Прогноз цены ETH: Сможет ли Ethereum преодолеть $3,000, когда доверие инвесторов возвращается?

Ethereum вновь набирает силу

По мере того как рынок постепенно восстанавливается после колебаний первой половины года, ценовая динамика ETH также привлекает всё большее внимание. Под влиянием множества благоприятных факторов рынок начинает предсказывать, сможет ли ETH пробить и удержаться выше отметки в 3000 долларов, а также открыть более широкое пространство для роста.

Дорожная карта обновления Pectra

Одним из самых значительных технологических прорывов Ethereum в последнее время является долгожданное обновление Pectra, которое значительно улучшает масштабируемость и экономическую эффективность основной сети Ethereum, рассматриваемое разработчиками как поворотный момент для давних препятствий. Виталик Бутерин недавно заявил на ETHGlobal, что план обновления уровня 1 позволит Ethereum достичь десятикратного увеличения мощности обработки транзакций в течение года, что окажет структурно положительное влияние на использование сети, разработку приложений и приток капитала.

Институциональные средства, поступающие в спотовый ETF на ETH

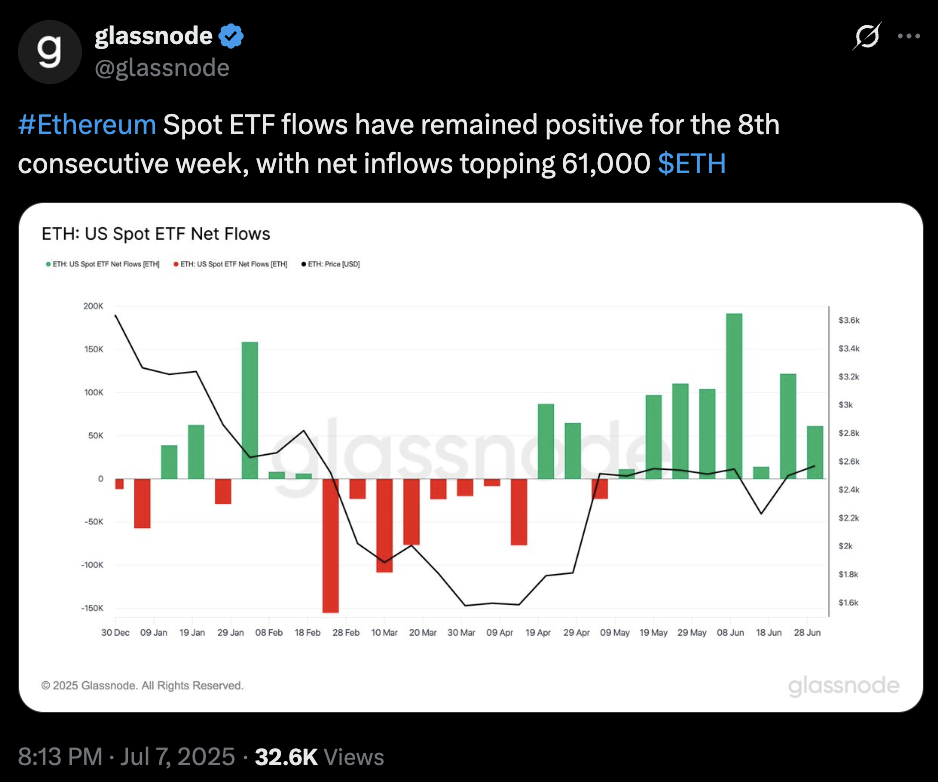

Помимо технического подъема, капитальный поток также демонстрирует бычье отношение на институциональном уровне. Согласно данным, опубликованным компанией Glassnode, спотовый ETF на ETH в США за последние восемь недель наблюдает постоянные чистые притоки, при этом на прошлой неделе приток составил более 61 000 ETH, что эквивалентно примерно 157 миллионам долларов.

(Источник: glassnode)

Этот тип ETF продукта в основном привлекает традиционных инвесторов, которые не знакомы с операциями в блокчейне. Стабильный приток средств в ETF показывает, что эти учреждения все еще имеют позитивный взгляд на будущий ценовой потенциал и рыночную позицию ETH. Анализ Santiment также упомянул, что спотовые ETF на Биткойн также находятся на стадии стабильного роста, что указывает на восстановление общего аппетита к риску на рынке.

Сигнал прорыва для ETH постепенно появляется.

