Asiftahsin

Share Crypto Related Market Analysis, Share Crypto Related knowledge for my follower(brother and Sister)

Asiftahsin

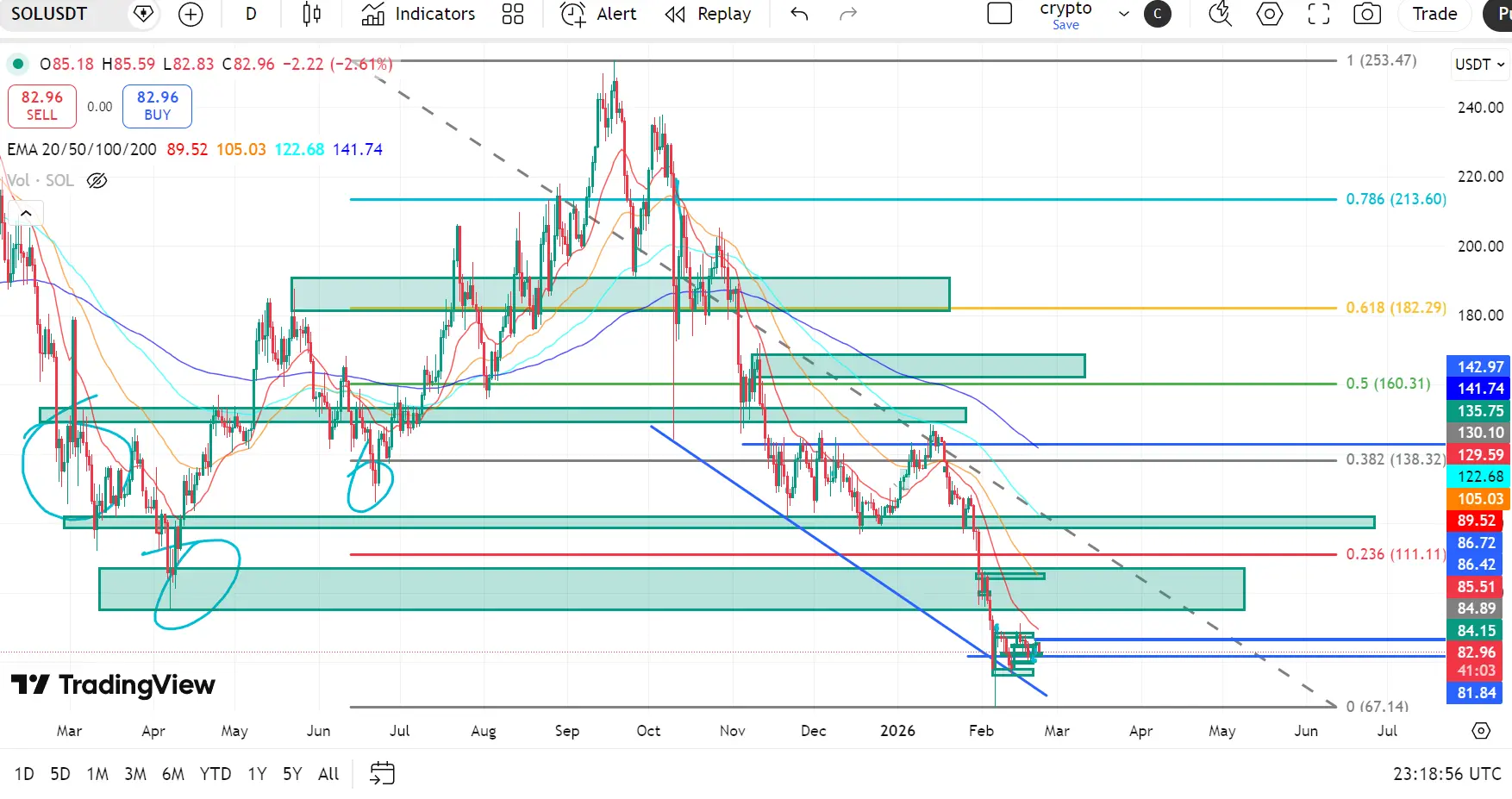

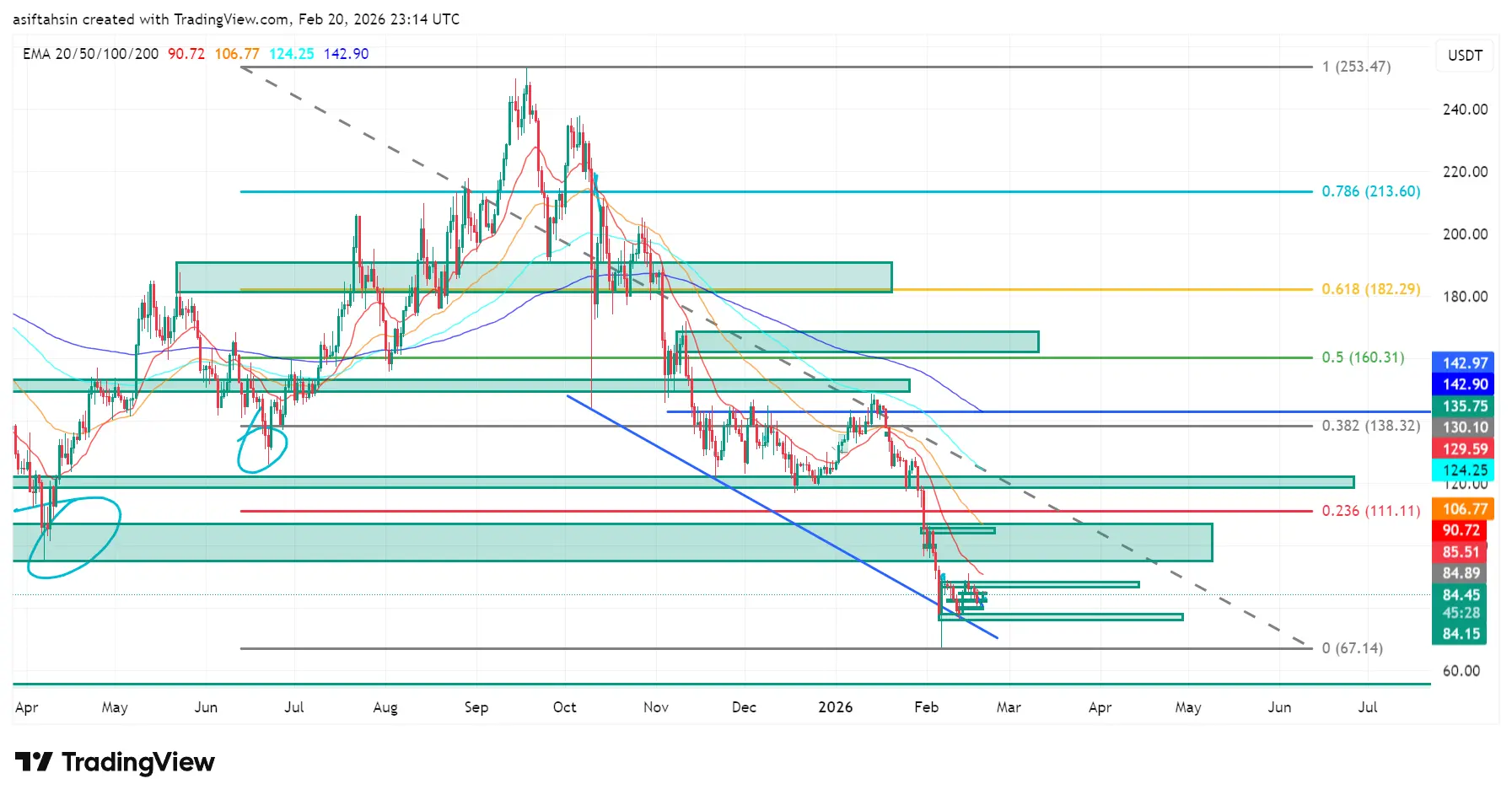

SOL Technical Outlook: Solana Consolidates at Cycle Lows After Impulsive Breakdown

Solana remains under sustained bearish pressure following a prolonged downtrend from the cycle high near $253. After losing the 0.236 Fibonacci level ($111), price accelerated lower and recently tapped the macro base near $67 (Fib 0) before staging a modest bounce.

The current structure shows short-term consolidation between $85–$90, but the broader trend remains decisively bearish unless major resistance levels are reclaimed.

EMA Structure (Bearish Alignment Remains Intact)

20 EMA: $87.41

50 EMA: $101.75

100 EM

Solana remains under sustained bearish pressure following a prolonged downtrend from the cycle high near $253. After losing the 0.236 Fibonacci level ($111), price accelerated lower and recently tapped the macro base near $67 (Fib 0) before staging a modest bounce.

