BTC Price Prediction: Bitcoin Sinks Below $115K, Will CME Gap Fill Lead to $110K Slide?

Will the CME Gap Fill Trigger a Rebound or Extended Downtrend?

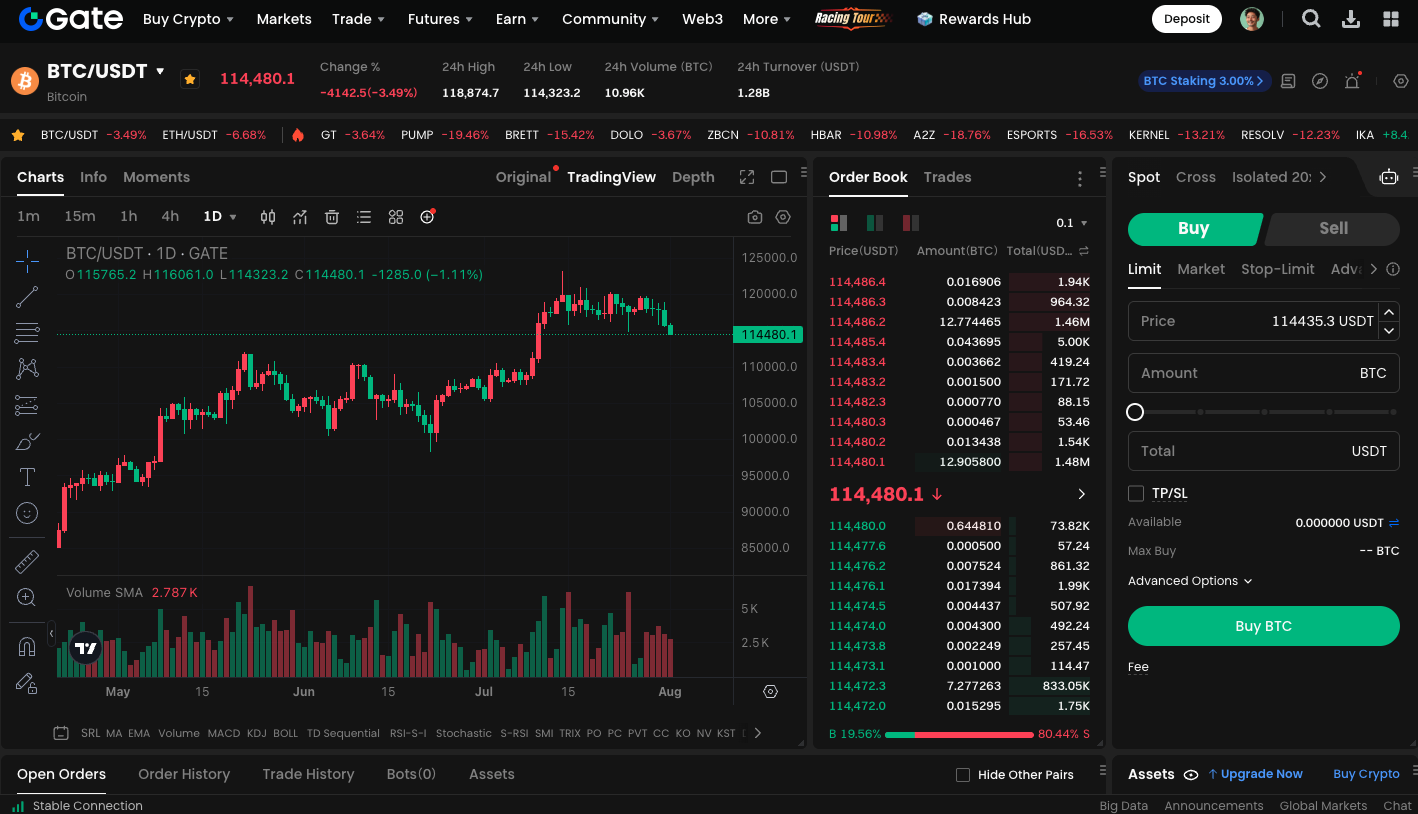

According to TradingView data, Bitcoin experienced a modest bounce after hitting its recent low and is now trading around $114,700. Some analysts see the gap fill as a catalyst for a technical rebound, with the crypto entrepreneur Ted Pillows suggesting this may set the stage for a recovery. However, opinions in the market remain divided. Trader Cipher X notes that if Bitcoin fails to climb back above $116,000, it could further test support at $104,000. Other analysts also point out that the price could retrace to the $110,000 support region.

Bitcoin Shows Sharper Volatility Than U.S. Stocks as Risk Assets Face Pressure

While U.S. equity futures also saw slight moves—S&P 500 futures edged down around 0.4%—Bitcoin has shown a notably stronger reaction. Analysis from The Kobeissi Letter highlights that market responses to the trade war are less intense than four months ago. The current correction is relatively mild, signaling growing market resilience to policy uncertainty.

Fundamentals and Rate Expectations Continue to Pressure Markets

Beyond policy developments, Federal Reserve Chair Powell delivered hawkish remarks earlier in the week. Even without a rate hike, market expectations for a rate cut in 2025 have diminished. On top of that, the latest Core Personal Consumption Expenditures (PCE) Index came in higher than anticipated, intensifying the pressure on risk assets.

Start trading BTC spot market now: https://www.gate.com/trade/BTC_USDT

Summary

Currently, Bitcoin remains directionless after the CME Gap was filled. In the near term, the key question is whether Bitcoin can establish support above the $116,000 technical threshold. If not, the market could test lower support levels at $111,800, $110,000, or even $104,000. Without significant improvement in fundamentals or the policy environment, Bitcoin will likely remain under volatile pressure.

Related Articles

2025 BTC Price Prediction: BTC Trend Forecast Based on Technical and Macroeconomic Data

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

Pi Coin Transaction Guide: How to Transfer to Gate.com

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

What is N2: An AI-Driven Layer 2 Solution