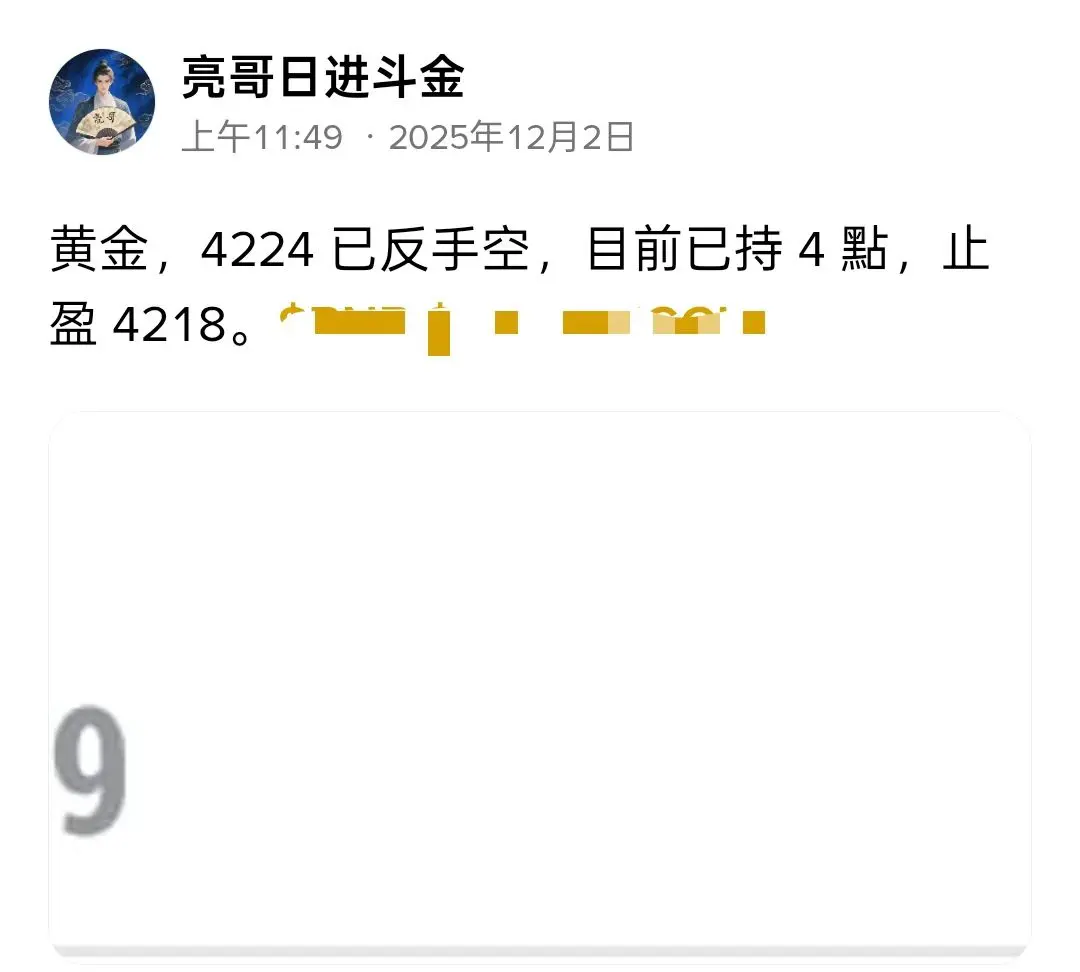

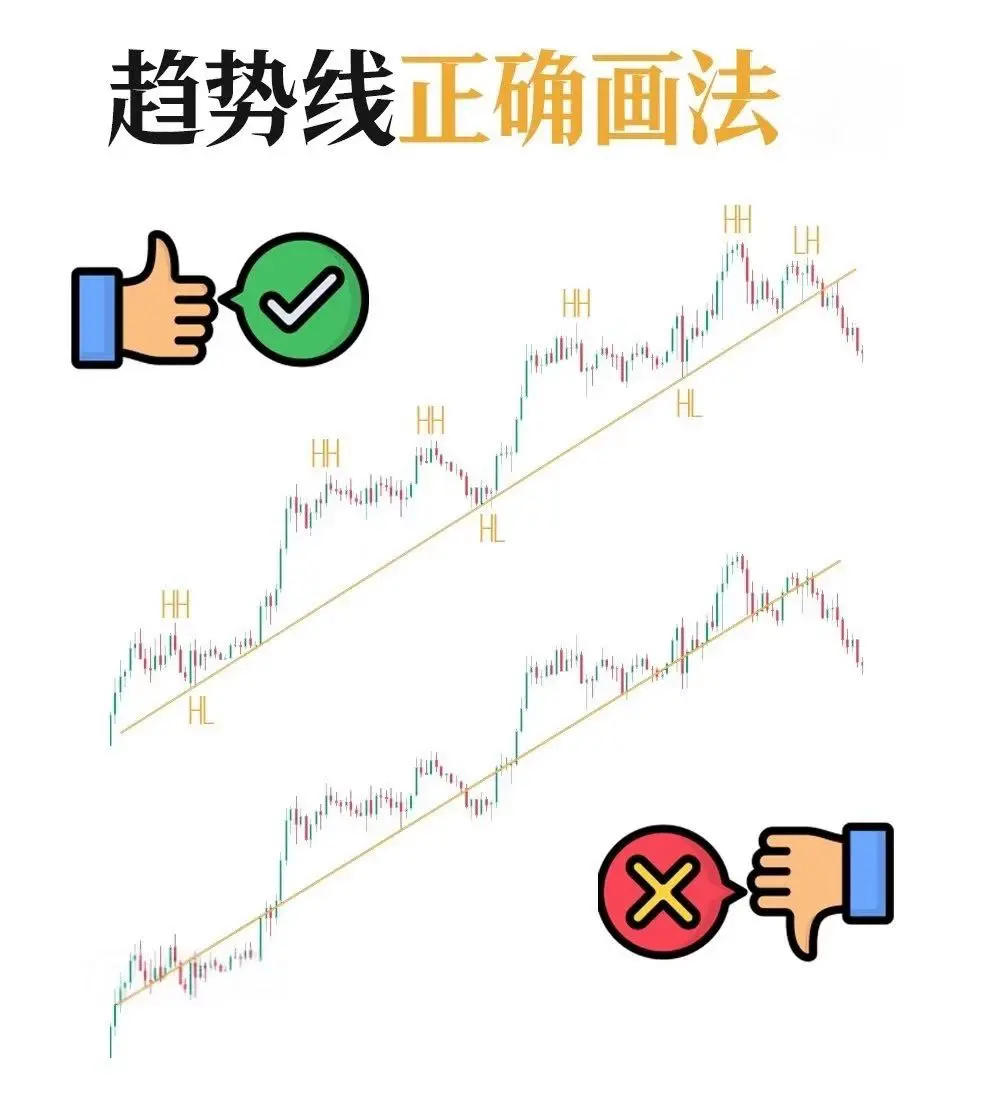

Profit never lies in seizing a particular opportunity, but in precisely avoiding risks—the first rule of trading is to survive in the market.

What truly defeats traders is often not missing out on a certain trend, but suffering deep drawdowns due to greed for unrealized gains and failure to exit in time.

Winning once in trading is not difficult; the hard part is not losing all your accumulated gains during emotional breakdowns. No one can always be right, but experts never make fatal mistakes.

Stop-loss is not failure, but the most fundamental respect for the market—only those who know how to

View OriginalWhat truly defeats traders is often not missing out on a certain trend, but suffering deep drawdowns due to greed for unrealized gains and failure to exit in time.

Winning once in trading is not difficult; the hard part is not losing all your accumulated gains during emotional breakdowns. No one can always be right, but experts never make fatal mistakes.

Stop-loss is not failure, but the most fundamental respect for the market—only those who know how to