The current structure shows short-term consolidation between $85–$90, but the broader trend remains decisively bearish unless major resistance levels are reclaimed.

EMA Structure (Bearish Alignment Remains Intact)

20 EMA: $87.41

50 EMA: $101.75

100 EM

SOL-2.66%

- Reward

- 4

- 2

- 1

- Share

LittleGodOfWealthPlutus :

:

Wishing you good luck in the Year of the Horse and may you prosper and become wealthy😘View More

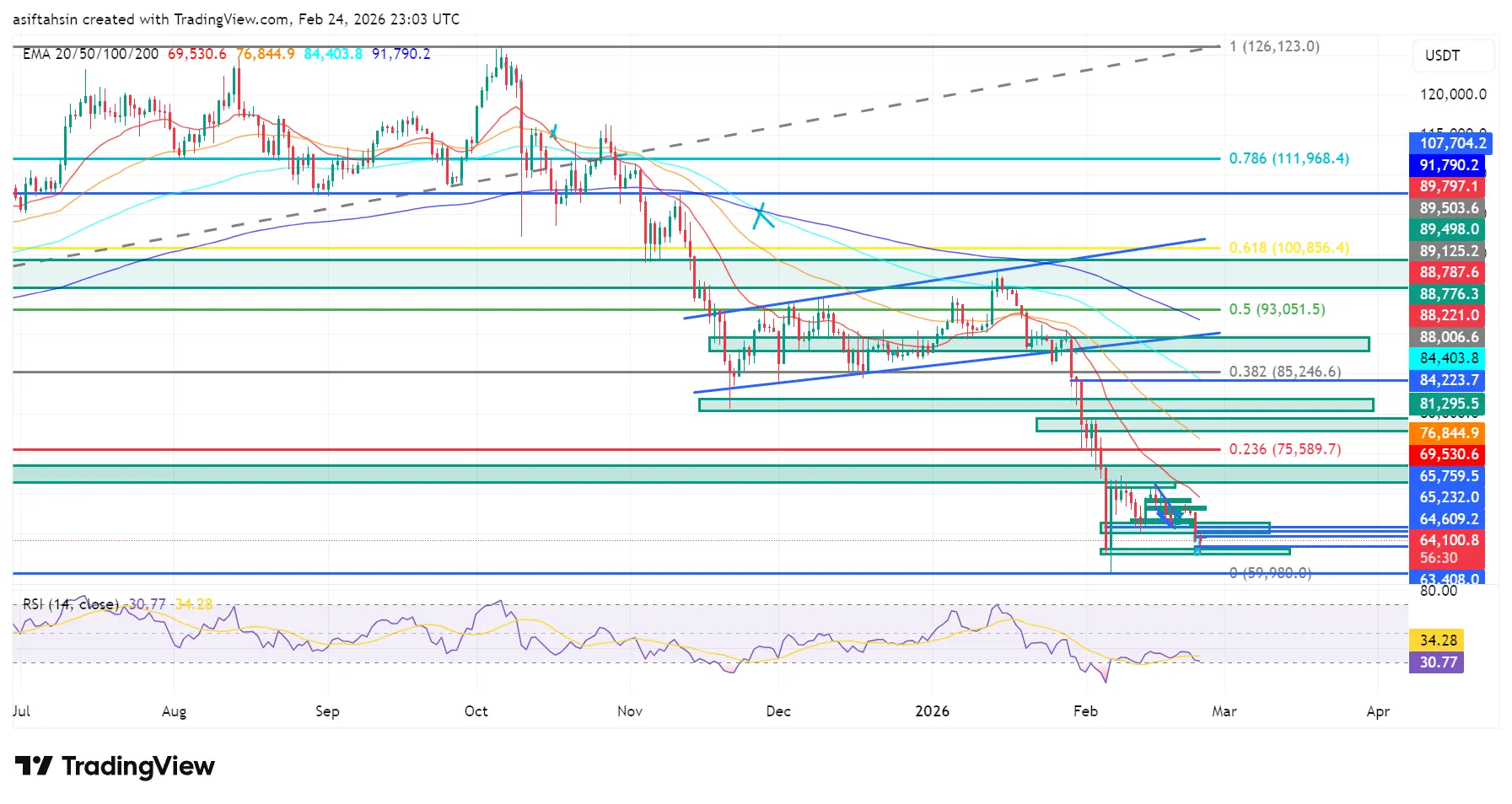

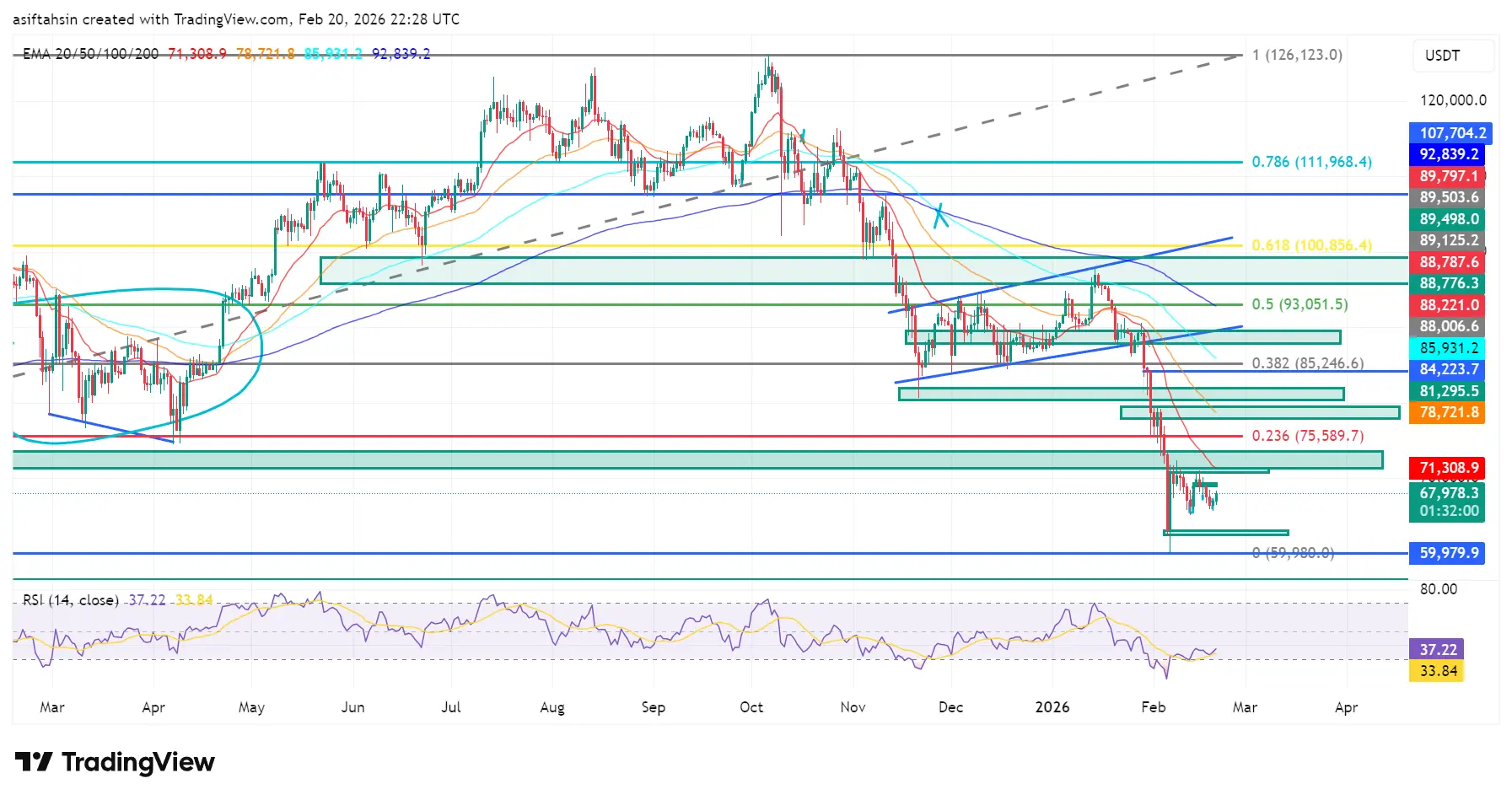

BTC Technical Outlook: Consolidating Just Above Macro Base After 0.236 Breakdown

Bitcoin remains in a strong corrective downtrend after rejecting from the $93K–$100K resistance cluster (0.5–0.618 Fibonacci zone).

