EncryptionMaster01

No content yet

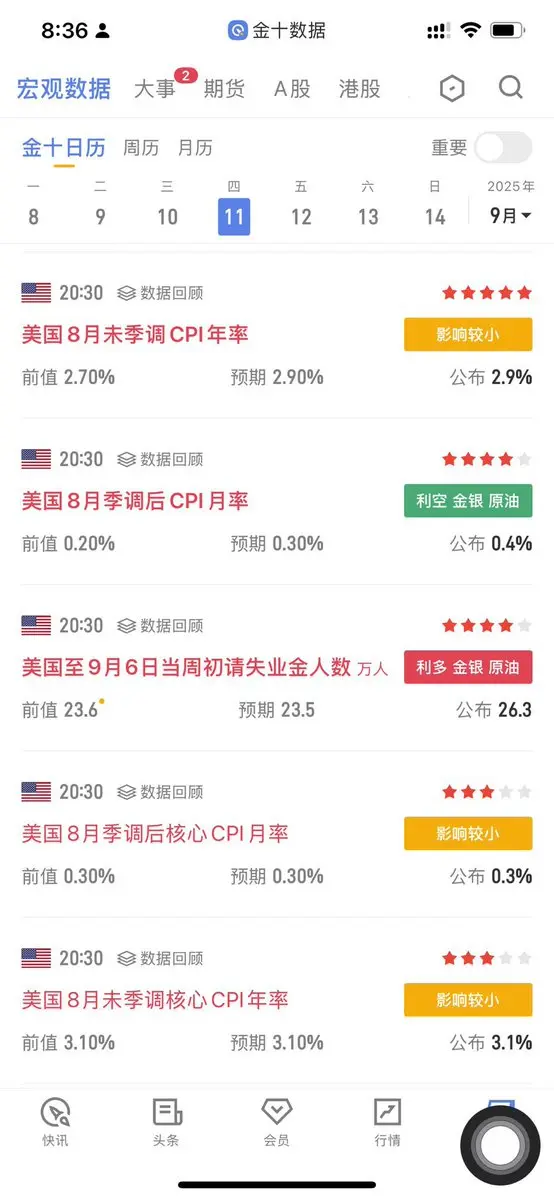

The US August unadjusted core CPI year-on-year is 3.1%, and the US August unadjusted CPI year-on-year is 2.9%.

The U.S. August unadjusted core CPI year-on-year is 3.1%, expected 3.10%, previous value 3.10%.;

US August seasonally adjusted core CPI month-on-month 0.3%, expected 0.30%, previous value 0.30%.

The US August unadjusted CPI year-on-year is 2.9%, expected at 2.90%, previous value 2.70%.

The seasonally adjusted CPI for the U.S. in August rose by 0.4%, expected at 0.30%, previous value 0.20%.

View OriginalThe U.S. August unadjusted core CPI year-on-year is 3.1%, expected 3.10%, previous value 3.10%.;

US August seasonally adjusted core CPI month-on-month 0.3%, expected 0.30%, previous value 0.30%.

The US August unadjusted CPI year-on-year is 2.9%, expected at 2.90%, previous value 2.70%.

The seasonally adjusted CPI for the U.S. in August rose by 0.4%, expected at 0.30%, previous value 0.20%.

- Reward

- like

- Comment

- Repost

- Share

The Fed's balance sheet decreased by $39 billion in August, to $6.60 trillion, the lowest level since April 2020.

Since the peak in April 2022, the Fed has reduced assets by $2.36 trillion, or -26.4%.

This offset 49.2% of the $4.81 trillion balance sheet expansion during the pandemic.

The Fed's assets as a percentage of GDP reached 21.8%, the lowest level since the first quarter of 2020, equal to the level in 2013.

However, the central bank's total assets are still $2.45 trillion, an increase of 59% compared to pre-pandemic levels.

The Fed has yet to fully withdraw the stimulus mea

View OriginalSince the peak in April 2022, the Fed has reduced assets by $2.36 trillion, or -26.4%.

This offset 49.2% of the $4.81 trillion balance sheet expansion during the pandemic.

The Fed's assets as a percentage of GDP reached 21.8%, the lowest level since the first quarter of 2020, equal to the level in 2013.

However, the central bank's total assets are still $2.45 trillion, an increase of 59% compared to pre-pandemic levels.

