply of 3,001.72400512 GTBTC, which is also the total and maximum supply, the token maintains full circulation in the market.

GTBTC's price is currently about 4.5% below its all-time high of $118,284.3, achieved just a few days ago on September 18, 2025. This recent high followed by a slight pullback suggests the token is in a consolidation phase after a period of rapid growth.

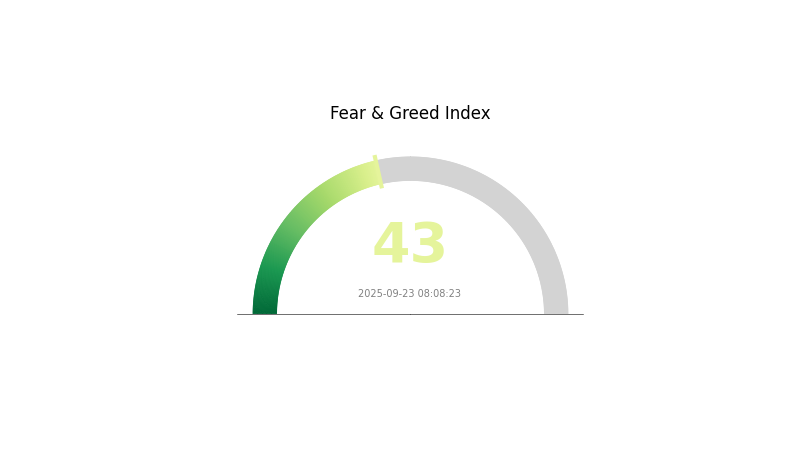

The market sentiment for cryptocurrencies overall is currently in the "Fear" zone, with a VIX index of 43. This general market fear could be influencing GTBTC's recent price action, despite its relative stability compared to the broader market.

Click to view the current GTBTC market price

GTBTC Market Sentiment Indicator

2025-09-23 Fear and Greed Index: 43 (Fear)

Click to view the current Fear & Greed Index

The crypto market sentiment remains cautious as the Fear and Greed Index hovers at 43, indicating a state of fear. This suggests investors are acting defensively, potentially creating buying opportunities for contrarian traders. However, it's crucial to remember that market sentiment can shift rapidly. Traders should stay vigilant, diversify their portfolios, and consider using risk management tools available on Gate.com to navigate these uncertain times effectively.

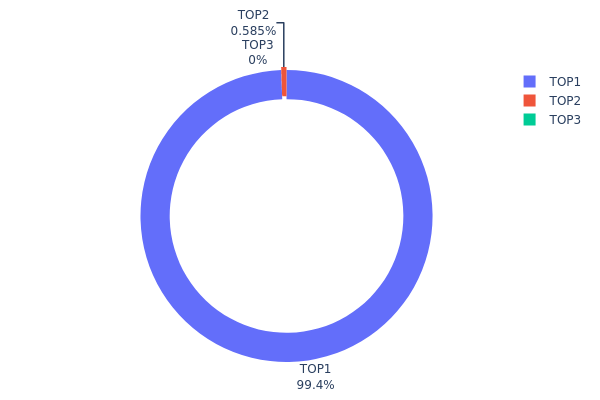

GTBTC Holdings Distribution

The address holdings distribution data provides crucial insights into the concentration of GTBTC ownership. In this case, the distribution reveals an extremely high level of centralization, with the top address holding 99.41% of the total supply. This significant concentration in a single address raises concerns about market stability and potential price manipulation.

The second-largest holder accounts for only 0.58% of the supply, while all other addresses combined hold a negligible 0.01%. This stark imbalance in distribution suggests that GTBTC's market structure is highly susceptible to the actions of the dominant holder. Such concentration could lead to increased volatility and reduced liquidity, as any significant movement by the top address could dramatically impact the token's price and availability in the market.

From a broader perspective, this distribution pattern indicates a low degree of decentralization and potentially compromised on-chain structural stability for GTBTC. Market participants should be aware of these risks and consider them when engaging with the token, as the actions of a single entity could have outsized effects on the overall market dynamics.

Click to view the current GTBTC Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xc882...84f071 | 894.61 | 99.41% |

| 2 | 0x0d07...b492fe | 5.26 | 0.58% |

| - | Others | -0 | 0.010000000000005% |

II. Key Factors Affecting Future GTBTC Price

Macroeconomic Environment

-

Inflation Hedging Properties: As a cryptocurrency, GTBTC may potentially serve as a hedge against inflation in certain economic conditions.

-

Geopolitical Factors: International geopolitical situations can influence the global cryptocurrency market, including GTBTC.

