Some Advice for Retail Investors in a Crypto Bear Market

The best advice you won’t read on a Sunday:

Some thoughts on the market and how to make money from it/navigate it. (long Sunday reading)

The market has changed a lot over the last 2 years, it’s matured over time and found more institutional bid and adoption.

1) As a retail small fish, you’re probably not going to make life changing amounts of money in Bitcoin. I just don’t think there’s really that much aggressive upside to be had. It’s too big as an asset now. I bought BTC @ 6k, I could’ve realised that as a 20x from 2018.

A 20x from here? $1.8M - that’s going to take much longer than 8 years IMO.

I think it would be more appropriate to view Bitcoin for retail as a store of value with constant bid. The downside of this is you can’t just buy ‘the safest’ asset in crypto i.e. rank number 1 and make life changing retail returns with 4 figures.

The upside of this is when I was in the markets back in the day, holding Bitcoin was torture. March 2020? 40% drop in a day. Imagine Bitcoin dropping to $54k in ONE day. It was so hard to stay exposed to crypto without painful volatility.

So the good news is (tempting fate here a little) it’s very unlikely Bitcoin would drop that much in a day - maybe 1 week - but that gives you lots of time to adjust and rethink your strategy.

2) Because of point number 1, it’s harder to make $ from crypto, you’ve got to extend down the risk curve. This means altcoins, or more recently, memecoins. Memecoins were this cycles altcoins - the memecoin mania was the alt season IMO.

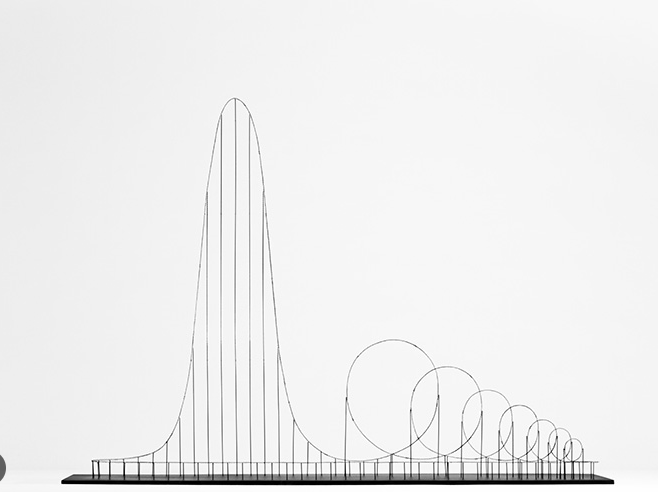

The problem with memes is they definitionally weren’t worth believing in or holding, so they completed their infamous rollercoaster pattern much more quickly.

The proliferation of memes + the inability to create huge wealth with Bitcoin has created short terminism mindsets within retail + young people.

I think this short terminism has been exacerbated for Gen Z or younger by the proliferation of high dopamine culture. Tik Tok, youtube shorts, instagram reels - modern gaming, everything - it’s all a dopamine rush.

Taking that dopamine rush mentality and applying it to investing/trading = 99% of people getting rekt - and they did, memes rekt most people.

Popular coins such as ETH + SOL also didn’t perform well, unless you were able to catch them in the depths of the bear market so these factors really pushed people into the ‘get rich quick’ way of thinking.

3) Get rich quick in crypto used to exist, now it probably doesn’t. So as I’ve explained, you used to be able to get rich quick in crypto by trading the majors like BTC or ETH - but now with institutional adoption that’s kinda off the table. I’ve explained the good and bad side of that and what it inevitably lead to (short terminism, instant gratification, gambling over investing, aping etc.)

Now let’s talk about what to actually do about it. Well, as a boring old unc, I’m here to tell you that getting rich slowly over the next 5-10 years is totally worthwhile.

For reference, being rich is not having 5M+ and living on yachts, being rich is not suffering from government tyranny, it’s having more free time to pursue hobbies + interests on earth, spending quality time with friends, wife or children because you’re not up to your eyeballs in stress from financial worry - that is actually being rich.

