Análisis completo de los 25 indicadores para cronometrar el punto máximo del mercado en un Mercado alcista

Introducción: ¿Cuándo suele terminar un mercado alcista de criptomonedas?

Un mercado alcista de criptomonedas se refiere a una fase en la que los precios de los activos suben rápidamente y el sentimiento de los inversores se dispara. Sin embargo, ninguna corrida alcista dura para siempre. Los patrones históricos muestran que los mercados alcistas a menudo llegan a un punto de inflexión después de que aparezcan señales específicas, dando paso finalmente a correcciones o incluso a mercados bajistas.

Este artículo examina los signos típicos de un mercado alcista que termina mediante el análisis de ciclos pasados del mercado, señales técnicas y on-chain debilitantes, opiniones de expertos y factores macroeconómicos que pueden frenar el impulso. La conclusión clave: estas señales de advertencia suelen aparecer temprano y sirven como referencias cruciales para identificar los riesgos principales.

¿Por qué necesitamos indicadores del mercado alcista?

Si bien el momento de ingresar a un mercado alcista es importante, la verdadera clave para la rentabilidad radica en salir de forma segura cerca del pico. Muchos inversores se unen a un rally alcista con éxito pero pierden la oportunidad de obtener ganancias óptimas debido a la avaricia o la incapacidad de reconocer los máximos del mercado.

Para ayudar a los inversores a mejorar su juicio, un analista comunitario @_43A6 en X (anteriormente Twitter) compiló una lista de señales principales históricamente probadas, posteriormente refinadas y resumidas por @DtDt666. Finalmente, el equipo de Coinglass visualizó e integró esto en la “Lista de verificación de señales de mercado alcista”, que presenta 30 indicadores diseñados para ayudar a los inversores a determinar si el mercado se está sobrecalentando y si es hora de asegurar ganancias o adoptar una estrategia más conservadora.

Visión general de 25 indicadores en 7 categorías

Esta sección se basa en la lista de 30 señales principales del mercado alcista de Coinglass e incorpora datos de plataformas como Looknode y CoinAnk. Los indicadores se organizan en 7 categorías principales, con 25 indicadores principales comúnmente utilizados destacados y explicados uno por uno. Nota: No se recomienda depender de un solo indicador para la toma de decisiones. Los indicadores deben evaluarse juntos para obtener una comprensión más completa de si el mercado ha entrado en una fase potencialmente superior.

Introducciones detalladas y análisis de los indicadores son los siguientes:

1. Indicadores de precio y valoración

Estos indicadores evalúan si un activo está sobrevalorado o subvalorado examinando tendencias de precios históricos, promedios a largo plazo y modelos de valor de mercado. Se utilizan para determinar si el Mercado alcista ha alcanzado una etapa de sobrevaloración.

Propósito: Identificar burbujas de precios y establecer el momento de entrada/salida.

Indicador común:

1) Índice de acumulación de Bitcoin AHR999 (Índice Ahr999 de Bitcoin)

Fuente: https://www.coinglass.com/zh-TW/mercado-alcista-picos-senales

El índice AHR999 mide la relación entre el precio actual de BTC, su costo de DCA (promedio de costo en dólares) a 200 días, y una estimación de precio modelada. Fue propuesto originalmente por el usuario de Weibo ahr999, combinando la estrategia de DCA con el timing del mercado para ayudar a los inversores a tomar decisiones informadas. El indicador refleja los retornos de DCA a corto plazo y la desviación de precios.

Rangos del índice AHR999:

- 4: Se recomienda encarecidamente reducir posiciones

- 1.2: Zona de precaución, no ideal para operar

- 0.45–1.2: Adecuado para DCA

- < 0.45: Bueno para pescar en el fondo

Análisis:

Un valor de ≥4 sugiere un máximo del mercado alcista. El valor actual es 0.78, lo que indica que este ciclo es adecuado para DCA.

2) Indicador de Escape Superior AHR999x (Indicador de Escape Superior de Bitcoin AHR999x)

Fuente: https://www.coinglass.com/zh-TW/mercado-alcista-pico-senales

El Índice AHR999x es una versión evolucionada del Índice AHR999. Todavía evalúa el precio actual de BTC frente a los precios históricos o precios estimados basados en modelos para evaluar la relación calidad-precio de comprar en el nivel actual.

Rangos de índice AHR999x:

- Por encima de 8: Considerado históricamente como una zona de fondo

- Entre 0-0.45: Históricamente considerada una zona superior

Análisis:

Una lectura de ≤0.45 señala un pico del mercado alcista. El valor actual es 3.87. Aunque no ha activado una señal de pico, se encuentra en una zona moderadamente alta y neutral, lo que sugiere que el mercado no está sobrecalentado y aún no señala un pico.

3) Múltiplo de Puell

Origen: https://www.coinglass.com/zh-TW/bull-market-peak-signals

David Puell originalmente creó este indicador. El valor representa el múltiplo del ingreso actual de los mineros en relación con su ingreso promedio durante el último año, de ahí el nombre "Puell Multiple".

El cálculo es: el valor en USD de la producción diaria de minería de Bitcoin dividido por el promedio de 365 días.

Esta métrica refleja principalmente los ingresos de los mineros. Dado que los mineros suelen vender parte de sus BTC para cubrir los costos operativos, ayuda a evaluar su rentabilidad y la posible presión de venta en el mercado.

- En el rango (8, +∞): Indica una zona de fondo

- En el rango (0, 0.45): Indica una zona superior

Análisis:

La zona superior del mercado alcista es ≥2.2. El valor actual es 1.31, lo que indica que los mineros se encuentran en una fase de ganancias saludable, sin desencadenar presión de venta sistémica.