The decisive breakdown below 0.382 ($85,246) and later the loss of 0.236 ($75,589) triggered accelerated downside pressure.

Price is now consolidating around $65,000–$69,000, hovering just above the macro Fibonacci 0 level at $59,980.

This is a critical higher-timeframe support region.

EMA Structure (Bearish Alignment)

20 EMA: $69,193

50 EMA: $76,140

100 EMA: $83,748

200 EMA: $91,312

Bitcoin remains in a strong corrective downtrend after rejecting from the $93K–$100K resistance cluster (0.5–0.618 Fibonacci zone).

The decisive breakdown below 0.382 ($85,246) and later the loss of 0.236 ($75,589) triggered accelerated downside pressure.

Price is now consolidating around $65,000–$69,000, hovering just above the macro Fibonacci 0 level at $59,980.

This is a critical higher-timeframe support region.

EMA Structure (Bearish Alignment)

20 EMA: $69,193

50 EMA: $76,140

100 EMA: $83,748

200 EMA: $91,312

BTC-1.34%

- Reward

- 3

- 1

- Repost

- Share

LittleGodOfWealthPlutus :

:

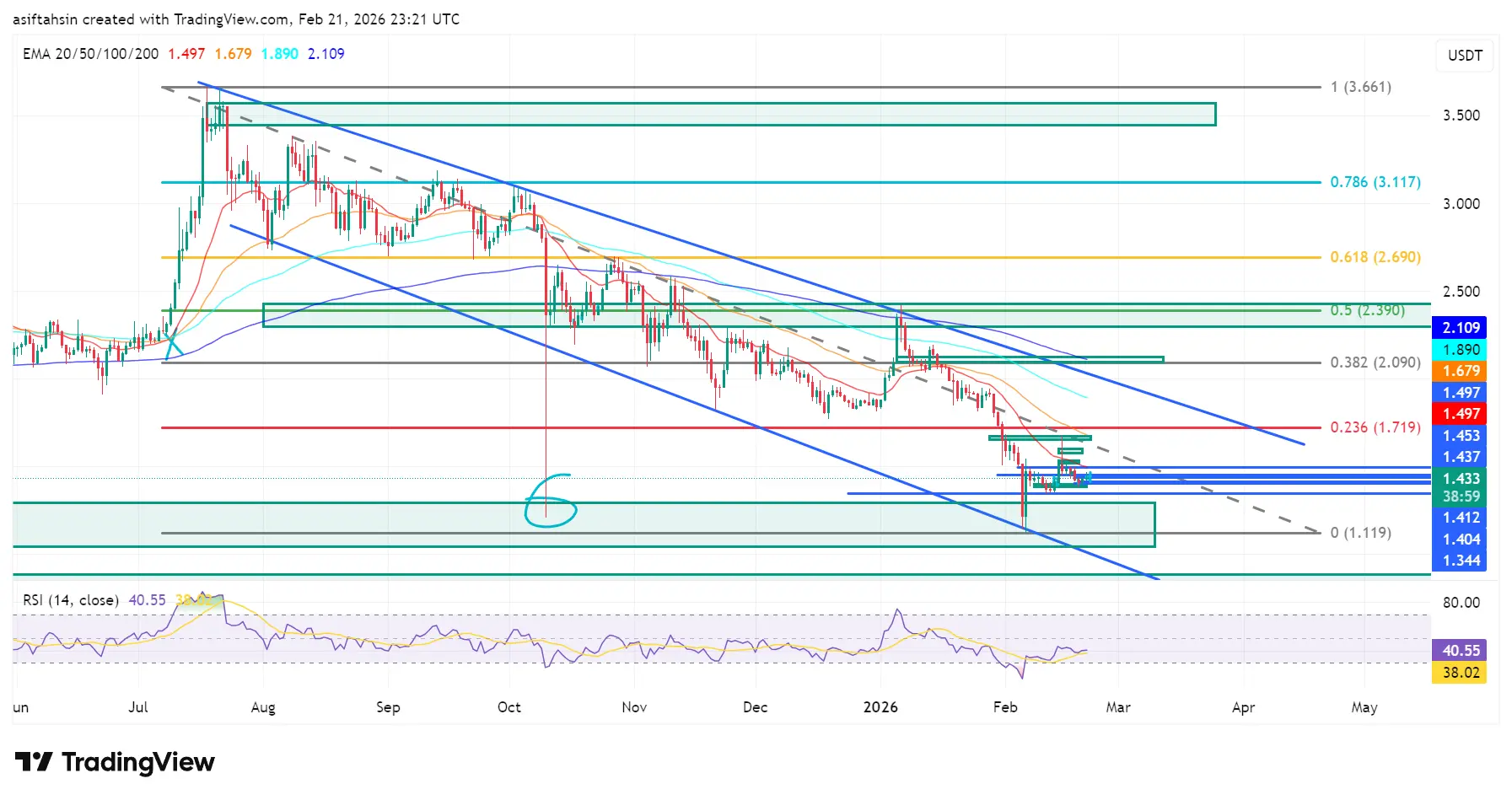

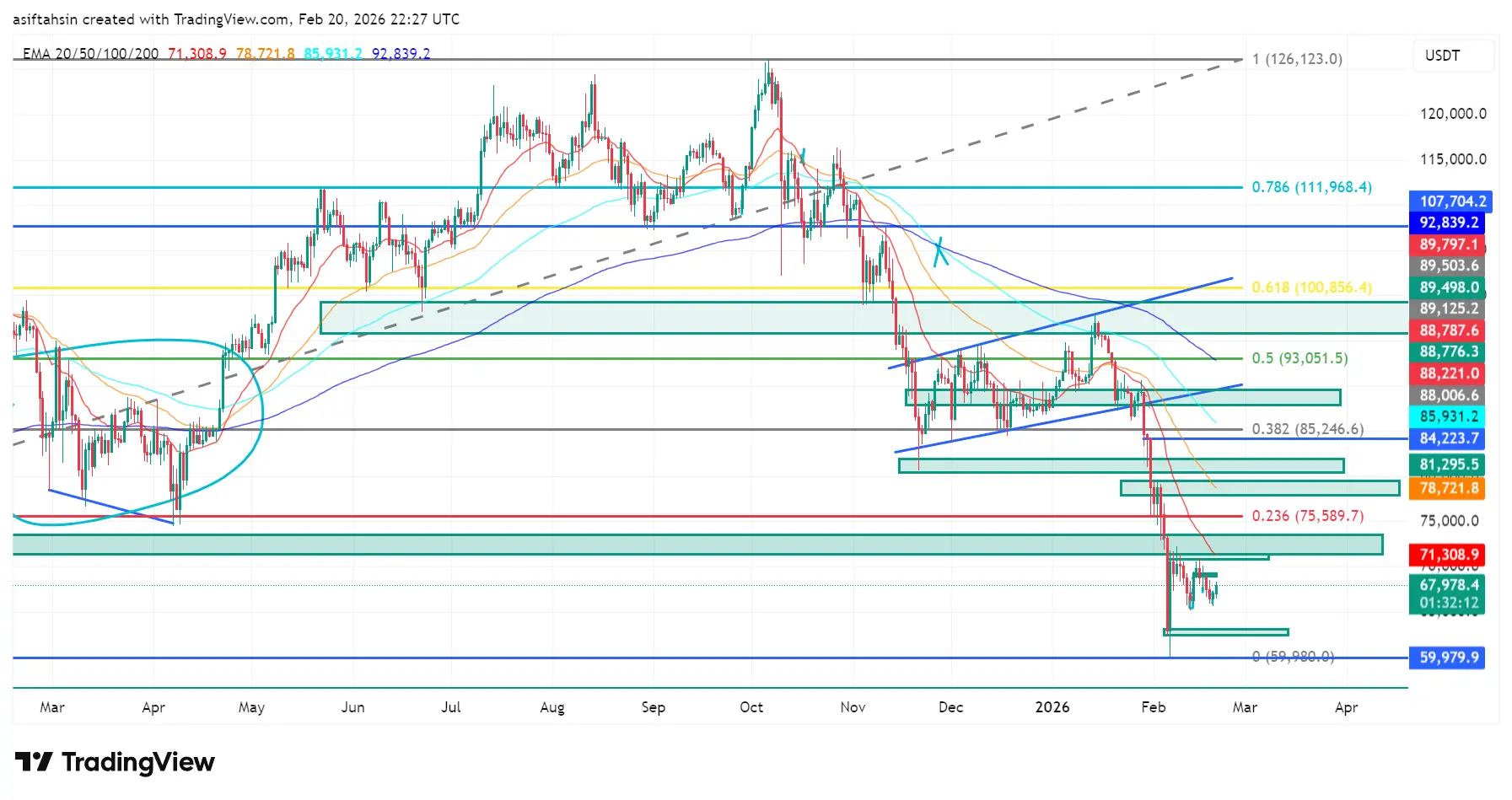

Direct to the Moon!XRP Technical Outlook: Consolidating Above Macro Base Inside Descending Channel

XRP remains in a broader corrective downtrend after rejecting from the $2.39–$2.69 resistance cluster (0.5–0.618 Fibonacci zone).

