Is OM the Next LUNA? Inside MANTRA’s Dark Past

Forward the Original Title ‘Is OM the LUNA of This Cycle? Uncovering MANTRA’s Controversial Past: Price Manipulation, Legal Disputes, and Aggressive OTC Promotion’

This sudden plunge is not just a technical issue, but more like a long-buried mine finally detonating.

“This is worse than LUNA.”

In the early hours of Beijing time today, a sudden plunge kept many crypto investors awake all night. MANTRA token OM dropped about 10% in just one hour, and then plummeted directly from $5.21 to $0.50, a drop of up to 90%.

The community was in an uproar, with sharp comments: “Many people are still holding OM to earn interest, and they weren’t even given time to escape. This is even more devastating than the LUNA flash crash back then.”

This sudden crash is not just a technical issue, but more like a long-buried mine finally detonating.

A Troubled Past? Uncovering the Controversies Behind MANTRA

In the world of Web3, it’s not uncommon for project valuations to stray far from fundamentals. However, when a DeFi protocol with just $4 million in TVL reaches a fully diluted valuation (FDV) of $9.5 billion, it’s bound to raise questions about its legitimacy.

MANTRA’s collapse may not have come out of nowhere. Over the years, the project has been mired in controversy and questionable practices:

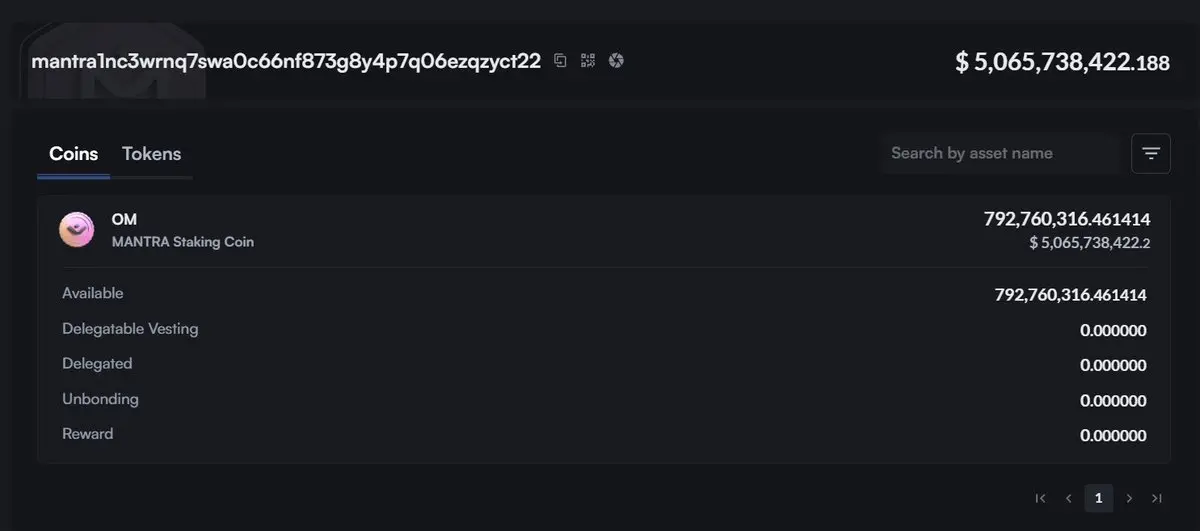

The project has a high level of centralized control. Crypto analyst Mosi pointed out that MANTRA controls the vast majority of $OM’s circulating supply. Up to 90% of $OM tokens (792 million) were held in a single wallet address managed by the team.

An endless token relay game. Crypto influencer Rui argued that OM operates more like a carefully packaged OTC fundraising scheme. Allegedly, over the past two years, the team raised more than $500 million via offline OTC sales using grassroots-style promotion. The model involved constantly issuing new tokens to absorb selling pressure from earlier investors—an endless loop of “new money for old tokens.” Once liquidity dries up or the market can no longer absorb unlocked tokens, the system risks collapsing.

The team reportedly cashed out during each price surge by deploying contracts and coordinating price pumps to extract additional profits.

