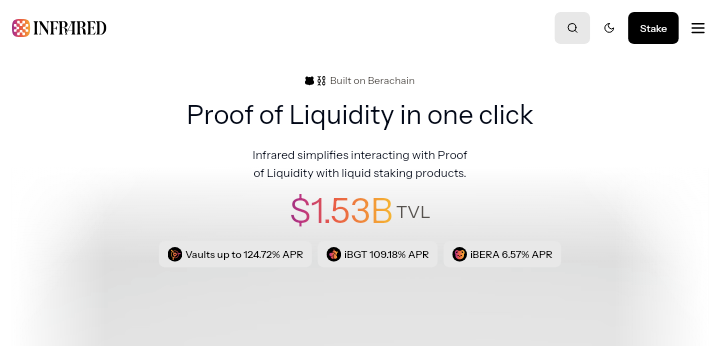

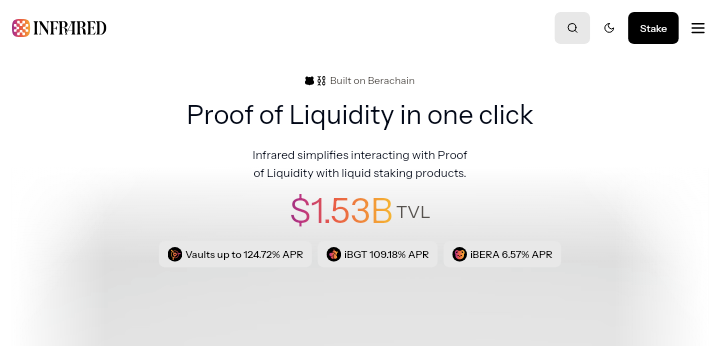

Infrared Finance: The Gateway to Proof-of-Liquidity on Berachain

Earning in crypto isn’t always easy. Staking, liquidity provision, and governance require time, effort, and technical know-how. Berachain’s Proof-of-Liquidity (PoL) model rewards users who provide liquidity, but it comes with challenges. BGT, the governance token, is soulbound, meaning it can’t be transferred or used freely. To earn rewards, users must manually delegate BGT to validators, a process that can be confusing and time-consuming. Infrared Finance makes PoL simple. It offers iBGT and iBERA, liquid versions of Berachain’s tokens, so users can stake, earn, and stay flexible. It also automates validator delegation and liquidity staking, ensuring users get the most out of PoL with minimal effort.

Understanding Berachain and Proof-of-Liquidity

Berachain is a blockchain built to reward liquidity. Most blockchains use Proof-of-Stake (PoS), where validators secure the network by staking tokens. Berachain replaces this with Proof-of-Liquidity (PoL), where users provide liquidity to earn governance power and network rewards. Instead of locking up tokens in a validator, users stake liquidity in approved pools. This system ensures that the most active participants in the network—liquidity providers—also have the most influence.

The key to Proof-of-Liquidity (PoL) is BGT (Berachain Governance Token) and BERA (Berachain’s gas token). BGT is earned by providing liquidity, but it is soulbound, meaning it cannot be transferred. Users must delegate BGT to validators to use effectively, directing emissions and earning rewards. While this design keeps governance power tied to active participants, it also creates friction. Many users struggle to manage their BGT efficiently, and since it isn’t liquid, they can’t use it elsewhere in DeFi.

This is where Infrared Finance steps in. Offering iBGT, a liquid version of BGT, allows users to earn rewards while keeping their assets flexible. The same applies to iBERA, which makes staking BERA more accessible. Infrared also automates validator delegation, removing the technical barriers that come with PoL. Instead of manually staking and managing rewards, users can deposit into Infrared’s vaults and let the system handle the rest. This makes PoL easier to use, allowing more people to participate in Berachain’s economy without needing deep technical knowledge.

What is Infrared Finance?

Infrared Finance is a liquid staking and liquidity management protocol built for Berachain’s Proof-of-Liquidity (PoL) system. It helps users stake Berachain’s tokens—BGT and BERA—without dealing with the usual complexities. Instead of manually managing validator delegation and liquidity staking, users can deposit their assets into Infrared’s PoL vaults and receive liquid staking tokens—iBGT for BGT and iBERA for BERA. These tokens let users stay liquid while earning rewards, making PoL easier and more accessible. With no deposit or withdrawal fees, Infrared ensures users maximize their returns with minimal effort.