4) Gráfico arcoíris de Bitcoin

Fuente: https://www.coinglass.com/es/bull-market-peak-signals

El Bitcoin Rainbow Chart es una herramienta de valoración a largo plazo que utiliza una curva de crecimiento logarítmico para predecir las posibles tendencias de precios de Bitcoin. Sus características clave incluyen:

- Las bandas de colores del arco iris superpuestas en la curva de crecimiento logarítmico, con diferentes colores que reflejan el sentimiento del mercado y las posibles oportunidades de compra/venta.

- El precio suele fluctuar dentro de estas bandas arcoíris a lo largo del canal de crecimiento logarítmico.

Cómo utilizar esta herramienta:

- Cuando el precio alcanza áreas de colores más cálidos, indica que el mercado puede estar sobrecalentado, lo que presenta una buena oportunidad para tomar ganancias.

- Cuando el precio cae a áreas de color más frío, el sentimiento del mercado es bajo, generalmente un buen momento para acumular Bitcoin.

Este gráfico se actualiza cada 24 horas para reflejar el último precio de cierre diario.

Análisis:

La zona superior del mercado alcista es ≥5. El valor actual es 2, lo que indica que la valoración sigue siendo saludable o ligeramente fresca, lo que sugiere que el mercado no está sobrecalentado.

5) Bitcoin MVRV Z-Score

Fuente: https://www.coinglass.com/zh-TW/bull-market-peak-signals

El MVRV-Z Score es un indicador relativo que mide la diferencia entre la 'capitalización de mercado circulante' de Bitcoin y la 'capitalización de mercado realizada', luego estandariza utilizando la capitalización de mercado circulante. Su fórmula es:

Puntuación MVRV-Z = (Capitalización de mercado circulante - Capitalización de mercado realizada) / Desviación estándar (Capitalización de mercado circulante)

El "valor de capitalización de mercado realizado" se basa en el valor de las transacciones en cadena de Bitcoin, calculado mediante la suma del "último valor movido" de todos los Bitcoins en la cadena. Por lo tanto, cuando este indicador es demasiado alto, sugiere que la capitalización de mercado de Bitcoin está sobrevalorada en relación con su valor real, lo que puede ser desfavorable para el precio de Bitcoin. Por el contrario, cuando es bajo, sugiere subvaloración.

Basado en datos históricos, cuando este indicador alcanza máximos históricos, la probabilidad de que el precio de Bitcoin experimente una tendencia a la baja aumenta, señalando un riesgo potencial de perseguir precios altos.

Análisis:

La zona superior del mercado alcista es ≥5. El valor actual es 1.76, lo que indica que el mercado todavía se encuentra en una zona de beneficios pero no está sobrecalentado, permaneciendo en un rango saludable y, por lo tanto, no ha activado una señal de techo.

6) Bitcoin Macro Oscillator (BMO)

Fuente: https://www.coinglass.com/zh-TW/mercado-alcista-picos-senales

El Oscilador Macro de Bitcoin (BMO) incluye los siguientes puntos clave:

1. Función principal: Integra cuatro indicadores clave del mercado para analizar la dinámica del mercado de Bitcoin.

2.Cuatro Indicadores Principales:

- Ratio MVRV: Evalúa si el Bitcoin está sobrevalorado o subvalorado.

- Ratio VWAP: Calcula el precio promedio basado en el volumen de negociación.

- Ratio CVDD: Realiza un seguimiento del valor de la transacción y considera la antigüedad de la moneda.

- Índice de Sharpe: Evalúa rendimientos ajustados al riesgo.

3. Valor práctico:

- Puede identificar los máximos y mínimos del mercado.

- Niveles altos pueden indicar un tope del mercado.

- Niveles bajos pueden indicar oportunidades de compra.

Análisis:

Análisis:

La zona superior del mercado alcista es ≥1.4. El valor actual es 0.51, lo que indica un estado saludable y subvaluado, sin signos de una burbuja.

7) Bitcoin MVRV Ratio

Fuente: https://www.coinglass.com/zh-TW/mercado-alcista-pico-senales

La relación MVRV (Valor de mercado frente al valor realizado) destaca incluye:

1. Función principal: MVRV es un indicador utilizado para evaluar si el mercado de Bitcoin está sobrevalorado o infravalorado.

2. Método de cálculo: MVRV = Valor de mercado (MV) / Valor realizado (RV).

3. Estándares clave de juicio:

- MVRV > 1: La mayoría de los titulares están en beneficio, lo que indica que el mercado puede estar sobrecalentado (señala un máximo del mercado).

- MVRV < 1: La mayoría de los titulares están en pérdida, lo que indica que el mercado puede estar infravalorado (señala un fondo de mercado).

4.Valor práctico:

- Consider buying when MVRV is close to or below 1.

- Considera vender cuando MVRV excede 3.

Nota: Se recomienda utilizar este indicador junto con otros, no depender únicamente de MVRV para la toma de decisiones.

Análisis:

La zona superior del mercado alcista es ≥3. El valor actual es 1.95, que se encuentra en una zona ligeramente sobrecalentada normal, aún no desencadenando una señal superior. Es adecuado para monitorear, y si el índice sube por encima de 2.5-3.0, puede ser necesario considerar una reducción gradual o estrategias más conservadoras.

