Análise de previsão de preço XRP/EUR

1. Introdução

Com a aceleração da digitalização global, o mercado de criptomoedas floresceu, emergindo como uma força dinâmica no setor financeiro. XRP, uma criptomoeda com posicionamento e funcionalidades únicas, desempenha um papel significativo neste mercado.

XRP é a criptomoeda nativa da rede Ripple, projetada para enfrentar ineficiências e altos custos em pagamentos transfronteiriços tradicionais. Ao contrário do Bitcoin e outras criptomoedas, o XRP foi pré-minerado, com um fornecimento total fixo de 100 bilhões de tokens. Esse mecanismo de emissão garante estabilidade relativa no fornecimento de mercado.

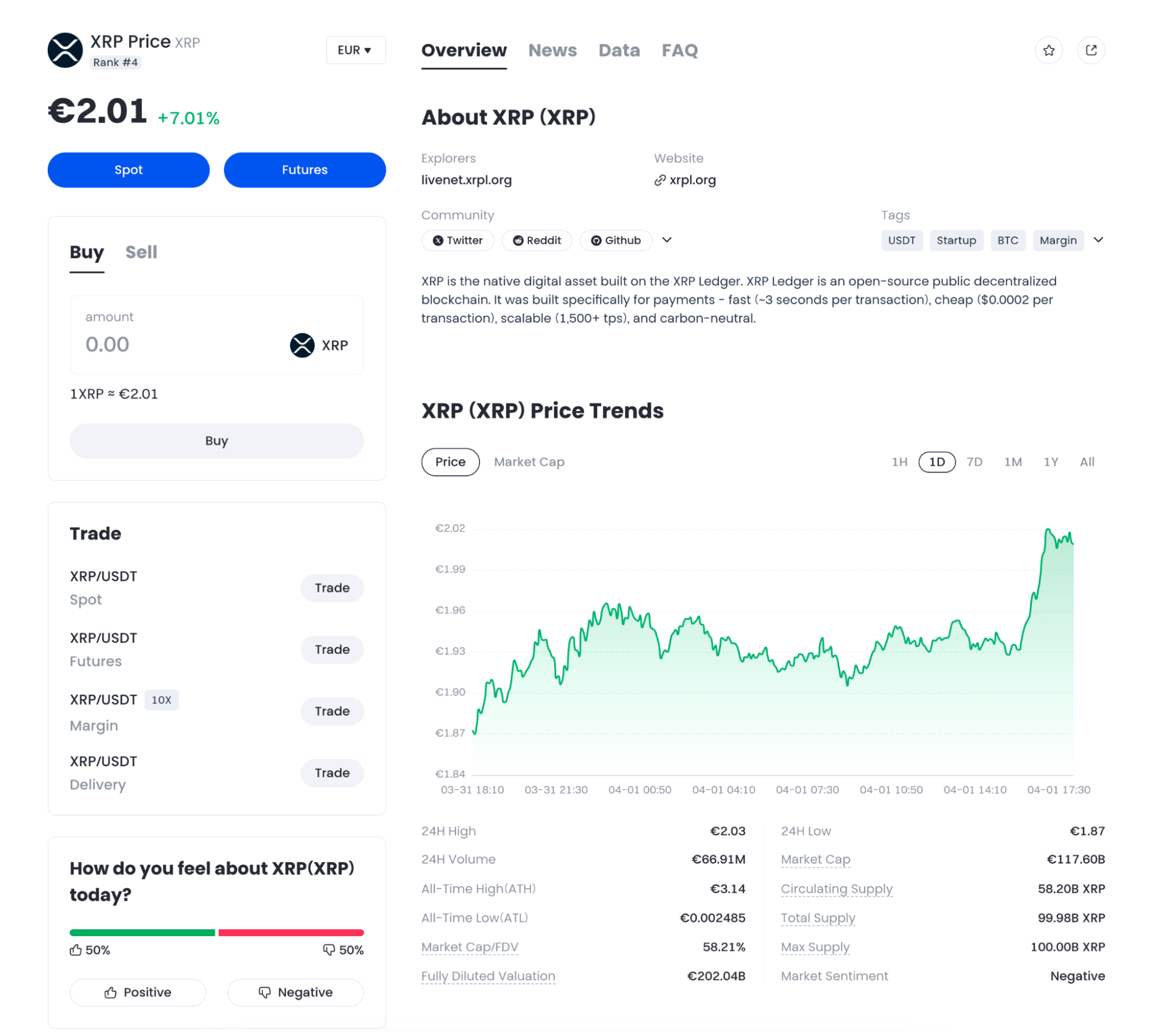

O XRP consistentemente se classifica entre as principais criptomoedas por capitalização de mercado, com alta atividade de negociação em grandes exchanges. Por exemplo, os volumes diários de negociação em plataformas como Gate.com frequentemente alcançam milhões ou mesmo dezenas de milhões de dólares, refletindo um forte interesse de mercado.

A Ripple, a empresa por trás do XRP, firmou parceria com várias instituições financeiras para facilitar transações transfronteiriças rápidas e de baixo custo usando XRP. Essas aplicações do mundo real aumentam o valor de mercado e a influência do XRP.

A taxa de câmbio XRP/EUR é influenciada por fatores internos (por exemplo, dinâmicas de oferta e demanda, avanços tecnológicos) e fatores externos (por exemplo, tendências macroeconômicas globais, políticas da zona do euro). Previsões de preços precisas ajudam os investidores a ajustar o momento de suas negociações e otimizar estratégias de investimento.

Negocie XRP na Gate.com:https://www.Gate.com/trade/XRP_USDT

Visão geral do XRP e do mercado de Euro

2.1 Visão Geral do XRP

2.1.1 Conceitos Básicos e Características do XRP

XRP é a criptomoeda nativa da rede Ripple, lançada pela Ripple Labs em 2012. Foi projetada com características únicas para atender às necessidades das transações financeiras modernas.

