2025 ZILPrice Prediction: Analyzing Future Trends and Growth Potential for Zilliqa in the Crypto Market

Introduction: ZIL's Market Position and Investment Value

Zilliqa (ZIL), as a high-throughput public blockchain platform, has achieved significant milestones since its inception in 2018. As of 2025, Zilliqa's market capitalization has reached $214,063,290, with a circulating supply of approximately 19,536,669,732 tokens, and a price hovering around $0.010957. This asset, often referred to as the "scalability solution," is playing an increasingly crucial role in areas such as electronic advertising, payments, sharing economy, and property rights management.

This article will comprehensively analyze Zilliqa's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors, to provide investors with professional price predictions and practical investment strategies.

I. ZIL Price History Review and Current Market Status

ZIL Historical Price Evolution

- 2020: During the crypto market crash in March, ZIL price hit its all-time low of $0.00239616

- 2021: Bull market peak, ZIL reached its all-time high of $0.255376 on May 7

- 2022-2023: Bearish crypto winter, price declined significantly from its peak

ZIL Current Market Situation

As of September 24, 2025, ZIL is trading at $0.010957, with a 24-hour trading volume of $254,138.54. The token has seen a 1.13% increase in the last 24 hours. ZIL's market cap currently stands at $214,063,290, ranking it 284th in the cryptocurrency market. The circulating supply is 19,536,669,732.74 ZIL, which is 93.03% of the total supply of 21,000,000,000 ZIL. Despite recent gains, ZIL is still down 29.17% over the past year, reflecting the broader market challenges faced by many cryptocurrencies.

Click to view the current ZIL market price

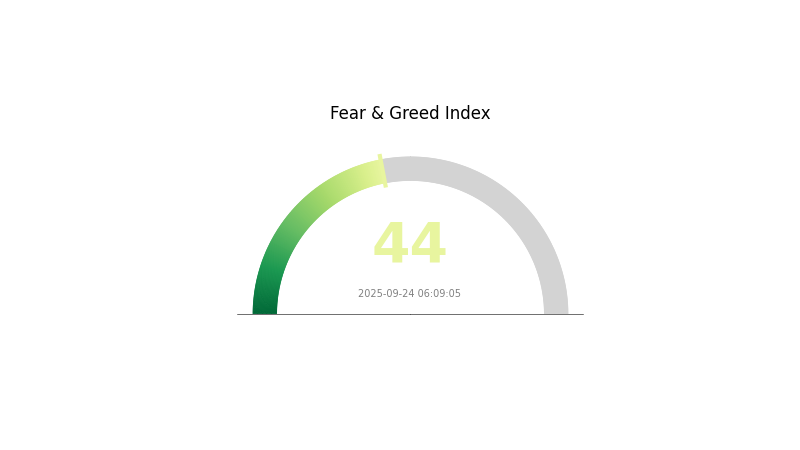

ZIL Market Sentiment Indicator

2025-09-24 Fear and Greed Index: 44 (Fear)

Click to view the current Fear & Greed Index

The crypto market sentiment for ZIL is currently in the "Fear" zone, with an index reading of 44. This suggests investors are exhibiting caution and uncertainty. During such periods, it's crucial to stay informed and avoid making impulsive decisions. While fear can present buying opportunities for some, it's essential to conduct thorough research and consider your risk tolerance. Remember, market sentiment can shift quickly, so stay updated with the latest ZIL news and analysis on Gate.com.

ZIL Holdings Distribution

The address holdings distribution data for ZIL reveals important insights into the token's ownership structure and market dynamics. This data typically shows the concentration of tokens among different addresses, providing a clear picture of how decentralized or centralized the token's ownership is.

Based on the provided data, it appears that the ZIL token distribution is relatively balanced, with no single address holding an overwhelmingly large percentage of the total supply. This suggests a healthy level of decentralization in ZIL's ownership structure. The absence of extremely large holders reduces the risk of market manipulation and contributes to a more stable price environment.

This distribution pattern indicates a robust market structure for ZIL, potentially leading to lower volatility and a reduced risk of sudden price swings caused by large holders. It also reflects positively on the token's overall health and its alignment with blockchain principles of decentralization and distributed ownership.

Click to view the current ZIL holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|

II. Key Factors Influencing ZIL's Future Price

Supply Mechanism

- Mining Reward Halving: ZIL undergoes periodic halving events that reduce the block rewards for miners, potentially impacting supply and price dynamics.

- Historical Pattern: Previous halvings have often led to short-term price volatility followed by long-term appreciation.

- Current Impact: The next halving is anticipated to tighten supply, potentially creating upward price pressure if demand remains stable or increases.

Institutional and Whale Dynamics

- Institutional Holdings: Major financial institutions have shown increasing interest in cryptocurrencies, with some adding ZIL to their portfolios.

- Enterprise Adoption: Several companies are exploring Zilliqa's blockchain technology for various applications, which could drive demand for ZIL.

