加密货币的宏观困境与未来机遇

这篇文章探讨了当前加密货币市场的关键趋势和挑战。作者分析了比特币在宏观经济压力下的定位,探讨它是风险资产还是避险资产的争议。文章还评估了以太坊的发展现状及其作为生产性资产的潜力。此外,文章还讨论了新兴的产品性资产如 Hyperliquid 的 HYPE,以及 DAO 治理模式的演变。在当前宏观环境不确定的情况下,作者建议关注新项目的发展机会。转发原文标题《市场恐慌状态及未来展望:以太坊仍是生产性资产吗?》

加密货币市场目前被宏观经济束缚。

我的 X 推文时间线充满了关于宏观经济的观点,而不是空投攻略或值得购买的迷因币推荐。

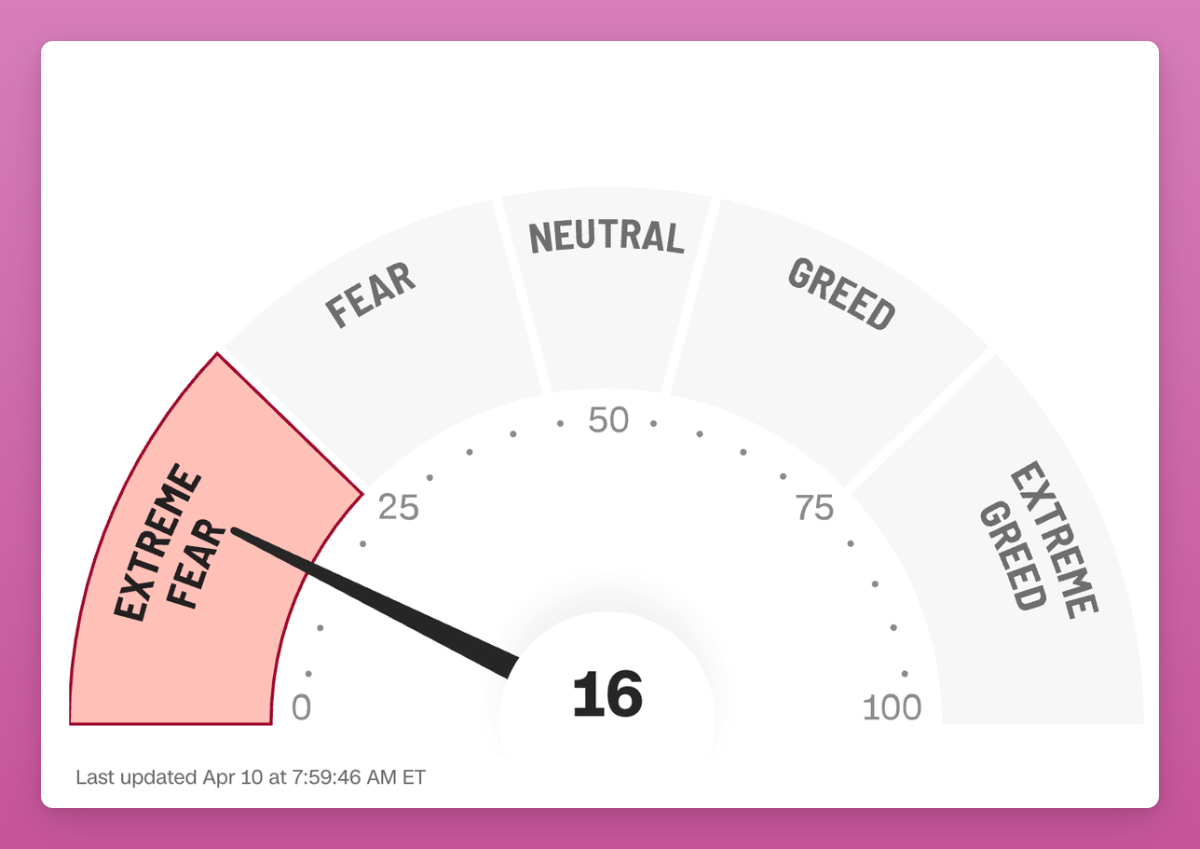

当我写下这些内容时,加密货币和 TradFi 市场都处于“极度恐惧”水平(即使在取消了一些关税之后)。

如今,驾驭加密市场比以往任何时候都更具挑战性,作为一名加密内容创作者,我从未感到如此无力。发布我那些平庸的宏观观点的诱惑也变得更强烈。

我同意 DonAlt 的观点,即在这个疯狂的世界中,加密货币往往被忽视。

不幸的是,如果这真的是世界秩序的转变以及“大债务周期”终结的标志(如 Ray Dalio 所说),那么我们将在未来数年面对一个不稳定的宏观环境。

然而,仍然会有一些相对稳定的阶段,在这些时期,关注点可以转向加密体系内部的发展。

关税暂停 90 天也可能带来机遇绿洲。

比特币——熊市还是牛市?

回头看,我早该在二月发布 《牛市还是熊市:接下来是什么?》 这篇博客时就清仓了。

我分享了各种比特币的链上数据图表,结果它从看涨迅速转为看跌(见下图)。唉,请不要责怪我,我跟 X 上的大多数“专家”一样迷茫。

我所知道的是,在由内部驱动的牛市中,链上数据的价值更高;而当市场由外部宏观因素主导时(就像现在),链上数据的影响就变得次要。

比特币已经成为一种宏观资产,两种主要思想正在竞相成为“真理”:

- BTC是像股票一样的风险资产吗?

- BTC是像黄金一样的避险资产吗?

这是比特币当前所面临的一场关键之战,但许多人并没有给予足够的重视。如果比特币并非避险资产,而是像纳斯达克一样波动的风险资产,那么它目前的市值就是站不住脚的,机构投资者也不会对此感兴趣。

在我的 《2025 年加密货币的真相与谎言》 在这篇文章中,我将比特币描述为一种不那么显而易见的宏观不确定性对冲工具。

比特币不能同时成为数字黄金和风险资产。