Failure to sustain above 0.382 ($2.09) followed by a decisive breakdown below 0.236 ($1.719) triggered strong downside continuation.

Price is now consolidating around $1.34–$1.46, hovering just above the macro Fibonacci 0 level at $1.119.

This is a critical higher-timeframe support region.

EMA Structure (Bearish Alignment)

20 EMA: $1.460

50 EMA: $1.635

100 EMA: $1.851

200 EMA: $2.081

XRP

XRP remains in a broader corrective downtrend after rejecting from the $2.39–$2.69 resistance cluster (0.5–0.618 Fibonacci zone).

Failure to sustain above 0.382 ($2.09) followed by a decisive breakdown below 0.236 ($1.719) triggered strong downside continuation.

Price is now consolidating around $1.34–$1.46, hovering just above the macro Fibonacci 0 level at $1.119.

This is a critical higher-timeframe support region.

EMA Structure (Bearish Alignment)

20 EMA: $1.460

50 EMA: $1.635

100 EMA: $1.851

200 EMA: $2.081

XRP

XRP-1.26%

- Reward

- 5

- 9

- Repost

- Share

GateUser-f0a66e66 :

:

To The Moon 🌕View More

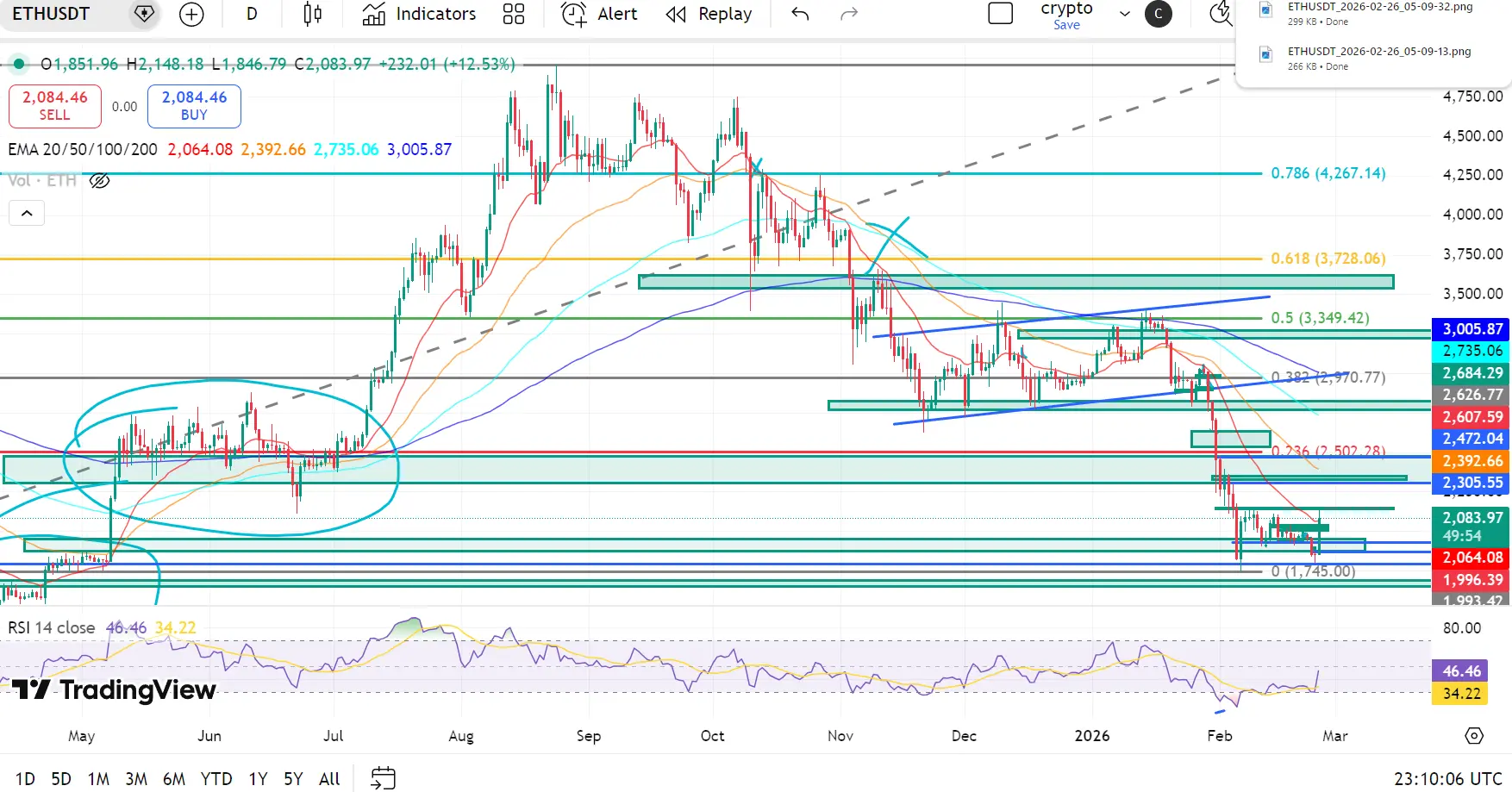

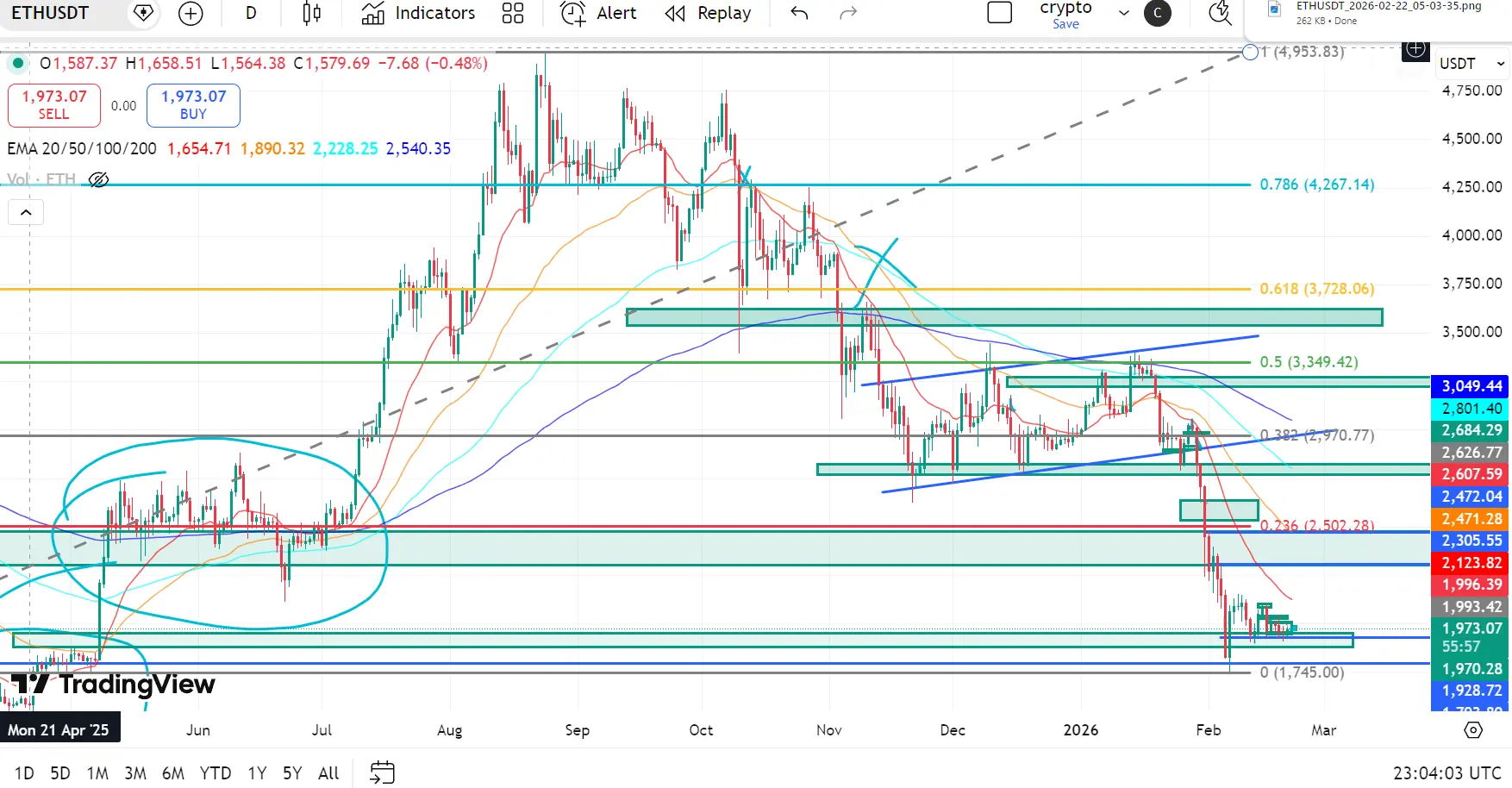

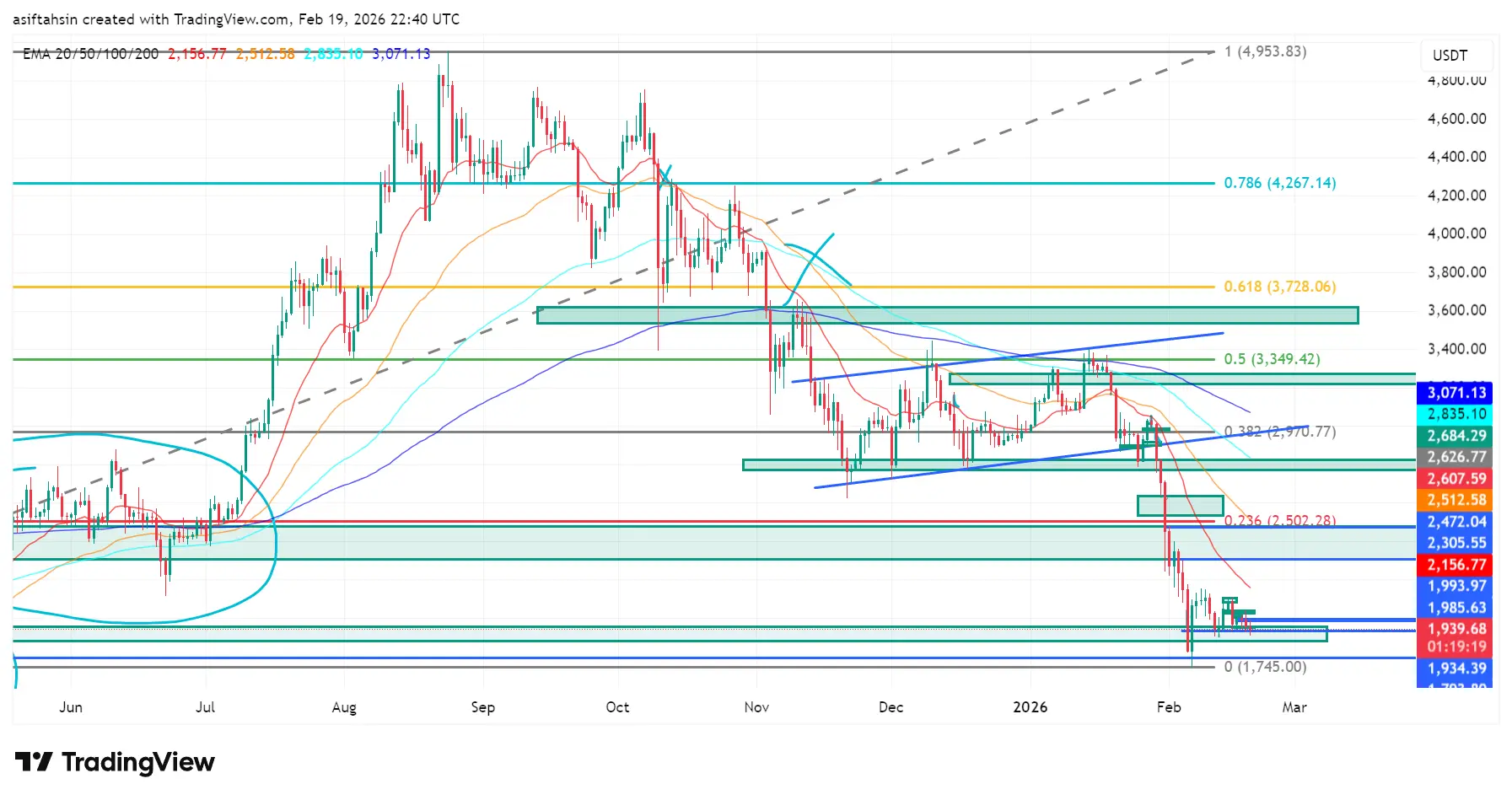

ETH Technical Outlook: Trading Just Above Macro Base After Major Breakdown

Ethereum remains in a strong corrective downtrend after rejecting from the $3,349–$3,728 resistance cluster (0.5–0.618 Fibonacci zone).

Failure to sustain above 0.382 ($2,970) followed by a decisive breakdown below 0.236 ($2,502) triggered aggressive downside continuation.

Price is now consolidating around $1,990–$2,080, hovering just above the macro Fibonacci 0 level at $1,745.

This is a major higher-timeframe support zone.

EMA Structure (Strong Bearish Alignment)

20 EMA: $2,064

50 EMA: $2,392

100 EMA: $2,735

200 EMA:

Ethereum remains in a strong corrective downtrend after rejecting from the $3,349–$3,728 resistance cluster (0.5–0.618 Fibonacci zone).

Failure to sustain above 0.382 ($2,970) followed by a decisive breakdown below 0.236 ($2,502) triggered aggressive downside continuation.

Price is now consolidating around $1,990–$2,080, hovering just above the macro Fibonacci 0 level at $1,745.

This is a major higher-timeframe support zone.

EMA Structure (Strong Bearish Alignment)

20 EMA: $2,064

50 EMA: $2,392

100 EMA: $2,735

200 EMA:

ETH-1.86%

