Cryptocurrency trading involves high volatility and high risk. When developing strategies, it is essential to consider market characteristics, risk tolerance, and investment goals. Below are some market-validated relatively robust strategy frameworks and precautions for your reference:

---

1. Core Principles

1. Risk First

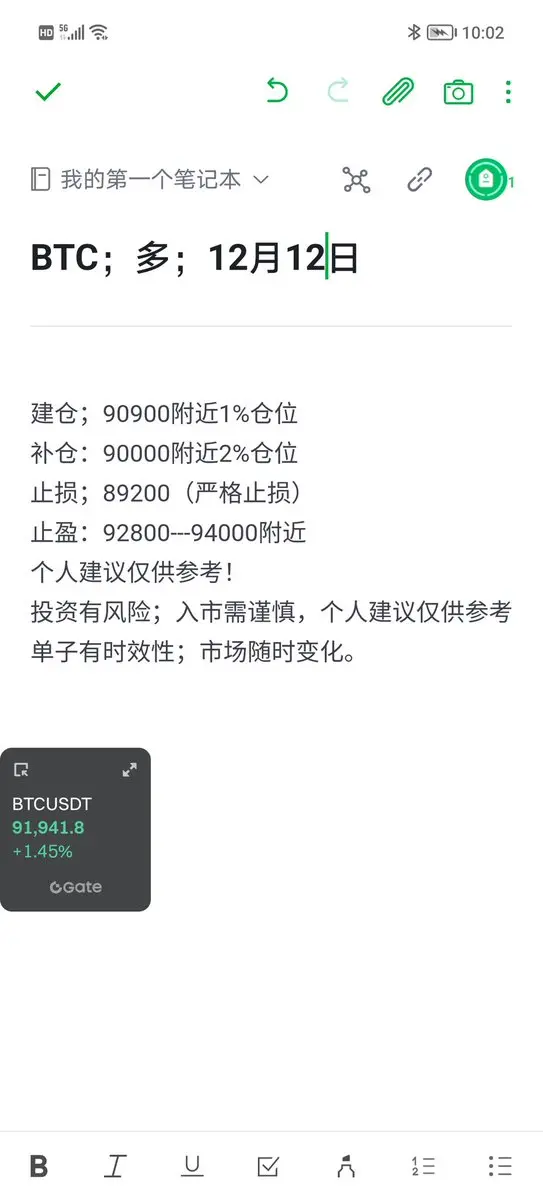

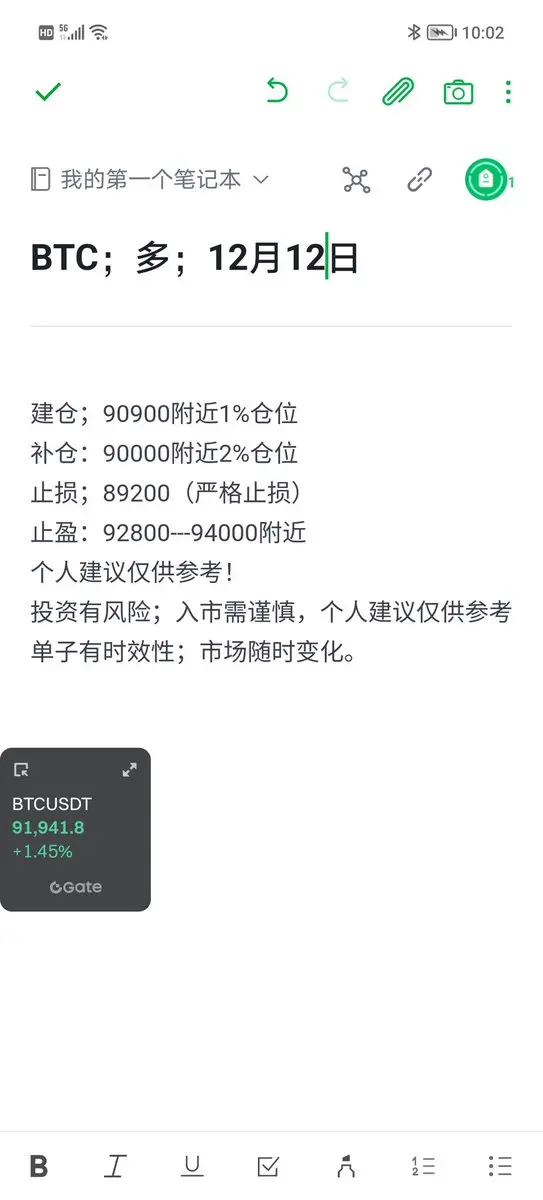

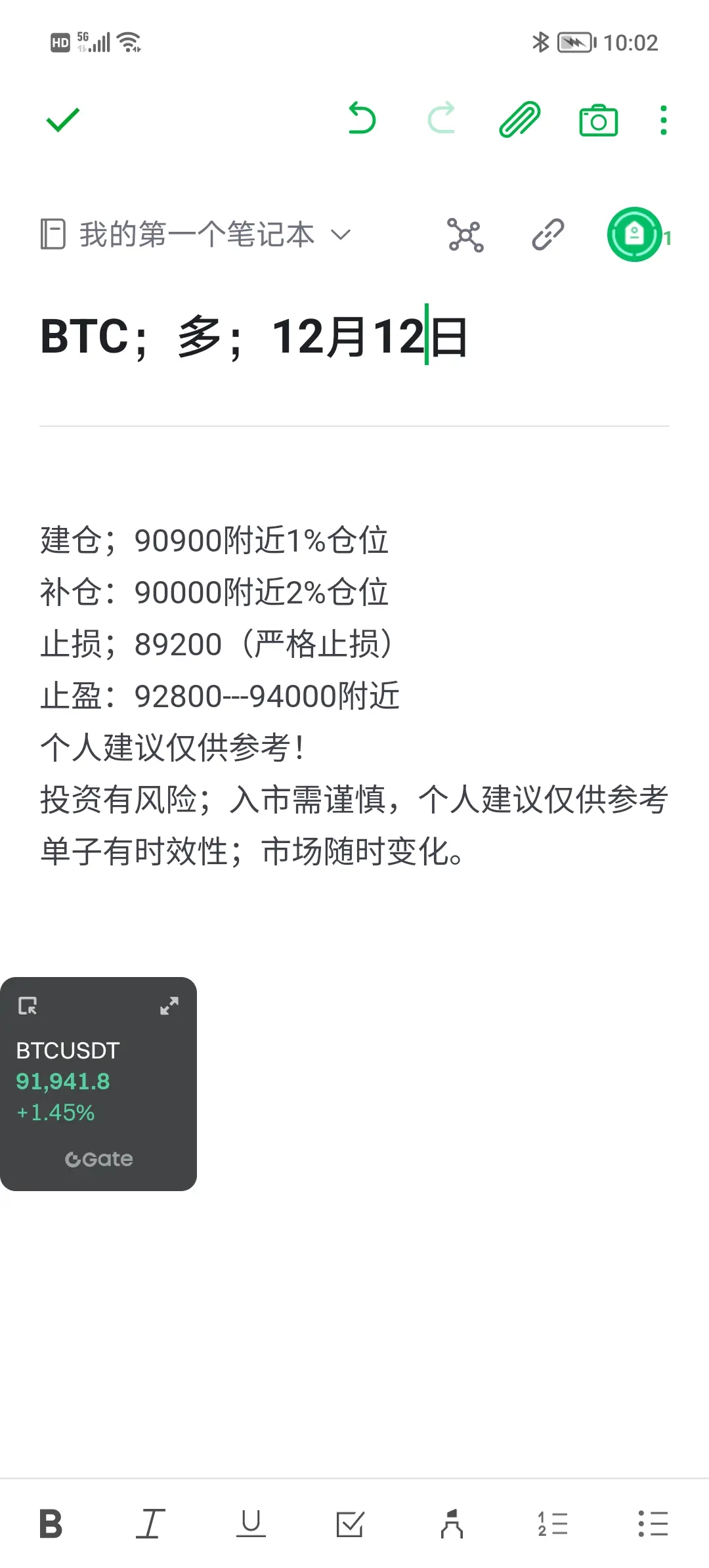

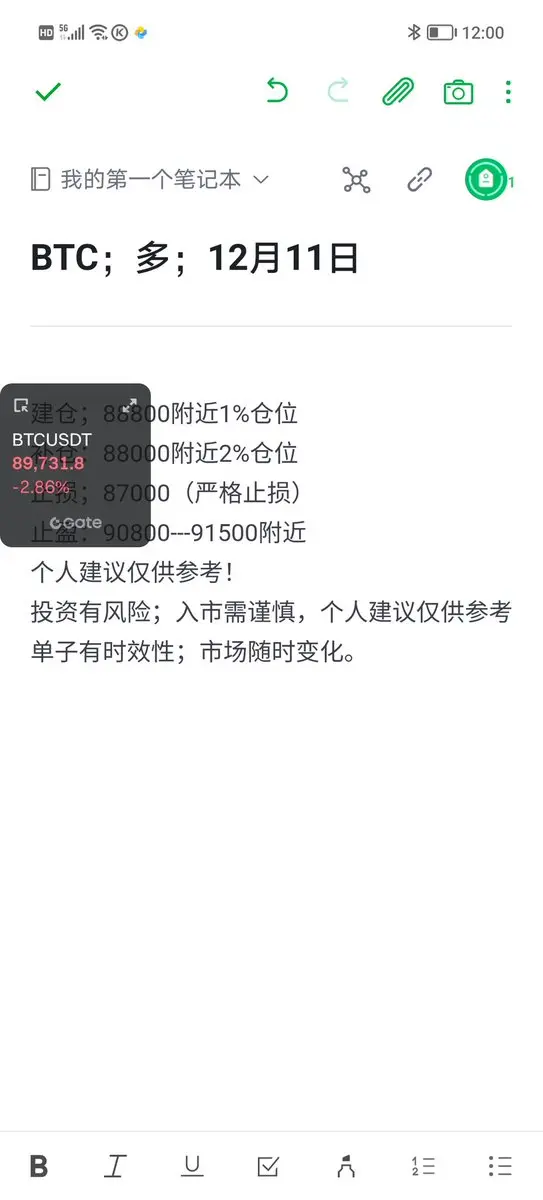