8) Bitcoin Mayer Múltiple

Fuente: https://www.coinglass.com/zh-TW/mercado-alcista-picos-senales

El Bitcoin Mayer Multiple se utiliza principalmente para evaluar el nivel de valor relativo del mercado de Bitcoin. Opera de la siguiente manera:

- Método de cálculo: Precio actual de Bitcoin / Precio promedio móvil de 200 días de Bitcoin.

- Proporciona evaluaciones de las condiciones del mercado:

- 1: Indica posibles condiciones de sobrecompra.

- <1: Indica posibles condiciones de sobreventa.

- Cerca de 1: Indica un mercado equilibrado.

Importante, cuando el índice supera 2.4, generalmente señala un mercado sobrecalentado, mientras que valores por debajo de 0.8 pueden indicar una oportunidad de compra.

Análisis:

La zona superior del mercado alcista es ≥2.2. El valor actual es 0.96, que se encuentra en el rango normal o infravalorado, sin activar una señal de mercado alcista superior.

9) Predicción del precio terminal (Precio terminal de Bitcoin)

Fuente: https://coinank.com/indexdata/btcPricePrediction

Este es un límite de precio a largo plazo predicho por un modelo on-chain creado por Checkmate. El precio terminal asume que todo el Bitcoin ha sido minado y que el valor histórico de todas las actividades on-chain está estandarizado. Proporciona un "límite de precio que podría alcanzarse si el ciclo actual entra en un estado de FOMO extremo", basado en el valor y el tiempo de las transacciones on-chain (Días de Moneda Destruidos), y se utiliza para estimar el modelo de valoración final de Bitcoin.

Juicio de condiciones del mercado:

- Si el precio de BTC está dentro del 10% del precio terminal: Entrando en la zona de burbujas, se recomienda tomar ganancias o salir parcialmente de las posiciones principales.

- Si el precio de BTC cruza el precio terminal: El mercado puede estar sobrecalentándose, y el mercado está en una fase de alto riesgo. Otros indicadores deben ser monitoreados.

- Si el precio de BTC está por debajo del precio terminal: El mercado no está sobrecalentado y se puede considerar mantenerlo.

Análisis:

El valor de referencia de la zona superior del mercado alcista de Coinglass es 187,702, lo que indica que el precio actual aún no ha alcanzado esta zona. Sin embargo, según el gráfico de CoinAnk, en los mercados alcistas pasados (2013, 2017, 2021), los precios de BTC se acercaron o tocaron la línea de precio terminal antes de ingresar a la zona superior. Esto generalmente ocurrió más tarde que el Top Cap o Delta Top, marcando el límite de precio en la fase eufórica final.

2. Análisis técnico y predicción del ciclo

A través de promedios móviles históricos, cruces de medias móviles, modelos multiplicadores y otras pautas técnicas y leyes cíclicas, se pronostican posibles techos del mercado alcista.

Propósito: predecir puntos de inflexión a partir de gráficos y ritmos temporales.

Indicadores comunes:

10) Indicador superior del ciclo Pi

El Indicador del Ciclo Pi presume de una alta precisión histórica y puede predecir los picos del mercado con precisión en un plazo de 3 días. Principalmente utiliza dos medias móviles para evaluar:

- media móvil de 111 días (corto plazo)

- 2x del promedio móvil de 350 días (a largo plazo)

Clave de juicio:

- Cuando la línea a corto plazo (111DMA) cruza por encima de la línea a largo plazo (350DMA x 2), generalmente indica que el mercado ha alcanzado un pico.

- El “Pi” en el nombre del indicador proviene de la razón 350/111 ≈ 3.153, que es muy cercana al valor de π (3.142).

Análisis:

La zona de escape del mercado alcista es ≥152,817, mientras que el valor actual es 83,852. El Indicador del Ciclo Pi aún no ha ingresado a la zona de escape, y Bitcoin aún no ha alcanzado un pico sobrecalentado. Actualmente se encuentra en un rango técnico a mediano plazo. Basado en la precisión histórica, se recomienda continuar monitoreando el cruce entre el 111DMA y 350DMA×2. Si el precio se acerca a $150,000 o más, se recomienda aumentar la precaución.

11) Multiplicador MA de 2 años

Fuente: https://coinank.com/zh-tw/indexdata/year2MA

Los puntos principales del indicador Multiplicador de la MA de 2 años son:

- Esta es una herramienta de inversión a largo plazo utilizada para determinar el momento de compra y venta de Bitcoin.

- Utiliza dos líneas clave:

- El promedio móvil de 2 años (línea verde, equivalente al promedio móvil de 730 días)

- 5 veces el promedio móvil de 2 años (línea roja)

Señales de compra y venta:

- Señal de compra: Cuando el precio cae por debajo del promedio móvil de 2 años (línea verde)

- Señal de venta: Cuando el precio supera 5 veces el promedio móvil de 2 años (línea roja)

Principio: Este indicador captura de manera efectiva los sentimientos extremos del mercado. Cuando los inversores están excesivamente emocionados, los precios suben en exceso, y cuando están excesivamente pesimistas, los precios caen demasiado. Al identificar estos períodos extremos, los inversores a largo plazo pueden encontrar mejores oportunidades de compra y venta.

Análisis:

La zona de escape del mercado alcista es ≥282,335, mientras que el valor actual es 83,852. El Multiplicador MA de 2 años actualmente no muestra señales de riesgo de escape. El precio del Bitcoin sigue estando significativamente por debajo de la línea roja, lo que sugiere que todavía hay margen para el crecimiento del precio y para mantener el valor para los titulares a largo plazo. Es importante monitorear continuamente cuando el precio se acerque a $280,000 o más para evaluar las posibles zonas de riesgo.

