What is Mitosis (MITO)?

What Is Mitosis?

(Source: MitosisOrg)

Mitosis reimagines liquidity positions as programmable modules, empowering participants to manage assets with greater flexibility. This innovative approach dismantles the tradition of concentrated financial power and addresses two entrenched challenges:

- Liquidity lock-up: Once assets are placed in liquidity pools, they often become static, limiting flexible utilization.

- Inequitable access: Many high-yield protocols or private deals are reserved for large capital players, making it difficult for retail participants to benefit equally.

Mitosis Core Mechanisms

Mitosis operates using a distinctive cross-chain architecture:

- When users deposit assets in Mitosis Vaults (across multiple blockchains), they receive Hub Assets on the Mitosis Chain.

- These Hub Assets aren’t just representative tokens; they can be deployed within two structures: Ecosystem-Owned Liquidity (EOL) and Matrix.

1. Ecosystem-Owned Liquidity (EOL)

The EOL framework enables community-driven governance over asset allocation. Token holders vote on fund distribution, establishing a decentralized asset management model. Participants receive miAssets as proof, which are programmable and usable in other financial applications.

2. Matrix

Matrix is Mitosis’s flagship product, offering users carefully curated opportunities for high-yield liquidity.

- Users deposit assets into Matrix Vaults and receive maAssets as proof.

- maAssets represent more than yield—they function as transferable liquidity positions on the Mitosis mainnet, supporting collateralization, trading, and access to other applications.

Both frameworks share a key advantage: liquidity positions are no longer locked, but can be modularly deployed across a range of financial strategies.

Programmable Liquidity

Traditional DeFi typically locks liquidity inside single protocols. Mitosis innovates by converting positions into programmable tokens. These tokens can be:

- Traded or transferred

- Used as collateral

- Split into principal and yield components

- Recombined into new financial instruments

This means Mitosis is more than a liquidity aggregator—it’s a decentralized financial engineering platform. Developers and users can leverage these programmable building blocks to create novel financial products.

The Power of Collective Bargaining

A central feature of Mitosis is its ability to aggregate smaller deposits into greater negotiating leverage. By pooling funds, Mitosis negotiates with DeFi protocols for higher yields and better terms, giving retail users access to profits once available only to major players. With standardized frameworks and transparent pricing, users can track the value of their assets and market conditions, ensuring genuinely fair participation.

Settlement and Cross-Chain Infrastructure

Mitosis is built on Mitosis Chain, designed specifically for DeFi. Its cross-chain settlement system tracks and synchronizes:

- Yield distribution

- Loss settlement

- Additional rewards

This infrastructure guarantees accuracy for cross-chain operations and supports complex financial applications. Mitosis is leading a new paradigm: liquidity positions become core components of financial innovation, not just stores of value.

