A Data-Driven Look at Trading Bots: Solana Remains the Main Battleground as Newcomers Surpass Veterans in Multi-Scenario Competition

As market sentiment cools down, trading bots are facing a new phase of adaptation and transformation—especially within the Solana ecosystem, where the competitive landscape is being rapidly reshaped. This article analyzes the current state of the trading bot market, how emerging forces are overtaking established players through multi-scenario competition, and the functional upgrades and user experience improvements of leading trading bots such as Axiom, Photon, BullX, Trojan, and GMGN.As market sentiment gradually cools and the on-chain ecosystem enters a cooling-off period, the trading volume and profits of trading bots have experienced a sharp decline, forcing them into a new phase of adaptation and transformation. At the same time, trading bots are becoming increasingly “involuted” — the once-simple strategy of fast token sniping is gradually becoming ineffective, replaced by more complex feature expansion, more flexible trading strategies, and higher standards for security.

As more participants shift from off-chain to on-chain environments, trading has entered a more advanced stage of competition. Trading bots, with their ability to snipe new tokens quickly, automate trades, and execute high-frequency arbitrage, once became essential tools for traders — especially shining during the MEME coin frenzy. However, as market sentiment cools, the on-chain ecosystem enters a lull period, and trading bots face a sharp drop in volume and profitability, entering a new stage of adaptation and transformation. Meanwhile, the industry is becoming increasingly competitive, with simple fast-snipe strategies giving way to more complex functionality, flexible tactics, and stronger security capabilities.

Solana Retains Dominance Amid Market Slump — Axiom Rises to Top, Surpassing Longtime Leaders

The trading bot market size fluctuates with the rise and fall of the on-chain ecosystem’s popularity. Over the past two months, despite a sharp decline, Solana quickly achieved a strong rebound, fully demonstrating the resilience and recovery of its ecosystem. Amidst these drastic changes, the competitive landscape of Solana’s trading bot market is being reshaped at an accelerated pace—top players are losing market share while emerging forces are rising rapidly, quietly igniting a battle for market dominance.

According to Dune data, over the past two months, the market share of trading bots on Solana experienced significant volatility, plummeting from a peak of 91.8% to a low of 18.2%. As of April 10, this share has rebounded to 85.1%, reestablishing Solana’s absolute dominance in the trading bot market. However, during this period, trading bot volumes on Base and BSC briefly surpassed those on Solana. Notably, in late March, BSC’s share once surged to 70.7%, while Solana dropped to just 18.2%.

From a user scale perspective, Dune data shows that as of April 10, Solana had more than 202,000 trading bot users—far exceeding BSC and Ethereum—accounting for 83% of the total, highlighting its dominant user base.

More specifically, trading volume of Solana-based trading bots saw a significant downward trend. Dune data indicates that over the past two months, the total trading volume dropped from nearly $1.06 billion to approximately $96 million, a 90.7% decrease. Meanwhile, daily revenue during this period also dropped by about 88.9% to $922,000.

Changes in on-chain participation are also accelerating the reshaping of the trading bot market. Veteran players are slowing down, while emerging forces are rising rapidly.

