Predicción de SUPERPrice para 2025: Análisis de tendencias de mercado y oportunidades de inversión en el sector de los activos digitales

Introducción: posición de mercado y valor de inversión de SUPER

SuperFarm (SUPER), como protocolo DeFi cross-chain pensado para aportar utilidad a cualquier token mediante granjas NFT, ha logrado avances notables desde su lanzamiento en 2021. A 2025, la capitalización de mercado de SUPER asciende a 339 657 022 $, con una oferta circulante aproximada de 628 412 622 tokens y un precio cercano a 0,5405 $. Este activo, apodado el “pionero del NFT farming”, está consolidando un rol esencial en los ámbitos de DeFi y la infraestructura NFT.

Este artículo analiza a fondo la evolución del precio de SUPER en el periodo 2025-2030, combinando patrones históricos, factores de oferta y demanda, desarrollo del ecosistema y condicionantes macroeconómicos para ofrecer previsiones profesionales de precios y estrategias de inversión aplicables.

I. Evolución histórica del precio de SUPER y situación de mercado actual

Evolución histórica del precio de SUPER

- 2021: Máximo histórico de 4,72 $ el 31 de marzo, repunte sustancial

- 2023: Descenso de mercado, mínimo histórico de 0,07 $ el 19 de octubre

- 2025: Recuperación gradual, estabilización cerca de 0,54 $

Situación actual del mercado de SUPER

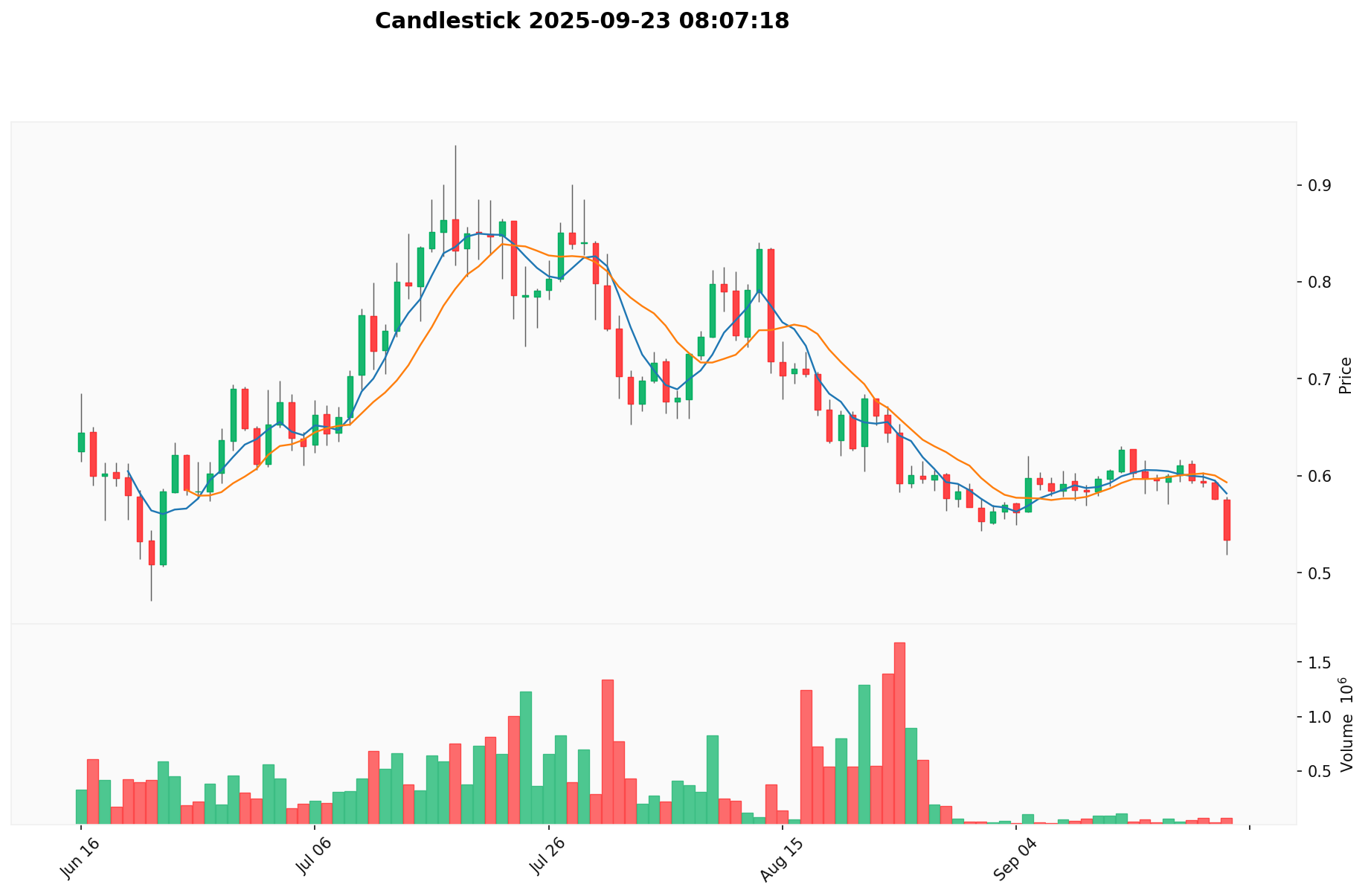

A fecha de 23 de septiembre de 2025, SUPER cotiza a 0,5405 $. En las últimas 24 horas, el token ha experimentado una ligera recuperación, subiendo un 0,85 %. Sin embargo, el comportamiento a plazos largos arroja caídas notables, con un descenso del 9,22 % en la última semana y del 16,56 % en el último mes. La capitalización de mercado actual es de 339 657 022 $, situando a SUPER en el puesto 222 del ranking global de criptomonedas. El volumen de negociación en las últimas 24 horas es de 20 637 $, lo que refleja una actividad moderada. Pese a las recientes ganancias a corto plazo, SUPER acumula un descenso del 41,81 % con respecto a un año atrás, en línea con la tendencia bajista general del mercado cripto.

Consulta el precio de mercado actual de SUPER

Indicador de sentimiento de mercado de SUPER

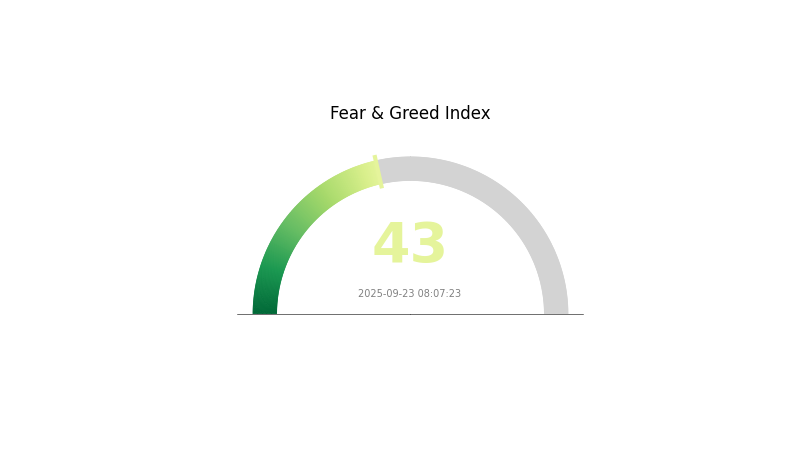

23-09-2025 Índice de Miedo y Avaricia: 43 (Miedo)

Consulta el Índice de Miedo y Avaricia actualizado

El sentimiento del mercado en el sector cripto permanece cauto: el Índice de Miedo y Avaricia marca 43, lo que indica predominio del miedo. Esto refleja que los inversores se muestran prudentes y poco propensos a asumir grandes riesgos. En estos periodos, conviene mantenerse informado y evitar decisiones precipitadas. Recuerda: el miedo generalizado puede convertirse en oportunidad para quienes invierten a largo plazo. Vigila indicadores clave y, antes de tomar decisiones importantes, consulta siempre a profesionales.

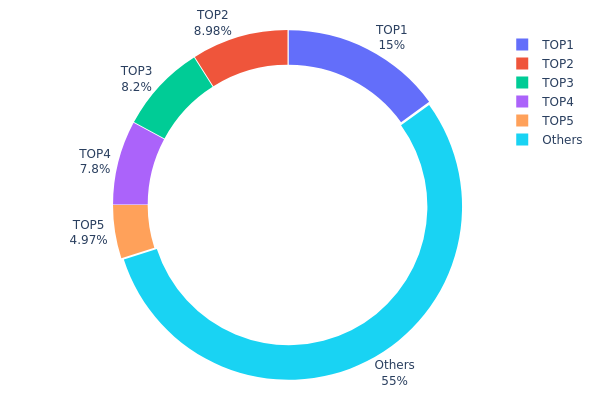

Distribución de tenencias de SUPER

El análisis de la distribución de direcciones muestra una fuerte concentración de tokens en pocas manos: el principal titular controla el 15,02 % del suministro total y el top cinco de direcciones alcanza conjuntamente el 44,96 % de los SUPER. Esta concentración revela una potencial problemática de centralización en el ecosistema.