2025 年加密货币的真相与谎言

1月3日

到 2025 年,BTC 的价格将达到 25 万美元,ETH 的价格将达到 1.2 万美元。

贝莱德相关研究表明了这一点,甚至之前的比特币怀疑论者 Ray Dalio 也承认比特币是“财富的储藏室”:

“在大债务周期的早期阶段,货币是‘硬通货’,意味着它既是交换媒介,也是不能轻易增加供应的财富储藏工具,比如黄金、纯银和比特币。像比特币这样的加密货币正在成为被广泛接受的硬通货,因为它在全球范围内获得了认可,并且其供应是有限的。货币最常见、最大的风险就是它会被大量印制。一旦你拥有印钞的权力,很难不滥用它。凡是有能力印钞的人,最终都会这么做。”— 雷·达里奥 (Ray Dalio) 国家如何破产:简介和第一章

我强烈推荐阅读 Ray Dalio 的新书《国家是如何破产的》。他在书中指出,美国目前正处于典型的“大债务周期”之中。根据 Dalio 的观点,世界将不得不建立新的秩序,同时重组现有债务。

这是对当今世界正在发生的事情的一篇富有洞察力的解释。

简而言之:美国会印钞,其他高负债国家也将效仿。在这种情境下,BTC 的表现可想而知。

你可以在 LinkedIn 免费阅读这本仍在写作中的书。

但问题是:比特币的交易行为更像是一种风险资产,而不是像黄金一样的避险资产(目前黄金已创下历史新高)。我认为,那些把比特币当作风险资产的人,其实正在把筹码交给那些把它当作避险资产的人手中。

我非常喜欢贝莱德在接受 Bankless 采访时的内容,他在访谈中讽刺了加密原生评论员/研究员,因为他们总是坚持比特币是风险资产,并根据失业率、非农就业数据或 ISM 制造业指数进行交易。

也许,用更简单的理论解释当前 BTC 走势,就是——资金流动性与印钞行为。当市场紧缩时,比特币表现得像个屎币;而当印钞机“哔哩哔哩”运转时,比特币的表现超过所有风险资产。

说实话,我预计 BTC 会随着法定系统被压垮而走低。

以太坊 - 从糟糕到……仍然同样糟糕

如果我们通过活跃地址和费用等基本面来评估 ETH,那么 ETH 回到 2018 年的水平是有意义的。

如果我们添加 L2 的活动地址,我们会看到进步,但这要归功于 Base。Optimism、Arbitrum 等其他 L2 网络几乎处于停滞状态。

首先,我并不认为交易费用是衡量一条一层网络(L1)价值的唯一标准,这一点我在这篇帖子中已经解释过了(点击图片可跳转 X 阅读原文):