Uma das características mais notáveis da XRP é a sua velocidade de transação extremamente rápida. Na rede Ripple, as transações de XRP são confirmadas em uma média de cerca de 4 segundos, superando significativamente o tempo médio de confirmação do Bitcoin de 10 minutos e o tempo médio do Ethereum de 15 segundos. Essa capacidade de processamento de transações rápidas permite que a XRP atenda a demandas de transações em grande escala e alta frequência, tornando-a particularmente adequada para cenários que exigem transações rápidas, como pagamentos transfronteiriços.

Baixos custos de transação são outra grande vantagem do XRP. As taxas de transação do XRP são mínimas, quase negligenciáveis. Para instituições financeiras, isso pode reduzir substancialmente os custos operacionais. Pagamentos transfronteiriços tradicionais frequentemente envolvem altas taxas cobradas pelos bancos, enquanto o uso do XRP para transferências transfronteiriças pode reduzir significativamente os custos de transação, proporcionando uma solução de pagamento mais econômica e eficiente para as instituições financeiras.

XRP também oferece alta versatilidade. Pode circular livremente dentro da rede Ripple e ser facilmente trocado por outras moedas digitais ou moedas fiduciárias. Essa versatilidade dá ao XRP amplo potencial de aplicação nos mercados financeiros globais, conectando diferentes sistemas financeiros e facilitando o livre fluxo de capital.

Além disso, a rede XRP emprega um mecanismo de consenso único - o Algoritmo de Consenso do Protocolo Ripple (RPCA). Esse mecanismo abandona o consenso tradicional de prova de trabalho (PoW), eliminando a necessidade de mineração intensiva de energia, tornando-o ecologicamente correto e eficiente. O mecanismo de consenso RPCA também garante a segurança e estabilidade da rede, permitindo que a rede XRP manipule grandes volumes de transações e mantenha a operação normal contra vários ataques à rede.

2.1.2 Relação Entre Ripple e XRP

Ripple é uma empresa de tecnologia focada em aplicações de blockchain no setor financeiro, e XRP é seu produto principal. Os dois compartilham uma relação próxima e mutuamente reforçadora.