- Reward

- 2

- Comment

- Repost

- Share

SOL Technical Outlook: Breakdown Toward Macro Base After 0.236 Loss

Solana remains in a strong corrective downtrend after rejecting from the $160–$182 resistance cluster (0.5–0.618 Fibonacci zone).

Failure to sustain above 0.382 ($138.32) followed by a decisive breakdown below 0.236 ($111.11) triggered accelerated downside pressure.

Price is now trading around $78–$84, approaching the macro Fibonacci 0 level at $67.14.

This is a major higher-timeframe support region.

EMA Structure (Strong Bearish Alignment)

20 EMA: $87.53

50 EMA: $102.99

100 EMA: $120.95

200 EMA: $140.48

SOL is trading below a

Solana remains in a strong corrective downtrend after rejecting from the $160–$182 resistance cluster (0.5–0.618 Fibonacci zone).

Failure to sustain above 0.382 ($138.32) followed by a decisive breakdown below 0.236 ($111.11) triggered accelerated downside pressure.

Price is now trading around $78–$84, approaching the macro Fibonacci 0 level at $67.14.

This is a major higher-timeframe support region.

EMA Structure (Strong Bearish Alignment)

20 EMA: $87.53

50 EMA: $102.99

100 EMA: $120.95

200 EMA: $140.48

SOL is trading below a

SOL-2.66%

- Reward

- 8

- 7

- Repost

- Share

NewName :

:

Thank you for information! View More

BTC Technical Outlook: Consolidating Near Macro Base After 0.236 Breakdown

Bitcoin remains in a strong corrective downtrend after rejecting from the $93K–$100K resistance cluster (0.5–0.618 Fibonacci zone).

The decisive breakdown below 0.382 ($85,246) and later the loss of 0.236 ($75,589) triggered accelerated downside pressure, pushing BTC toward macro support.

Currently, BTC is consolidating around $64K–$66K, hovering just above the macro Fibonacci 0 level at $59,980.

This is a major structural decision zone.

EMA Structure (Strong Bearish Alignment)

20 EMA: $69,530

50 EMA: $76,844

100 EMA: $

Bitcoin remains in a strong corrective downtrend after rejecting from the $93K–$100K resistance cluster (0.5–0.618 Fibonacci zone).

The decisive breakdown below 0.382 ($85,246) and later the loss of 0.236 ($75,589) triggered accelerated downside pressure, pushing BTC toward macro support.

Currently, BTC is consolidating around $64K–$66K, hovering just above the macro Fibonacci 0 level at $59,980.