The Fed has yet to fully withdraw the stimulus mea

- Reward

- like

- Comment

- Repost

- Share

In August, the PPI inflation rate dropped to 2.6%, lower than the expected 3.3%.

The core PPI inflation rate dropped to 2.8%, below the expected 3.5%.

Since March 2024, the month-on-month inflation of PPI has been negative for only the second time.

Interest rate cuts are coming.

View OriginalThe core PPI inflation rate dropped to 2.8%, below the expected 3.5%.

Since March 2024, the month-on-month inflation of PPI has been negative for only the second time.

Interest rate cuts are coming.

- Reward

- like

- Comment

- Repost

- Share

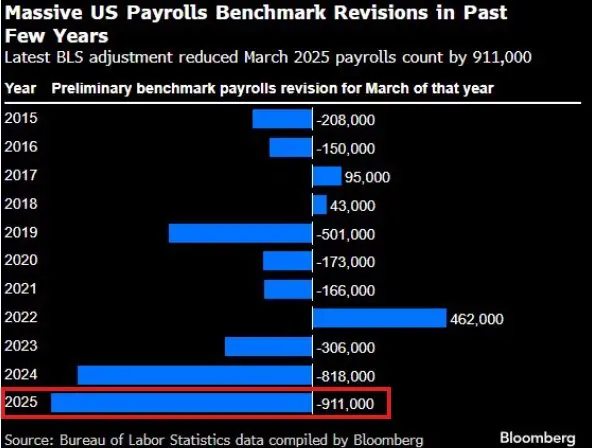

Interest rate cuts are coming:

Today, the U.S. Bureau of Labor Statistics (BLS) revised the employment numbers, which were nearly -230,000 higher than expected.

Moreover, it is also larger than the preliminary revised value for 2024 by -93,000.

The preliminary revision of total employment positions for 2024 and 2025 has now exceeded 1.7 million.

The Federal Reserve has no choice but to cut interest rates!

Today, the U.S. Bureau of Labor Statistics (BLS) revised the employment numbers, which were nearly -230,000 higher than expected.

Moreover, it is also larger than the preliminary revised value for 2024 by -93,000.

The preliminary revision of total employment positions for 2024 and 2025 has now exceeded 1.7 million.

The Federal Reserve has no choice but to cut interest rates!

BLS2.17%

- Reward

- like

- Comment

- Repost

- Share

August non-farm payrolls flew out with a "surprise"

On the eve of the release of the US non-farm payroll data for August, the US Bureau of Labor Statistics stated, "Sorry, we are currently experiencing technical issues. All Bureau of Labor Statistics data retrieval tools will be available again once we resolve the issues."

It is currently unclear whether the incident will affect the scheduled release of the report.

View OriginalOn the eve of the release of the US non-farm payroll data for August, the US Bureau of Labor Statistics stated, "Sorry, we are currently experiencing technical issues. All Bureau of Labor Statistics data retrieval tools will be available again once we resolve the issues."

It is currently unclear whether the incident will affect the scheduled release of the report.

- Reward

- like

- Comment

- Repost

- Share

Initial Jobless Claims in the US last week:

Actual value: 237K (237,000 people) → Higher than expected

Market expectation: 230K (230,000 people)

Previous value: 229K (229,000 people)

The number of unemployment benefit applications exceeded expectations, and increased by 8K compared to the previous week, indicating that the labor market is gradually weakening.

Although the overall level is not particularly high, combined with the ADP employment report (only +54,000, far below expectations), it can be seen that the U.S. job market is cooling down.

For the Federal Reserve, such data often strengt

Actual value: 237K (237,000 people) → Higher than expected

Market expectation: 230K (230,000 people)

Previous value: 229K (229,000 people)

The number of unemployment benefit applications exceeded expectations, and increased by 8K compared to the previous week, indicating that the labor market is gradually weakening.

Although the overall level is not particularly high, combined with the ADP employment report (only +54,000, far below expectations), it can be seen that the U.S. job market is cooling down.

For the Federal Reserve, such data often strengt

ADP-1.79%

- Reward

- like

- Comment

- Repost

- Share

In August, the ADP employment figure in the United States increased by 54,000, with an expectation of 68,000 and a previous value of 104,000!

This indicates that employment growth in the U.S. private sector was significantly below expectations in August and has slowed considerably compared to the previous month.

📉 Market Meaning:

The job market continues to cool, indicating a weakening economic momentum.