Ripple desempenha um papel crítico no desenvolvimento tecnológico e atualizações do XRP. A empresa investe recursos significativos na otimização contínua da arquitetura técnica subjacente do XRP para aprimorar seu desempenho e segurança. Em termos de capacidade de processamento de transações, as inovações da Ripple permitiram que a rede XRP lidasse com até 1.500 transações por segundo, abordando efetivamente gargalos na tecnologia tradicional de blockchain. A empresa também prioriza a segurança da rede XRP, empregando algoritmos avançados de criptografia e tecnologias de assinatura múltipla para proteger os ativos do usuário. Essas otimizações e inovações técnicas fornecem uma base sólida para a competitividade do mercado do XRP.

A Ripple expande ativamente os cenários de aplicação do XRP ao colaborar com instituições financeiras globais para promover o uso do XRP em pagamentos transfronteiriços. A solução de pagamento transfronteiriço da empresa, RippleNet, utiliza o XRP como moeda intermediária para facilitar transferências de fundos transfronteiriças rápidas e de baixo custo. Atualmente, várias instituições financeiras conhecidas, incluindo o MoneyGram, aderiram ao RippleNet e utilizam o XRP para pagamentos transfronteiriços. Essa expansão de aplicações práticas não apenas aumenta a demanda e o valor do XRP, mas também aprimora seu reconhecimento nos mercados financeiros globais.

Os esforços de marketing e branding da Ripple também impactam significativamente o desenvolvimento do XRP. A empresa promove as vantagens e perspectivas do XRP participando de exposições de fintech, sediando seminários do setor e colaborando com a mídia para disseminar atualizações e conquistas, atraindo mais investidores e usuários.

Visão geral do mercado de 2,2 euros

O euro é a moeda oficial de 19 países da UE e tem desempenhado uma posição importante no sistema monetário global desde a sua introdução em 1999.

Em termos de força econômica, a Eurozona inclui muitos estados membros economicamente robustos, como Alemanha, França e Itália. Esses países se destacam na manufatura, serviços, tecnologia e outros setores, conferindo à Eurozona uma parcela substancial do PIB global. De acordo com dados do FMI, a Eurozona representa cerca de 15% do PIB global, proporcionando uma base econômica sólida para a posição internacional do euro.

Nas liquidações comerciais internacionais, o euro é a segunda moeda mais importante depois do dólar americano. Muitos países preferem usar o euro para liquidações comerciais com a Eurozona. Os dados da SWIFT mostram que o euro representa cerca de 30% das liquidações comerciais internacionais. Seu uso generalizado facilita o comércio entre a Eurozona e outras regiões, aumentando a influência global do euro.

Como moeda de reserva internacional, o euro é uma escolha chave para os bancos centrais em todo o mundo. Sua estabilidade e a força econômica da zona do euro sustentam seu papel nas reservas globais. Em 2024, o euro compreende cerca de 20% das reservas globais de câmbio, ficando atrás apenas do dólar dos Estados Unidos. Manter reservas em euros ajuda os bancos centrais a diversificar riscos e facilita as interações econômicas com a zona do euro.

Recentemente, o desempenho do euro tem sido influenciado por vários fatores. Os dados econômicos indicam alguma pressão sobre o crescimento da zona do euro. Flutuações na inflação, mudanças nas taxas de desemprego e o desempenho dos setores de manufatura e serviços impactam a taxa de câmbio do euro. As políticas monetárias do Banco Central Europeu também afetam significativamente o euro. Políticas expansionistas, como cortes de taxas e flexibilização quantitativa, aumentam o fornecimento de euros, potencialmente enfraquecendo seu valor, enquanto políticas de aperto podem fortalecê-lo. Condições econômicas globais, fatores geopolíticos e tendências em outras moedas principais também influenciam indiretamente a taxa de câmbio do euro.

