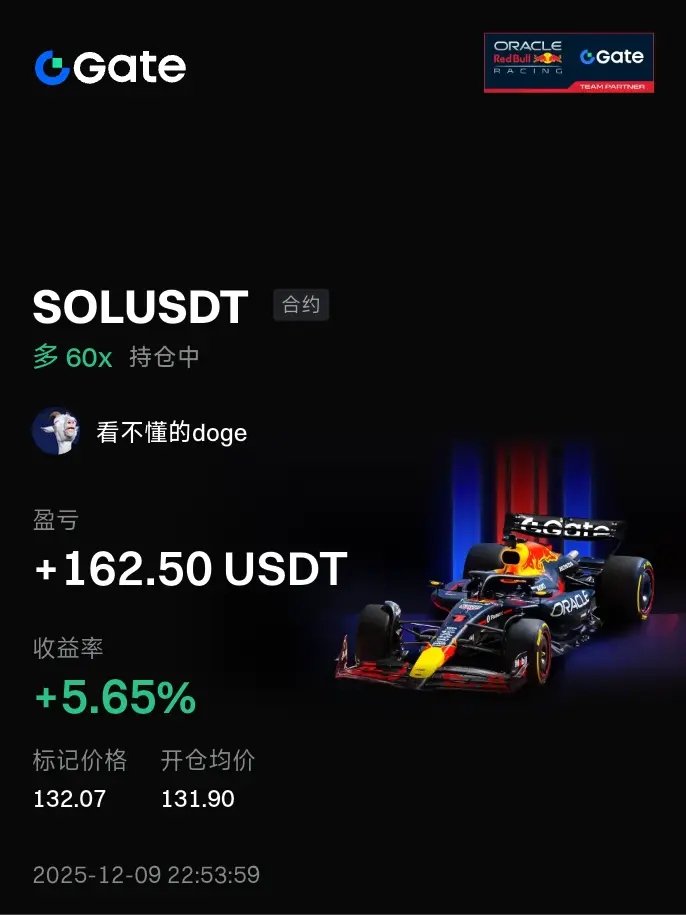

Can'tUnderstandDoge

#Gate广场圣诞送温暖

There will be significant volatility this week, next week, and the final week. The cost of trial and error for short-term trades has increased, so leverage and position sizes need to be reduced. For short-term trades without much cost advantage, regardless of being long or short, stop losses should be set as needed; only by stopping out can you enter at a more suitable position. For example, as long as BTC doesn't break through 94600 this week, shorting near 93850-94050 would be at the highest point. But if 94600 is breached, it could spike up to the 96300-97850 consolidation ran

There will be significant volatility this week, next week, and the final week. The cost of trial and error for short-term trades has increased, so leverage and position sizes need to be reduced. For short-term trades without much cost advantage, regardless of being long or short, stop losses should be set as needed; only by stopping out can you enter at a more suitable position. For example, as long as BTC doesn't break through 94600 this week, shorting near 93850-94050 would be at the highest point. But if 94600 is breached, it could spike up to the 96300-97850 consolidation ran

BTC2.78%