The Mission and Vision of Infrared Finance

Infrared’s mission is to make Proof-of-Liquidity easy and rewarding for all users. By providing liquid staking solutions and automated validator delegation, Infrared lowers the barrier to entry for both beginners and experienced users. Its vision is to become the core infrastructure for PoL on Berachain, ensuring the network remains secure, efficient, and widely adopted. Through continuous development and deep integration with Berachain, Infrared aims to simplify staking, enhance rewards, and drive the long-term growth of the ecosystem.

The Technology Behind Infrared Finance

PoL Vaults and Automated Staking

Infrared’s PoL vaults are smart contracts that manage liquidity staking on behalf of users. Instead of manually staking liquidity to earn Berachain Governance Tokens (BGT), users deposit their LP tokens into an Infrared vault. The vault automatically stakes the assets, delegates BGT to validators, and optimizes rewards. This eliminates manual interaction with Berachain’s staking system, making PoL participation easier.

Liquid Staking: iBGT and iBERA

Infrared converts illiquid staking assets into liquid staking tokens (LSTs).

- iBGT: Represents staked BGT. Instead of holding non-transferable BGT, users receive iBGT, which they can stake to earn additional rewards or use across DeFi.

- iBERA: Represents staked BERA. BERA is required for validator staking, but many users lack the capital or infrastructure to run a validator. iBERA allows anyone to stake small amounts of BERA while still earning staking rewards.

These LSTs make staking assets usable across the Berachain ecosystem, increasing capital efficiency.

Validator Infrastructure and Governance Integration

Infrared is deeply integrated into Berachain’s validator network, ensuring staked assets contribute to network security. When users stake through Infrared, their BGT is delegated to a distributed set of validators, optimizing governance participation. This system helps balance power across the network while maximizing rewards.

Smart Contract Security and Efficiency

Infrared’s smart contracts are built with security as a priority. The platform has undergone rigorous audits to ensure that user funds remain safe. By automating staking, delegation, and liquidity management, Infrared reduces the risk of human error while making the system more efficient.

Key Features of Infrared Finance

iBGT: Liquid Staking for BGT

Berachain’s BGT (Berachain Governance Token) is earned through Proof-of-Liquidity, but it is soulbound, meaning it cannot be transferred. This limits its use outside governance and validator delegation. Infrared solves this by introducing iBGT, a liquid version of BGT. Users who stake liquidity in Infrared’s PoL vaults earn iBGT instead of holding non-transferable BGT. iBGT can be staked to earn governance rewards or used across DeFi protocols. This allows users to maximize rewards without locking up assets in a rigid system. By liquidating governance power, Infrared expands BGT’s usability while maintaining its core role in PoL governance.

iBERA: Liquid Staking for BERA

To run a validator on Berachain, users must stake BERA, the network’s native gas token. However, validator staking requires technical knowledge and significant capital, making it inaccessible to many users. iBERA solves this by offering a liquid staking solution for BERA. When users stake BERA through Infrared, they receive iBERA, which is backed 1:1 by staked BERA. Unlike traditional staking, iBERA allows users to earn validator rewards while liquidating their tokens. iBERA can be traded, used as collateral, or deployed in DeFi applications while still accruing staking rewards. This system democratizes validator staking, letting users participate without needing to operate validator infrastructure themselves.

PoL Vaults: Automated Staking and Yield Optimization

Infrared’s PoL vaults simplify earning rewards from Berachain’s PoL system. Normally, users must manually provide liquidity, stake their LP tokens, and delegate BGT to validators. PoL vaults automate this entire process. When users deposit LP tokens into an Infrared vault, the system stakes the liquidity, delegates earned BGT to validators, and converts it into iBGT. This ensures that users receive maximum rewards without needing to manage complex staking strategies. PoL vaults are designed to be one-click solutions that optimize rewards while reducing friction.