Like having a small mortgage or something - these things palpably change your life for the better. Don’t get sucked into all this ‘rolex and fancy sports cars’ BS - that’s shit designed to keep you poor and part of the system. You’ve very much still in the matrix if you think owning luxury cars + watches + materialistic things are the key to happiness. (CC: Tate bros)

Enough preaching, let’s talk actionables.

Laddering in: Yes Bitcoin is less volatile, but it’s still volatile, be patient, check sentiment, wait for someone to blow up and ladder in your buys - I’m not saying time bottoms, that’s too hard and risky. I’m saying be patient, have some cash on hand and deploy more cash the lower it goes in a laddered approach.

DCA (dollar cost average): Pick a number you can afford every month, say it’s $250 - buy that much Bitcoin every month (62.5 every week will be better)

It’s a boring strategy but you’re effectively always buying the lows and as Bitcoin moves up, you don’t even need an ATH to make good returns. Plus, as we discussed, Bitcoin is pretty much a cert for being around 10 years from now, so holding it as an asset is going to be much easier - this is what Cobie meant when he said the easy road is 100k-250k btw.

Farm airdrops: yeah they’ve dropped off, but they’ll still be around here and there. It’s free money, just take some off the table to pay the taxman.

Learn about crypto and keep researching in your spare time - use this knowledge to build your account. Once your account is built up, look for InfoFi deals (if it’s still around) or KOL deals for respectable and reputable projects - don’t promote trash to get ahead, it’s unethical and it will damage your brand in the long run. Your friends are not exit liquidity.

Don’t quit your job. Can’t express this enough. Investing is like a roller coaster - you can’t get off until the ride’s finished. If your money is in a long term multi year investment (like ETH or BTC) - you can’t pull it out half way through because you need the money.

Money you invest is gone - so only invest money you can afford to lose. Don’t over invest, don’t invest/trade emotionally. Build your investment thesis and build stoicism (so you don’t panic sell) and don’t be a dummy, I mean build a 5-10 year investment thesis about BTC or ETH not about AIDogecoinNFTclubwifhat or something FFS.

Save your money, be frugal. If you’re using newly acquired money to buy flash things you’re doing this:

‘We buy things we don’t need, with money we don’t have, to impress people we don’t like’

‘Oh but I do have the money’, trust me bro, you don’t, you’re gunna need that money down the line, I’m 36, trust me, you’ll need it. Life is expensive. really expensive - especially if you have dependents.

Most young men buy flashy things to impress girls or peers because they’re insecure, which is totally understandable, I’ve been that age, it sucks, it’s not easy - but it’s not acceptable.

Best thing I ever did to combat this issue when I was younger was get jacked. I leveraged the fact I had high testosterone at that age and just got to work. This meant I always felt confident and/or superior entering a room because I was always jacked and in shape - I didn’t need a watch with a fancy name on it to prove something. My body did that for me. I also didn’t need fancy clothes. You wear a $10k shirt and I’ll still looked better than you in a T-shirt because it hugs my body and shows my athletic outline.

Anyway, just my 2 cents and my opinion, some may disagree and that’s fine. I’ve said enough, I could go on but I’ll leave it there.

I hope this helps someone and there’s an ounce of wisdom in it for someone. Any questions, my DM’s are always open - or fire off in the comments so everyone can benefit and ofc happy Sunday.

Disclaimer:

- This article is reprinted from [Picolas_Caged]. All copyrights belong to the original author [Picolas_Caged]. If there are objections to this reprint, please contact the Gate Learn team, and they will handle it promptly.

- Liability Disclaimer: The views and opinions expressed in this article are solely those of the author and do not constitute any investment advice.

- Translations of the article into other languages are done by the Gate Learn team. Unless mentioned, copying, distributing, or plagiarizing the translated articles is prohibited.

Related Articles

Reflections on Ethereum Governance Following the 3074 Saga

Gate Research: 2024 Cryptocurrency Market Review and 2025 Trend Forecast

Gate Research: BTC Breaks $100K Milestone, November Crypto Trading Volume Exceeds $10 Trillion For First Time

NFTs and Memecoins in Last vs Current Bull Markets

Altseason 2025: Narrative Rotation and Capital Restructuring in an Atypical Bull Market