Tokens são mais do que apenas custos de aquisição de clientes: eles servem como ferramentas para avaliar o comportamento do usuário

Este artigo explora o papel dos tokens como ferramentas de subscrição para o comportamento do usuário no espaço cripto e analisa a mineração de airdrop, o design de incentivo de token e como gamificar e financeirizar o comportamento do usuário pode impulsionar a aquisição e retenção de usuários de forma eficaz.Você possui alguns erros, avisos ou alertas. Se estiver usando o modo imprudente, desative-o para ver informações úteis e alertas embutidos.

A maioria dos fundadores considera o CAC como uma métrica contábil. No crypto, especialmente para aplicativos ou protocolos que exigem interação frequente do usuário, está mais próximo das finanças estruturadas. Os tokens não são apenas incentivos; são instrumentos de subscrição.

Eles incorporam opções no comportamento do usuário, transformando os gastos com crescimento de um custo afundado em um portfólio de reivindicações contingentes sobre a participação futura. Quando você emite um token, você não está “recompensando” um usuário: você está efetivamente escrevendo um derivativo comportamental.

O CAC tradicional é dinheiro saindo pela porta. O CAC Token é exposição com payoff convexo, precificação endógena e momentum reflexivo. Isso não é marketing. É formação de capital, abstraída para o nível do usuário. Fazer isso corretamente é fundamental para gerar momentum ascendente em aquisição, retenção e mindshare.

Há uma razão pela qual as pessoas gostam @nikitabierestão cada vez mais envolvidos em criptografia. A criptografia é uma das últimas fronteiras, fora do desenvolvimento de agentes, onde há uma verdadeira inovação em engenharia de crescimento e distribuição.

Airdrop Farming: A Curva de Rendimento Prematura

A agricultura de airdrop é frequentemente mal compreendida. Sim, é extrativa. Sim, muitas vezes é manipulada. Mas sob a superfície mercenária há uma verdade mais profunda: os usuários estão expressando expectativas de valor do token de longo prazo e precificando seu tempo de acordo. Não é comportamento por recompensa. É comportamento como exercício de opção.

Airdrops iniciais criaram mercados de comportamento primitivo. Muitos de nós, eu incluso, começaram no DeFi com base na expectativa de recompensas futuras por meio da agricultura.

Especuladores anteciparam a generosidade do protocolo simulando convicção. Os protocolos, por sua vez, toleraram o vazamento, porque até mesmo atividades barulhentas criaram liquidez, distribuição e estrutura narrativa. Essa captura de atenção, no final das contas, ajudou na descoberta de preços.

Farming não foi um hack. Foi o primeiro mercado a precificar futuros de atenção. E, em última análise, a cripto é um local para negociar e financeirizar atenção.

CAC como Exposição Estruturada

Nos modelos tradicionais de crescimento, o CAC é uma constante. Na criptografia, é uma curva que é esculpida através de emissões, vesting, decaimento e mecânica de jogo.

Você pode pensar em cada usuário como uma fatia de exposição:

Adotantes precoces = alto risco, alta alavancagem.

Usuários avançados = fluxo de caixa estável, menor variância.

Referenciadores = agentes de distribuição com delta de rede incorporado.

Os tokens permitem que você precifique essas tranche dinamicamente, não apenas em dólares, mas em instrumentos nativos do protocolo que se valorizam reflexivamente à medida que a rede escala. Não se trata de "pagar usuários". É escrever opções de compra sobre sua futura tração e distribuí-las para aqueles que a geram.

Design de Incentivo: Convexidade Fractal

Sistemas de tokens bem projetados criam convexidade em camadas:

- Você é recompensado por agir cedo.

- Você é recompensado novamente se os outros agirem porque você agiu.

- Você é recompensado uma terceira vez se o sistema em si repassa para cima como resultado.

Alguns dos sistemas mais divertidos em cripto se inclinaram para essas mecânicas para criar pontos de Schelling naturais: reflexividade através da atividade onchain. Apenas 3;3 mano.

E todo mundo sabe que o pagamento não é linear. É recursivo. Isso cria convexidade fractal onde cada unidade de esforço gera exposição de segunda e terceira ordem ao sucesso do protocolo.

O design eficaz de incentivos codifica isso no sistema:

- Sistemas de pontos como warrants suaves e superfícies de volatilidade.

- Agendas de vencimento como bloqueios sintéticos.

- Custos de ação diferenciados (em termos de subscrição) para atrair diferentes personas de usuário, incluindo investidores.

Você não está oferecendo certeza. Você está oferecendo exposição ao potencial. É isso que faz espalhar.