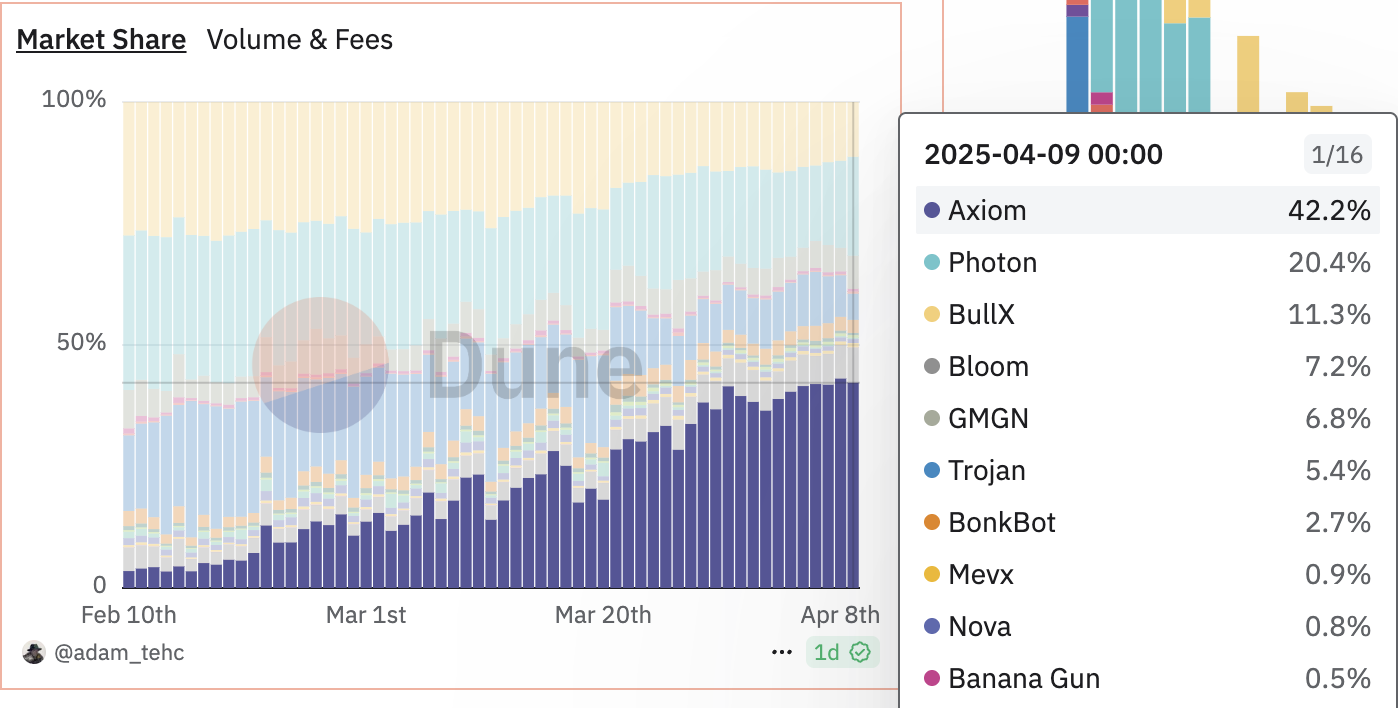

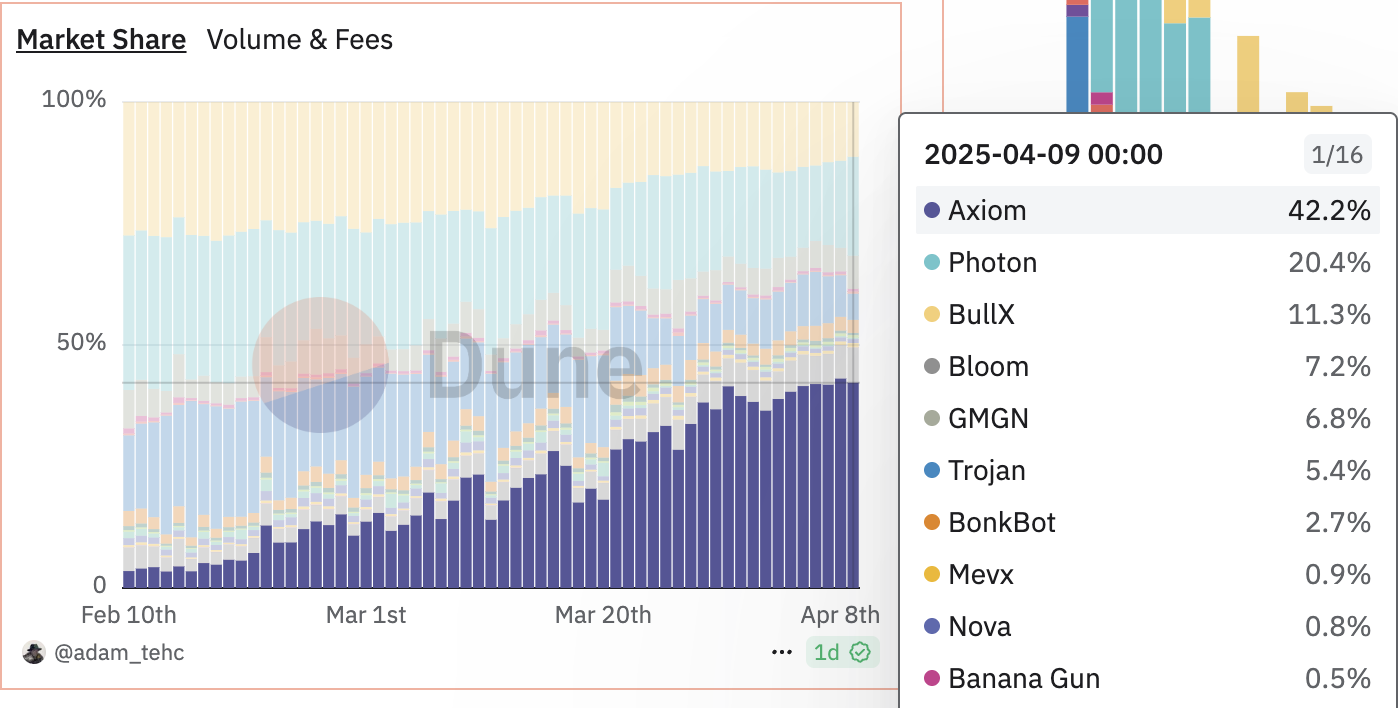

Dune data shows that in the past two months, among 17 Solana-based trading bots, the top three by trading volume were: Photon with $3.96 billion, BullX with $3.59 billion, and Trojan with $2.82 billion. However, leading bots saw significant market share shrinkage. Photon’s share dropped from 31.8% to 20.4% (down about 35.85%); BullX fell from 27.5% to 11.3%; and Trojan, previously third, declined to 5.4%.

Notably, the emerging trading bot Axiom has shown strong growth momentum. Its market share surged from 3.5% to 42.2% in just two months, rising to the top as of April 9. Judging by its growth trend, Axiom’s dominance in the Solana ecosystem is expanding rapidly. On April 9 alone, Axiom accounted for nearly 42.2% of daily trading volume and about 44.2% of daily revenue.

From Trading Features to User Experience, Trading Bots Undergo Multi-Scenario Upgrades

With the widespread adoption of “sniping” strategies, trading bots have become essential tools for traders to gain early access and capture market opportunities. However, amid increasingly fierce competition and a growingly complex on-chain ecosystem, traders now require not only fast execution but also accurate market insight and stronger asset security.

Through examining the latest market developments of five leading trading bots in the Solana ecosystem—Axiom, Photon, BullX, Trojan, and GMGN—PANews found that these platforms are actively improving their ecosystem layout through multi-dimensional feature upgrades, full-scenario coverage, and enhanced security, in order to meet traders’ diverse needs for speed, insight, and asset protection.

Axiom

Axiom is incubated by Y Combinator and has rapidly expanded its market share over the past month. Axiom offers several functional highlights: (1) Automation Tools: Features like one-click sniping allow users to quickly participate in new token launches; copy trading enables users to follow experienced traders’ strategies and execute trades automatically; advanced strategies support dynamic take-profit/stop-loss settings, conditional orders, and other complex trading logic executed by the platform;(2) Data Analysis Tools: Includes professional trading indicators that track whale wallets, capital flows, and smart money movements in real time; the InsightX bubble chart visually displays token popularity, trading volume, and community activity; integration with X (Twitter) helps track project updates, KOL opinions, and market sentiment in real time;(3) Diverse Financial Tools: Axiom integrates with products like HyperLiquid perpetuals and Marginfi yield tools to cater to different risk preferences;(4) User Asset Security: Offers a non-custodial wallet, integration with Coinbase (supporting weekly purchases up to $500 without KYC), and MEV protection mechanisms to reduce frontrunning and sandwich attacks;(5) Multi-Dimensional Reward System: Users can earn SOL rewards and Axiom points through trading volume, referrals, and completing tasks. However, Axiom also has notable limitations compared to competitors—such as limited language support, operating exclusively within the Solana ecosystem, and no mobile app availability.

