Tuesday $ETH Ethereum Market Analysis

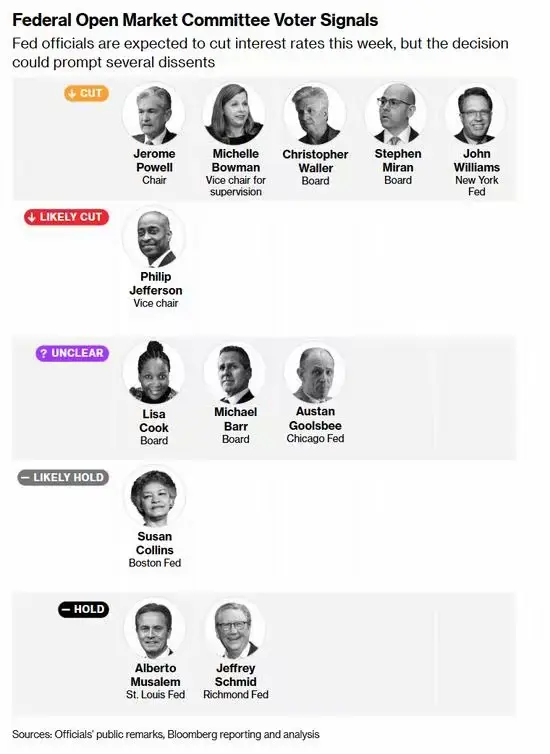

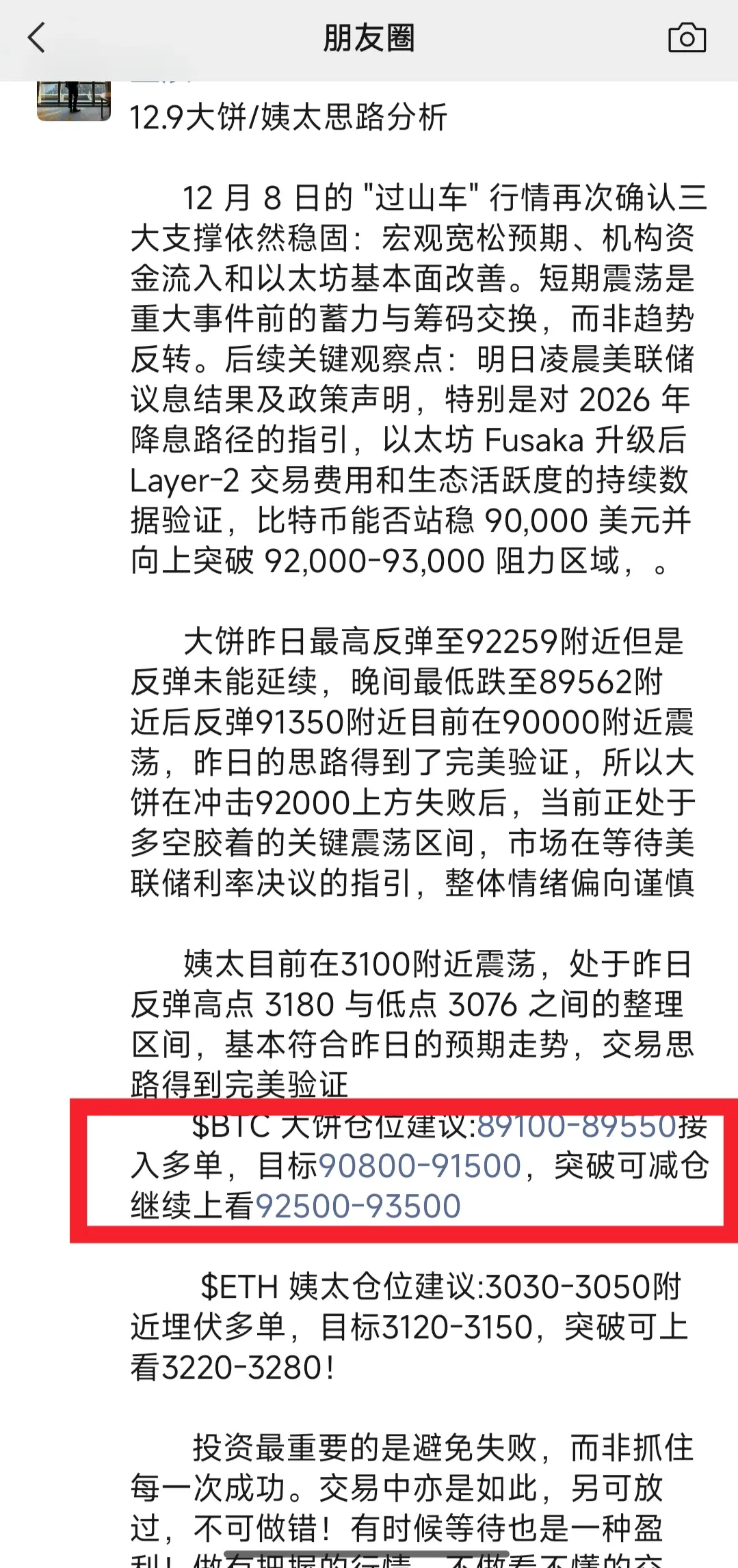

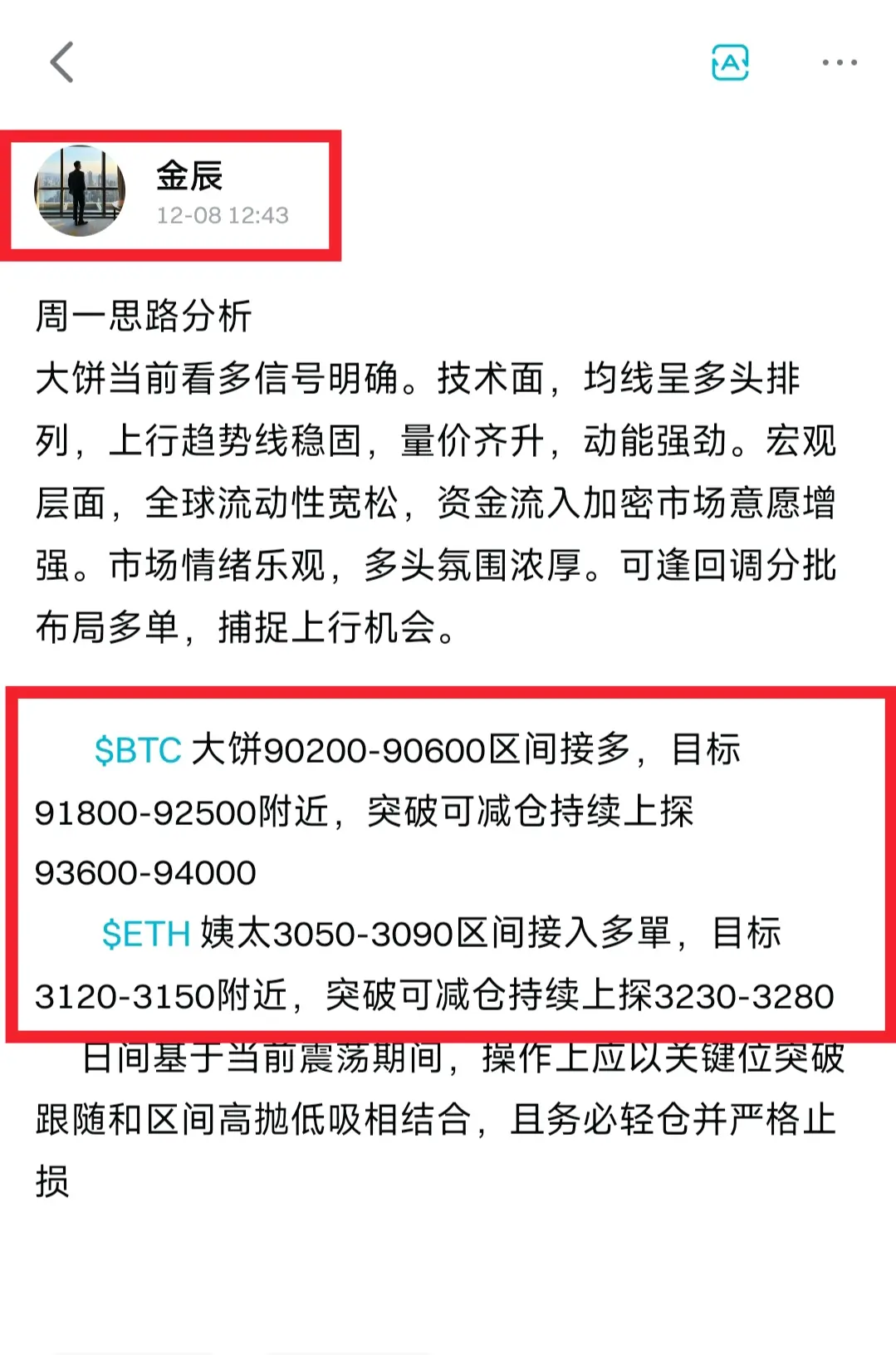

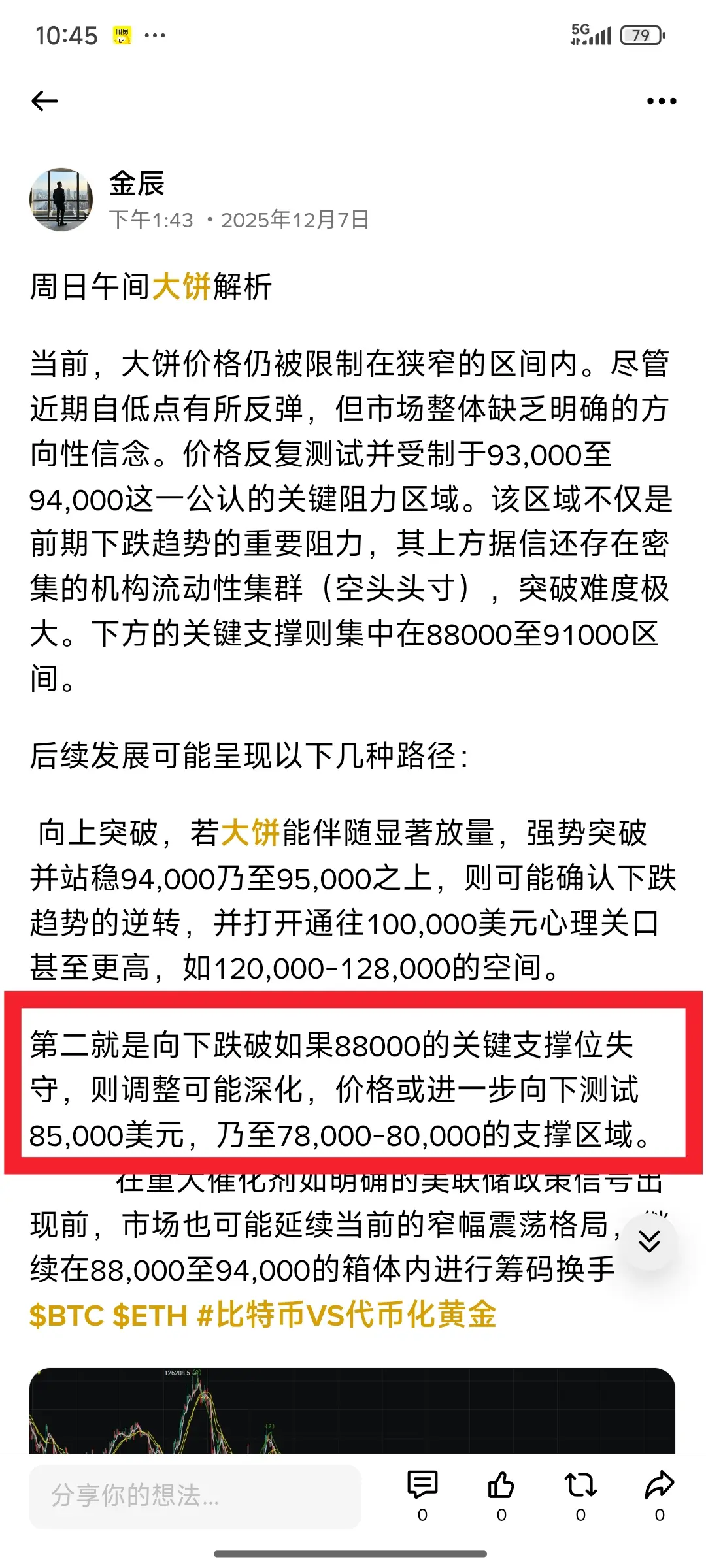

Compared to Bitcoin’s breakout, Ethereum’s price action appears more stable and restrained. The price fluctuated narrowly within the $3,080-$3,180 range, with a slight intraday increase of 0.04%. This movement indicates that the market is cautious ahead of major events, choosing to accumulate strength above key support levels.

In addition to following Bitcoin’s overall market trend, Ethereum’s own “Fusaka” network upgrade has been successfully activated, aiming to improve network efficiency. Meanwhile, its on-chain ecosystem, especially the activity of La

View OriginalCompared to Bitcoin’s breakout, Ethereum’s price action appears more stable and restrained. The price fluctuated narrowly within the $3,080-$3,180 range, with a slight intraday increase of 0.04%. This movement indicates that the market is cautious ahead of major events, choosing to accumulate strength above key support levels.

In addition to following Bitcoin’s overall market trend, Ethereum’s own “Fusaka” network upgrade has been successfully activated, aiming to improve network efficiency. Meanwhile, its on-chain ecosystem, especially the activity of La