2.3 Estado atual do mercado de negociação XRP/EUR

Análise de Liquidez de Mercado 2.3.1

A liquidez do par de negociação XRP/EUR é um indicador chave da atividade de mercado e da convertibilidade de ativos. Vários fatores influenciam a liquidez do mercado.

O volume de negociação é um determinante crítico da liquidez. Volumes de negociação mais altos indicam mais ordens de compra e venda, permitindo que os investidores negociem XRP a preços mais razoáveis com mais facilidade. Quando os volumes de negociação XRP/EUR são altos, a liquidez de mercado melhora, possibilitando transações mais rápidas com impactos de preço menores. Durante períodos de negociação de pico, os volumes XRP/EUR aumentam, melhorando a liquidez e permitindo que os investidores executem negociações rapidamente com flutuações de preço mínimas.

A profundidade da exchange também impacta significativamente a liquidez. Profundidade refere-se à distribuição e quantidade de ordens de compra e venda em diferentes níveis de preço. Exchanges com livros de ordens profundos para XRP/EUR podem absorver grandes negociações sem movimentos de preço substanciais, melhorando a liquidez. Por outro lado, a profundidade rasa pode levar a oscilações de preço significativas com grandes ordens, aumentando os custos de negociação e reduzindo a liquidez. As principais exchanges de criptomoedas atraem participantes diversos e market makers, proporcionando liquidez profunda para a negociação de XRP/EUR.

A diversidade dos participantes do mercado também afeta ainda mais a liquidez. Mercados com uma mistura de investidores de varejo, players institucionais e market makers tendem a ter uma melhor liquidez. Investidores institucionais trazem capital substancial e estratégias profissionais, aumentando os volumes e a estabilidade de negociação. Os market makers fornecem cotações contínuas de compra e venda, garantindo a liquidez do mercado. Diferentes tipos de investidores com necessidades e comportamentos variados contribuem para um mercado mais ativo e líquido. A falta de diversidade de participantes pode reduzir a atividade e a liquidez.

3. Análise dos Tendências Históricas de Preço XRP/EUR

3.1 Tendências de Preço de Longo Prazo

A longo prazo, os preços do XRP/EUR têm mostrado uma volatilidade significativa, influenciada por múltiplos fatores, com um histórico de altos e baixos.

Entre 2013 e 2017, o XRP disparou em meio ao boom do mercado de criptomoedas em geral. Em 2013, o XRP rompeu os $0.01 e continuou subindo com o entusiasmo do mercado. No final de 2017, o XRP atingiu o pico de $3.84, o que se traduziu em um preço alto em euros. Esta alta foi impulsionada pelo sentimento otimista do mercado, pelo crescente interesse dos investidores em criptomoedas e pelos esforços da Ripple para promover soluções de pagamento transfronteiriças, o que impulsionou as expectativas em relação à utilidade do XRP.

No entanto, o mercado baixista de criptomoedas de 2018 fez com que os preços do XRP/EUR despencassem. O XRP caiu mais de 90% para cerca de $0.25, com quedas semelhantes em relação ao euro. O crash foi desencadeado por regulamentações globais mais rígidas de criptomoedas, minando a confiança dos investidores e levando a vendas massivas. A ação judicial da SEC contra a Ripple, alegando ofertas de títulos não registrados, ainda mais prejudicou o sentimento, exacerbando a queda de preço.

De 2019 a 2021, os preços do XRP/EUR entraram em uma fase de recuperação. Em 2019, o XRP subiu gradualmente para cerca de $0.35 no início de 2020. Em 2021, à medida que o mercado de criptomoedas se recuperava, o XRP subiu novamente, atingindo o pico de $1.96, com ganhos correspondentes em relação ao euro. Essa recuperação foi apoiada por condições de mercado melhoradas, pela alta do Bitcoin e pelos contínuos desenvolvimentos tecnológicos e parcerias da Ripple, que fortaleceram a utilidade e a confiança de mercado do XRP.