Photon

In recent months, Photon has mainly focused on updating and optimizing trading features. For example, the newly launched SNAP function allows users to customize trading settings (such as wallet tracking, X post tracking, and notification features); the multi-wallet function supports distributing funds from one wallet to multiple wallets and buying/selling any token simultaneously. Photon also announced plans to release a BNB Beta version and has launched USDC trading pairs on Solana.

BullX

In February 2024, BullX announced a major update that introduced several new features, including the fastest migration sniping tool, faster order filling and chart performance, a Twitter (X) tracker, and enhanced Hyper Vision (which tracks historical X usernames, developer migration behavior, and bot transaction fees). It also highlighted several UX improvements. Additionally, BullX has strengthened its security by banning third-party browser extensions.

Trojan

Several months ago, Trojan launched its core feature TrojanSniper, which allows users to set parameters such as sniping amount, slippage, and fees according to their own risk appetite and trading strategies. It also introduced filters (e.g., minimum/maximum liquidity, token pool allocation, developer holding ratio, supported platforms) and a MEV protection mechanism. TrojanSniper also includes whitelisting and blacklisting, enabling users to filter out specific tokens or developer addresses they do not want to target. In addition, Trojan launched a developer sell trigger alert and improved broadcast speed by 70%.

GMGN

In recent months, GMGN has launched a series of feature upgrades. These include support for TRON chain withdrawals, while simultaneously disabling Telegram bot withdrawals, requiring users to operate only through the web platform. GMGN also introduced mandatory Google 2FA (two-factor authentication) and whitelisted withdrawal address restrictions, ensuring that transfers are limited to pre-approved addresses in order to significantly reduce security risks. In terms of trading features, GMGN launched multi-wallet management for the Solana chain, allowing users to manage multiple wallets seamlessly through a single interface. It also introduced new tools for holder trend analysis, including whale wallet movements, insider (front-run) wallet behavior, and blue-chip token trend indexes, helping users gain better insight into market dynamics. For trading decisions, GMGN added features like grouped tracking of followed wallets, ultra-fast copy trading, and a “monitor square” that displays real-time smart money and KOL trading activity, with KOL profile pictures marked directly on charts. It also temporarily opened a Twitter scraping tool, which can scan tweets, replies, bios, etc., to automatically detect token contracts and support quick trading. To further improve trading speed and reliability, GMGN completed a global distributed infrastructure deployment in March, including AWS hosting, Solana validator node deployment, and custom-built RPC nodes.

In addition, GMGN has expanded its platform through the launch of a mobile app, BNB Chain integration, and a referral rewards system to drive further growth.

Disclaimer:

This article is reprinted from [PANews]. All copyrights belong to the original author [Nancy]. If there are any objections to this reprint, please contact the Gate Learn team, and the team will handle it promptly according to relevant procedures.

Disclaimer: The views and opinions expressed in this article represent only the author’s personal views and do not constitute any investment advice.

Other language versions of the article are translated by the Gate Learn team. Unless otherwise stated, copying, distributing, or plagiarizing the translated versions without mentioning Gate.io is strictly prohibited.

A Data-Driven Look at Trading Bots: Solana Remains the Main Battleground as Newcomers Surpass Veterans in Multi-Scenario Competition

Solana Retains Dominance Amid Market Slump — Axiom Rises to Top, Surpassing Longtime Leaders

From Trading Features to User Experience, Trading Bots Undergo Multi-Scenario Upgrades

As market sentiment gradually cools and the on-chain ecosystem enters a cooling-off period, the trading volume and profits of trading bots have experienced a sharp decline, forcing them into a new phase of adaptation and transformation. At the same time, trading bots are becoming increasingly “involuted” — the once-simple strategy of fast token sniping is gradually becoming ineffective, replaced by more complex feature expansion, more flexible trading strategies, and higher standards for security.