12) RSI - 22 Día

Fuente: TradingView, RSI de BTCUSD configurado a 22 días

El índice de fuerza relativa (RSI) es un oscilador de impulso propuesto por el analista técnico J. Welles Wilder en 1978, utilizado para medir la fuerza de las fluctuaciones recientes en el precio de un activo. El RSI se calcula típicamente en base a 14 días de operaciones; sin embargo, en la práctica, los traders ajustan los parámetros de acuerdo a sus estrategias comerciales específicas y las condiciones del mercado.

RSI-22Day se refiere al indicador RSI calculado en un período de 22 días (puede establecer el número de días en 22 usted mismo). Es más suave que el período estándar de 14 días y es más adecuado para el análisis de tendencias a medio y largo plazo.

Intervalo de referencia:

- RSI > 70: El mercado está sobrecalentado, posiblemente sobrecomprado, entrando en precaución.

- RSI < 30: El mercado está sobrevendido, posiblemente subvaluado, punto de compra potencial.

Análisis:

La zona de escape del mercado alcista es ≥ 80, con el valor actual en 45.29, lo que indica que el mercado aún no ha entrado en la zona de alto riesgo. Es neutral a ligeramente frío, lo que significa que el repunte a corto plazo no se ha expandido en exceso, por lo que no desencadena una señal de escape.

13) Promedio móvil de 4 años de Bitcoin

Definición del promedio móvil de 4 años: Calcula el precio de cierre diario promedio de Bitcoin durante los últimos 4 años (aproximadamente 1460 días) y se utiliza para analizar tendencias a largo plazo.

¿Por qué es importante:

- Corresponde al ciclo de reducción a la mitad de Bitcoin cada 4 años y tiene un valor de análisis de ciclo a largo plazo.

- A menudo se utiliza como una línea de soporte y resistencia sólida para ayudar a determinar los puntos de reversión del mercado.

Cómo usar:

- Oportunidad de compra: Cuando el precio cae cerca del promedio móvil de 4 años y recibe apoyo, especialmente cerca del final de un mercado bajista.

- Oportunidad de venta: Cuando el precio es significativamente más alto que el promedio móvil de 4 años y comienza a disminuir, puede ser una oportunidad para salir del mercado.

Ejemplo de validación:

Durante el mercado alcista de 2020-2021, el precio fue significativamente más alto que el promedio móvil, lo que indica una sobrecompra; durante el mercado bajista de 2018-2019, el precio cayó cerca del promedio móvil y se recuperó, confirmando la fiabilidad de este indicador.

Análisis:

El índice de escape del mercado alcista es ≥ 3.5, con un valor actual de 1.85. En esta etapa, Bitcoin sigue por encima del promedio a largo plazo pero aún no ha entrado en una sobrevaloración extrema o zona de burbuja, permaneciendo en una fase saludable del mercado alcista.

14) Índice CBBI (Índice de carrera alcista de Bitcoin Crypto)

El índice CBBI (nombre completo Colin Talks Crypto Bitcoin Bull Run Index) es un indicador utilizado para evaluar la fase del ciclo del mercado de Bitcoin. Es una herramienta de análisis integral del ciclo del mercado que combina múltiples indicadores en cadena y técnicos, utilizando un "Puntaje de Confianza" (0-100) para determinar si Bitcoin se acerca al tope de un mercado alcista o al fondo de un mercado bajista.

Rango de referencia:

- 80–90 puntos: El mercado puede estar acercándose al tope del mercado alcista, lo que sugiere precaución.

- <20 puntos: El mercado puede estar en el fondo del mercado bajista, lo que lo convierte en un posible punto de entrada.

Análisis:

La referencia de escape del mercado alcista es ≥ 90, con el valor actual en 72. Sugiere que el mercado puede estar en las etapas intermedias a tardías de un mercado alcista, pero aún no en la cima. Este rango se observa comúnmente en las etapas intermedias a tardías de un mercado alcista, donde el mercado ha ganado impulso y sentimiento, pero aún no ha entrado completamente en una fase de burbuja. Es importante tener en cuenta que el CBBI está en la etapa Beta, y la composición del indicador puede ajustarse en cualquier momento.

3. Flujo de capital y asignación de activos

Refleja las tendencias de asignación de grandes fondos e inversores institucionales en el mercado, incluidos los flujos de fondos de ETF, los flujos de spot y derivados, y la dinámica del capital que se mueve dentro y fuera de Bitcoin y altcoins.

Propósito: Seguir el comportamiento de los principales actores y la tendencia de reasignación de activos.

Indicadores comunes:

15) Días continuos de salida neta de ETF de Bitcoin Spot (Días de salidas netas de ETF)

El ETF de Bitcoin (fondo cotizado en bolsa) es una herramienta financiera que permite a los inversores participar en las fluctuaciones de precios de Bitcoin a través de los mercados financieros tradicionales de forma indirecta. Los inversores compran acciones del fondo en lugar de poseer Bitcoin real, lo que lo hace accesible para inversores convencionales que pueden no estar familiarizados con la tecnología de criptomonedas.

Principales características del Bitcoin ETF:

- Diferencia de propiedad: los inversores poseen acciones del fondo ETF en lugar de Bitcoin real.

- Restricciones de horario de negociación: los ETF se negocian en los mercados de valores tradicionales durante horas específicas, a diferencia del mercado de criptomonedas 24/7.