Validator Infrastructure and Governance Delegation

Infrared integrates directly with Berachain’s validator infrastructure, ensuring that staked assets contribute to network security. Instead of leaving BGT unused, Infrared’s system delegates BGT to a distributed set of validators, ensuring governance power is actively utilized. This delegation model prevents centralization by spreading voting power across multiple validators, balancing influence within the network. Users benefit from automated delegation, meaning they don’t need to manually track governance mechanics or adjust their staking. This ensures that Berachain’s consensus remains decentralized, allowing participants to earn maximum rewards without actively managing governance decisions.

No Deposit or Withdrawal Fees, Minimal Performance Fees

Unlike many staking platforms that charge fees for deposits and withdrawals, Infrared does not impose any upfront costs. Users can enter and exit PoL vaults freely. The only fee Infrared charges is a small performance fee on rewards, which is redistributed to holders of $IRED, Infrared’s native token. This fee structure ensures that users keep most of their earnings, while the protocol remains sustainable. By eliminating unnecessary fees, Infrared makes PoL participation more efficient and cost-effective for all users.

Use Cases of Infrared Finance

Earning Yield Without Losing Liquidity

Traditional staking locks up assets, making them unusable. With iBGT and iBERA, users can stake and still access their tokens for trading, lending, or collateral in DeFi. This allows users to earn staking rewards without sacrificing liquidity, making their assets more efficient.Simplifying Validator Participation

Running a validator requires technical knowledge and a large amount of BERA. Many users lack the resources to stake directly. Infrared’s iBERA lets users stake small amounts of BERA while still earning validator rewards. This makes staking more accessible, allowing broader participation in Berachain’s security and governance.Automated Staking and Governance Management

Delegating BGT to validators is essential for earning rewards, but managing it manually is complex. Infrared’s PoL vaults automate this process, ensuring optimal validator delegation and yield generation. Users deposit liquidity and let Infrared handle the rest, maximizing returns with minimal effort.Enabling Governance Influence for Liquidity Providers

Since BGT is soulbound and non-transferable, liquidity providers often struggle to use their governance power effectively. iBGT allows them to stake their governance rewards and earn additional incentives, giving them more influence in Berachain’s decision-making while keeping their assets flexible.Lowering the Barrier to Entry for DeFi Users

Many DeFi users find Proof-of-Liquidity complex due to staking requirements, validator delegation, and liquidity management. Infrared’s one-click PoL vaults remove these obstacles, allowing users to participate in Berachain’s ecosystem without deep technical expertise.Cost-Efficient Staking with No Entry or Exit Fees

Unlike many platforms that charge deposit or withdrawal fees, Infrared allows users to enter and exit PoL staking for free. The only fee is a small performance fee, which is distributed to $IRED token holders, ensuring a fair and sustainable reward model.

How to Get Started with Infrared Finance

Infrared Finance makes staking and earning through Berachain’s Proof-of-Liquidity (PoL) system easy. Getting started is a simple three-step process, whether you’re new to liquid staking or looking to optimize your rewards.

1.Get LP Tokens

Before you can stake in Infrared’s PoL vaults, you need LP tokens. These tokens represent your share of liquidity in a PoL-eligible pool on Berachain’s native decentralized exchange, BEX.

- Choose a PoL-eligible pool, such as BERA-HONEY.

- Provide an equal amount of both assets to the pool.

- Receive LP tokens as a deposit receipt.

These LP tokens will be used in Infrared’s vaults to generate rewards. This step is essential because it ensures that liquidity providers contribute to Berachain’s PoL mechanism, earning governance power (BGT) in return.

2.Stake LP Tokens in an Infrared Vault

Once you have LP tokens, the next step is staking them in an Infrared vault. This process is fully automated, so you don’t need to delegate BGT or manage governance participation manually.

- Deposit your LP tokens into the relevant Infrared vault (e.g., the BERA-HONEY vault).

- The vault automatically stakes the assets, earning BGT rewards on your behalf.

- Staked assets begin generating yield without additional steps.

Infrared’s smart contracts handle validator delegation and reward optimization, removing the need for users to manually interact with the PoL system. This makes staking accessible to both beginners and experienced DeFi users.

