Will Uniswap v4 and the “UNIfication” Upgrade Ignite a New Price Cycle for UNI?

Uniswap v4: A Comprehensive Ecosystem Upgrade

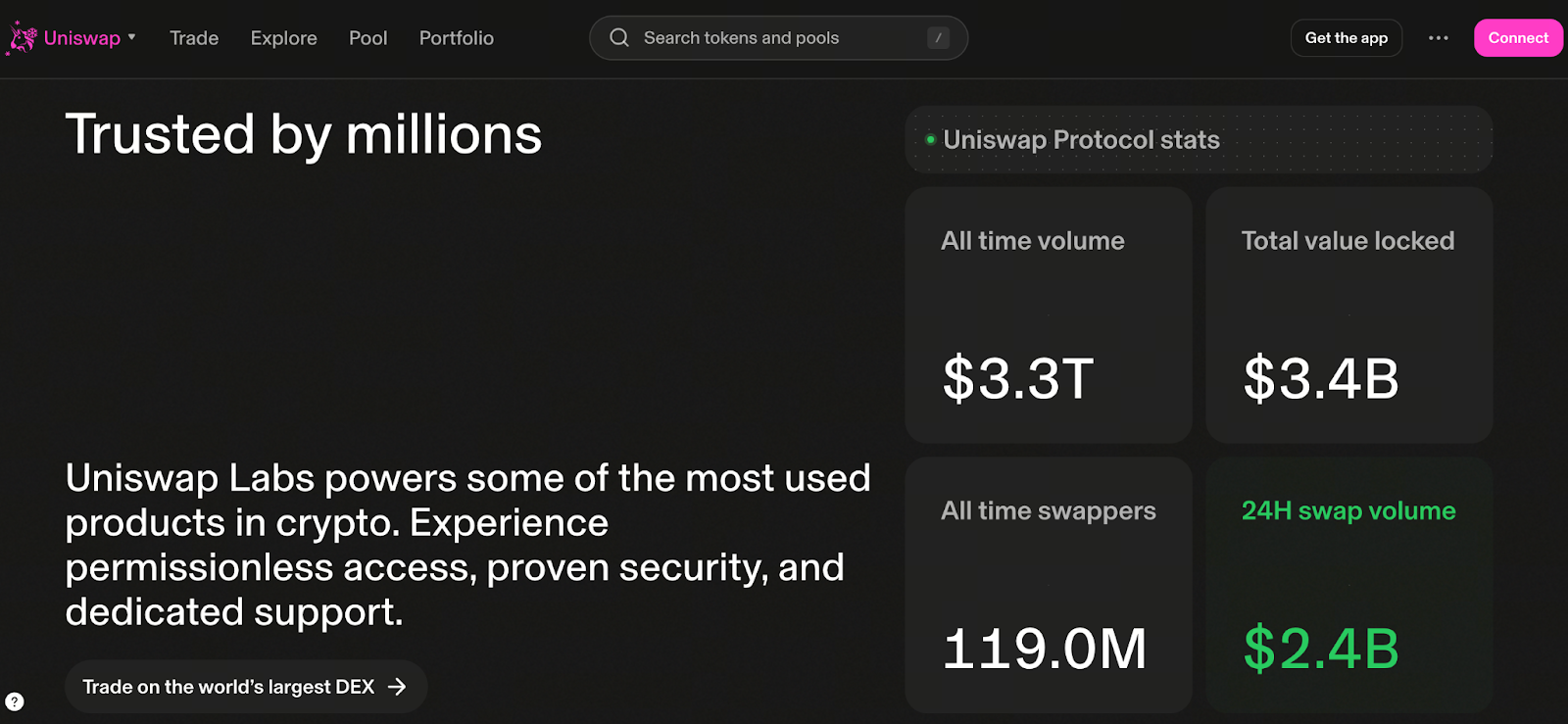

Image: https://app.uniswap.org/

The release of Uniswap v4 signals the protocol’s evolution from a basic DEX trading platform to a modular liquidity platform. The centerpiece of v4 is its new hooks mechanism, which empowers developers to integrate custom logic and build more flexible, highly tailored AMM functionalities.

This innovation paves the way for advanced features on Uniswap, such as dynamic fee pools, custom market-making strategies, automated liquidation modules, and even cross-chain liquidity management. As the platform becomes more open:

- The number of ecosystem developers is likely to increase

- Market-making efficiency for new assets will improve

- Trading volumes could rise

- Fee revenue may become more stable

v4 is not just a technical upgrade—it’s a strategic move to strengthen Uniswap’s network effects and lay the groundwork for UNI’s long-term value.

The Importance of the UNIfication Governance Proposal

UNIfication stands out as a pivotal proposal aimed at overhauling UNI’s tokenomics. Its key objectives include:

- Activating the Fee Switch: allowing protocol revenue to flow to token holders or fund token burns.

- Token buybacks and burns: reducing circulating supply to bolster value from the supply side.

- Adjusting incentive mechanisms: potentially providing long-term lock-up incentives for liquidity providers to enhance TVL stability.

- Enhancing user and developer rewards: boosting ecosystem participation and protocol usage.

If implemented, UNI would transition from a pure governance token to one that captures real protocol value, fundamentally shifting its valuation model.

UNI’s Recent Price Action and Whale Behavior

UNI has recently traded around $5, with several periods of simultaneous surges in both price and volume. Three main trends stand out:

- Whale accumulation at lower levels: On-chain data reveals some addresses have increased holdings during price pullbacks.

- Rising net outflows from exchanges: As governance upgrades gain attention, some addresses are withdrawing UNI from exchanges, reducing overall selling pressure.

- Improved short-term trading sentiment: The market has turned bullish, driven by macro tailwinds and a recovering crypto ecosystem.

These factors provide short-term support, but whale activity could also trigger sharp price swings.

Short- and Mid-Term Outlook: Opportunities and Risks

Potential Growth Drivers:

- Ecosystem expansion following the official rollout of v4

- UNIfication proposal approval, directly reshaping UNI’s supply-demand dynamics

- Major institutions entering DeFi blue-chip assets

- Rising risk appetite in the market (especially as BTC and ETH trend upward)

Key Risks to Monitor:

- Regulatory uncertainty: DEX regulatory changes could shift market expectations at any time.

- Delays or failures in governance proposals: Unmet expectations could trigger sell-offs.

- Macroeconomic tightening: Shifts in US Treasury yields or broader liquidity could impact crypto markets.

- Sudden large-scale whale sell-offs: These can spark short-term panic.

Overall, the medium-term outlook remains cautiously optimistic, but expect continued high short-term volatility.

Actionable Investment Advice

- Short-term traders: Monitor the $4.8–$5.0 support range, key governance proposal milestones, and large on-chain transfers.

- Medium- to long-term investors: Consider a phased entry strategy and closely track developments in token burn and revenue return mechanisms.

- Always manage risk: Set stop-losses, avoid chasing price spikes, and steer clear of heavy positions during whale sell-offs.

Conclusion

Uniswap is at a pivotal crossroads of technology upgrades and tokenomics reform. v4 brings new ecosystem expansion opportunities, while successful implementation of UNIfication could fundamentally enhance UNI’s value capture. In the near term, UNI’s price will likely remain volatile with market sentiment, but over the medium and long term, protocol upgrades provide a solid foundation for future growth.

Related Articles

2025 BTC Price Prediction: BTC Trend Forecast Based on Technical and Macroeconomic Data

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

Pi Coin Transaction Guide: How to Transfer to Gate.com

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

What is N2: An AI-Driven Layer 2 Solution