- Estructura de tarifas: los ETF tienen tarifas de gestión, mientras que mantener Bitcoin directamente solo requiere pagar tarifas de negociación.

- Conveniencia y Seguridad: Evita la gestión de billeteras y los riesgos de claves privadas, reduciendo las barreras técnicas.

Importancia:

Los ETF de Bitcoin se consideran un puente crucial para la adopción generalizada de criptomonedas, atrayendo capital institucional y conservador y mejorando la legitimidad y liquidez de Bitcoin dentro de los sistemas financieros tradicionales.

Análisis:

La referencia de escape del mercado alcista es ≥ 10, con el valor actual en 2. El mercado no ha mostrado signos de retiros de fondos a gran escala continuos, lo que indica un ajuste saludable dentro de las fluctuaciones a corto plazo, por lo que aún no ha alcanzado el umbral de escape.

16) Ratio de ETF a BTC

Fuente: SoSoValueETF - US Bitcoin Spot ETF

El índice ETF-to-BTC es un indicador que mide la cantidad de Bitcoin mantenida por los Fondos Cotizados en Bolsa (ETF) de Bitcoin en relación con la oferta circulante total de Bitcoin.

Representa la proporción de 'la cantidad total de Bitcoin mantenida por todos los ETF de Bitcoin spot' a 'la oferta circulante total de Bitcoin'. Esta proporción sirve como una métrica de observación importante para la participación institucional, el bloqueo de liquidez y la estructura del mercado.

Fórmula de cálculo:

Relación ETF-to-BTC = (Cantidad total de Bitcoin en todos los ETF de Bitcoin) / (Suministro circulante total de Bitcoin)

Usos prácticos:

- Evaluación de la influencia del mercado: Esta proporción refleja la influencia de los ETF de Bitcoin en el mercado general de Bitcoin. Una proporción más alta puede indicar que los inversores institucionales están reteniendo cantidades significativas de Bitcoin a través de ETF, mostrando un fuerte interés y confianza en Bitcoin.

- Análisis de liquidez: Si los ETFs tienen grandes cantidades de Bitcoin, puede afectar la liquidez del mercado, ya que estos Bitcoins suelen estar bloqueados en el fondo, reduciendo la oferta disponible para operar en el mercado.

- Pronóstico de tendencia de precios: A medida que más Bitcoin es retenido por ETF, la oferta disponible en el mercado disminuye, lo que puede ejercer presión al alza sobre los precios.

Evaluación del rango:

- Cuanto mayor sea la proporción → Indica que más BTC está siendo bloqueado a largo plazo por las instituciones del ETF, reduciendo la oferta y potencialmente causando presión al alza en el precio.

- Cuanto menor sea la proporción → Indica una menor participación institucional, más salidas de ETF o una demanda a corto plazo debilitada.

Análisis:

La referencia de escape del mercado alcista es ≤ 3.5%, con el valor actual en 5.34%. El valor ha excedido el umbral de escape, lo que indica que las instituciones están acumulando Bitcoin en grandes cantidades, y el mercado se encuentra en una fase dominada por instituciones. Aunque la demanda es fuerte, superar el valor crítico también puede sugerir que el impulso de capital a corto plazo se acerca a la saturación, una señal estándar en las etapas posteriores de un mercado alcista. Si el crecimiento del ETF se ralentiza o se convierte en salidas, podría desencadenar una corrección del mercado.

17) Dominancia de Bitcoin

La Dominancia de Bitcoin es un indicador que mide la proporción de capitalización de mercado de Bitcoin en todo el mercado de criptomonedas. Específicamente, es la relación entre la capitalización de mercado de Bitcoin y la capitalización de mercado total de todas las criptomonedas, generalmente expresada como un porcentaje.CoinGecko

Fórmula de cálculo:

Dominio de Bitcoin = (Capitalización de mercado de Bitcoin / Capitalización total del mercado de criptomonedas) × 100%

Importancia:

- Indicador de tendencia del mercado: la Dominancia de Bitcoin se puede utilizar para medir el sentimiento y las tendencias del mercado. Cuando la proporción aumenta, indica que los inversores prefieren Bitcoin, a menudo debido a un aumento en la aversión al riesgo del mercado. Cuando la proporción disminuye, puede sugerir que los inversores se están interesando más en otras criptomonedas (como Ethereum, Ripple, etc.), lo que potencialmente señala la llegada de la “temporada de altcoins.”

- Ajuste de cartera: Los inversores pueden ajustar su asignación de activos en función de los cambios en la Dominancia de Bitcoin. Por ejemplo, cuando la Dominancia de Bitcoin aumenta, puede ser apropiado aumentar las tenencias de Bitcoin; por el contrario, si la dominancia disminuye, se podría considerar asignar más a las altcoins.

Análisis:

La referencia de escape del mercado alcista es ≥ 65%. El valor actual es 61.95%. Todavía no estamos en la zona de riesgo en la parte superior, pero se está acercando. Se necesita atención para ver si la cuota de mercado de Bitcoin sigue aumentando.

18) Costo promedio de Bitcoin de MicroStrategy

MicroStrategy (ahora conocida como Strategy) es una empresa estadounidense de software de inteligencia empresarial que comenzó a adquirir Bitcoin como activo de reserva financiera en agosto de 2020. A partir del 30 de marzo de 2025, la empresa posee un total de 528,185 Bitcoins, con un costo total de compra de aproximadamente $35.63 mil millones, lo que hace que el precio promedio de compra por Bitcoin sea de alrededor de $66,384.56. Estas tenencias representan aproximadamente el 2.5% del suministro total de Bitcoin.

