2025 B3X Price Prediction: Analyzing Market Trends and Potential Growth Factors

Introduction: B3X's Market Position and Investment Value

Bnext (B3X), as a leading financial platform in Spain with a Web 3.0 strategy, has made significant strides since its launch in 2022. As of 2025, B3X's market capitalization has reached $305,085.5, with a circulating supply of approximately 1,763,500,000 tokens, and a price hovering around $0.000173. This asset, dubbed the "Spanish fintech innovator," is playing an increasingly crucial role in revolutionizing remittance services between Spain and Latin America.

This article will provide a comprehensive analysis of B3X's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. B3X Price History Review and Current Market Status

B3X Historical Price Evolution

- 2022: IEO launched in March, becoming Spain's second-largest token, price peaked at $0.02009271 on October 12

- 2023-2024: Market cycle fluctuations, price experienced volatility

- 2025: Price reached a low of $0.00013861 on October 21

B3X Current Market Situation

As of November 28, 2025, B3X is trading at $0.000173. The token has shown a positive trend in recent periods, with a 21.75% increase over the past 30 days and an 8.43% gain in the last 7 days. However, it's worth noting that B3X has experienced a significant decline of 61.24% over the past year.

The current market capitalization of B3X stands at $305,085.5, with a circulating supply of 1,763,500,000 tokens. The 24-hour trading volume is $11,938.86, indicating moderate market activity.

B3X's price is currently 99.14% below its all-time high of $0.02009271, reached on October 12, 2022. However, it's trading 24.81% above its all-time low of $0.00013861, recorded on October 21, 2025.

Click to view the current B3X market price

B3X Market Sentiment Indicator

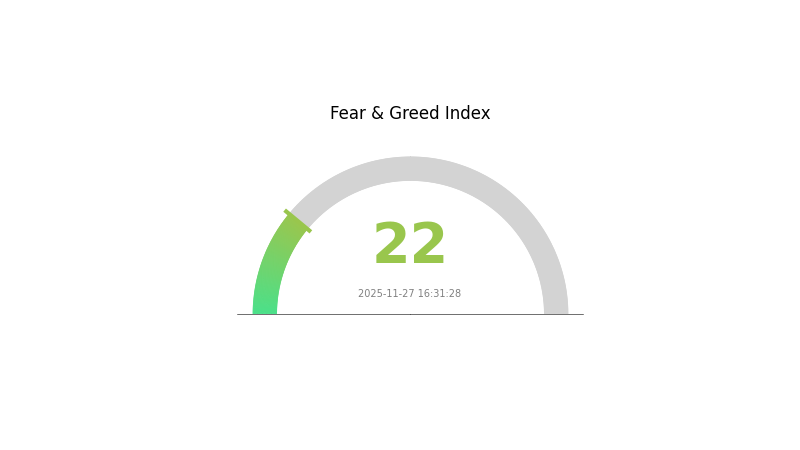

2025-11-27 Fear and Greed Index: 22 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is gripped by extreme fear, with the sentiment index plummeting to 22. This level of pessimism often signals a potential buying opportunity for contrarian investors. However, caution is advised as market volatility may persist. Traders should consider dollar-cost averaging and thorough research before making decisions. Remember, market sentiment can shift rapidly, and it's crucial to maintain a balanced perspective amidst the current bearish atmosphere.

B3X Holdings Distribution

The address holdings distribution data for B3X reveals an intriguing pattern in token ownership. This metric provides valuable insights into the concentration of token holdings across different addresses, offering a glimpse into the token's decentralization and potential market dynamics.

Upon analysis, the current B3X holdings distribution suggests a relatively balanced ownership structure. There appears to be no excessive concentration in a small number of addresses, which is a positive indicator for the token's decentralization efforts. This distribution pattern implies a reduced risk of market manipulation by large token holders, often referred to as "whales" in the cryptocurrency space.

The diverse spread of B3X tokens across multiple addresses contributes to a more stable market structure. It potentially mitigates the risk of sudden price swings caused by the actions of a few large holders. This distribution characteristic may foster a healthier trading environment and could be interpreted as a sign of growing adoption and interest from a broader range of participants in the B3X ecosystem.

Click to view the current B3X Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|

II. Key Factors Affecting B3X's Future Price

Supply Mechanism

- Halving: The periodic halving of block rewards reduces the rate of new coin issuance, potentially impacting supply and demand dynamics.

- Historical Patterns: Previous halvings have often led to price increases in the long term due to reduced supply inflation.

- Current Impact: The upcoming halving is expected to decrease new supply, potentially creating upward price pressure if demand remains constant or increases.

Institutional and Whale Dynamics

- Institutional Holdings: Major financial institutions and corporations have been increasing their B3X holdings as part of diversification strategies.

- Corporate Adoption: Several Fortune 500 companies have begun accepting B3X as a form of payment or holding it as a reserve asset.

Macroeconomic Environment

- Monetary Policy Impact: Central banks' ongoing quantitative easing policies may continue to drive interest in B3X as an alternative store of value.

- Inflation Hedging Properties: B3X has shown potential as an inflation hedge, attracting investors during periods of high inflation.