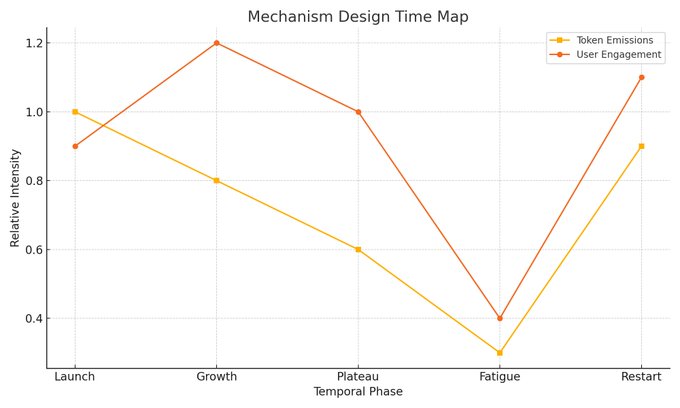

Design de Mecanismo: Tempo, Reflexividade, Ritmo

O CAC tradicional é estático. Os Tokens permitem que você controle o ritmo. Desbloqueios baseados no tempo. Emissões sazonais. Multiplicadores expirantes. Todos esses moldam a densidade comportamental, que é a frequência e intensidade do engajamento do usuário.

Sistemas CAC bem projetados equilibram:

Reflexividade (os usuários precificam seu próprio comportamento),

Escassez (janelas de ganhos se fecham),

Narrativa (o progresso é compartilhável),

Volatilidade (os resultados são incertos, mas não nulos).

Em cripto, referência não é marketing de afiliados, subcriação memética. Os usuários se tornam agentes CAC, compensados não pelo alcance, mas pela reflexão: sua capacidade de trazer outros que também desejam exposição.

Isso transforma a viralidade de um coeficiente (k-factor) em um ciclo de feedback financeiro:

- Convidar → pontos → influência → atenção → valorização do preço → mais convites.

Adiciona apostas à distribuição. A ação incentivada com alcance social torna-se uma velocidade narrativa de auto-preço.

Os Tokens são CAC com tempo. Daí o ditado: “a tecnologia é boa quando o preço sobe.” Se a reflexividade for sustentada, os efeitos de rede nativos de criptografia podem durar mais do que muitos tradicionais mecanismos de viralidade.

Hyperliquid.

Desfoque e Explosão: Extração Mecanizada de Liquidez

@blur_ioexecutou o CAC como instrumento com precisão cirúrgica.

Pontos não eram distintivos de fidelidade. Eles eram futuros de emissões, baseados em classificação e ponderados pelo tempo. Cada usuário se tornou um micro market maker competindo sob curvas de incentivo em declínio.

O quadro de líderes não era apenas gamificação. Foi a descoberta de preço onchain de quem poderia negociar com mais intensidade sob pressão. Podemos culpar o Blur por implodir o mercado de NFTs, e talvez até mesmo as finanças de NFT como um todo. A convexidade fractal significava que todos os ativos, todas as coleções e todas as ações se tornaram fortemente correlacionados.

Mas esse sistema fez exatamente o que @PacmanBlurpretende: dominar agressivamente o mercado.

Liquidez profunda. Sem queima de CAC. Assimetria de informação perfeita. Não foi marketing. Foi um leilão estruturado para liquidez e atenção.

Blast empurrou ainda mais - o CAC não era apenas um custo. Tornou-se um metajogo.

A era inicial do Blast foi um dos períodos mais divertidos no cripto para muitos usuários de dApp. Ele se inclinou fortemente para a subscrição do comportamento do usuário e financeirizou essa subscrição explicitamente. Mercados de balcão foram formados em torno do Blast Gold e Points. Equipes competiam por fluxos ao enviar e capturar a atenção. O metajogo era multi-ator, soma-zero e especulativo por design.

Muito foi dito sobre o que a equipe Blast fez certo e o que não fez, mas é óbvio para todos que o sistema Blast teve um impacto significativo no espaço de design para incentivos de token. As regras eram explícitas, a especulação foi abraçada e novos mercados foram criados em torno do valor futuro do comportamento do usuário que estava sendo subscrito de forma periódica e sistemática.

Resumo: Gamificação da Avaliação do Comportamento do Usuário

Jogos especulativos com informações incompletas são inerentemente convexos. Antes do TGE, a velocidade especulativa diminui à medida que mais clareza é obtida. A diferença entre esperança e realidade se estreita à medida que um sistema se aproxima do horizonte de eventos TGE. Algo que qualquer usuário avançado do Blast teria experimentado visceralmente em maio/junho. Como tal, equipes inteligentes estão buscando inspiração em outros lugares.

