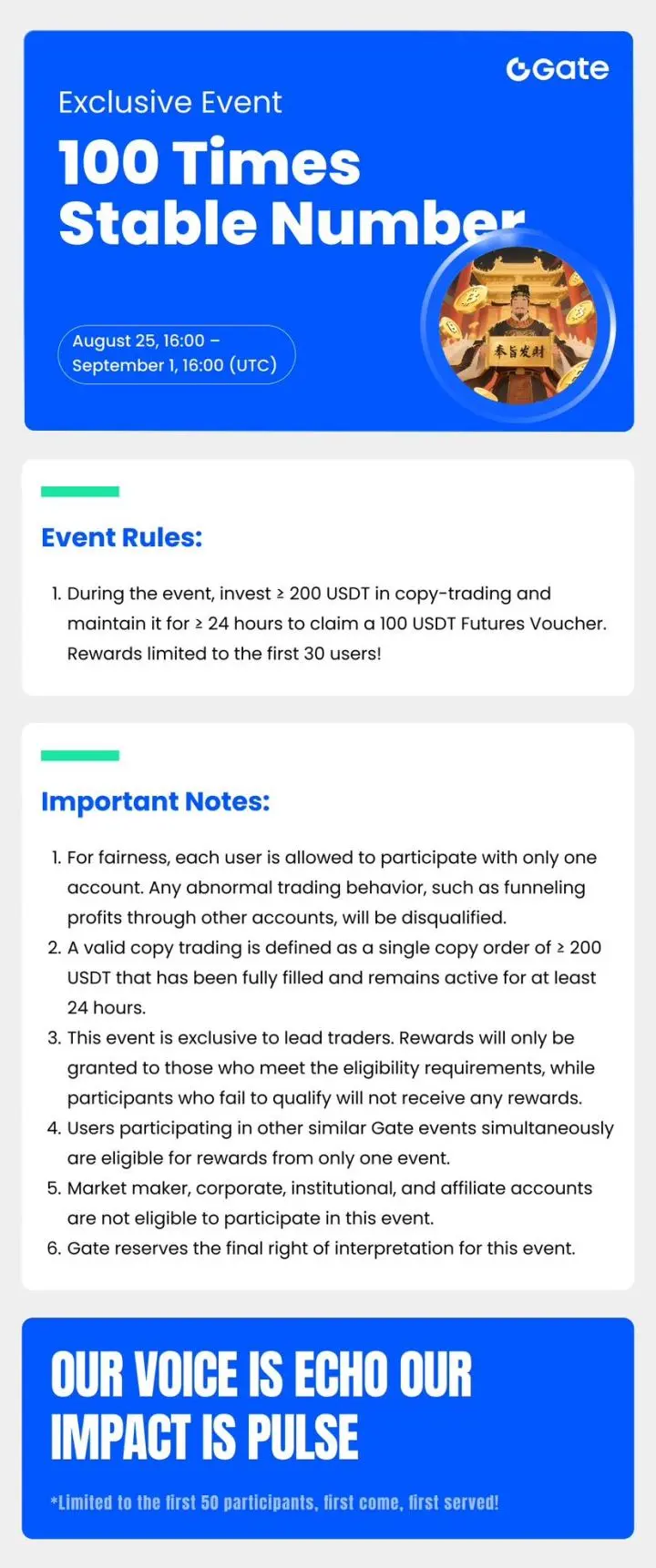

Those who want to copy trading can come and take a look at my place, carefully selected lead traders, lead in copy trading has exceeded 120 days, the profit curve is steadily rising, low leverage, only operating BTC, Ether, and mainstream altcoins, relatively stable returns.

View Original[The user has shared his/her trading data. Go to the App to view more.]