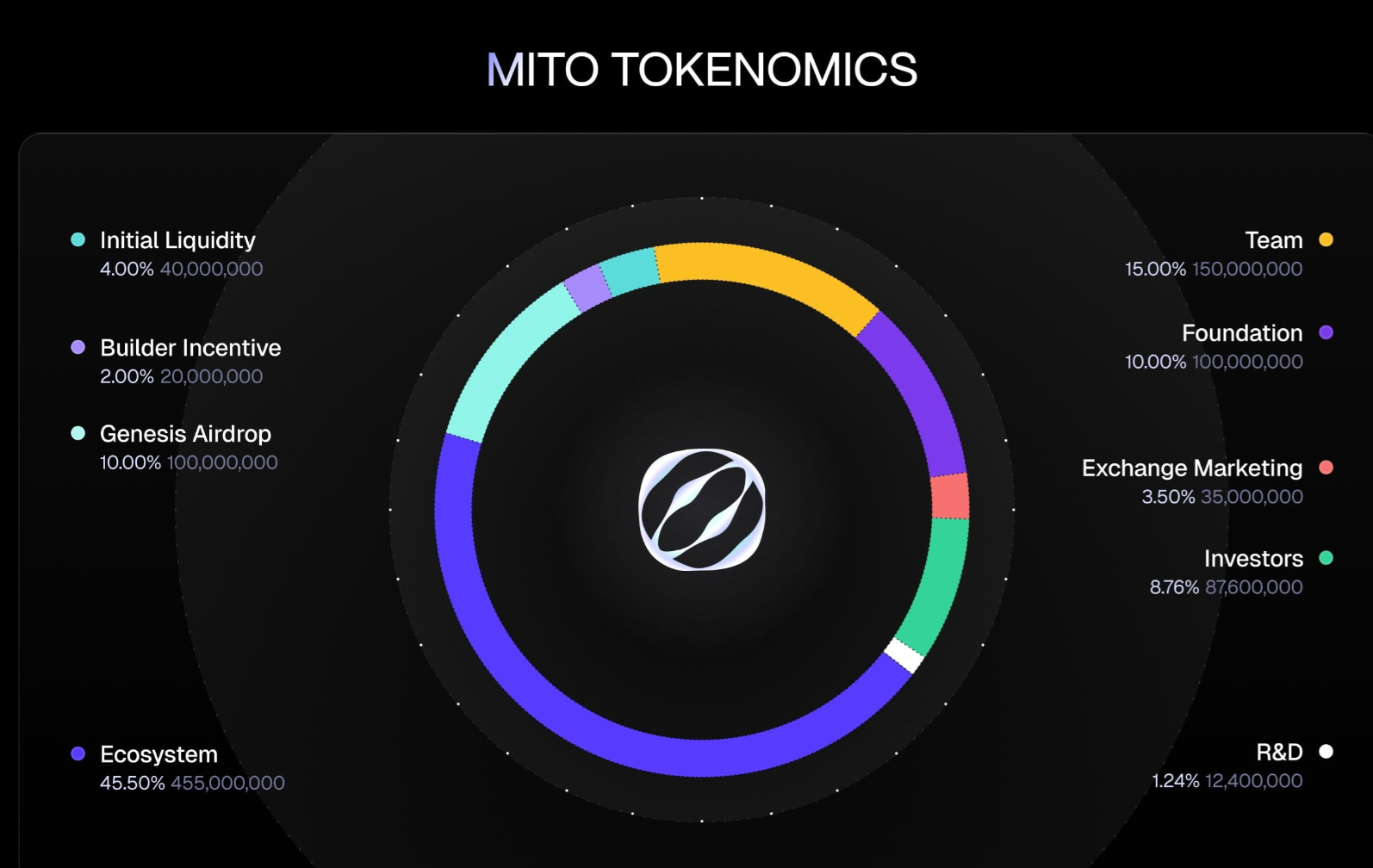

Mitosis Tokenomics

MITO has a total supply of 1,000,000,000 MITO, serving governance, liquidity incentives, staking, collateralization, and ecosystem participation. The Mitosis Foundation has announced the following MITO allocation:

- Ecosystem development (45.5%): The largest share, used to reward liquidity providers, support protocol growth, and incentivize long-term contributors.

- Team (15%): For core members and tech teams, ensuring ongoing development and maintenance.

- Foundation (10%): For strategic reserves and long-term governance.

- Genesis airdrop (10%): Rewards early community participants and builds a decentralized base.

- Investors (8.76%): Supports initial project funding and market expansion.

- Initial liquidity (4%): Ensures basic trading depth for MITO in the market.

- Exchanges and marketing (3.5%): Promotes the ecosystem and increases market exposure.

- Builder incentives (2%): Encourages developers to build on Mitosis.

- R&D (1.24%): Dedicated to technical advancement and protocol upgrades.

(Source: Mitosis)

This allocation framework balances ecosystem incentives, team sustainability, and market growth to foster a healthy, long-term cycle.

tMITO: Incentives for Long-Term Commitment

Mitosis introduces tMITO, a time-locked version of MITO, primarily granted to genesis airdrop recipients who choose enhanced rewards. Key features of tMITO:

- Fully tradable and transferable: Even when locked, tMITO can circulate freely on-chain.

- Staking and mining: Stake with Mitosis validators or ecosystem apps to earn gMITO rewards.

- Collateral: Usable in lending markets.

- Liquidity provision: Eligible for liquidity mining in MITO/tMITO AMM pools.

- After a 180-day lockup, each tMITO converts to 2.5x the original MITO allocation, plus Bonus Pool rewards.

This system incentivizes users to commit for the long term and more deeply align their tokens with the ecosystem, strengthening Mitosis’s economic foundation.

What Sets Mitosis Apart?

- Liquidity freedom: Assets aren’t locked in a single protocol—they become programmable building blocks.

- Collective strength: Retail participants benefit from pooled deposits generating higher returns.

- Financial engineering innovation: Mitosis supports splitting, merging, collateralization, and diverse utilities.

- Long-term incentives: tMITO and Bonus Pool drive deeper, ongoing ecosystem support.