As more participants shift from off-chain to on-chain environments, trading has entered a more advanced stage of competition. Trading bots, with their ability to snipe new tokens quickly, automate trades, and execute high-frequency arbitrage, once became essential tools for traders — especially shining during the MEME coin frenzy. However, as market sentiment cools, the on-chain ecosystem enters a lull period, and trading bots face a sharp drop in volume and profitability, entering a new stage of adaptation and transformation. Meanwhile, the industry is becoming increasingly competitive, with simple fast-snipe strategies giving way to more complex functionality, flexible tactics, and stronger security capabilities.

Solana Retains Dominance Amid Market Slump — Axiom Rises to Top, Surpassing Longtime Leaders

The trading bot market size fluctuates with the rise and fall of the on-chain ecosystem’s popularity. Over the past two months, despite a sharp decline, Solana quickly achieved a strong rebound, fully demonstrating the resilience and recovery of its ecosystem. Amidst these drastic changes, the competitive landscape of Solana’s trading bot market is being reshaped at an accelerated pace—top players are losing market share while emerging forces are rising rapidly, quietly igniting a battle for market dominance.

According to Dune data, over the past two months, the market share of trading bots on Solana experienced significant volatility, plummeting from a peak of 91.8% to a low of 18.2%. As of April 10, this share has rebounded to 85.1%, reestablishing Solana’s absolute dominance in the trading bot market. However, during this period, trading bot volumes on Base and BSC briefly surpassed those on Solana. Notably, in late March, BSC’s share once surged to 70.7%, while Solana dropped to just 18.2%.

From a user scale perspective, Dune data shows that as of April 10, Solana had more than 202,000 trading bot users—far exceeding BSC and Ethereum—accounting for 83% of the total, highlighting its dominant user base.

More specifically, trading volume of Solana-based trading bots saw a significant downward trend. Dune data indicates that over the past two months, the total trading volume dropped from nearly $1.06 billion to approximately $96 million, a 90.7% decrease. Meanwhile, daily revenue during this period also dropped by about 88.9% to $922,000.

Changes in on-chain participation are also accelerating the reshaping of the trading bot market. Veteran players are slowing down, while emerging forces are rising rapidly.

Dune data shows that in the past two months, among 17 Solana-based trading bots, the top three by trading volume were: Photon with $3.96 billion, BullX with $3.59 billion, and Trojan with $2.82 billion. However, leading bots saw significant market share shrinkage. Photon’s share dropped from 31.8% to 20.4% (down about 35.85%); BullX fell from 27.5% to 11.3%; and Trojan, previously third, declined to 5.4%.

Notably, the emerging trading bot Axiom has shown strong growth momentum. Its market share surged from 3.5% to 42.2% in just two months, rising to the top as of April 9. Judging by its growth trend, Axiom’s dominance in the Solana ecosystem is expanding rapidly. On April 9 alone, Axiom accounted for nearly 42.2% of daily trading volume and about 44.2% of daily revenue.

From Trading Features to User Experience, Trading Bots Undergo Multi-Scenario Upgrades

With the widespread adoption of “sniping” strategies, trading bots have become essential tools for traders to gain early access and capture market opportunities. However, amid increasingly fierce competition and a growingly complex on-chain ecosystem, traders now require not only fast execution but also accurate market insight and stronger asset security.

Through examining the latest market developments of five leading trading bots in the Solana ecosystem—Axiom, Photon, BullX, Trojan, and GMGN—PANews found that these platforms are actively improving their ecosystem layout through multi-dimensional feature upgrades, full-scenario coverage, and enhanced security, in order to meet traders’ diverse needs for speed, insight, and asset protection.