Desde 2022, os preços do XRP/EUR têm oscilado entre €0.5 e €0.7. A incerteza em torno da batalha legal da Ripple com a SEC e a instabilidade macroeconômica global, incluindo picos de inflação e tensões geopolíticas, têm contribuído para essa negociação limitada a uma faixa de preço. Apesar desses desafios, as vantagens únicas do XRP nos pagamentos transfronteiriços têm mantido sua atividade de mercado e estabilidade de preço.

3.2 Características de Volatilidade de Preços a Curto Prazo

Ao longo do último ano, os preços do XRP/EUR têm exibido flutuações frequentes e grandes, refletindo a incerteza e complexidade inerentes ao mercado de criptomoedas.

Uma análise detalhada dos dados de preços revela volatilidade de alta frequência, com múltiplas subidas e descidas alternadas dentro de períodos curtos. Algumas semanas viram 2-3 oscilações de preços significativas. Este padrão decorre da alta atividade de negociação do mercado de criptomoedas, participantes diversos e negociação 24/7, permitindo que os preços reajam rapidamente às notícias. Os investidores de varejo, que dominam o mercado, são particularmente sensíveis às discussões nas redes sociais e fóruns, levando a mudanças rápidas de sentimento e negociações frequentes que amplificam a volatilidade.

Em termos de amplitude, XRP/EUR tem experimentado movimentos diários substanciais, frequentemente variando de 5% a 10%. Eventos de notícias importantes podem desencadear oscilações ainda maiores. Por exemplo, desenvolvimentos positivos no caso da SEC da Ripple podem estimular ganhos de preço rápidos, enquanto notícias negativas podem causar quedas acentuadas. Tendências macroeconômicas mais amplas, como mudanças na política dos bancos centrais ou eventos geopolíticos, também impactam os preços do XRP/EUR.

Por exemplo, em meados de maio de 2024, a notícia da parceria da Ripple com uma grande instituição financeira impulsionou o XRP/EUR em 8% em três dias. Por outro lado, em agosto de 2024, uma queda global no mercado de ações desencadeou aversão ao risco, levando a uma queda semanal de 10% no XRP/EUR, à medida que o capital fluía para fora das criptomoedas.

3.3 Fatores Influenciando Tendências de Preços

3.3.1 Oferta e Demanda de Mercado

A dinâmica de oferta e demanda do XRP afeta diretamente e criticamente sua taxa de câmbio com o euro.

Do lado da oferta, o fornecimento total fixo de 100 bilhões de tokens da XRP inclui uma parte mantida nas contas de garantia da Ripple, liberada gradualmente sob um mecanismo controlado. Esse fornecimento estruturado garante a estabilidade do mercado. Ajustes no ritmo de liberação podem impactar o fornecimento do mercado: liberações mais rápidas podem aumentar o fornecimento, potencialmente pressionando os preços se a demanda não acompanhar o ritmo, enquanto liberações mais lentas poderiam apoiar aumentos de preço, reduzindo os tokens disponíveis. Por exemplo, quando a Ripple reduz as liberações de garantia, menos XRP entram no mercado, potencialmente elevando os preços, à medida que os investidores competem por oferta limitada.

A demanda por XRP em pagamentos transfronteiriços e outras aplicações influencia significativamente os preços. À medida que a integração econômica global avança, crescem as necessidades de pagamentos transfronteiriços. A velocidade e eficiência de custos do XRP o tornam atraente para instituições financeiras. A adoção mais ampla da RippleNet e das soluções de Liquidez Sob Demanda (ODL) aumenta a demanda institucional por XRP. Quando mais instituições utilizam o XRP para pagamentos, elas precisam comprá-lo, impulsionando a demanda e potencialmente elevando os preços se a oferta permanecer constante.

O sentimento do mercado de criptomoedas também afeta a demanda. Perspectivas otimistas podem estimular compras, elevando os preços, enquanto o pessimismo pode desencadear vendas e quedas de preços.

3.3.2 Fatores Macroeconômicos

As condições econômicas globais e da zona do euro impactam significativamente os preços do XRP/EUR.