Technological Development and Ecosystem Building

- Ecosystem Applications: The development of decentralized applications (DApps) and other projects within the GTBTC ecosystem could impact its value and adoption.

III. GTBTC Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $76,876 - $95,000

- Neutral prediction: $95,000 - $113,053

- Optimistic prediction: $113,053 - $167,318 (requires sustained bullish market conditions)

2027-2028 Outlook

- Market phase expectation: Potential bull market continuation

- Price range forecast:

- 2027: $104,655 - $244,196

- 2028: $108,733 - $289,273

- Key catalysts: Increased institutional adoption, technological advancements in the crypto space

2029-2030 Long-term Outlook

- Base scenario: $247,215 - $254,632 (assuming steady market growth)

- Optimistic scenario: $262,048 - $305,558 (assuming accelerated mainstream adoption)

- Transformative scenario: $305,558+ (extreme favorable conditions such as global economic shifts towards digital assets)

- 2030-12-31: GTBTC $254,632 (125% increase from 2025 levels)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 167318.44 | 113053 | 76876.04 | 0 |

| 2026 | 192054.44 | 140185.72 | 114952.29 | 24 |

| 2027 | 244196.51 | 166120.08 | 104655.65 | 47 |

| 2028 | 289273.2 | 205158.3 | 108733.9 | 81 |

| 2029 | 262048.69 | 247215.75 | 175523.18 | 118 |

| 2030 | 305558.66 | 254632.22 | 180788.88 | 125 |

IV. GTBTC Professional Investment Strategies and Risk Management

GTBTC Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Conservative investors seeking BTC exposure with yield

- Operation suggestions:

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Monitor short-term and long-term trends

- Relative Strength Index (RSI): Identify overbought/oversold conditions

- Key points for swing trading:

- Monitor BTC price movements as GTBTC is closely correlated

- Pay attention to Gate.com's BTC reserve changes

GTBTC Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-5% of portfolio

- Moderate investors: 5-10% of portfolio

- Aggressive investors: 10-20% of portfolio

(2) Risk Hedging Solutions

- Diversification: Balance GTBTC with other crypto assets

- Stop-loss orders: Set appropriate levels to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 wallet

- Cold storage solution: Hardware wallet for large holdings

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for GTBTC

GTBTC Market Risks

- BTC price volatility: GTBTC value directly affected by BTC price fluctuations

- Liquidity risk: Potential challenges in large-scale trading during market stress

- Yield compression: Possibility of reduced yields in a competitive market

GTBTC Regulatory Risks

- Regulatory uncertainty: Evolving global regulations may impact GTBTC operations

- Compliance requirements: Potential changes in KYC/AML policies affecting users

- Cross-border restrictions: Possible limitations on GTBTC accessibility in certain jurisdictions

GTBTC Technical Risks

- Smart contract vulnerabilities: Potential security issues in the underlying code

- Blockchain network congestion: Transaction delays during high network activity

- Integration risks: Challenges in maintaining multi-chain compatibility

VI. Conclusion and Action Recommendations

GTBTC Investment Value Assessment

GTBTC offers a unique proposition for BTC holders seeking yield while maintaining liquidity. Long-term value lies in its ability to generate returns on BTC holdings, but short-term risks include market volatility and regulatory uncertainties.

GTBTC Investment Recommendations

✅ Beginners: Start with a small allocation, focus on understanding the mechanics ✅ Experienced investors: Consider GTBTC as part of a diversified crypto portfolio ✅ Institutional investors: Evaluate GTBTC for potential yield enhancement on BTC holdings

Ways to Participate in GTBTC Trading

- Direct purchase: Buy GTBTC on Gate.com spot market

- Staking: Stake BTC on Gate.com to mint GTBTC

- DeFi integration: Use GTBTC in supported DeFi protocols for additional yield opportunities

Cryptocurrency investments carry extremely high risks. This article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Is GBTC stock a buy?

Yes, GBTC stock could be a good buy in 2025. With Bitcoin's growing adoption and potential price increases, GBTC offers exposure to Bitcoin in a traditional investment vehicle.

How much BTC is left in GBTC?

As of 2025, GBTC holds approximately 633,000 BTC, representing about 3% of Bitcoin's total supply. This amount may fluctuate slightly due to ongoing conversions and market activities.

Why is grayscale bitcoin trust dropping?

Grayscale Bitcoin Trust may be dropping due to market volatility, regulatory concerns, or increased competition from spot Bitcoin ETFs. Investor sentiment and overall crypto market trends can also impact its performance.

Is GBTC a good way to buy bitcoin?

GBTC can be a convenient way to gain exposure to Bitcoin without directly owning it. However, it often trades at a premium or discount to Bitcoin's price, which may affect returns.

Share

Content