This is a major structural decision zone.

EMA Structure (Strong Bearish Alignment)

20 EMA: $69,530

50 EMA: $76,844

100 EMA: $

BTC-1.34%

- Reward

- 4

- 4

- Repost

- Share

Ryakpanda :

:

2026 Go Go Go 👊View More

XRP Technical Outlook: Holding Above Macro Base Inside Descending Channel

XRP remains in a broader corrective downtrend after rejecting from the $2.39–$2.69 resistance cluster (0.5–0.618 Fibonacci zone).

The breakdown below 0.382 ($2.09) and later the decisive loss of 0.236 ($1.719) accelerated downside pressure, pushing price toward macro support.

Currently, XRP is consolidating around $1.34–$1.36, hovering just above the macro Fibonacci 0 level at $1.119.

This is a key structural decision zone.

EMA Structure (Bearish Alignment)

20 EMA: $1.474

50 EMA: $1.656

100 EMA: $1.870

200 EMA: $2.094

XR

XRP remains in a broader corrective downtrend after rejecting from the $2.39–$2.69 resistance cluster (0.5–0.618 Fibonacci zone).

The breakdown below 0.382 ($2.09) and later the decisive loss of 0.236 ($1.719) accelerated downside pressure, pushing price toward macro support.

Currently, XRP is consolidating around $1.34–$1.36, hovering just above the macro Fibonacci 0 level at $1.119.

This is a key structural decision zone.

EMA Structure (Bearish Alignment)

20 EMA: $1.474

50 EMA: $1.656

100 EMA: $1.870

200 EMA: $2.094

XR

XRP-1.26%

- Reward

- 3

- 3

- Repost

- Share

User_any :

:

LFG 🔥View More

ETH Technical Outlook: Testing Macro Base After 0.236 Breakdown

Ethereum remains in a strong corrective downtrend after rejecting from the $3,349–$3,728 resistance cluster (0.5–0.618 Fibonacci zone).

The breakdown below 0.382 ($2,970) and later a decisive loss of 0.236 ($2,502) triggered accelerated downside pressure, pushing ETH toward macro support.

Price is now consolidating around $1,860–$1,930, hovering just above the macro Fibonacci 0 level at $1,745.

This is a major structural support zone.

EMA Structure (Strong Bearish Alignment)

20 EMA: $2,084

50 EMA: $2,427

100 EMA: $2,766

200 EMA: $

Ethereum remains in a strong corrective downtrend after rejecting from the $3,349–$3,728 resistance cluster (0.5–0.618 Fibonacci zone).

The breakdown below 0.382 ($2,970) and later a decisive loss of 0.236 ($2,502) triggered accelerated downside pressure, pushing ETH toward macro support.

Price is now consolidating around $1,860–$1,930, hovering just above the macro Fibonacci 0 level at $1,745.

This is a major structural support zone.

EMA Structure (Strong Bearish Alignment)

20 EMA: $2,084

50 EMA: $2,427

100 EMA: $2,766

200 EMA: $

ETH-1.86%

- Reward

- 3

- 6

- Repost

- Share

Discovery :

:

Ape In 🚀View More

SOL Technical Outlook: Consolidating Above Macro Base After 0.236 Breakdown

Solana remains in a broader corrective downtrend after rejecting from the $160–$182 resistance cluster (0.5–0.618 Fibonacci zone).

The breakdown below 0.382 ($138.32) and later the decisive loss of 0.236 ($111.11) accelerated downside momentum, pushing price toward macro support.

Currently, SOL is consolidating around $82–$86, forming a short-term base just above the macro Fibonacci 0 level at $67.14.

This is a key structural decision zone.

EMA Structure (Bearish Alignment)

20 EMA: $89.52

50 EMA: $105.03

100 EMA: $122.

Solana remains in a broader corrective downtrend after rejecting from the $160–$182 resistance cluster (0.5–0.618 Fibonacci zone).

The breakdown below 0.382 ($138.32) and later the decisive loss of 0.236 ($111.11) accelerated downside momentum, pushing price toward macro support.

Currently, SOL is consolidating around $82–$86, forming a short-term base just above the macro Fibonacci 0 level at $67.14.

This is a key structural decision zone.

EMA Structure (Bearish Alignment)

20 EMA: $89.52

50 EMA: $105.03

100 EMA: $122.

SOL-2.66%

- Reward

- 4

- 3

- Repost

- Share

ybaser :

:

To The Moon 🌕View More

BTC Technical Outlook: Consolidating Above Macro Base After Losing 0.236

Bitcoin remains in a broader corrective structure after failing to sustain above the $93K–$100K resistance cluster (0.5–0.618 Fibonacci zone).

The rejection from higher levels led to a breakdown below 0.382 ($85,246) and later a decisive loss of 0.236 ($75,589), accelerating the decline toward macro support.

Price is now consolidating around $66K–$70K, forming a short-term base just above the macro Fibonacci 0 level at $59,980.

This is a major structural decision zone for BTC.

EMA Structure (Bearish Alignment)

20 EMA: $70

Bitcoin remains in a broader corrective structure after failing to sustain above the $93K–$100K resistance cluster (0.5–0.618 Fibonacci zone).

The rejection from higher levels led to a breakdown below 0.382 ($85,246) and later a decisive loss of 0.236 ($75,589), accelerating the decline toward macro support.

Price is now consolidating around $66K–$70K, forming a short-term base just above the macro Fibonacci 0 level at $59,980.

This is a major structural decision zone for BTC.

EMA Structure (Bearish Alignment)

20 EMA: $70

BTC-1.34%

- Reward

- 2

- Comment

- Repost

- Share

XRP Technical Outlook: Consolidating Above Macro Base Within Descending Channel

XRP remains in a broader corrective downtrend after failing to hold above the $2.39–$2.69 resistance cluster (0.5–0.618 Fibonacci zone).

The rejection from higher structure led to a breakdown below 0.382 ($2.09) and later a decisive loss of 0.236 ($1.719), accelerating the decline toward macro support.

Price is now consolidating around $1.40–$1.45, forming a short-term base just above the macro Fibonacci 0 level at $1.119.

This area is a critical decision zone for the next directional move.

EMA Structure (Bearish A

XRP remains in a broader corrective downtrend after failing to hold above the $2.39–$2.69 resistance cluster (0.5–0.618 Fibonacci zone).

The rejection from higher structure led to a breakdown below 0.382 ($2.09) and later a decisive loss of 0.236 ($1.719), accelerating the decline toward macro support.

Price is now consolidating around $1.40–$1.45, forming a short-term base just above the macro Fibonacci 0 level at $1.119.

This area is a critical decision zone for the next directional move.

EMA Structure (Bearish A

XRP-1.26%

- Reward

- 3

- 2

- 1

- Share

HighAmbition :

:

To The Moon 🌕View More

ETH Technical Outlook: Ethereum Consolidating Near Macro Base After Losing 0.236

Ethereum remains in a strong corrective downtrend after failing to sustain above the $3,349–$3,728 resistance cluster (0.5–0.618 Fibonacci zone).

The rejection from the upper structure led to a breakdown below 0.382 ($2,970) and later a decisive loss of 0.236 ($2,502), accelerating the decline toward macro support.

Price is now consolidating around $1,970–$2,050, just above the macro Fibonacci 0 level at $1,745, forming a short-term base after an aggressive selloff.

This zone is a major structural decision area.

E

Ethereum remains in a strong corrective downtrend after failing to sustain above the $3,349–$3,728 resistance cluster (0.5–0.618 Fibonacci zone).

The rejection from the upper structure led to a breakdown below 0.382 ($2,970) and later a decisive loss of 0.236 ($2,502), accelerating the decline toward macro support.

Price is now consolidating around $1,970–$2,050, just above the macro Fibonacci 0 level at $1,745, forming a short-term base after an aggressive selloff.

This zone is a major structural decision area.

E

ETH-1.86%

- Reward

- 2

- 5

- Repost

- Share

GateUser-b4b88d3c :

:

khiw8rzjvhxhcjvjvjfs7gg6d7t9uohifys6r8yphogjvnvys6dohpjlcudhvkbkvj ga6dihigif8gohojobkbkblnlnlnpjoh8r7hkjView More

SOL Technical Outlook: Solana Holding Above Macro Base After Losing 0.236

Solana remains in a sustained corrective downtrend after rejecting from the $160–$182 resistance cluster (0.5–0.618 Fibonacci zone).

The breakdown below 0.382 ($138) and later 0.236 ($111) confirmed structural weakness, accelerating the decline toward macro support.

Price is now consolidating near $84–$90, just above the macro Fibonacci 0 level at $67.14, forming a short-term base after a sharp selloff.