Middle Eastern capital takeover. According to Ye Su, OM’s FDV dropped below $20 million in 2023, and the project was on the verge of being abandoned. A Middle Eastern investment group later acquired the project, retaining only the original CEO and replacing the rest of the team. This new backer—known for owning luxury villas, resorts, and various RWA assets—rebranded OM as an RWAfi project. Riding the RWA narrative and employing aggressive token control strategies, OM surged over 200x in 2024.

Legal disputes and allegations of fund misuse. According to the South China Morning Post, the Hong Kong High Court once ordered six members of MANTRA DAO to disclose financial records after allegations surfaced that the team misappropriated DAO assets.

Large amount of unpaid promises and token commitments. Crypto KOL Phyrex claimed he invested in the project early on but never received the promised tokens. Even after winning a lawsuit in 2023, MANTRA allegedly refused to comply with the judgment, citing its relocation from Hong Kong to the U.S. “Not a cent or a single token was ever paid,” he stated.

Controversial airdrop practices. According to IceFrog, MANTRA’s project team has faced heavy criticism for its airdrop practices. From the early stages, the team frequently changed the rules and repeatedly delayed the token unlock schedule, ultimately leading to users’ expectations being consistently unmet. During the airdrop distribution phase, the project lacked transparency and responded coldly to community concerns. It even implemented a “witch-hunt”-style purge mechanism, revoking users’ eligibility for the airdrop on the grounds of so-called “Sybil attacks,” yet never disclosed any concrete criteria or supporting data for these judgments.

Unpacking the Collapse: Forced Liquidations and Whale Sell-Offs

Following OM’s cliff-like price crash—which quickly triggered panic and suspicion within the community—the MANTRA team issued an urgent statement within hours, attempting to clarify that the project had no direct involvement in the sharp market movements. Multiple analyses and speculations have circulated regarding the causes of the crash, which can be broadly attributed to two key factors:

Forced Liquidations Sparked Market Volatility

According to MANTRA co-founder JP Mullin, the extreme volatility in OM’s market was triggered by reckless forced liquidations of OM positions by centralized exchanges. He noted that these liquidations occurred suddenly, without adequate prior warning or notification to the account holders.

Data shows that within the past 12 hours, the OM crash led to over $66.97 million in forced liquidations, with ten positions each exceeding $1 million in liquidation value.

Strategic Investors Dumped Large Positions

On-chain data from Lookonchain revealed that prior to the crash, at least 17 wallets transferred a total of 43.6 million OM—worth approximately $227 million at the time—onto exchanges, representing around 4.5% of OM’s circulating supply. Two of these wallet addresses were reportedly linked to MANTRA’s strategic investor, Laser Digital.

Additionally, according to Spot On Chain, 19 wallets—suspected to be controlled by a single entity—transferred 14.27 million OM (approximately $91 million) to OKX within the three days leading up to the crash, at an average price of $6.375. These same wallets had previously acquired 84.15 million OM from Binance in late March, spending roughly $564.7 million at an average price of $6.711. It is believed these entities may have hedged some positions on other platforms, further intensifying the downward spiral.

OM’s 90% plunge serves as yet another harsh reminder of the ruthless “exit liquidity” dynamics that still plague the crypto market. OM is not the first project to fall victim to such a fate—and it certainly won’t be the last. In a space where hype and bubbles coexist, only vigilance and rational investing can help navigate the ever-shifting crypto landscape with resilience.

Disclaimer:

This article is reprinted from [ChainCatcher]. Forward the Original Title ‘Is OM the LUNA of This Cycle? Uncovering MANTRA’s Controversial Past: Price Manipulation, Legal Disputes, and Aggressive OTC Promotion’. The copyright belongs to the original author [Fairy, ChainCatcher]. If you have any objection to the reprint, please contact the Gate Learn team, and the team will handle it as soon as possible according to the relevant procedures.

Disclaimer: The views and opinions expressed in this article represent only the author’s personal views and do not constitute any investment advice.

Other language versions of the article are translated by the Gate Learn team. The translated article may not be copied, distributed or plagiarized without mentioning Gate.io.

Related Articles

The Future of Cross-Chain Bridges: Full-Chain Interoperability Becomes Inevitable, Liquidity Bridges Will Decline

Solana Need L2s And Appchains?

Sui: How are users leveraging its speed, security, & scalability?

Navigating the Zero Knowledge Landscape

What is Tronscan and How Can You Use it in 2025?