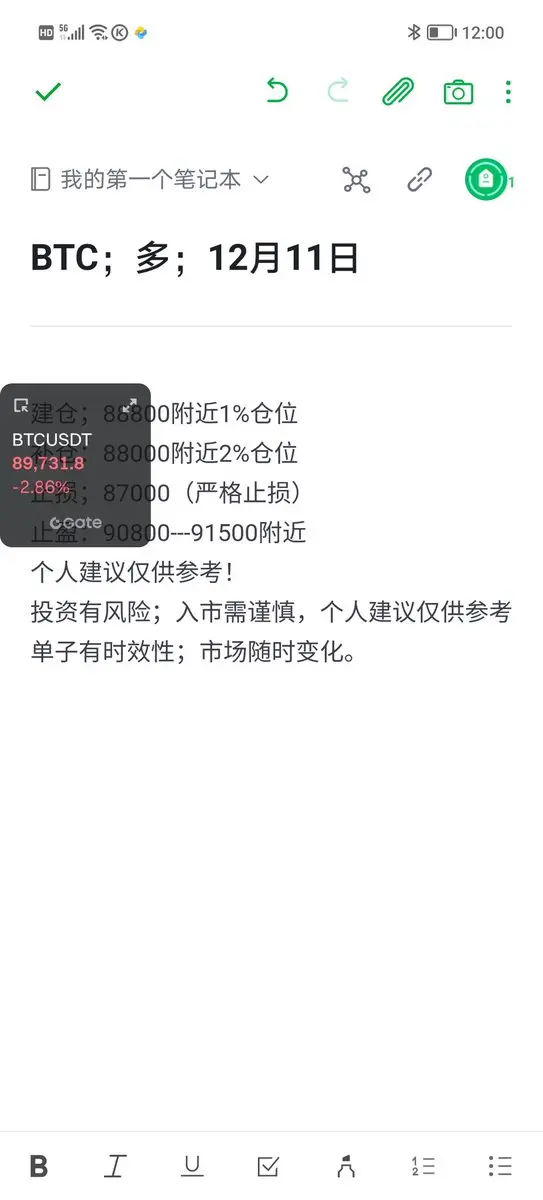

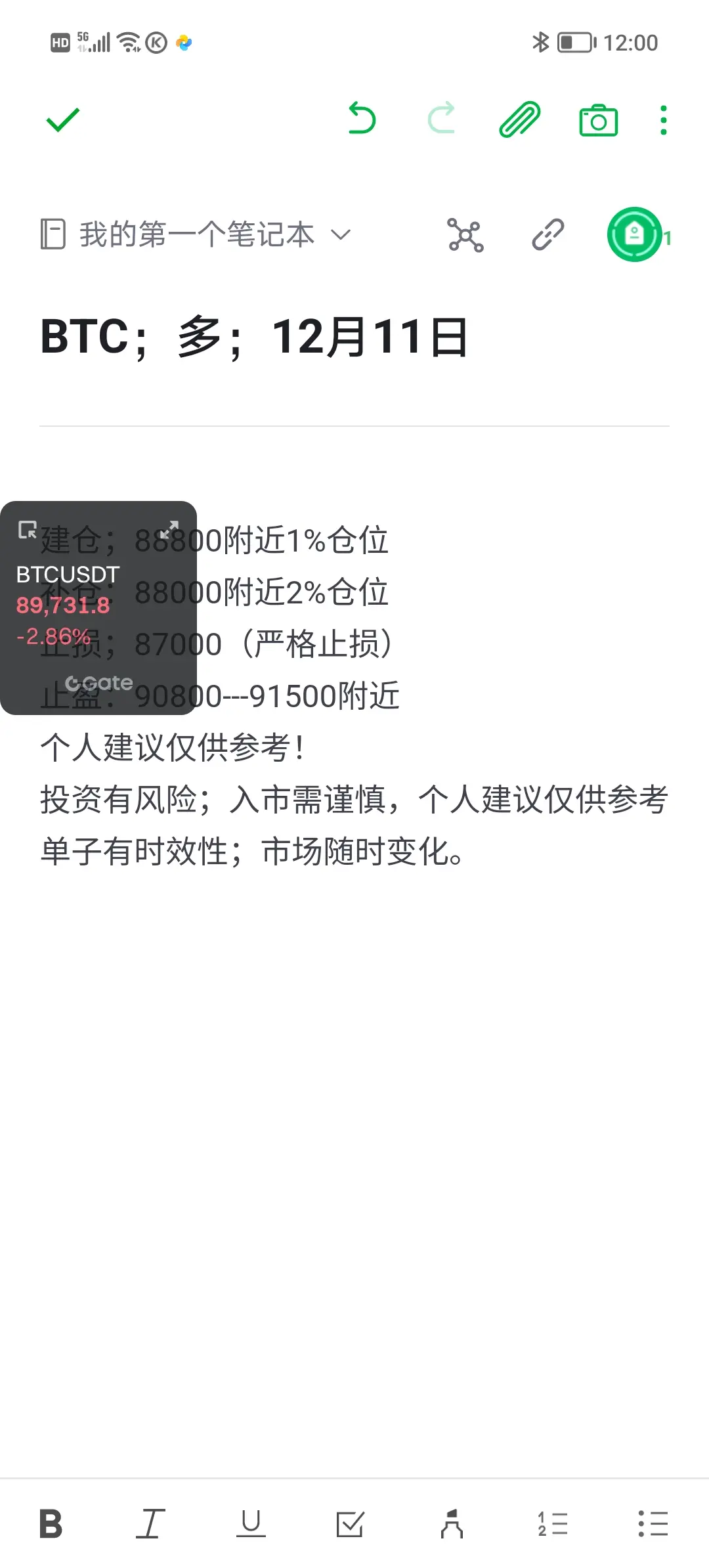

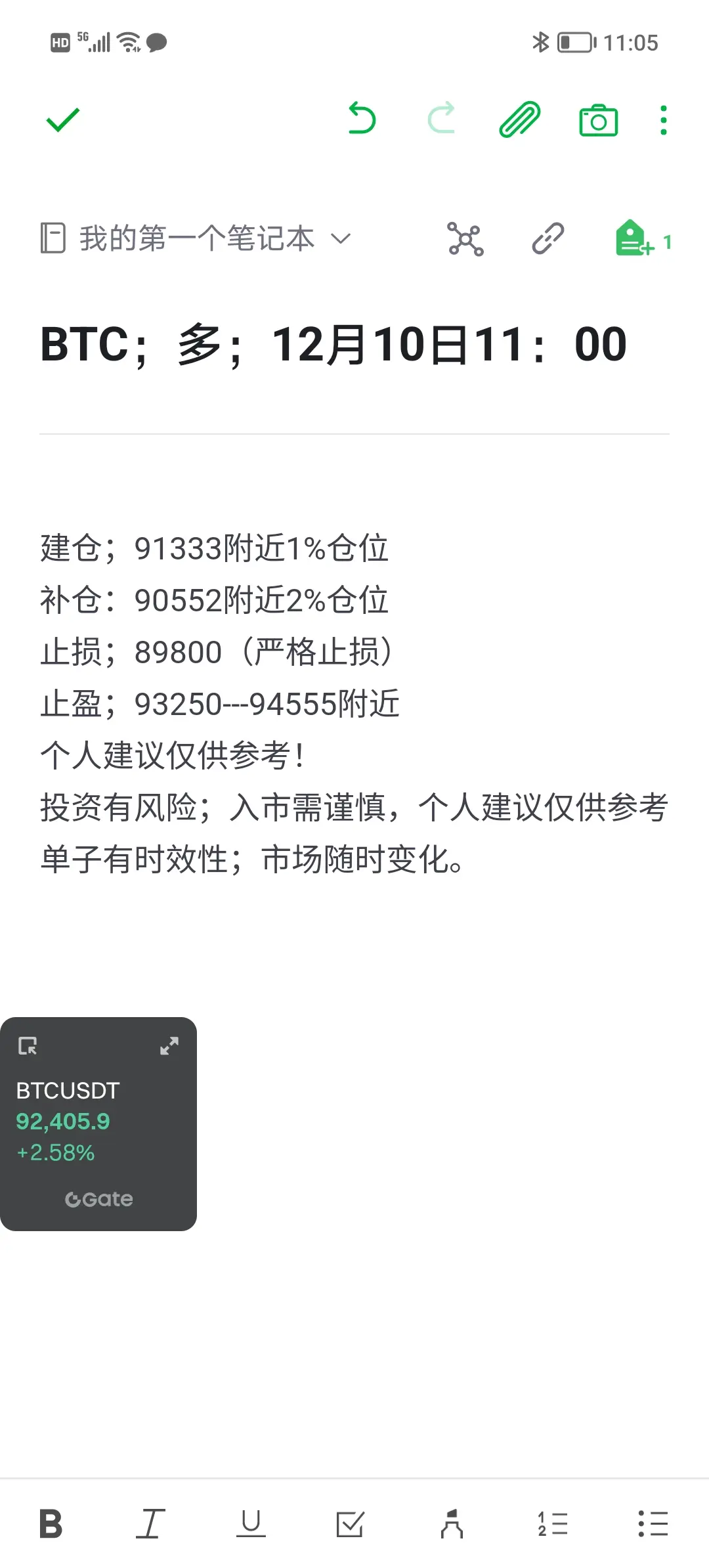

· Control risk per trade within 1%-2% of total funds to avoid emotional all-in bets.

· Store long-term assets in cold wallets; only keep necessary funds on exchanges.

2. Follow Market Trends

· Bull markets favor trend-following; bear markets focus on swing trading or

View Original---

1. Core Principles

1. Risk First

· Control risk per trade within 1%-2% of total funds to avoid emotional all-in bets.

· Store long-term assets in cold wallets; only keep necessary funds on exchanges.

2. Follow Market Trends

· Bull markets favor trend-following; bear markets focus on swing trading or