This is a critical decision zone for SOL’s next major move.

EMA Structure (Strong Bearish Alignment)

20 EMA: $90.72

50

Solana remains in a sustained corrective downtrend after rejecting from the $160–$182 resistance cluster (0.5–0.618 Fibonacci zone).

The breakdown below 0.382 ($138) and later 0.236 ($111) confirmed structural weakness, accelerating the decline toward macro support.

Price is now consolidating near $84–$90, just above the macro Fibonacci 0 level at $67.14, forming a short-term base after a sharp selloff.

This is a critical decision zone for SOL’s next major move.

EMA Structure (Strong Bearish Alignment)

20 EMA: $90.72

50

SOL-2.66%

- Reward

- 5

- 3

- Repost

- Share

MasterChuTheOldDemonMasterChu :

:

Good luck and prosperity 🧧View More

BTC Technical Outlook: Bitcoin Stabilizing Above Macro Support After Breakdown Below 0.236

Bitcoin remains in a broader corrective phase after failing to hold above the $93,000–$100,800 resistance cluster (0.5–0.618 Fibonacci zone).

The breakdown below 0.382 ($85,246) and then decisively below 0.236 ($75,589) confirmed structural weakness and triggered an accelerated decline toward macro support.

Price is now consolidating near $67,000–$71,000, forming a short-term base just above the macro Fibonacci 0 level at $59,980.

This area represents a major decision zone for BTC’s next directional move

Bitcoin remains in a broader corrective phase after failing to hold above the $93,000–$100,800 resistance cluster (0.5–0.618 Fibonacci zone).

The breakdown below 0.382 ($85,246) and then decisively below 0.236 ($75,589) confirmed structural weakness and triggered an accelerated decline toward macro support.

Price is now consolidating near $67,000–$71,000, forming a short-term base just above the macro Fibonacci 0 level at $59,980.

This area represents a major decision zone for BTC’s next directional move

BTC-1.34%

- Reward

- 6

- 3

- Repost

- Share

MasterChuTheOldDemonMasterChu :

:

2026 Go Go Go 👊View More

XRP Technical Outlook: Consolidation Above Macro Support Within Descending Channel

XRP remains in a broader corrective structure after failing to hold above the $2.39–$2.69 resistance cluster (0.5–0.618 Fibonacci zone).

Price continues to respect a well-defined descending channel, forming consistent lower highs and lower lows since the rejection near $3.60.

After breaking below 0.236 ($1.719), XRP dropped sharply toward the macro base and is now consolidating near $1.34–$1.40, attempting short-term stabilization.

This region is a key decision zone for the next directional move.

EMA Structure (

XRP remains in a broader corrective structure after failing to hold above the $2.39–$2.69 resistance cluster (0.5–0.618 Fibonacci zone).

Price continues to respect a well-defined descending channel, forming consistent lower highs and lower lows since the rejection near $3.60.

After breaking below 0.236 ($1.719), XRP dropped sharply toward the macro base and is now consolidating near $1.34–$1.40, attempting short-term stabilization.

This region is a key decision zone for the next directional move.

EMA Structure (

XRP-1.26%

- Reward

- 5

- 7

- Repost

- Share

CryptoSat :

:

💯TRADING STRATEGY mentioned in pinned messageView More

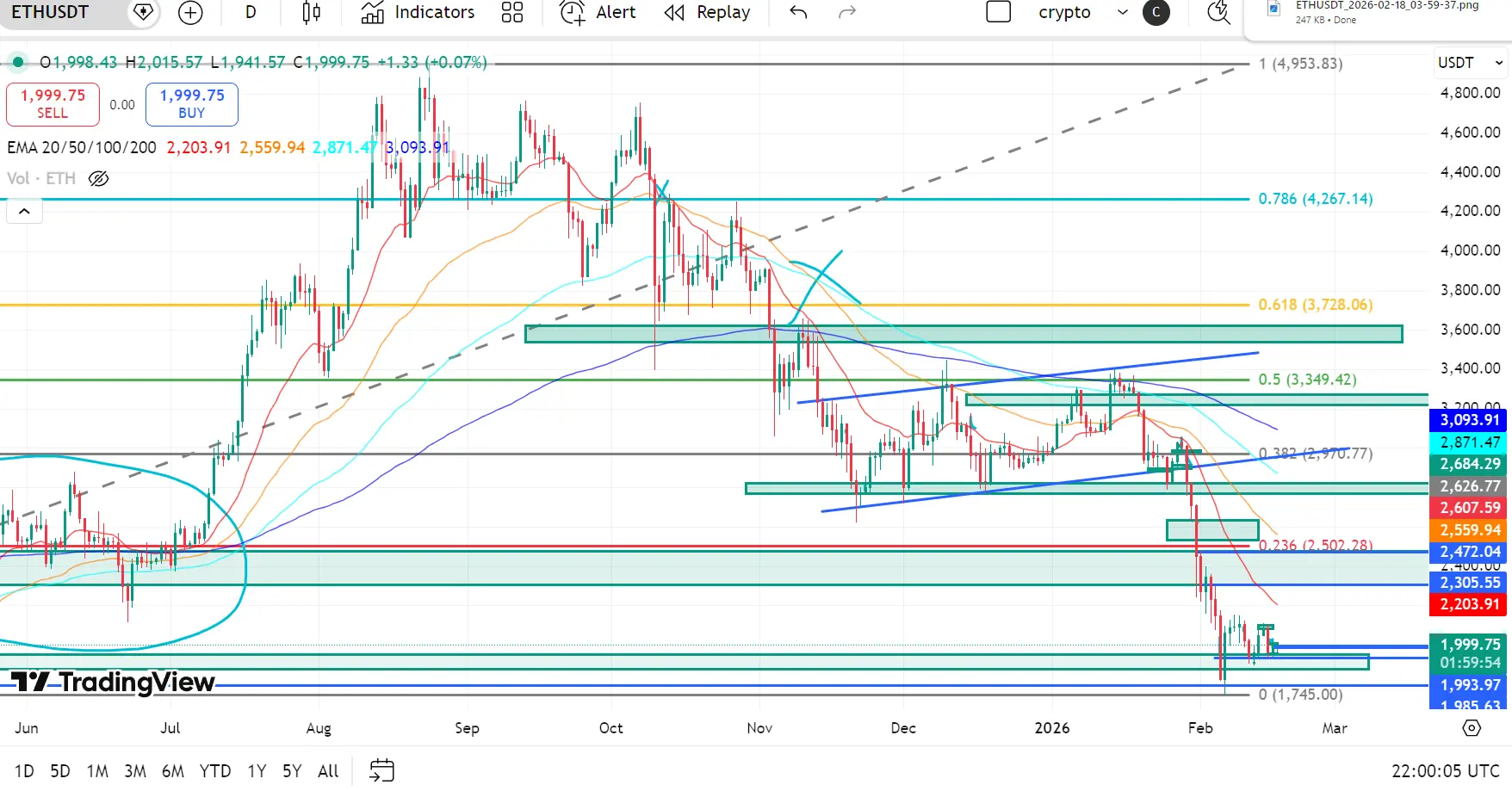

ETH Technical Outlook: Ethereum Testing Macro Base After Losing 0.236 Support

Ethereum remains in a sustained corrective downtrend after failing to hold above the $3,300–$3,700 resistance cluster (0.5–0.618 Fibonacci region).

Multiple lower highs inside a descending structure, followed by a decisive breakdown below 0.236 ($2,502), confirmed continuation of bearish momentum.

Price is now consolidating near $1,940–$2,000, just above the macro base around $1,745, forming a short-term stabilization range after an extended decline from the $4,200+ highs.

This region is a critical decision zone for

Ethereum remains in a sustained corrective downtrend after failing to hold above the $3,300–$3,700 resistance cluster (0.5–0.618 Fibonacci region).

Multiple lower highs inside a descending structure, followed by a decisive breakdown below 0.236 ($2,502), confirmed continuation of bearish momentum.

Price is now consolidating near $1,940–$2,000, just above the macro base around $1,745, forming a short-term stabilization range after an extended decline from the $4,200+ highs.

This region is a critical decision zone for

ETH-1.86%

- Reward

- 10

- 6

- Repost

- Share

LittleGodOfWealthPlutus :

:

Good luck in the Year of the Horse! Wishing you prosperity and wealth😘View More

SOL Technical Outlook: Solana Testing Macro Support After Losing 0.236 Structure

Solana remains in a sustained corrective decline after failing to hold above the $130–$160 resistance cluster, which aligned with the 0.382–0.5 Fibonacci retracement zone.