与其只关注费用被稀释、将 L2 视为对 ETH 的威胁,不如将 ETH 看作一种生产性资产:

- 在 ICO 时代,ETH 是参与代币销售的主要货币:项目方的金库资产基本以 ETH 计价。具有讽刺意味的是,这种情况至今仍在影响市场,因为很多早期项目仍在抛售它们当年募集到的 ETH。

- 在 DeFi Summer 时期,ETH 是参与流动性挖矿的主要资产:为了在 SUSHI/ETH 等流动性池中挖矿,比如获取 SUSHI,你必须使用 ETH。

- 在 NFT 狂热阶段,ETH 是(目前仍然是)主要的交易货币。

我曾在 《牛市中的 DeFi Degen 操盘手册》 中,将赌注压在了 L1 网络作为生产性资产之上:SUI、STX、INJ、SOL 等被用来参与生态系统的空投挖矿。拿到空投 —— 卖掉换回 L1 资产 —— 然后重复操作。

但大多数这些 L1 并未成功扩展其生态系统。即便有些做到了(如 STX、SUI),空投质量也很一般。

我对 ETH 的押注是基于 Eigenlayer 的再质押机制,这让我相信 ETH 会成为区块链历史上最具生产力的资产:通过将 ETH 再质押,可以获得比单纯质押更高的收益,并从 Eigenlayer 生态中获取大量空投。但最终,Eigenlayer 的表现令人失望。我曾以为 Symbiotic 有机会改变局面,但目前来看,它也无关紧要。

有没有看涨的信号?以太坊持有者的平均成本价为 2200 美元,这意味着多数持有者目前处于亏损状态。

目前,ETH 仍然具有一定的生产属性,主要用于 DeFi 中作为抵押品。但在本轮周期中,ETH 的生产力不如 SOL,后者在迷因币狂热中发挥了核心作用,既充当交易媒介,也作为价值储存手段。

我认为 SOL 正在走 ETH 过去的路线。迷因币泡沫崩溃后,目前还没有新的叙事接替它来驱动 SOL 的需求。但由于 SOL 市值较低、发行奖励高,在 Kamino Multiply 池中仍可获得高达 25% 年化收益(APY)。你能找到 ETH 有这么高收益的项目吗?

要扭转 $ETH 的趋势需要:

- 稳定、抗风险的宏观环境和有利的监管环境。

- 让 ETH 成为更具生产力的资产

美国正在发生的监管变革其实对 ETH 及其他 L1 是利好。它们将吸引更多稳定币,推动资产代币化,并促进整体应用的增长。

但即使在资产代币化以太坊主导的极度看涨情境下,也不一定能真正带动 ETH 本身上涨。

想象一下,如果特斯拉(TSLA)股票上线以太坊,这对 DeFi 来说无疑是利好,因数十亿甚至数万亿美元的传统金融资产可以作为抵押品,用于借出稳定币进行日常消费。

又比如苹果(AAPL)股票能在 Uniswap 上全球流通交易。这将为 DeFi 协议(及其代币)带来黄金时代,我们将摆脱“内部循环 + 杠杆驱动”的阶段,像 Aave、Fluid、Uniswap 等协议的手续费收入将激增。

但这对 ETH 作为生产性资产意味着什么?确实,交易量会上升,但以太坊基金会计划大幅降低 L1 与 L2 的交易费用。

我更关心的是:真实世界资产(RWA)将会与 ETH 配对,还是与稳定币配对?说实话,为什么要和 ETH 配对呢?

这些交易是否会发生在不与主网共享收入的 L2 网络上,比如 Base?以太坊基金会是否会要求这些 L2 向主网缴纳分润?