¿Por qué se ve el costo de MicroStrategy como una referencia superior de escape?

- MicroStrategy representa a inversores institucionales y actúa como un "barómetro de sentimiento."

- La línea de costos de MicroStrategy = la línea de defensa institucional o punto de ruptura alcista.

- Históricamente, varias veces cuando el precio de Bitcoin rompió por encima de la línea de costos de MicroStrategy, fue seguido por una afluencia de capital en el mercado.

- Referencia de configuración de Coinglass: BTC ≥ 2x el costo de MicroStrategy

Precio de Bitcoin vs Costo de MicroStrategy

- A largo plazo por debajo: Observar o acumular a precios más bajos a largo plazo.

- Cerca o ligeramente por encima: considere mantener dependiendo de la situación.

- Significativamente por encima (por ejemplo, más de 2 veces): Ejercer precaución, considerar tomar ganancias gradualmente.

Análisis:

La referencia de escape del mercado alcista es ≥ 155,655. El valor actual es 63,657. Todavía hay una brecha significativa entre el valor actual y el valor de referencia de escape, lo que indica que el mercado no está sobrecalentado y Bitcoin sigue en un rango relativamente saludable, por lo tanto, no se activa el indicador superior de escape.

4. Datos en cadena y comportamiento de retención

Observar los datos en cadena para rastrear el comportamiento de los titulares a largo y corto plazo, modelos HODL, días de destrucción de monedas, etc., ayuda a determinar si los inversores experimentados están obteniendo beneficios o si el mercado se está enfriando.

Propósito: Monitorear los movimientos de los creyentes en cadena y los cambios entre el comportamiento de retención a largo plazo y a corto plazo.

Indicadores comunes:

19) Suministro de titulares a largo plazo de Bitcoin

El Suministro de Titular a Largo Plazo (LTH) se refiere a la cantidad de Bitcoin en manos de carteras que han mantenido el activo durante más de 155 días. Se utiliza para reflejar la confianza a largo plazo en el mercado y la presión de venta.

Intervalo de referencia:

- Señal alcista: Cuando los precios son bajos, si la oferta a largo plazo sigue aumentando, muestra que el mercado está acumulando.

- Señal de advertencia: Cuando los precios están en sus máximos, si la oferta LTH disminuye, puede indicar ventas a precios altos.

Análisis:

La referencia de escape del mercado alcista es ≤ 13.5M BTC. El valor actual es 14.61M BTC. Actualmente, el suministro de LTH sigue siendo alto y el mercado aún no ha entrado en una fase de presión de venta a gran escala. Sin embargo, si la cantidad en manos disminuye rápidamente y se acerca o cae por debajo del nivel de 13.5M, se debe tener precaución, ya que podría indicar que los titulares a largo plazo están comenzando a liberar sus posiciones, ingresando en una zona de alto riesgo.

20) Riesgo de reserva de Bitcoin

Visión general del indicador de riesgo de reserva:

- Función principal: Evalúa el nivel de confianza de los titulares a largo plazo en Bitcoin.

Señales de inversión:

- Señal de compra: Cuando la confianza es alta pero el precio es bajo (zona verde).

- Señal de venta: Cuando la confianza disminuye pero el precio es alto (zona roja).

Cálculo: Los siguientes factores se utilizan para evaluarlo:

- Días de Destrucción de Bitcoin (BDD): Rastrea la duración de la tenencia.

- BDD ajustado (ABDD): Considera el impacto en la circulación.

- Valor de la moneda de destrucción (VOCD): Seguimiento del valor de destrucción.

Por qué es efectivo: Cuando los titulares a largo plazo (generalmente más experimentados) comienzan a vender en grandes cantidades, a menudo señala que el mercado está cerca de un máximo, y ABDD superará el valor promedio.

Análisis:

Mercado alcista escape referencia ≥ 0.005, el valor actual es 0.0021, todavía en la zona segura, sin presión de escape todavía.

21) Bitcoin Ratio RHODL

Visión general de la proporción RHODL:

Definición y cálculo:

- Compara la relación de las olas de retención de 1 semana y 1-2 años, considerando el factor de edad del mercado.

- Basado en el valor realizado de UTXO (salidas de transacción no gastadas), que es el precio en la última transferencia de token.

Uso:

- Cuando el valor de 1 semana es significativamente mayor que el valor de 1-2 años, indica un mercado sobrecalentado.

- Cuando la proporción se acerca a la zona roja, es un buen momento para tomar ganancias.

Ventajas:

- En comparación con otros indicadores, evita el error de juicio desde abril de 2013, ofreciendo mayor precisión.

- Es adecuado para inversores a largo plazo, ayudando a predecir posibles puntos de retroceso y tiempos de rebote.

Análisis:

Referencia de escape del mercado alcista ≥ 10000, el valor actual es 2682, la proporción de RHODL está muy por debajo de la zona de escape. Si bien los fondos a corto plazo están siendo más activos, aún no han dominado el mercado, y los titulares a largo plazo siguen manteniendo la estabilidad.

5. Datos de stablecoins y apalancamiento

Datos relacionados con la liquidez del mercado, las tasas de préstamo y los ratios de apalancamiento. Estos pueden revelar si el mercado está utilizando excesivamente el apalancamiento y si el costo de capital es demasiado alto.

Uso: Mide los riesgos de burbuja del mercado y las presiones de préstamo.