Although wages are still rising, the weak addition of jobs may lead the Federal Reserve to consider lowering interest rates or easing in future policies.

Industry data also shows that the lei

This indicates that employment growth in the U.S. private sector was significantly below expectations in August and has slowed considerably compared to the previous month.

📉 Market Meaning:

The job market continues to cool, indicating a weakening economic momentum.

Although wages are still rising, the weak addition of jobs may lead the Federal Reserve to consider lowering interest rates or easing in future policies.

Industry data also shows that the lei

ADP-1.79%

- Reward

- like

- Comment

- Repost

- Share

GN #ETH# #BTC# reported on the work 🫡

The FedWatch tool shows that the market believes there is a 95% probability of a 25 basis point rate cut at this FOMC meeting.

Investors have almost regarded this interest rate cut as a "done deal."

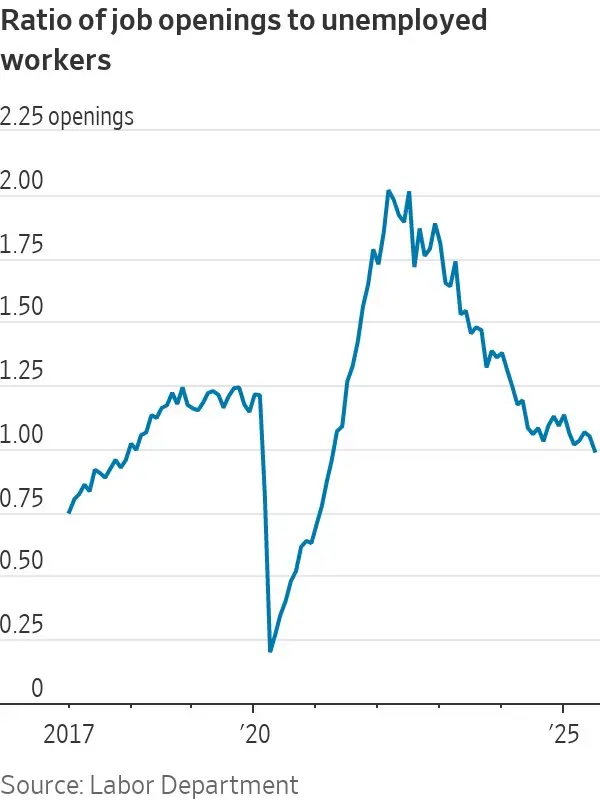

1. The labor market is cooling down.

The number of job vacancies has dropped to a low point, with the job-to-unemployment ratio falling below 1, indicating that the pressure on the labor market has eased.

2. Inflationary pressures ease

Core inflation is gradually easing, and the price trend is getting closer to the Federal Reserve's target.

3. Economic gro

View OriginalThe FedWatch tool shows that the market believes there is a 95% probability of a 25 basis point rate cut at this FOMC meeting.

Investors have almost regarded this interest rate cut as a "done deal."

1. The labor market is cooling down.

The number of job vacancies has dropped to a low point, with the job-to-unemployment ratio falling below 1, indicating that the pressure on the labor market has eased.

2. Inflationary pressures ease

Core inflation is gradually easing, and the price trend is getting closer to the Federal Reserve's target.