3.Earn and Claim Rewards

Once your LP tokens are staked, you start earning rewards. These rewards are automatically converted into iBGT, making them more flexible.

- BGT rewards are converted to iBGT at a 1:1 ratio.

- iBGT can be staked for additional rewards or used across Berachain’s DeFi ecosystem.

- Additional incentives, such as LP yield and validator rewards, are included depending on the vault.

Users can claim rewards anytime, giving them full control over their staking earnings. Since iBGT is liquid, it can be traded, used as collateral, or added to liquidity pools, unlike BGT, which remains soulbound.

4.Explore iBGT and iBERA for More Opportunities

Infrared’s liquid staking system doesn’t stop at iBGT. Users who stake BERA through Infrared receive iBERA, a liquid version of staked BERA.

- Staking BERA through Infrared generates iBERA, backed 1:1 by staked assets.

- iBERA earns staking rewards while remaining usable in DeFi for lending, borrowing, and trading.

This provides an alternative for users who want validator rewards without locking up assets in validator staking.

5.No Fees for Deposits or Withdrawals

Unlike many staking protocols that charge entry and exit fees, Infrared imposes no deposit or withdrawal costs. Users can stake and unstake freely. The only fee is a small performance fee, which is redistributed to holders of $IRED, Infrared’s native token. This ensures that users keep the majority of their rewards while maintaining the protocol’s sustainability.

Fundraising

Infrared Finance successfully raised $2.5 million in a seed round, led by Synergis with participation from NGC Ventures, Tribe Capital, CitizenX, Shima Capital, Dao5, Signum Capital, Ouroboros Capital, Decima, Oak Grove Ventures, DoraHacks, and Tenzor Capital. The round also saw support from key individuals, including Alex Shin, Albert Chon, Charles Lu, Mr. Block, and Chris Spadafora. This funding is instrumental in expanding Infrared’s infrastructure, developing PoL vaults, validator networks, and its native Liquid Staking Token (iBGT).

The most substantial milestone came with a $14 million Series A round, announced on March 4, 2025, led by Framework Ventures. This round also saw participation from various angels and DAOs, including TempleDAO, MIM_Spell, and StakeStone, reflecting broad community and investor support. The funds are intended to enhance Infrared’s mission of providing accessible, top-tier infrastructure for Berachain’s users and builders.

Conclusion

Infrared Finance is shaping the future of Proof-of-Liquidity on Berachain by making staking simple, liquid, and accessible. With iBGT, iBERA, and automated PoL vaults, technical barriers are removed, and user rewards are optimized. Backed by top-tier investors and a strong development team, Infrared is positioned to drive adoption and innovation in Berachain’s growing ecosystem. Whether you’re a liquidity provider, validator, or DeFi user, Infrared makes earning in Berachain easier.

Infrared Finance: The Gateway to Proof-of-Liquidity on Berachain

Understanding Berachain and Proof-of-Liquidity

What is Infrared Finance?

The Technology Behind Infrared Finance

Key Features of Infrared Finance

Use Cases of Infrared Finance

How to Get Started with Infrared Finance

Fundraising

Conclusion

Earning in crypto isn’t always easy. Staking, liquidity provision, and governance require time, effort, and technical know-how. Berachain’s Proof-of-Liquidity (PoL) model rewards users who provide liquidity, but it comes with challenges. BGT, the governance token, is soulbound, meaning it can’t be transferred or used freely. To earn rewards, users must manually delegate BGT to validators, a process that can be confusing and time-consuming. Infrared Finance makes PoL simple. It offers iBGT and iBERA, liquid versions of Berachain’s tokens, so users can stake, earn, and stay flexible. It also automates validator delegation and liquidity staking, ensuring users get the most out of PoL with minimal effort.

Understanding Berachain and Proof-of-Liquidity

Berachain is a blockchain built to reward liquidity. Most blockchains use Proof-of-Stake (PoS), where validators secure the network by staking tokens. Berachain replaces this with Proof-of-Liquidity (PoL), where users provide liquidity to earn governance power and network rewards. Instead of locking up tokens in a validator, users stake liquidity in approved pools. This system ensures that the most active participants in the network—liquidity providers—also have the most influence.