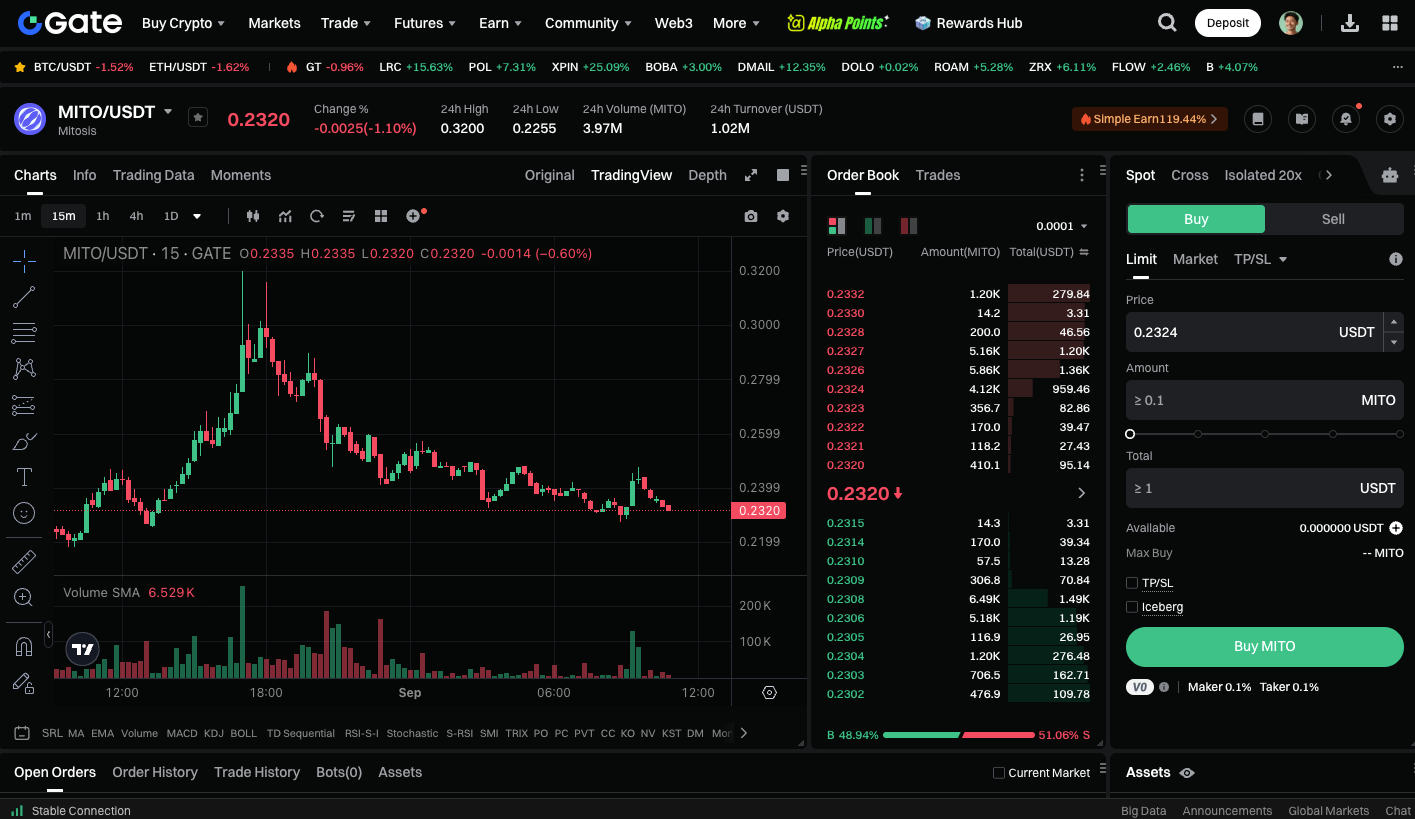

Trade MITO spot now: https://www.gate.com/trade/MITO_USDT

Conclusion

Mitosis (MITO) marks a new era in DeFi, turning static liquidity into dynamic, programmable components with financial engineering capabilities. Through EOL and Matrix, Mitosis offers equal opportunity for smaller users and a powerful foundation for developers. With its mainnet launch, tMITO incentive program, and expanding Matrix activities, Mitosis is poised to become one of the most creative and inclusive cornerstone protocols in the evolving DeFi ecosystem.

Related Articles

2025 BTC Price Prediction: BTC Trend Forecast Based on Technical and Macroeconomic Data

Pi Coin Transaction Guide: How to Transfer to Gate.com

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

What is N2: An AI-Driven Layer 2 Solution