Axiom

Axiom is incubated by Y Combinator and has rapidly expanded its market share over the past month. Axiom offers several functional highlights: (1) Automation Tools: Features like one-click sniping allow users to quickly participate in new token launches; copy trading enables users to follow experienced traders’ strategies and execute trades automatically; advanced strategies support dynamic take-profit/stop-loss settings, conditional orders, and other complex trading logic executed by the platform;(2) Data Analysis Tools: Includes professional trading indicators that track whale wallets, capital flows, and smart money movements in real time; the InsightX bubble chart visually displays token popularity, trading volume, and community activity; integration with X (Twitter) helps track project updates, KOL opinions, and market sentiment in real time;(3) Diverse Financial Tools: Axiom integrates with products like HyperLiquid perpetuals and Marginfi yield tools to cater to different risk preferences;(4) User Asset Security: Offers a non-custodial wallet, integration with Coinbase (supporting weekly purchases up to $500 without KYC), and MEV protection mechanisms to reduce frontrunning and sandwich attacks;(5) Multi-Dimensional Reward System: Users can earn SOL rewards and Axiom points through trading volume, referrals, and completing tasks. However, Axiom also has notable limitations compared to competitors—such as limited language support, operating exclusively within the Solana ecosystem, and no mobile app availability.

Photon

In recent months, Photon has mainly focused on updating and optimizing trading features. For example, the newly launched SNAP function allows users to customize trading settings (such as wallet tracking, X post tracking, and notification features); the multi-wallet function supports distributing funds from one wallet to multiple wallets and buying/selling any token simultaneously. Photon also announced plans to release a BNB Beta version and has launched USDC trading pairs on Solana.

BullX

In February 2024, BullX announced a major update that introduced several new features, including the fastest migration sniping tool, faster order filling and chart performance, a Twitter (X) tracker, and enhanced Hyper Vision (which tracks historical X usernames, developer migration behavior, and bot transaction fees). It also highlighted several UX improvements. Additionally, BullX has strengthened its security by banning third-party browser extensions.

Trojan

Several months ago, Trojan launched its core feature TrojanSniper, which allows users to set parameters such as sniping amount, slippage, and fees according to their own risk appetite and trading strategies. It also introduced filters (e.g., minimum/maximum liquidity, token pool allocation, developer holding ratio, supported platforms) and a MEV protection mechanism. TrojanSniper also includes whitelisting and blacklisting, enabling users to filter out specific tokens or developer addresses they do not want to target. In addition, Trojan launched a developer sell trigger alert and improved broadcast speed by 70%.

GMGN

In recent months, GMGN has launched a series of feature upgrades. These include support for TRON chain withdrawals, while simultaneously disabling Telegram bot withdrawals, requiring users to operate only through the web platform. GMGN also introduced mandatory Google 2FA (two-factor authentication) and whitelisted withdrawal address restrictions, ensuring that transfers are limited to pre-approved addresses in order to significantly reduce security risks. In terms of trading features, GMGN launched multi-wallet management for the Solana chain, allowing users to manage multiple wallets seamlessly through a single interface. It also introduced new tools for holder trend analysis, including whale wallet movements, insider (front-run) wallet behavior, and blue-chip token trend indexes, helping users gain better insight into market dynamics. For trading decisions, GMGN added features like grouped tracking of followed wallets, ultra-fast copy trading, and a “monitor square” that displays real-time smart money and KOL trading activity, with KOL profile pictures marked directly on charts. It also temporarily opened a Twitter scraping tool, which can scan tweets, replies, bios, etc., to automatically detect token contracts and support quick trading. To further improve trading speed and reliability, GMGN completed a global distributed infrastructure deployment in March, including AWS hosting, Solana validator node deployment, and custom-built RPC nodes.

In addition, GMGN has expanded its platform through the launch of a mobile app, BNB Chain integration, and a referral rewards system to drive further growth.

Disclaimer:

This article is reprinted from [PANews]. All copyrights belong to the original author [Nancy]. If there are any objections to this reprint, please contact the Gate Learn team, and the team will handle it promptly according to relevant procedures.

Disclaimer: The views and opinions expressed in this article represent only the author’s personal views and do not constitute any investment advice.

Other language versions of the article are translated by the Gate Learn team. Unless otherwise stated, copying, distributing, or plagiarizing the translated versions without mentioning Gate.io is strictly prohibited.