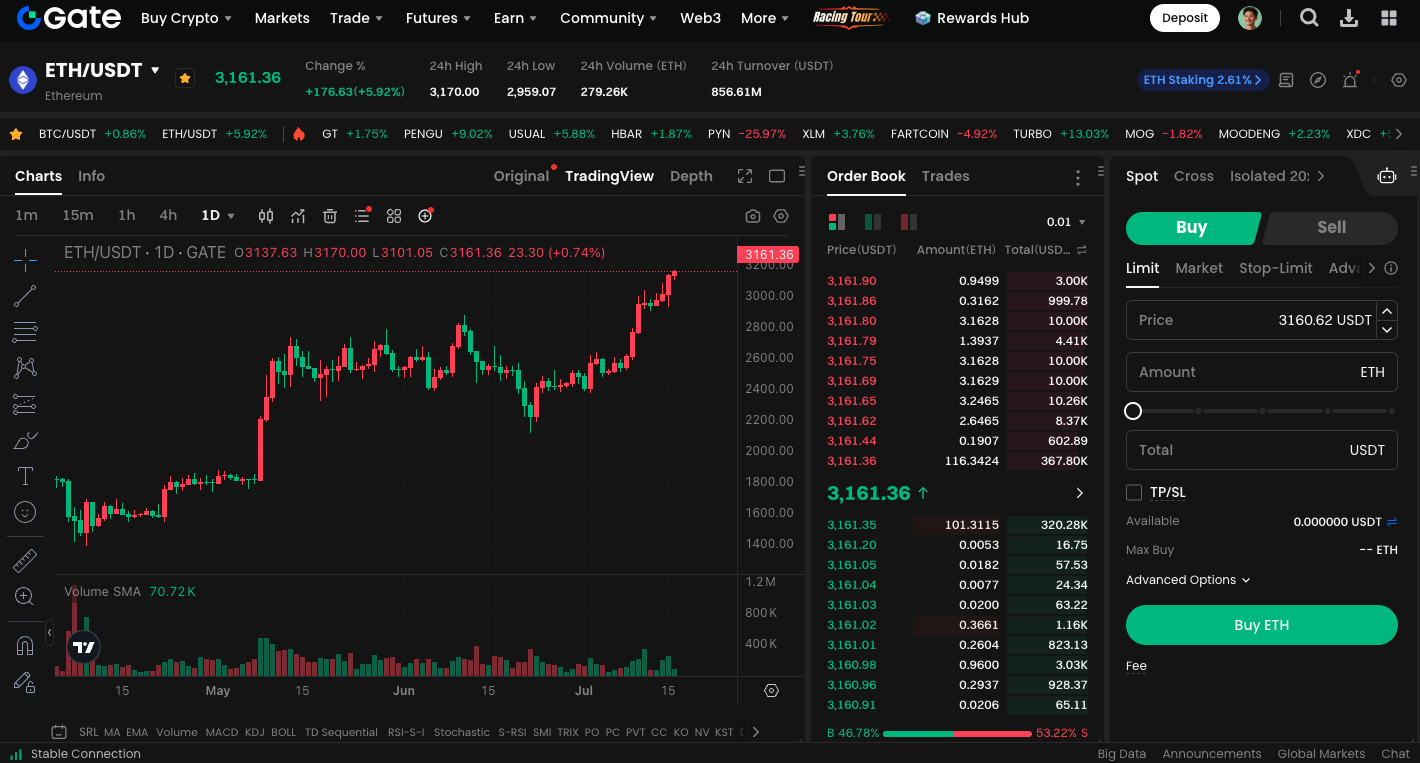

Несмотря на недавнюю консолидацию цены ETH, которая теперь преодолела свой диапазон, технический график и рыночные настроения предполагают, что предыдущие боковые движения могли быть периодом накопления перед значительным ростом. Если рынок продолжит выпускать положительные новости, такие как более четкая нормативная среда, увеличение объема торгов с ETF на ETH или восстановление активности сети ETH, то $3,000 больше не будет просто техническим барьером, а скорее станет отправной точкой нового восходящего тренда.

Начните торговать спотовым ETH немедленно:https://www.gate.com/trade/ETH_USDT

Резюме

На основе комплексных технических обновлений, капитальных потоков и рыночных настроений, долгосрочная структура ETH продолжает укрепляться. Для инвесторов, которые сейчас находятся в стороне, если ETH успешно удержится выше отметки в 3,000 USD, это может спровоцировать двойное прорыв как в техническом, так и в психологическом аспектах, открыв новую волну вызовов на уровне 3,500 и даже 4,000 USD.

Похожие статьи

Как переводить средства с Binance безопасно и эффективно

Понимание токена TRUMP в одной статье: Комплексный анализ токена $TRUMP

Как отследить транзакцию USDT BEP20?

Сколько времени займет добыча 1 биткойна в 2025 году? Подробное руководство

Что такое MELANIA: мем-монета на миллиард долларов, запущенная первой леди США