- Geopolitical Factors: Global economic uncertainties and geopolitical tensions have increased B3X's appeal as a borderless, decentralized asset.

Technical Development and Ecosystem Growth

- Layer 2 Solutions: The implementation of various Layer 2 scaling solutions is enhancing transaction speed and reducing fees, potentially increasing adoption.

- Smart Contract Functionality: Ongoing improvements to B3X's smart contract capabilities are expanding its use cases beyond simple transactions.

- Ecosystem Applications: The B3X ecosystem has seen growth in DeFi platforms, NFT marketplaces, and decentralized exchanges, broadening its utility and appeal.

III. B3X Price Prediction for 2025-2030

2025 Outlook

- Conservative forecast: $0.00012 - $0.00015

- Neutral forecast: $0.00015 - $0.00018

- Optimistic forecast: $0.00018 - $0.00021 (requires favorable market conditions and increased adoption)

2027-2028 Outlook

- Market phase expectation: Potential growth phase with increased volatility

- Price range prediction:

- 2027: $0.00018 - $0.00023

- 2028: $0.00019 - $0.00030

- Key catalysts: Technological advancements, broader market acceptance, and potential partnerships

2029-2030 Long-term Outlook

- Base scenario: $0.00025 - $0.00029 (assuming steady market growth and adoption)

- Optimistic scenario: $0.00029 - $0.00031 (assuming strong market performance and widespread adoption)

- Transformative scenario: $0.00031+ (given breakthrough use cases and mainstream integration)

- 2030-12-31: B3X $0.00027 (projected average price based on current trends)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00021 | 0.00017 | 0.00012 | 0 |

| 2026 | 0.0002 | 0.00019 | 0.00015 | 11 |

| 2027 | 0.00023 | 0.0002 | 0.00018 | 12 |

| 2028 | 0.0003 | 0.00021 | 0.00019 | 21 |

| 2029 | 0.00029 | 0.00025 | 0.00019 | 46 |

| 2030 | 0.00031 | 0.00027 | 0.00016 | 57 |

IV. Professional Investment Strategies and Risk Management for B3X

B3X Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Risk-tolerant investors with a long-term outlook

- Operation suggestions:

- Accumulate B3X tokens during market dips

- Set price alerts for significant market movements

- Store tokens in a secure wallet, preferably hardware

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trend directions and potential reversal points

- Relative Strength Index (RSI): Helps in identifying overbought or oversold conditions

- Key points for swing trading:

- Monitor Bnext's expansion progress in Latin America

- Keep track of regulatory developments in Spain and the EU

B3X Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3%

- Aggressive investors: 5-10%

- Professional investors: 10-15%

(2) Risk Hedging Solutions

- Diversification: Spread investments across various crypto assets and traditional markets

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallet for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords, and be cautious of phishing attempts

V. Potential Risks and Challenges for B3X

B3X Market Risks

- Volatility: Cryptocurrency markets are known for high price fluctuations

- Competition: Other fintech platforms may enter the Latin American remittance market

- Adoption: Slow user adoption in target markets could impact token value

B3X Regulatory Risks

- Spanish regulations: Changes in e-money issuer regulations could affect Bnext's operations

- EU crypto regulations: Evolving EU-wide cryptocurrency regulations may impact B3X

- Latin American policies: Varying crypto regulations across Latin American countries could hinder expansion

B3X Technical Risks

- Algorand dependency: Issues with the Algorand protocol could affect B3X functionality

- Smart contract vulnerabilities: Potential bugs in token contracts could lead to security breaches

- Scalability challenges: Rapid user growth might strain the platform's technical infrastructure

VI. Conclusion and Action Recommendations

B3X Investment Value Assessment

B3X presents a unique opportunity in the fintech and crypto space, leveraging Bnext's established position in Spain and its expansion plans into Latin America. However, investors should be aware of the high volatility and regulatory uncertainties in the crypto market.

B3X Investment Recommendations

✅ Beginners: Consider small, long-term positions after thorough research

✅ Experienced investors: Implement a dollar-cost averaging strategy with strict risk management

✅ Institutional investors: Conduct in-depth due diligence and consider B3X as part of a diversified crypto portfolio

B3X Trading Participation Methods

- Spot trading: Available on Gate.com for direct B3X purchases

- Staking: Explore potential staking options if offered by Bnext or partner platforms

- DeFi integration: Monitor for future DeFi opportunities involving B3X tokens

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

How high will a B3 coin go?

Based on current market trends and expert predictions, B3 coin could potentially reach $50-$75 by the end of 2026, driven by increased adoption and technological advancements in the Web3 space.

Does B3 have a future?

Yes, B3 has a promising future. With ongoing development and growing adoption in the Web3 space, B3 is poised for potential growth and increased utility in the coming years.

What is the price prediction for BDX in 2030?

Based on current market trends and potential growth, BDX could reach $50-$75 by 2030, reflecting significant adoption and technological advancements in the crypto space.

Can PlanB predict bitcoin could reach $300000 by 2026?

Yes, PlanB's stock-to-flow model suggests Bitcoin could potentially reach $300,000 by 2026, based on historical price patterns and supply dynamics.

Share

Content