Durante o crescimento econômico global, mercados financeiros fortes e alta disposição ao risco encorajam investimentos em ativos de alto risco e alta recompensa como criptomoedas. XRP, como uma importante criptomoeda, se beneficia de aumento de influxos de capital, potencialmente subindo de preço. Por outro lado, durante períodos de recessão econômica, investidores preferem ativos seguros como dinheiro, ouro ou o dólar americano, reduzindo a demanda por criptomoedas e pressionando os preços do XRP/EUR. Por exemplo, a crise financeira de 2008 viu os mercados de criptomoedas, incluindo XRP, despencarem.

A saúde econômica da zona do euro afeta diretamente o XRP/EUR. O crescimento forte, a inflação estável e o baixo desemprego fortalecem a confiança no euro, potencialmente diminuindo o apelo relativo do XRP e limitando os ganhos de preço. Por outro lado, recessões na zona do euro, alta inflação ou aumento do desemprego podem enfraquecer o euro, tornando o XRP mais atraente como investimento alternativo, potencialmente elevando seu preço em relação ao euro.

3.3.3 Política Regulatória

As regulamentações globais de criptomoedas impactam profundamente os preços do XRP/EUR, muitas vezes causando grande volatilidade.

Alguns países impõem restrições rígidas às criptomoedas, limitando a negociação, o investimento ou o uso, o que pode reduzir a demanda e a liquidez local do XRP, pressionando os preços. Por exemplo, proibições de envolvimento de instituições financeiras com criptomoedas limitam severamente a utilidade do XRP nesses mercados, reduzindo a demanda e os preços. Por outro lado, regulamentações de suporte, como a legalização antecipada de câmbio no Japão, aumentam a aceitação e a atividade de negociação do XRP, apoiando os preços.

A ação judicial da SEC contra a Ripple influenciou particularmente os preços do XRP/EUR. Desde a alegação da SEC em 2020 de que o XRP era um título não registrado, os preços têm sido altamente sensíveis aos desenvolvimentos do caso. Uma decisão desfavorável classificando o XRP como um título poderia restringir sua negociação e utilidade, reduzindo a demanda e os preços. Um resultado favorável removeria a incerteza, aumentaria a confiança dos investidores e provavelmente impulsionaria os preços para cima.

3.3.4 Desenvolvimento Tecnológico

O progresso tecnológico da Ripple e as tendências mais amplas das criptomoedas afetam significativamente os preços do XRP/EUR.

As inovações contínuas da Ripple na RippleNet melhoram a velocidade das transações, reduzem os custos e melhoram a segurança, fortalecendo a vantagem competitiva da XRP nos pagamentos transfronteiriços. À medida que mais instituições adotam essas soluções, a demanda e os preços da XRP podem aumentar. Por exemplo, o processamento de transações mais rápido poderia atrair mais usuários, aumentando a demanda e os preços.

Expandir os casos de uso do XRP além dos pagamentos—em áreas como financiamento da cadeia de suprimentos ou DeFi—poderia impulsionar ainda mais a demanda e os preços. A integração bem-sucedida nas cadeias de suprimentos, permitindo liquidações rápidas, aumentaria significativamente a utilidade e o valor de mercado do XRP.

Avanços tecnológicos em toda a indústria também são importantes. Se o XRP não conseguir acompanhar inovações como novos mecanismos de consenso ou métodos de criptografia, sua competitividade e preço poderiam sofrer. Por outro lado, a adoção de tecnologias de ponta poderia aprimorar o desempenho e o apelo do XRP, apoiando o crescimento do preço.

3.3.5 Sentimento de Mercado

O sentimento do investidor e as tendências nas redes sociais influenciam significativamente os preços do XRP/EUR, muitas vezes causando volatilidade a curto prazo.

Investidores de criptomoedas são altamente sensíveis a notícias e mudanças de sentimento. Otimismo sobre as perspectivas da XRP, impulsionado por parcerias da Ripple ou avanços tecnológicos, pode incentivar compras e aumentos de preços. Por outro lado, pessimismo devido a riscos legais ou competição pode desencadear vendas e quedas de preços. Durante o processo judicial da SEC contra a Ripple, a incerteza levou a vendas generalizadas, reduzindo drasticamente os preços do XRP/EUR.