The key to Proof-of-Liquidity (PoL) is BGT (Berachain Governance Token) and BERA (Berachain’s gas token). BGT is earned by providing liquidity, but it is soulbound, meaning it cannot be transferred. Users must delegate BGT to validators to use effectively, directing emissions and earning rewards. While this design keeps governance power tied to active participants, it also creates friction. Many users struggle to manage their BGT efficiently, and since it isn’t liquid, they can’t use it elsewhere in DeFi.

This is where Infrared Finance steps in. Offering iBGT, a liquid version of BGT, allows users to earn rewards while keeping their assets flexible. The same applies to iBERA, which makes staking BERA more accessible. Infrared also automates validator delegation, removing the technical barriers that come with PoL. Instead of manually staking and managing rewards, users can deposit into Infrared’s vaults and let the system handle the rest. This makes PoL easier to use, allowing more people to participate in Berachain’s economy without needing deep technical knowledge.

What is Infrared Finance?

Infrared Finance is a liquid staking and liquidity management protocol built for Berachain’s Proof-of-Liquidity (PoL) system. It helps users stake Berachain’s tokens—BGT and BERA—without dealing with the usual complexities. Instead of manually managing validator delegation and liquidity staking, users can deposit their assets into Infrared’s PoL vaults and receive liquid staking tokens—iBGT for BGT and iBERA for BERA. These tokens let users stay liquid while earning rewards, making PoL easier and more accessible. With no deposit or withdrawal fees, Infrared ensures users maximize their returns with minimal effort.

The Mission and Vision of Infrared Finance

Infrared’s mission is to make Proof-of-Liquidity easy and rewarding for all users. By providing liquid staking solutions and automated validator delegation, Infrared lowers the barrier to entry for both beginners and experienced users. Its vision is to become the core infrastructure for PoL on Berachain, ensuring the network remains secure, efficient, and widely adopted. Through continuous development and deep integration with Berachain, Infrared aims to simplify staking, enhance rewards, and drive the long-term growth of the ecosystem.

The Technology Behind Infrared Finance

PoL Vaults and Automated Staking

Infrared’s PoL vaults are smart contracts that manage liquidity staking on behalf of users. Instead of manually staking liquidity to earn Berachain Governance Tokens (BGT), users deposit their LP tokens into an Infrared vault. The vault automatically stakes the assets, delegates BGT to validators, and optimizes rewards. This eliminates manual interaction with Berachain’s staking system, making PoL participation easier.

Liquid Staking: iBGT and iBERA

Infrared converts illiquid staking assets into liquid staking tokens (LSTs).

- iBGT: Represents staked BGT. Instead of holding non-transferable BGT, users receive iBGT, which they can stake to earn additional rewards or use across DeFi.

- iBERA: Represents staked BERA. BERA is required for validator staking, but many users lack the capital or infrastructure to run a validator. iBERA allows anyone to stake small amounts of BERA while still earning staking rewards.

These LSTs make staking assets usable across the Berachain ecosystem, increasing capital efficiency.

Validator Infrastructure and Governance Integration

Infrared is deeply integrated into Berachain’s validator network, ensuring staked assets contribute to network security. When users stake through Infrared, their BGT is delegated to a distributed set of validators, optimizing governance participation. This system helps balance power across the network while maximizing rewards.

Smart Contract Security and Efficiency

Infrared’s smart contracts are built with security as a priority. The platform has undergone rigorous audits to ensure that user funds remain safe. By automating staking, delegation, and liquidity management, Infrared reduces the risk of human error while making the system more efficient.