3. Economic gro

- Reward

- like

- Comment

- Repost

- Share

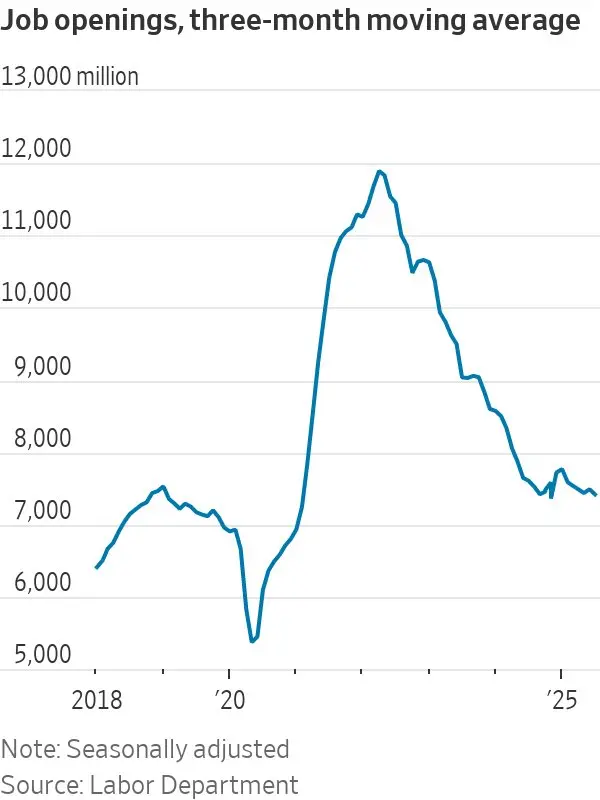

Job Vacancy ( July 2025

Core Data

The job vacancies in July dropped to the lowest level since September 2024, with a three-month average of approximately 7.4 million.

The number of job vacancies/unemployed persons has fallen below 1 for the first time since the beginning of 2021.

1. Labor market cooling: recruitment demand weakens, and the supply-demand relationship tends to balance.

2. Macroeconomic Impact: High interest rates and economic slowdown have suppressed corporate expansion.

3. Inflation and Wages: The reduction in job positions has eased the upward pressure on wages, helping to cur

View OriginalCore Data

The job vacancies in July dropped to the lowest level since September 2024, with a three-month average of approximately 7.4 million.

The number of job vacancies/unemployed persons has fallen below 1 for the first time since the beginning of 2021.

1. Labor market cooling: recruitment demand weakens, and the supply-demand relationship tends to balance.

2. Macroeconomic Impact: High interest rates and economic slowdown have suppressed corporate expansion.

3. Inflation and Wages: The reduction in job positions has eased the upward pressure on wages, helping to cur

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

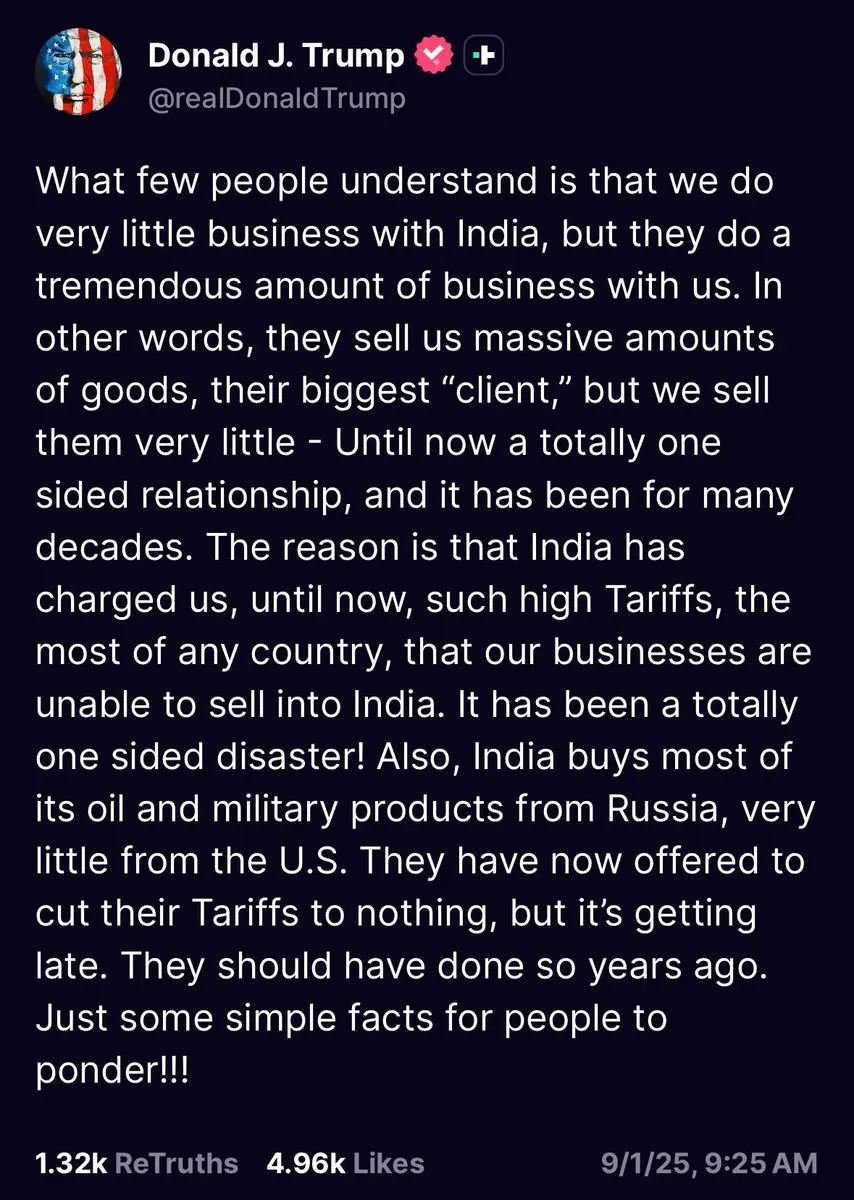

President Trump stated that India has proposed to reduce tariffs on the United States to 0%.