Multiple lower highs inside a descending channel, followed by a breakdown below 0.236 ($111), confirmed continuation of the bearish structure.

Price is now consolidating near $80–$85, just above the macro base region around $67, forming a short-term stabilization zone after an extended selloff from the $200+ highs.

This area represents a key dec

Solana remains in a sustained corrective decline after failing to hold above the $130–$160 resistance cluster, which aligned with the 0.382–0.5 Fibonacci retracement zone.

Multiple lower highs inside a descending channel, followed by a breakdown below 0.236 ($111), confirmed continuation of the bearish structure.

Price is now consolidating near $80–$85, just above the macro base region around $67, forming a short-term stabilization zone after an extended selloff from the $200+ highs.

This area represents a key dec

SOL-2.66%

- Reward

- 4

- 3

- Repost

- Share

1314u :

:

Happy New Year 🧨View More

BTC Technical Outlook: Bitcoin Consolidates Near Macro Base After Breakdown Below 0.236

Bitcoin remains in a corrective phase after failing to sustain acceptance above the $85,000–$93,000 resistance region, which aligns with the 0.5–0.618 Fibonacci retracement zone.

Repeated rejection from this supply cluster, combined with the breakdown below the ascending support structure, confirmed a transition from bullish continuation into a broader corrective trend.

Price is currently consolidating near the $66,000–$70,000 region, forming a short-term base after an extended decline from the $100K+ highs

Bitcoin remains in a corrective phase after failing to sustain acceptance above the $85,000–$93,000 resistance region, which aligns with the 0.5–0.618 Fibonacci retracement zone.

Repeated rejection from this supply cluster, combined with the breakdown below the ascending support structure, confirmed a transition from bullish continuation into a broader corrective trend.

Price is currently consolidating near the $66,000–$70,000 region, forming a short-term base after an extended decline from the $100K+ highs

BTC-1.34%

- Reward

- 7

- 2

- 1

- Share

Ryakpanda :

:

Wishing you great wealth in the Year of the Horse 🐴View More

XRP Technical Outlook: Breakdown Below 0.236, Testing Cycle Base Support

XRP has completed a clear distribution → breakdown → markdown phase after rejecting from the 0.786 (3.117) macro supply zone.

Following rejection from 0.618 (2.690) and failure to sustain above 0.5 (2.390), price formed consistent lower highs inside a descending channel before decisively breaking below 0.236 (1.719).

XRP is now consolidating around 1.45–1.50, just above the macro base at 1.119.

EMA Structure (Bearish Alignment)

20 EMA: 1.533

50 EMA: 1.724

100 EMA: 1.929

200 EMA: 2.137

Price is trading below all major EMAs

XRP has completed a clear distribution → breakdown → markdown phase after rejecting from the 0.786 (3.117) macro supply zone.

Following rejection from 0.618 (2.690) and failure to sustain above 0.5 (2.390), price formed consistent lower highs inside a descending channel before decisively breaking below 0.236 (1.719).

XRP is now consolidating around 1.45–1.50, just above the macro base at 1.119.

EMA Structure (Bearish Alignment)

20 EMA: 1.533

50 EMA: 1.724

100 EMA: 1.929

200 EMA: 2.137

Price is trading below all major EMAs

XRP-1.26%

- Reward

- 7

- 5

- Repost

- Share

NewName :

:

Thank you for information! View More

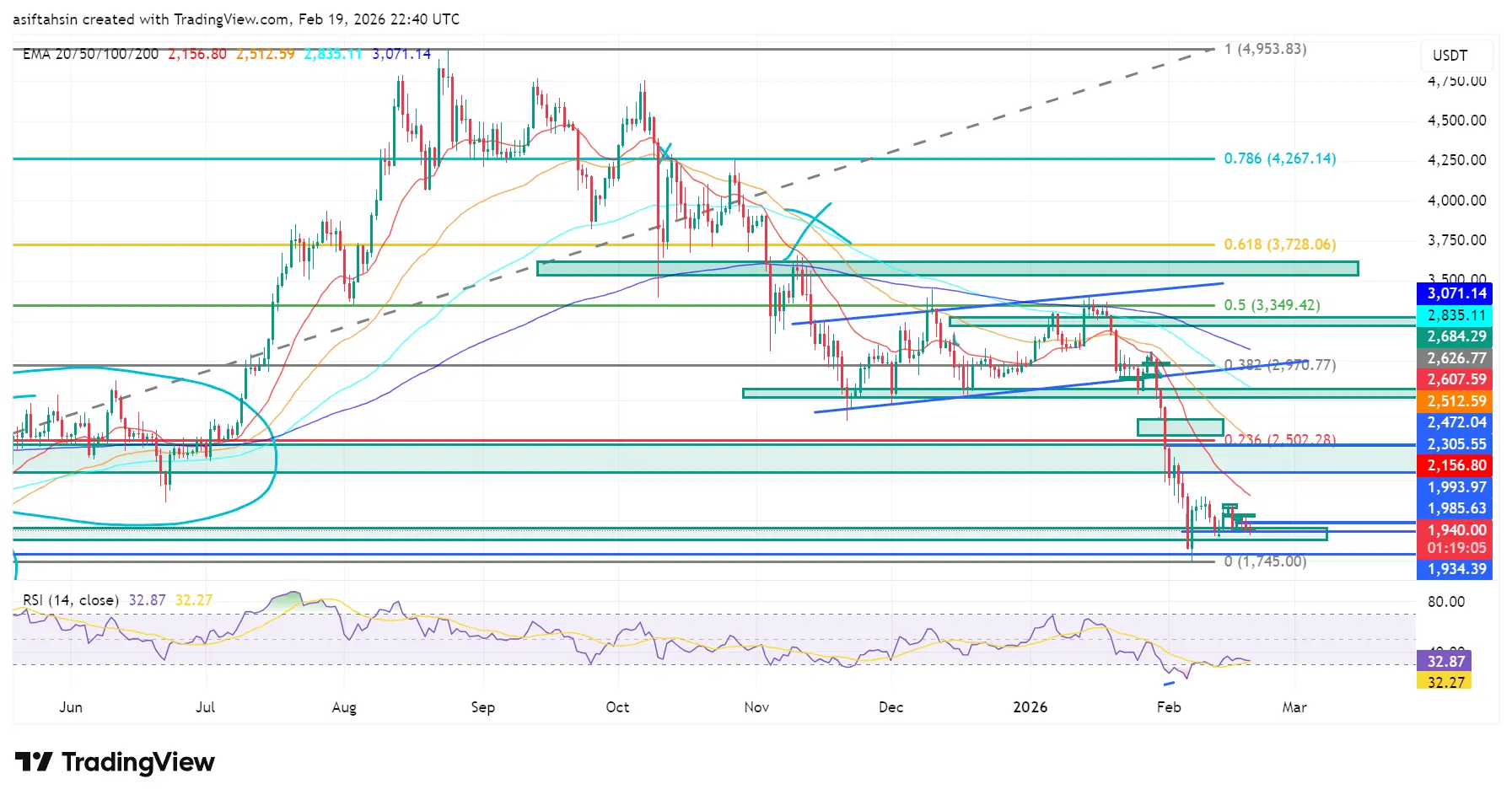

ETH Technical Outlook: Breakdown Below 0.236, Testing Cycle Lows

ETH has completed a clear distribution → breakdown → markdown sequence after rejecting from the 0.786 Fibonacci region near 4,267.

Following rejection from 0.618 (3,728) and failure to hold 0.5 (3,349), price formed consistent lower highs before losing 0.382 (2,970) and decisively breaking below 0.236 (2,502).

ETH is now consolidating near 1,950–2,050, just above the macro base at 1,745.

EMA Structure (Strong Bearish Alignment)

20 EMA: 2,203

50 EMA: 2,559

100 EMA: 2,871

200 EMA: 3,093

Price is trading below all major EMAs, confir

ETH has completed a clear distribution → breakdown → markdown sequence after rejecting from the 0.786 Fibonacci region near 4,267.

Following rejection from 0.618 (3,728) and failure to hold 0.5 (3,349), price formed consistent lower highs before losing 0.382 (2,970) and decisively breaking below 0.236 (2,502).

ETH is now consolidating near 1,950–2,050, just above the macro base at 1,745.

EMA Structure (Strong Bearish Alignment)

20 EMA: 2,203

50 EMA: 2,559

100 EMA: 2,871

200 EMA: 3,093

Price is trading below all major EMAs, confir

ETH-1.86%

- Reward

- 4

- 8

- Repost

- Share

NewName :

:

Thank you for information! View More