Key Features of Infrared Finance

iBGT: Liquid Staking for BGT

Berachain’s BGT (Berachain Governance Token) is earned through Proof-of-Liquidity, but it is soulbound, meaning it cannot be transferred. This limits its use outside governance and validator delegation. Infrared solves this by introducing iBGT, a liquid version of BGT. Users who stake liquidity in Infrared’s PoL vaults earn iBGT instead of holding non-transferable BGT. iBGT can be staked to earn governance rewards or used across DeFi protocols. This allows users to maximize rewards without locking up assets in a rigid system. By liquidating governance power, Infrared expands BGT’s usability while maintaining its core role in PoL governance.

iBERA: Liquid Staking for BERA

To run a validator on Berachain, users must stake BERA, the network’s native gas token. However, validator staking requires technical knowledge and significant capital, making it inaccessible to many users. iBERA solves this by offering a liquid staking solution for BERA. When users stake BERA through Infrared, they receive iBERA, which is backed 1:1 by staked BERA. Unlike traditional staking, iBERA allows users to earn validator rewards while liquidating their tokens. iBERA can be traded, used as collateral, or deployed in DeFi applications while still accruing staking rewards. This system democratizes validator staking, letting users participate without needing to operate validator infrastructure themselves.

PoL Vaults: Automated Staking and Yield Optimization

Infrared’s PoL vaults simplify earning rewards from Berachain’s PoL system. Normally, users must manually provide liquidity, stake their LP tokens, and delegate BGT to validators. PoL vaults automate this entire process. When users deposit LP tokens into an Infrared vault, the system stakes the liquidity, delegates earned BGT to validators, and converts it into iBGT. This ensures that users receive maximum rewards without needing to manage complex staking strategies. PoL vaults are designed to be one-click solutions that optimize rewards while reducing friction.

Validator Infrastructure and Governance Delegation

Infrared integrates directly with Berachain’s validator infrastructure, ensuring that staked assets contribute to network security. Instead of leaving BGT unused, Infrared’s system delegates BGT to a distributed set of validators, ensuring governance power is actively utilized. This delegation model prevents centralization by spreading voting power across multiple validators, balancing influence within the network. Users benefit from automated delegation, meaning they don’t need to manually track governance mechanics or adjust their staking. This ensures that Berachain’s consensus remains decentralized, allowing participants to earn maximum rewards without actively managing governance decisions.

No Deposit or Withdrawal Fees, Minimal Performance Fees

Unlike many staking platforms that charge fees for deposits and withdrawals, Infrared does not impose any upfront costs. Users can enter and exit PoL vaults freely. The only fee Infrared charges is a small performance fee on rewards, which is redistributed to holders of $IRED, Infrared’s native token. This fee structure ensures that users keep most of their earnings, while the protocol remains sustainable. By eliminating unnecessary fees, Infrared makes PoL participation more efficient and cost-effective for all users.

Use Cases of Infrared Finance

Earning Yield Without Losing Liquidity

Traditional staking locks up assets, making them unusable. With iBGT and iBERA, users can stake and still access their tokens for trading, lending, or collateral in DeFi. This allows users to earn staking rewards without sacrificing liquidity, making their assets more efficient.Simplifying Validator Participation

Running a validator requires technical knowledge and a large amount of BERA. Many users lack the resources to stake directly. Infrared’s iBERA lets users stake small amounts of BERA while still earning validator rewards. This makes staking more accessible, allowing broader participation in Berachain’s security and governance.Automated Staking and Governance Management

Delegating BGT to validators is essential for earning rewards, but managing it manually is complex. Infrared’s PoL vaults automate this process, ensuring optimal validator delegation and yield generation. Users deposit liquidity and let Infrared handle the rest, maximizing returns with minimal effort.Enabling Governance Influence for Liquidity Providers

Since BGT is soulbound and non-transferable, liquidity providers often struggle to use their governance power effectively. iBGT allows them to stake their governance rewards and earn additional incentives, giving them more influence in Berachain’s decision-making while keeping their assets flexible.Lowering the Barrier to Entry for DeFi Users

Many DeFi users find Proof-of-Liquidity complex due to staking requirements, validator delegation, and liquidity management. Infrared’s one-click PoL vaults remove these obstacles, allowing users to participate in Berachain’s ecosystem without deep technical expertise.Cost-Efficient Staking with No Entry or Exit Fees

Unlike many platforms that charge deposit or withdrawal fees, Infrared allows users to enter and exit PoL staking for free. The only fee is a small performance fee, which is distributed to $IRED token holders, ensuring a fair and sustainable reward model.