这些关键问题,目前仍没有明确答案。

代币化无疑是 ETH 多头阵营最看好的叙事之一,但如 Sam 在下文所说,这种叙事不一定能直接惠及以太坊本身。

更何况现在还有越来越多的项目在挑战以太坊在代币化与机构采用方面的地位:如 Plume、Ethena、Securitize 等正在推出面向 TradFi 的 L1 网络,比如 Converge。

总的来说,我希望看到 ETH 再次成为一个更具生产力的资产。低收益、不断下跌的抵押品资产,显然不足以支撑一个市值 2000 亿美元的网络继续上涨。

当前最具生产力的资产

那么,现在哪些资产是最具生产力的?

Hyperliquid 的 HYPE

其主要原因有两个:

- Hyperliquid 产生的费用比 Solana、以太坊更多,并用它来回购 $HYPE

- 以HYPE为核心的HyperEVM生态系统正在兴起

HyperEVM 生态中充满了即将发布代币的 DeFi 项目分叉。策略其实非常简单:识别最有潜力的协议,把 HYPE 投进去。

大多数 dApp 专注于杠杆循环策略。基本操作流程如下:

1) 将资金质押到 HYPE 的 LST(流动性质押代币)中;

2)使用 LST 作为抵押品借出资产或铸造稳定币;

3)用借来的资产再次循环质押,继续操作。

这种方式在市场波动时风险较高,因此我更偏向保守策略,比如仅质押在 LST 中,或仅使用 Hyperliquid 原生平台参与(Nansen 会提供空投!)

当然,dApp 的生命周期极短,来得快去得也快,所以我写这篇内容时可能情况已经发生变化。这是一份我整理的最新协议列表,供你参考。

说实话,我目前的计划就是参与挖矿,然后把生态空投卖掉换更多 HYPE 🙁

Initia 的 INIT

虽然还未正式上线,但我认为一旦启动,将会出现不错的挖矿机会。

正如我在 《五大热门项目及即将上线代币》(Top 5 Hot Upcoming TGEs) 中所解释的,Initia 的“Enshrined 流动性”机制允许用户单独质押 INIT,或使用经认证的 INIT-X LP 代币(其中 INIT 为配对代币)参与 DPoS 机制获取奖励。

“Enshrined 流动性”是一种有点“庞氏代币经济”的设计,强制生态系统中的所有代币至少 50% 要与 INIT 配对。这些 LP 代币必须经过治理白名单审核。

不过,我在这里会持谨慎态度:Initia 的 Enshrined 模型与 Berachain 非常相似。虽然 Berachain 上的收益非常诱人,但如果你不清楚操作规则,很容易被聪明的 LP 割韭菜。

所以建议深入研究生态系统,并清楚自己什么时候该退出。

Sonic 的 S 与 Ronin 的 RON

这两个生态系统目前都在进行流动性挖矿活动:

- Sonic:S 代币总额 2 亿的流动性挖矿活动将于 2025 年 6 月结束。**由于 S 是生态的核心资产,尽管宏观环境低迷,S 相较 BTC 表现稳定,且超越了 ETH 与 SOL。这正是所谓“生产性资产”的特征。不过,6 月对 S 持有者来说也可能是一个高风险时期。

- Ronin:推出总额 300 万美元的奖励池,分布于多个 LP 池中。USDC/RON 与 ETH/RON 的年化收益高达约 75%。 点击这里了解更多。

比特币——惊喜!

比特币的收益一直被视为“圣杯”,但这通常伴随着安全性的妥协:你需要将 BTC 存入由多签或第三方地址控制的 L2 网络。

尽管如此,BTCfi 协议如 Lombard Finance 在低调情况下,TVL 已增长至 17 亿美元——超过了 Pancakeswap、Raydium 或 Rocket Pool。