Macroeconomic Environment

- Monetary Policy Impact: Central banks' decisions on interest rates and quantitative easing measures can affect crypto markets, including ZIL.

- Inflation Hedging Properties: In high inflation environments, cryptocurrencies like ZIL may be viewed as potential stores of value.

- Geopolitical Factors: Global tensions and economic uncertainties can increase demand for alternative assets, potentially benefiting ZIL.

Technical Development and Ecosystem Growth

- Zilliqa 2.0 Upgrade: The upcoming major network upgrade aims to enhance scalability and interoperability, potentially attracting more users and developers.

- DeFi Expansion: The growth of decentralized finance projects on Zilliqa could increase utility and demand for ZIL.

- Ecosystem Applications: Key DApps and projects building on Zilliqa, such as decentralized exchanges and NFT platforms, contribute to the network's value proposition.

III. ZIL Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.00897 - $0.01095

- Neutral prediction: $0.01095 - $0.01133

- Optimistic prediction: $0.01133 - $0.01171 (requires positive market sentiment and project developments)

2027-2028 Outlook

- Market phase expectation: Potential growth phase with increasing adoption

- Price range forecast:

- 2027: $0.01038 - $0.01617

- 2028: $0.01299 - $0.01849

- Key catalysts: Technological advancements, increased partnerships, and overall crypto market growth

2029-2030 Long-term Outlook

- Base scenario: $0.0163 - $0.0185 (assuming steady project development and market growth)

- Optimistic scenario: $0.02071 - $0.02313 (with significant ecosystem expansion and mainstream adoption)

- Transformative scenario: $0.02313+ (with breakthrough use cases and major institutional investment)

- 2030-12-31: ZIL $0.0185 (potential peak of long-term growth cycle)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.01171 | 0.01095 | 0.00897 | 0 |

| 2026 | 0.0128 | 0.01133 | 0.01076 | 3 |

| 2027 | 0.01617 | 0.01206 | 0.01038 | 10 |

| 2028 | 0.01849 | 0.01412 | 0.01299 | 29 |

| 2029 | 0.02071 | 0.0163 | 0.01516 | 49 |

| 2030 | 0.02313 | 0.0185 | 0.0124 | 69 |

IV. Professional ZIL Investment Strategies and Risk Management

ZIL Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors with high risk tolerance

- Operational advice:

- Accumulate ZIL during market dips

- Set price targets for partial profit-taking

- Store ZIL in secure hardware wallets

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversals

- RSI (Relative Strength Index): Monitor overbought/oversold conditions

- Key points for swing trading:

- Set stop-loss orders to limit potential losses

- Take profits at predetermined resistance levels

ZIL Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3%

- Aggressive investors: 5-10%

- Professional investors: Up to 15%

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple cryptocurrencies

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallets for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for ZIL

ZIL Market Risks

- Volatility: Cryptocurrency markets are highly volatile

- Competition: Other blockchain platforms may outperform Zilliqa

- Liquidity: Lower trading volume compared to top cryptocurrencies

ZIL Regulatory Risks

- Regulatory uncertainty: Changing regulations may impact ZIL's adoption

- Legal status: Potential classification as a security in some jurisdictions

- Cross-border transactions: Varying regulations across countries

ZIL Technical Risks

- Scalability challenges: Potential limitations in network growth

- Smart contract vulnerabilities: Bugs or exploits in smart contracts

- Network security: Possible 51% attacks or other security breaches

VI. Conclusion and Action Recommendations

ZIL Investment Value Assessment

Zilliqa offers long-term potential with its high-throughput blockchain solution, but faces short-term risks due to market volatility and competition in the blockchain space.

ZIL Investment Recommendations

✅ Beginners: Start with small, regular investments to build a position over time ✅ Experienced investors: Consider a balanced approach with both long-term holdings and active trading ✅ Institutional investors: Conduct thorough due diligence and consider ZIL as part of a diversified crypto portfolio

ZIL Trading Participation Methods

- Spot trading: Buy and sell ZIL on Gate.com

- Staking: Participate in ZIL staking programs for passive income

- DeFi: Explore decentralized finance options on the Zilliqa network

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Is there a future for Zilliqa?

Yes, Zilliqa has a promising future. Projections indicate potential price growth, with estimates reaching $0.014179 by 2030, suggesting a positive long-term outlook for the cryptocurrency.

How much is Zil in 2025?

Based on current forecasts, Zil is expected to reach $0.01180 by the end of 2025, representing a -41.27% change from its current price.

What is the price prediction for Zil in 2025?

Based on market analysis, Zilliqa (ZIL) is predicted to reach $0.01180 by the end of 2025, representing a 41.27% decline from current levels.

What's happening with Zil?

Zil's price is experiencing a downward trend. Predictions suggest a potential 10% decrease by late 2024, with the bearish momentum likely to continue into 2025.

Share

Content