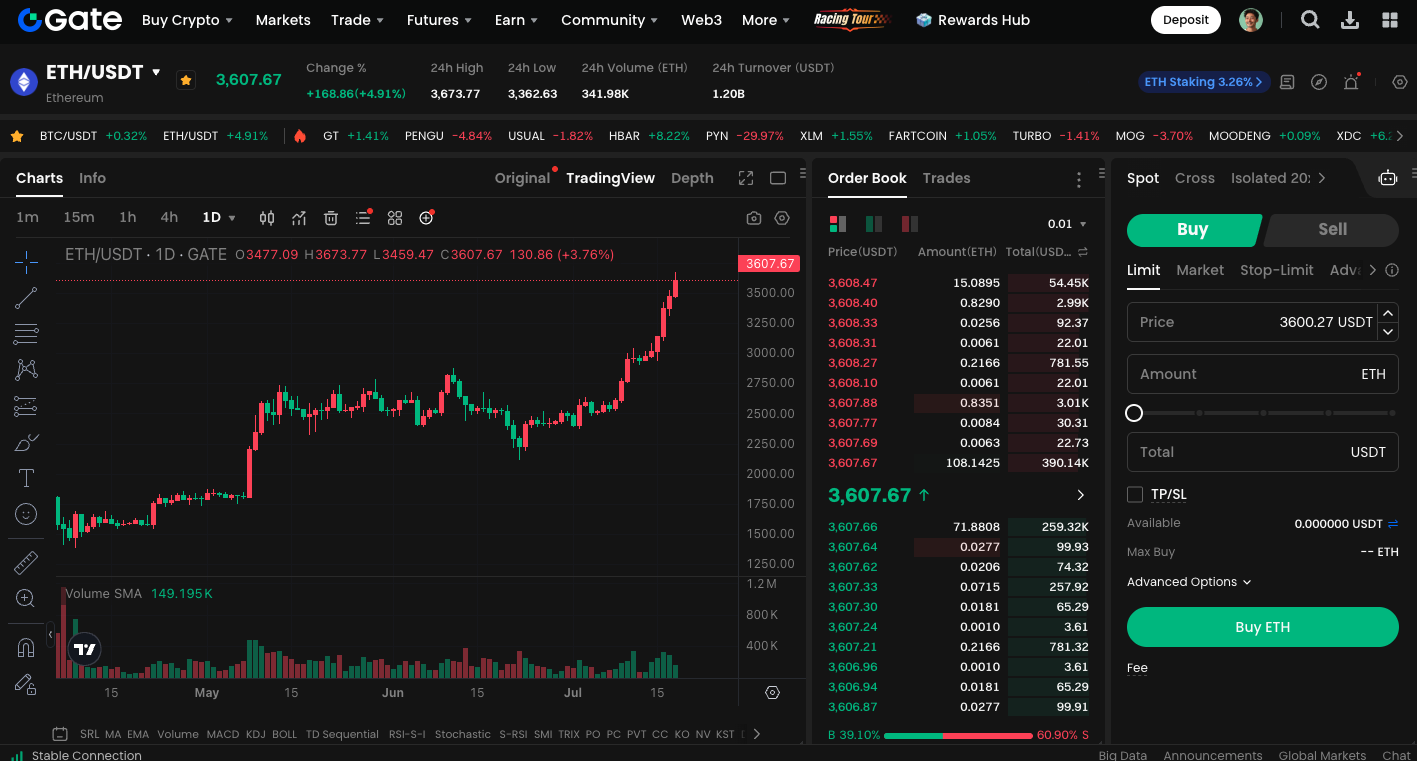

Ethereum Price Prediction: Triangle Formation Returns as ETH Eyes Breakout Above $3,600

Introduction

With Ether (ETH) firmly holding above the $3,000 mark, market sentiment has grown increasingly bullish. Technical and fundamental indicators align and signal further upside for ETH, suggesting the potential for a new rally, with price targets at $3,600 and higher.

Technical Analysis of ETH

Recent candlestick patterns have led analysts to note that ETH is repeating a technical setup similar to that observed in May earlier this year. At that time, Ether surged from around $1,800 to $2,700 in a single month—a gain of over 40%. Analysts highlight a comparable structure unfolding now: ETH first broke through a key resistance level, then entered a brief consolidation period, and is currently forming a symmetrical triangle chart pattern reminiscent of that previous rally.

According to crypto analyst CryptosBatman, after ETH’s breakout above $3,000, the token has entered a period of accumulation—a classic accumulation phase. If the price breaks decisively above the triangle’s upper boundary, a strong next leg up is likely, with projected upside targets of $3,600 to $3,800, representing approximately 20% additional growth potential.

Dual Engines: Spot ETF Net Inflows and Institutional Accumulation

(Source: CryptosBatman)

Bullish signals are not limited to technicals; capital flows also provide positive momentum. According to Farside, spot Ether exchange-traded funds (ETFs) have recorded consecutive days of net inflows, reflecting sustained interest from institutional investors. Major asset managers such as BlackRock and Fidelity are purchasing tens of thousands of ETH daily, demonstrating strong conviction in ETH’s long-term value.

Several publicly traded companies are also significantly increasing their ETH holdings. Enterprises like SharpLink and BitMine have amassed Ether holdings valued at several billion dollars, further boosting demand for ETH.

For more information on ETH spot trading, visit: https://www.gate.com/trade/ETH_USDT

Conclusion

In summary, technical and fundamental factors are driving bullish momentum for ETH in the short to medium term. If ETH successfully breaks out from the current consolidation range, $3,600 could become the next major target, while continued capital inflows and institutional accumulation provide a solid foundation for the next potential move upward.

Related Articles

2025 BTC Price Prediction: BTC Trend Forecast Based on Technical and Macroeconomic Data

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

Pi Coin Transaction Guide: How to Transfer to Gate.com

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

What is N2: An AI-Driven Layer 2 Solution