TRUMP1.75%

- Reward

- like

- Comment

- Repost

- Share

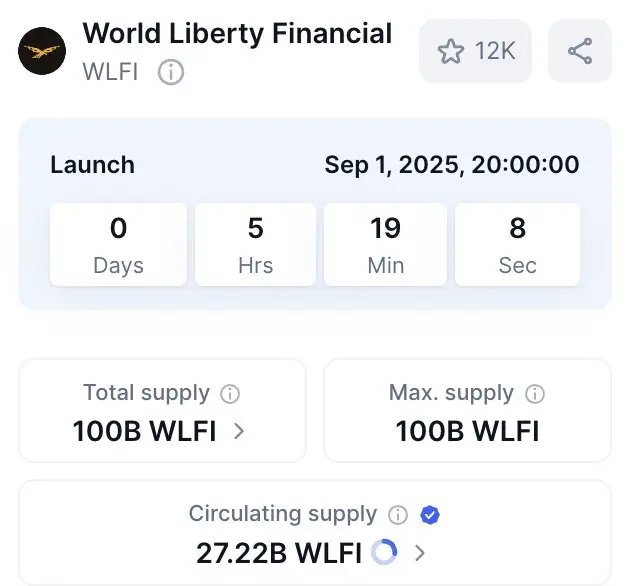

Is this confirmed✅? Initial circulation of 27.2 billion Tokens!

View Original

- Reward

- like

- Comment

- Repost

- Share

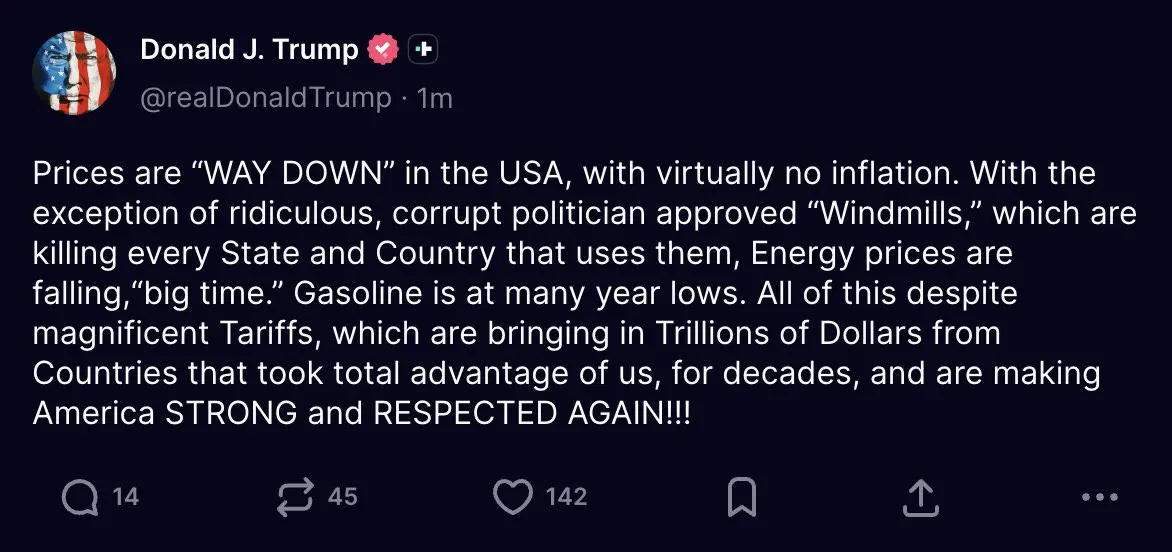

President Trump stated, "American prices have dropped significantly, and there is almost no Inflation."

TRUMP1.75%

- Reward

- like

- Comment

- Repost

- Share