通过 Lombard Vaults,你可以一次性从多达 6 个协议中获取收益与空投! 点击查看 Vault 页面。

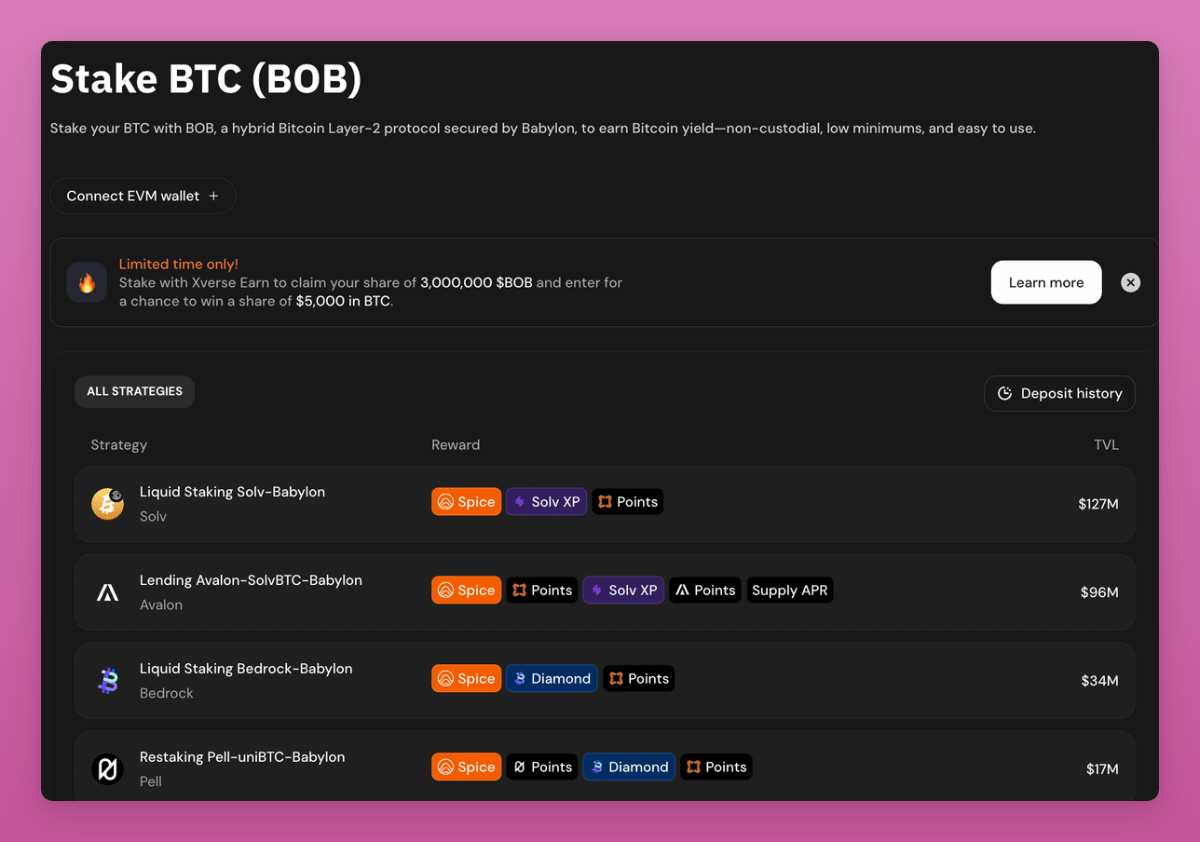

还有一些更简单直接的收益方式,比如使用 Xverse 和 Bob L2。

例如,你可以通过 Solv Protocol 将 BTC 质押进 Babylon,并获得液态质押代币 solvBTC.BBN。

虽然当前年化收益尚不明确,但就在我写这篇文章时,Babylon 的代币 BABY 已以 2.82 亿美元市值上线,FDV 达 12 亿美元。

相比之下,$EIGEN 的市值为 1.83 亿美元,FDV 为 13 亿美元。

也许“再质押”叙事并未消亡——它只是转移到了比特币网络上。

检查下面线程查看各类收益的详细拆解:

代币经济学中的两个糟糕先例

Pancakeswap 目前正在与 Binance 密切合作,特别是在 Binance x Pancakeswap TGE 方面,因为 Binance 旨在推广其 Web3 钱包。

这一合作对 Pancakeswap 是利好消息,因为其交易量已将其推升为仅次于 Uniswap 的第二大 DEX。在过去一周中,PCS 创造了 1126 万美元的手续费收入,仅比 Hyperliquid 少 200 万美元。