Un reparto tan desigual puede afectar de manera decisiva la dinámica de mercado. Si alguno de los grandes titulares decide vender o transferir sus tokens, la volatilidad del precio podría aumentar notablemente. Además, la elevada concentración incrementa los riesgos de manipulación, ya que unos pocos actores tendrían capacidad para influir en la cotización.

En términos de descentralización, aunque el 55,04 % de los tokens está en manos del resto de direcciones, el peso del top cinco indica que la gobernanza y la estabilidad del ecosistema podrían depender demasiado de sus movimientos.

Consulta la distribución de tenencias de SUPER

| Top | Dirección | Cantidad | % |

|---|---|---|---|

| 1 | 0x7226...250cb1 | 150 257,48 K | 15,02 % |

| 2 | 0x8c96...d0b887 | 89 797,14 K | 8,97 % |

| 3 | 0xbda1...3a4700 | 82 000,00 K | 8,20 % |

| 4 | 0xf6e4...2e14ca | 78 020,00 K | 7,80 % |

| 5 | 0x7080...ac3f2c | 49 720,80 K | 4,97 % |

| - | Otros | 550 202,65 K | 55,04 % |

II. Factores clave que determinarán el precio futuro de SUPER

Mecanismo de suministro

- Quema de tokens: SUPER cuenta con un mecanismo de quema que reduce el suministro a lo largo del tiempo.

- Evolución histórica: Las quemas previas han favorecido el precio de SUPER por la contracción de la oferta circulante.

- Impacto actual: La quema continuada debería ejercer presión alcista sobre el precio de SUPER, siempre que la demanda no disminuya.

Desarrollo tecnológico y crecimiento del ecosistema

- Actualizaciones de la plataforma: SuperFarm sigue perfeccionando su plataforma de creación y farming NFT, mejorando experiencia de usuario y funcionalidades.

- Aplicaciones del ecosistema: El ecosistema de SuperFarm abarca marketplaces NFT, opciones de yield farming y puentes cross-chain para NFT, lo que amplía la utilidad y el valor potencial de SUPER.

III. Predicción de precio de SUPER para 2025-2030

Perspectivas para 2025

- Escenario conservador: 0,39493 $ – 0,541 $

- Escenario neutral: 0,541 $ – 0,57887 $

- Escenario optimista: 0,57887 $ – 0,80631 $ (requiere fuerte impulso y mayor adopción)

Perspectivas 2027-2028

- Fase esperada: crecimiento con mayor volatilidad

- Rango de precios previsto:

- 2027: 0,62164 $ – 0,87439 $

- 2028: 0,75539 $ – 0,87221 $

- Impulsores principales: avances técnicos, aceptación de mercado y alianzas estratégicas

Perspectiva a largo plazo 2029-2030

- Escenario base: 0,82548 $ – 1,02773 $ (con crecimiento sostenido y adopción gradual)

- Escenario optimista: 1,02773 $ – 1,22997 $ (con aceleración de la adopción y coyuntura favorable)

- Escenario disruptivo: 1,22997 $ – 1,50 $ (con innovaciones rupturistas e integración masiva)

- 31-12-2030: SUPER 1,21272 $ (techo potencial en contexto favorable)

| Año | Precio máximo previsto | Precio medio previsto | Precio mínimo previsto | Variación |

|---|---|---|---|---|

| 2025 | 0,57887 | 0,541 | 0,39493 | 0 |

| 2026 | 0,80631 | 0,55994 | 0,36396 | 3 |

| 2027 | 0,87439 | 0,68312 | 0,62164 | 26 |

| 2028 | 0,87221 | 0,77876 | 0,75539 | 44 |

| 2029 | 1,22997 | 0,82548 | 0,69341 | 52 |

| 2030 | 1,21272 | 1,02773 | 0,99689 | 90 |

IV. Estrategias profesionales de inversión y gestión de riesgos en SUPER

Metodología de inversión en SUPER

(1) Estrategia de holding a largo plazo

- Dirigida a: inversores de largo plazo

- Recomendaciones:

- Acumula SUPER en caídas de mercado

- Mantén la posición durante al menos 1-2 años para superar la volatilidad

- Guarda los tokens en un hardware wallet seguro

(2) Estrategia de trading activo

- Herramientas técnicas:

- Medias móviles: utiliza las de 50 y 200 días para seguir tendencias

- RSI: detecta situaciones de sobrecompra o sobreventa

- Pautas para swing trading:

- Establece stops de pérdidas para limitar riesgos

- Fija objetivos de toma de beneficios predeterminados

Framework de gestión de riesgos para SUPER

(1) Principios de asignación de activos

- Perfil conservador: 1–3 % del portfolio cripto

- Perfil agresivo: 5–10 %

- Inversor profesional: hasta 15 %

(2) Cobertura de riesgo

- Diversificación: distribuye la inversión entre varios criptoactivos

- Órdenes de stop: automatiza ventas para limitar pérdidas

(3) Soluciones de custodia segura

- Recomendación de hardware wallet: Gate Web3 Wallet

- Almacenamiento en frío: paper wallet para largos plazos

- Medidas de seguridad: activa 2FA, guarda claves privadas offline y mantente alerta ante phishing

V. Riesgos y desafíos potenciales de SUPER

Riesgos de mercado

- Alta volatilidad: movimientos abruptos de precios frecuentes en cripto

- Competencia: nuevos proyectos DeFi y NFT pueden restar cuota de mercado

- Poca liquidez: volúmenes bajos pueden mermar la estabilidad del precio

Riesgos regulatorios

- Marco legal incierto: cambios pueden afectar su operativa

- Cumplimiento transfronterizo: diferencias normativas entre jurisdicciones

- Impacto fiscal: variaciones en tributación de criptoactivos

Riesgos técnicos

- Vulnerabilidades en smart contracts: posibilidad de exploits o ataques

- Escalabilidad: congestión de red en escenarios de alta demanda

- Interoperabilidad: integración con otras blockchains

VI. Conclusión y recomendaciones de actuación

Valoración de la inversión en SUPER

SUPER presenta potencial a largo plazo en el espacio NFT y DeFi, aunque enfrenta volatilidad a corto y competencia en auge. Valora siempre tu tolerancia al riesgo antes de invertir.

Recomendaciones de inversión en SUPER

✅ Si eres principiante: empieza con importes pequeños y fomenta tu formación

✅ Si tienes experiencia: adopta un enfoque equilibrado y aplica DCA regularmente

✅ Inversores institucionales: realiza un due diligence exhaustivo y valora alianzas estratégicas

Formas de participar en el trading de SUPER

- Spot trading: compra y mantén SUPER en Gate.com

- Staking: participa en programas de staking de SUPER para ingresos pasivos

- Farming NFT: explora el ecosistema NFT de SUPER para nuevas oportunidades

La inversión en criptomonedas conlleva riesgos muy altos; este texto no sustituye el asesoramiento financiero. Toma decisiones según tu perfil de riesgo y consulta siempre con profesionales. No inviertas jamás más de lo que puedes permitirte perder.

FAQ

¿Subirá el precio de SuperRare?

Sí, se prevé que el precio de SuperRare aumente. El avance del mercado NFT y el posicionamiento de SuperRare en el arte digital pueden incrementar su demanda y valor en próximos años.

¿Cuál es la previsión de precio para XRP en 2030?

De acuerdo con las tendencias actuales y el análisis de mercado, XRP podría situarse entre 10 $ y 15 $ en 2030, impulsado por el crecimiento de la adopción y nuevas alianzas financieras.

¿Qué riesgos presenta SuperVerse?

Principales riesgos: volatilidad de mercado, cambios regulatorios, vulnerabilidades técnicas y posible fracaso del proyecto. Infórmate bien antes de invertir.

¿Qué previsión de futuro hay para Siacoin?

Se espera que Siacoin crezca de manera sostenida, pudiendo alcanzar entre 0,05 $ y 0,10 $ en 2026, gracias a la adopción de almacenamiento descentralizado y los avances en tecnología blockchain.

Compartir

Contenido