Indicadores comunes:

22) Ahorros líquidos en USDT

Este indicador refleja la tasa de interés anualizada para inversores que depositan USDT en plataformas para "ahorros líquidos," lo cual está estrechamente relacionado con la demanda de fondos USDT y la actividad de apalancamiento del mercado. Es un indicador importante para medir los costos de capital del mercado y reflejar la liquidez general del mercado.

Cómo interpretar:

Tasa de interés en aumento (por encima del 29%):

Indica una demanda inusualmente alta de USDT, a menudo asociada con períodos de alta demanda de operaciones de alto apalancamiento. Esto suele coincidir con el sobrecalentamiento del mercado y la especulación excesiva, lo que indica que el mercado alcista puede estar acercándose a su pico.Tasa de interés baja (mucho menos del 29%):

Indica una demanda normal o baja de fondos, con un sentimiento de mercado más moderado. El mercado alcista aún no ha entrado en una fase frenética.

Análisis:

La referencia superior del mercado alcista es ≥ 29%, el valor actual es 5.8%, lo que indica un rango bajo normal, lo que sugiere que la demanda de apalancamiento del mercado no es alta y los inversores no están endeudándose en exceso para especular.

6. Comunidad y Calor del Sentimiento

Esto implica observar el entusiasmo de los participantes del mercado, FOMO (Miedo a Perderse), índice de miedo y densidad de opinión pública. Se utiliza para identificar si los inversores se encuentran en un estado de irracionalidad colectiva.

Propósito: Determinar si el mercado está sobrecalentado o entrando en una fase de frenesí del mercado.

Indicadores comunes:

23) Bitcoin Beneficio/Pérdida no realizada neto (NUPL)

NUPL (Net Unrealized Profit/Loss) es un indicador en cadena utilizado para medir la ganancia y pérdida no realizadas de los titulares del mercado en general, reflejando el sentimiento del mercado.

Método de cálculo:

- Basado en dos puntos de datos clave: capitalización de mercado (precio actual × circulación) y valor realizado (suma de los precios de las últimas transacciones).

Juicio de Etapa del Mercado:

- NUPL alto (>50%): Indica que el mercado está sobrecalentado, adecuado para tomar ganancias.

- Bajo NUPL (<0%): Indica pánico en el mercado, posiblemente una oportunidad de compra.

Valor práctico:

- Sigue el equilibrio entre el crecimiento de la capitalización del mercado y la toma de beneficios.

- Puede usarse para predecir los máximos y mínimos del mercado, ya que un NUPL alto suele aparecer antes de un pico.

Este es un indicador importante para medir el sentimiento de los inversores, ayudando a los inversores a cronometrar mejor el mercado.

Análisis:

La referencia del pico del mercado alcista es ≥70%. El valor actual es del 47.74%, lo que indica que el mercado aún no ha alcanzado un estado extremo de toma de ganancias. La mayoría de los titulares están en ganancias, pero aún no han entrado en la locura de la venta masiva.

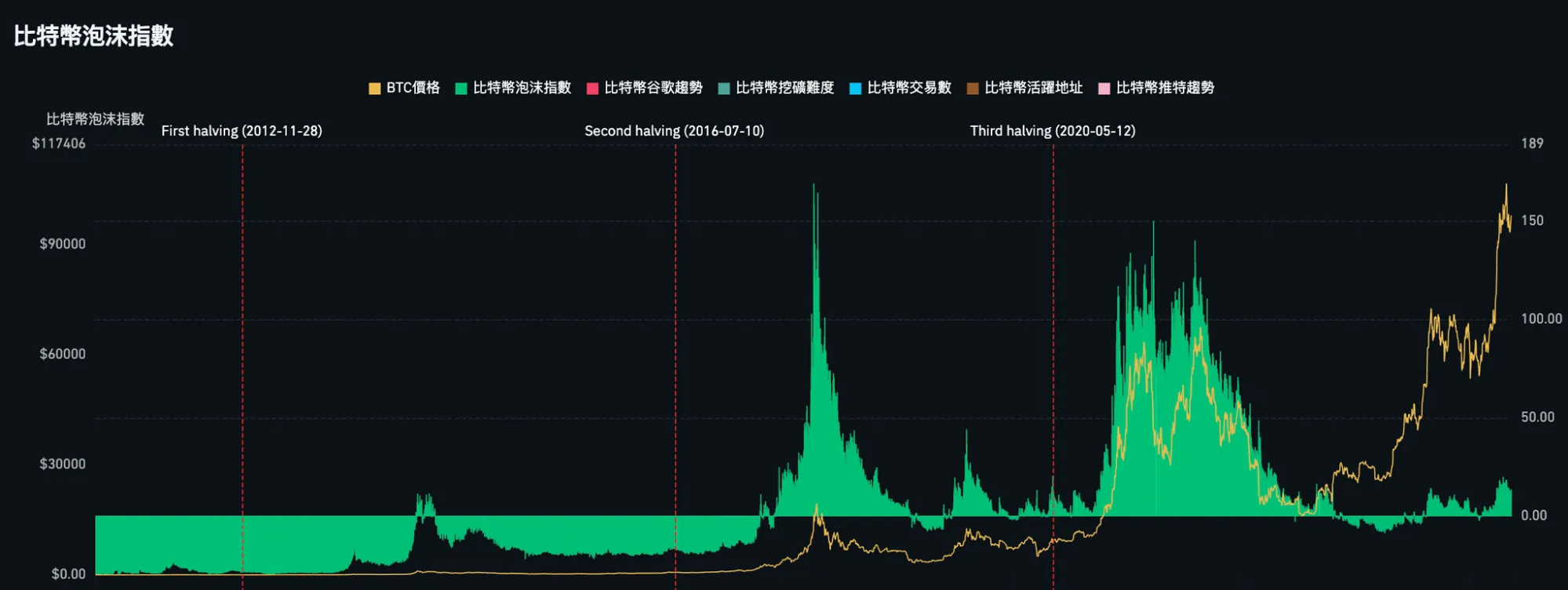

24) Índice de la burbuja de Bitcoin

El índice de la burbuja de Bitcoin, creado por el usuario de Weibo Ma Chao Terminal, es un indicador integral utilizado para evaluar si el precio de Bitcoin se está desviando de sus fundamentos y sentimiento del mercado, evaluando la razonabilidad del precio de mercado de BTC.