@AbstractChainO design de incentivo é menos financeirizado do que o Blast, mas a velocidade para o interesse especulativo é alimentada através da absorção de algumas lições do design de jogos. A maioria dos usuários de criptomoedas está intimamente familiarizada com os sistemas de recompensa que existem nos jogos - conquistas, status, títulos, equipamentos etc.

O Abstract é posicionado como uma L2 de uso geral acessível para aplicações de criptografia de consumo. Apenas faz sentido que o Portal Abstract leve a uma gamificação explícita das interações onchain, enquanto ainda valida o comportamento do usuário por meio da criação de XP, embora de forma menos explícita. Com base no que estou observando, sua abordagem está se mostrando sustentável.

Embora haja menos variação e foco na geração de narrativas sobre o preço futuro do token, há uma forte velocidade de aquisição de usuários e uso real e orgânico dos aplicativos. O uso de distintivos e formas de conquistas que podem ser desbloqueadas para alimentar um ciclo dopaminérgico para usuários e agricultores cria uma etapa intermediária entre uma campanha de incentivo e TGE - permitindo que a equipe da cadeia e os construtores principais não tenham pressa para lançar um token e para direcionar usuários suficientes para a cadeia para sustentar um PMF orgânico.

A Tese do App Gordo: CAC se Torna o Balanço Patrimonial

A Tese do Protocolo Gordo disse que a infra capturaria valor. Isso pode ainda ser verdade, mas os primitivos CAC aqui sugerem outra coisa:

O aplicativo é o balanço. Estes não são apenas produtos - são economias sintéticas, com suas próprias moedas, emissões e mercados de crenças. Blur.friend.tech. Explosão. Cada um engendrou sistemas CAC que inicializaram a liquidez, distribuição e narrativa em paralelo.

CAC não é um custo. É um modelo de subscrição tokenizado para crescimento. O token é capital sintético.

CAC Agora É Uma Superfície Financeira

Em criptografia, o CAC não é algo que você diminui. É algo que você precifica. Você não gasta para adquirir usuários. Você escreve instrumentos que os expõem ao potencial positivo de seu próprio comportamento.

Por isso, os melhores motores de crescimento de criptografia se parecem mais com jogos, fundos de hedge ou movimentos culturais do que startups. Eles são sistemas projetados para:

Jogos que sustentam a atenção

Superfícies financeiras que geram reflexividade

Motores de crescimento que se parecem com produtos estruturados

Embora, até certo ponto, eu ainda acredite que o embarque é um meme, e alguns dos protocolos mais bem-sucedidos no espaço são relativamente insulares, acredito que estamos nos aproximando de um ponto de inflexão onde, através da gamificação, um usuário não nativo poderá experimentar os benefícios de um protocolo ou produto endossando seu comportamento e, assim, será capaz de ver os benefícios de ter um metajogo financeiro.

A integração é um meme porque os turistas querem construir casos de uso de cripto não especulativos. Cripto, em um nível de consumidor, é pura especulação. Ouça os traders, agricultores e usuários reais, não pessoas que entraram no espaço para fazer carreira a partir da última captação de Alt L1.

A integração não acontecerá trazendo um monte de consumidores aleatórios para os aplicativos onchain, mas onde a tecnologia, o know-how e as soluções de design para subscrever o comportamento do usuário se tornam parte integrante de qualquer aplicativo de consumo em um espírito de niilismo financeiro e incerteza.

Aviso Legal:

- Este artigo é reproduzido a partir de [ Lauris]. Todos os direitos autorais pertencem ao autor original [Lauris]. Se houver objeções a esta reimpressão, entre em contato com o Gate Aprenderequipe e eles lidarão com isso prontamente.

- Isenção de Responsabilidade: As opiniões e pontos de vista expressos neste artigo são exclusivamente do autor e não constituem qualquer conselho de investimento.

- A equipe do Gate Learn faz traduções do artigo para outros idiomas. Copiar, distribuir ou plagiar os artigos traduzidos é proibido, a menos que mencionado.

Artigos Relacionados

Top 10 Empresas de Mineração de Bitcoin

Top 20 Cripto Airdrops em 2025

Uma explicação detalhada das regras do Airdrop Magic Eden (ME), passos de reivindicação e planos futuros

12 Melhores Sites para Caçar Airdrops de Cripto em 2025

Uma breve história dos lançamentos aéreos e das estratégias anti-Sybil: sobre a tradição e o futuro da cultura do parasitismo