How to Get Started with Infrared Finance

Infrared Finance makes staking and earning through Berachain’s Proof-of-Liquidity (PoL) system easy. Getting started is a simple three-step process, whether you’re new to liquid staking or looking to optimize your rewards.

1.Get LP Tokens

Before you can stake in Infrared’s PoL vaults, you need LP tokens. These tokens represent your share of liquidity in a PoL-eligible pool on Berachain’s native decentralized exchange, BEX.

- Choose a PoL-eligible pool, such as BERA-HONEY.

- Provide an equal amount of both assets to the pool.

- Receive LP tokens as a deposit receipt.

These LP tokens will be used in Infrared’s vaults to generate rewards. This step is essential because it ensures that liquidity providers contribute to Berachain’s PoL mechanism, earning governance power (BGT) in return.

2.Stake LP Tokens in an Infrared Vault

Once you have LP tokens, the next step is staking them in an Infrared vault. This process is fully automated, so you don’t need to delegate BGT or manage governance participation manually.

- Deposit your LP tokens into the relevant Infrared vault (e.g., the BERA-HONEY vault).

- The vault automatically stakes the assets, earning BGT rewards on your behalf.

- Staked assets begin generating yield without additional steps.

Infrared’s smart contracts handle validator delegation and reward optimization, removing the need for users to manually interact with the PoL system. This makes staking accessible to both beginners and experienced DeFi users.

3.Earn and Claim Rewards

Once your LP tokens are staked, you start earning rewards. These rewards are automatically converted into iBGT, making them more flexible.

- BGT rewards are converted to iBGT at a 1:1 ratio.

- iBGT can be staked for additional rewards or used across Berachain’s DeFi ecosystem.

- Additional incentives, such as LP yield and validator rewards, are included depending on the vault.

Users can claim rewards anytime, giving them full control over their staking earnings. Since iBGT is liquid, it can be traded, used as collateral, or added to liquidity pools, unlike BGT, which remains soulbound.

4.Explore iBGT and iBERA for More Opportunities

Infrared’s liquid staking system doesn’t stop at iBGT. Users who stake BERA through Infrared receive iBERA, a liquid version of staked BERA.

- Staking BERA through Infrared generates iBERA, backed 1:1 by staked assets.

- iBERA earns staking rewards while remaining usable in DeFi for lending, borrowing, and trading.

This provides an alternative for users who want validator rewards without locking up assets in validator staking.

5.No Fees for Deposits or Withdrawals

Unlike many staking protocols that charge entry and exit fees, Infrared imposes no deposit or withdrawal costs. Users can stake and unstake freely. The only fee is a small performance fee, which is redistributed to holders of $IRED, Infrared’s native token. This ensures that users keep the majority of their rewards while maintaining the protocol’s sustainability.

Fundraising

Infrared Finance successfully raised $2.5 million in a seed round, led by Synergis with participation from NGC Ventures, Tribe Capital, CitizenX, Shima Capital, Dao5, Signum Capital, Ouroboros Capital, Decima, Oak Grove Ventures, DoraHacks, and Tenzor Capital. The round also saw support from key individuals, including Alex Shin, Albert Chon, Charles Lu, Mr. Block, and Chris Spadafora. This funding is instrumental in expanding Infrared’s infrastructure, developing PoL vaults, validator networks, and its native Liquid Staking Token (iBGT).

The most substantial milestone came with a $14 million Series A round, announced on March 4, 2025, led by Framework Ventures. This round also saw participation from various angels and DAOs, including TempleDAO, MIM_Spell, and StakeStone, reflecting broad community and investor support. The funds are intended to enhance Infrared’s mission of providing accessible, top-tier infrastructure for Berachain’s users and builders.

Conclusion

Infrared Finance is shaping the future of Proof-of-Liquidity on Berachain by making staking simple, liquid, and accessible. With iBGT, iBERA, and automated PoL vaults, technical barriers are removed, and user rewards are optimized. Backed by top-tier investors and a strong development team, Infrared is positioned to drive adoption and innovation in Berachain’s growing ecosystem. Whether you’re a liquidity provider, validator, or DeFi user, Infrared makes earning in Berachain easier.