Plataformas de mídia social como Twitter e Reddit desempenham um papel fundamental na formação do sentimento. Notícias positivas, análises ou endossos de figuras influentes podem atrair rapidamente compradores, impulsionando os preços para cima. Por exemplo, analistas proeminentes otimistas com o XRP podem desencadear ondas de compra. Notícias negativas, como preocupações com a segurança, podem desencadear vendas de pânico e quedas de preços.

4. Resultados da Previsão de Preço XRP/EUR

4.1 Previsão de Preço a Curto Prazo (1 - 3 Meses)

Com base na análise técnica, fundamental e quantitativa, espera-se que os preços do XRP/EUR subam inicialmente, seguidos por consolidação nos próximos 1-3 meses.

Indicadores técnicos mostram um momento otimista, com médias móveis formando uma "cruz dourada" e o Índice de Força Relativa (RSI) na faixa de 50-70, sugerindo um potencial adicional de alta. Padrões de gráfico indicam um pequeno canal ascendente, com os preços prontos para quebrar para cima, potencialmente estendendo os ganhos.

Fundamentalmente, as parcerias em expansão da Ripple e os potenciais desenvolvimentos positivos no caso da SEC apoiam o crescimento do preço. Por exemplo, a adoção do XRP por um banco europeu para pagamentos transfronteiriços poderia atrair o interesse dos investidores e elevar os preços.

Modelos quantitativos preveem um aumento para €1.2–€1.5, seguido por consolidação na faixa de €1.3–€1.4. Os investidores devem monitorar os movimentos de preço e ajustar as estratégias de acordo.

5. Recomendações de Investimento XRP

5.1 Conselhos de Investimento

Recomendações personalizadas para diferentes tipos de investidores:

Investidores de curto prazo: Dada a volatilidade esperada, os traders tolerantes ao risco podem comprar durante as quedas, definindo níveis de stop-loss e take-profit rigorosos (por exemplo, vender a €1,5, cortar perdas a €1,1). Fique atento às notícias de mercado e sinais técnicos para sair se as condições piorarem. Evite exposição excessiva devido a oscilações de curto prazo imprevisíveis.

Investidores de Médio Prazo: Concentre-se em fundamentos como o crescimento do negócio da Ripple e clareza regulatória. Acumule XRP a preços mais baixos (por exemplo, abaixo de €0.7) e mantenha-se firme através das flutuações, a menos que surjam desenvolvimentos negativos significativos (por exemplo, decisões adversas da SEC). Diversifique para mitigar o risco.

Investidores de Longo Prazo: Aloque uma parte das carteiras para XRP se for otimista sobre seu potencial de pagamentos transfronteiriços. Acompanhe o progresso tecnológico da Ripple, as tendências de adoção e as regulamentações globais. Evite superconcentração; equilibre com outros ativos. Ajuste as participações conforme as condições de mercado evoluem.

Conclusão

As tendências históricas do XRP/EUR revelam ciclos longos pronunciados e volatilidade a curto prazo, moldados por mudanças na oferta e demanda, forças macroeconômicas, regulamentações, tecnologia e sentimento. Os traders de curto prazo podem capitalizar com oscilações de preços, enquanto os investidores de longo prazo devem ponderar a utilidade do XRP contra os riscos regulatórios e de mercado. Manter-se informado, diversificar e gerenciar o risco são essenciais para navegar com sucesso nos investimentos em criptomoedas.

Artigos Relacionados

Analisando o Hack do Bybit Usando o Ataque Multi-Signature Radiant como Exemplo

Como Vender Pi Coin: Um Guia para Iniciantes

O que é BOB (Build On BNB)

Pippin: Uma nova exploração do framework de IA integrado com MEME

JOGO: O agente de IA 'engine' do ecossistema Virtuals