Los factores considerados en el cálculo incluyen:

- Precio, aumento del precio en 60 días, sentimiento público, dificultad de la tasa de hash, direcciones activas y transacciones de red.

Uso:

- Cuanto más alto sea el índice, más se desvía el precio de Bitcoin del sentimiento general del mercado.

- Un índice negativo o bajo puede indicar una buena oportunidad de compra.

Análisis:

La referencia del pico del mercado alcista es ≥80. El valor actual es 13.48, lo que indica que el aumento de precio actual todavía está respaldado por fundamentos y sentimiento de la comunidad, y aún no ha entrado en una fase irracional y frenética.

7. Observación de la temporada de Altcoins y rotación

Realice un seguimiento para ver si los fondos de Bitcoin empiezan a moverse hacia otros activos (como ETH, L1, MEME coins, etc.) y evalúe si el mercado en su conjunto está entrando en una fase de rotación de alto riesgo.

Uso: Predecir la locura de las altcoins y los riesgos potenciales en las etapas posteriores de un mercado alcista.

Indicadores comunes:

25) Índice de la Temporada de Altcoins

El Índice de la Temporada de Altcoins se utiliza principalmente para medir el rendimiento del mercado de criptomonedas no Bitcoin (altcoins) y si superan a Bitcoin en un período específico. El índice se actualiza diariamente.

Base de cálculo:

- El rendimiento relativo de las Altcoins frente a Bitcoin: Si el 80% de las 50 principales monedas en los últimos 90 días superan a Bitcoin (excluyendo las monedas estables). (Confirmado por el autor y el equipo técnico de Coinglass)

- Dominancia del mercado de BTC: La participación de capitalización de mercado de Bitcoin en todo el mercado de criptomonedas.

- Volumen y volatilidad de negociación de BTC/Altcoin: Si el volumen de negociación y los precios de altcoin aumentan significativamente mientras que Bitcoin permanece relativamente estable, podría señalar el inicio de una temporada de altcoin.

- Sentimiento de la comunidad y opinión pública en aumento.

Uso:

- Para determinar si el mercado ha entrado en la "Temporada de Altcoins".

- Como referencia para la rotación de capital y los cambios en la estructura del mercado.

- Para ayudar a los inversores con la asignación de activos y la gestión del riesgo.

Interpretación:

- Índice ≥ 75: Claramente ingresando en la Temporada de Altcoins, con una importante entrada de capital en altcoins, a menudo observada al final de un mercado alcista, potencialmente señalando un máximo.

- Índice ≤ 25: El capital de mercado sigue concentrado en Bitcoin, con altcoins con un rendimiento inferior, lo que indica que la Temporada de Altcoins aún no ha llegado.

Análisis:

La referencia superior del mercado alcista es ≥ 75. El valor actual es 20, lo que indica que las altcoins están subrendiendo significativamente a Bitcoin, y el mercado sigue estando dominado por Bitcoin. Las altcoins aún no han tomado el liderazgo de Bitcoin, lo que sugiere que el mercado alcista aún no ha entrado en la fase de "frenesí final". Desde una perspectiva de rotación y distribución de capital, el riesgo de un tope de mercado aún no es evidente, pero se debe prestar atención a si este índice sube rápidamente.

Conclusión

De las siete categorías y 25 señales principales del mercado alcista resumidas en este artículo, está claro que aunque el mercado se encuentra en la etapa intermedia-alta del mercado alcista de Bitcoin, aún no ha habido un sobrecalentamiento sistémico o formación de burbujas.

Si comienzas a sentir que el mercado se está volviendo demasiado caliente, no es necesario liquidar todas las posiciones inmediatamente. En su lugar, puedes adoptar un enfoque gradual:

- Comience a tomar ganancias gradualmente.

- Ajuste la exposición al riesgo y la asignación de activos mediante la reducción del apalancamiento y evitando tokens impulsados por FOMO.

- Aumenta la flexibilidad de tus fondos.

- Monitorear cambios en múltiples indicadores simultáneamente.

Como se mencionó al principio, no es recomendable depender únicamente de un solo indicador. Si varios indicadores se alinean, la fiabilidad de la señal de techo del mercado será mayor.

Finalmente, estos indicadores se proporcionan solo como referencia y no deben considerarse consejos de inversión o herramientas predictivas absolutas. La verdadera sabiduría en inversión radica en comprender los ciclos del mercado, gestionar el riesgo y proteger las ganancias en el momento adecuado. Abordemos el mercado de criptomonedas, lleno de oportunidades y desafíos, con racionalidad y paciencia.

Artículos relacionados

¿Qué es Tronscan y cómo puedes usarlo en 2025?

¿Cómo hacer su propia investigación (DYOR)?

¿Cómo apostar ETH?

¿Qué es SegWit?

Las 10 principales plataformas de comercio de monedas MEME