然而,这并没有推高 CAKE 价格。

为了解决这个问题,CAKE 正在改变代币经济,从收入分享和社区驱动的决策转变为由团队管理的回购和销毁。

问题:PCS(Pancakeswap) 此前“拉垮”了两个基于治理聚合模式运行的协议 —— Magpie 和 StakeDAO。

这类似于 Convex 和 Curve 的关系:veCRV 代币用于治理和激励机制,而 CVX 代币则作为叠加协议存在,用于简化流程并集中收益。

这种操作为市场树立了一个危险的先例,未来投资者在选择类似“元治理类协议”时,必须慎重考虑其风险。

Crypto.com

比起 Pancakeswap,更糟糕的是 Crypto.com 的案例。

TL:DR,Crypto com 在与 Trump Media 合作发行 ETF 一篮子加密货币(其中包括 CRO 本身)之前,未销毁 70% 的 BURNT 代币(2021 年)。

Crypto.com 将割韭菜提升到了一个全新的高度。不幸的是,这个行业似乎已经忘记了,但我没有。 Crypto.com 将永远保留在我的公司黑名单上。

这两个例子都为该行业树立了不好的先例。代币经济必须是可预测的才能进行投资。难怪人们只相信比特币。

如果有一天 2100 万比特币的上限被取消,那就准备好迎接一场大抛售吧。

旧的 DAO 已死,新的 DAO 万岁

我认为旧有的 DAO 模式正在被彻底革新,但由于当前宏观环境混乱,很多人可能错过了这场正在发生的“变革狂欢”。

几个月后,我预期会有越来越多的 DAO 开始尝试不同的投票机制与代币经济模型的变革:

- DeFi 中的“治理游说”(买票行为)将成为越来越严重的问题,因为没有实际收益分配或质押机制的治理代币缺乏吸引力。

- Aragon 提供了模块化的 DAO 构建能力,将不同治理功能隔离在不同插件中,实现更灵活的组织架构。

其中,最让我兴奋的是 Futarchy(预测市场治理) 模型。

它通过预测市场引导 DAO 决策,旨在提升效率,解决“一币一票”模型中的诸多弊端。

例如,Arbitrum DAO 考虑推出质押:

创建了两个预测市场:

- 市场A:“如果实行质押机制,六个月后$ARB的价格会是多少?”

- 市场B:“如果不实施质押机制,六个月后$ARB的价格会是多少?”

代币持有者在这些市场上下注。如果市场 A 显示的 $ARB 预测价格高于市场 B,则采用质押机制。

这可以彻底改变 DAO 投票。

在 Arbitrum 的 Lobby Finance 买票事件 之后,Arbitrum 的领导层也感受到了治理低效的问题,随后发布了新的提案:《Arbitrum 未来愿景》。

为了解决现有治理结构的效率问题,Arbitrum 基金会与 Offchain Labs 的核心团队将接手大部分重要决策权。

这也伴随着 BORG 的增长 (预算、目标一致、范围有限、可治理) 实体,特别是 Lido。

无论是 Lido 的 BORG 子组织,还是 Arbitrum 的“愿景”转向,其实都是在试图解决同一个根本问题:DAO 是去中心化的,但执行混乱、效率低、缺乏清晰结构。

简而言之,真正去中心化的 DAO 并未如期成功,最终 Arbitrum、Lido 等团队又重新回到了决策中心的位置。

接下来会发生什么?

在当前这种一条推文就能左右整个加密市场方向的局势下,预测未来真的太难了。

然而,我正在密切关注 Babylon 的代币表现如何、Initia TGE 的运行情况以及以太坊的 Pectra 如何升级以改善当前的用户体验。

特朗普关于关税的 90 天延迟决策为市场带来了一些缓解,我认为不少项目会利用这个窗口期来上线代币、启动主网,或推出新计划。

这三个月,正是我们“清洗所有血统、重新上阵”的时候!

为此,我还计划分享我对令人兴奋的新加密项目的看法。需要研究的东西太多了!

声明:

- 本文转载自 [Ignas | DeFi Research],原文标题《市场恐慌状态及未来展望:以太坊仍是生产性资产吗?》,所有版权归原作者所有 [Ignas | DeFi Research]。若对本次转载有异议,请联系 Gate Learn 团队,他们会及时处理。

- 免责声明:本文所表达的观点和意见仅代表作者个人观点,不构成任何投资建议。

- Gate Learn 团队将文章翻译成其他语言。除非另有说明,否则禁止复制、分发或抄袭翻译文章。

相关文章

不可不知的比特币减半及其重要性

如何选择比特币钱包?

CKB:闪电网络促新局,落地场景需发力