Yusfirah

Belum ada konten

Yusfirah

#AIBotClawdbotGoesViral

Seiring kita memasuki tahun 2026, pelaporan profesional tentang crypto dan AI telah mengalami evolusi yang terlihat. Pasar sebagian besar telah melewati era peningkatan hype dan kebisingan yang didorong meme menuju permintaan analisis kecerdasan yang berisikan sinyal tinggi dan dapat dipindai yang menjelaskan tidak hanya apa yang sedang tren, tetapi mengapa hal itu penting, siapa yang mendapatkan manfaat, dan di mana ketidakseimbangan sebenarnya terletak. Kenaikan mendadak Clawdbot adalah contoh klasik dari pergeseran ini, karena mengungkapkan kesenjangan yang semakin

Seiring kita memasuki tahun 2026, pelaporan profesional tentang crypto dan AI telah mengalami evolusi yang terlihat. Pasar sebagian besar telah melewati era peningkatan hype dan kebisingan yang didorong meme menuju permintaan analisis kecerdasan yang berisikan sinyal tinggi dan dapat dipindai yang menjelaskan tidak hanya apa yang sedang tren, tetapi mengapa hal itu penting, siapa yang mendapatkan manfaat, dan di mana ketidakseimbangan sebenarnya terletak. Kenaikan mendadak Clawdbot adalah contoh klasik dari pergeseran ini, karena mengungkapkan kesenjangan yang semakin

TOKEN2,22%

- Hadiah

- 5

- 3

- Posting ulang

- Bagikan

Thynk :

:

Mengamati dengan Seksama 🔍️Lihat Lebih Banyak

#VanEckLaunchesAVAXSpotETF

Peluncuran VanEck Avalanche ETF (VAVX) di Nasdaq, efektif mulai 26 Januari 2026, menandai titik balik yang tegas dalam evolusi produk kripto institusional. Sementara ETF Bitcoin dan Ethereum spot telah menetapkan legitimasi dan jalur regulasi, VAVX memperkenalkan dimensi yang sama sekali baru: hasil on-chain native yang tertanam langsung ke dalam struktur ETF yang diatur. Ini bukan sekadar produk altcoin lainnya, melainkan peningkatan struktural dalam cara aset digital dapat disimpan, dimonetisasi, dan dibenarkan di neraca institusional.

Selama bertahun-tahun, kriti

Lihat AsliPeluncuran VanEck Avalanche ETF (VAVX) di Nasdaq, efektif mulai 26 Januari 2026, menandai titik balik yang tegas dalam evolusi produk kripto institusional. Sementara ETF Bitcoin dan Ethereum spot telah menetapkan legitimasi dan jalur regulasi, VAVX memperkenalkan dimensi yang sama sekali baru: hasil on-chain native yang tertanam langsung ke dalam struktur ETF yang diatur. Ini bukan sekadar produk altcoin lainnya, melainkan peningkatan struktural dalam cara aset digital dapat disimpan, dimonetisasi, dan dibenarkan di neraca institusional.

Selama bertahun-tahun, kriti

- Hadiah

- 3

- 3

- Posting ulang

- Bagikan

HilalSafi24 :

:

2026 GOGOGO 👊2026 GOGOGO 👊2026 GOGOGO 👊Lihat Lebih Banyak

#GrowthPointsDrawRound16

Putaran Pengundian Growth Points Putaran 16 telah muncul sebagai pilar utama keterlibatan komunitas di fase pembukaan tahun 2026, mencerminkan bagaimana platform digital secara fundamental telah meningkatkan mekanisme loyalitas mereka. Apa yang dulunya berfungsi sebagai sistem poin-untuk-aktivitas sederhana kini telah matang menjadi ekonomi partisipasi skala penuh, di mana keterlibatan yang konsisten dihargai dengan hasil yang nyata dan bernilai tinggi. Putaran 16, khususnya, menonjol karena selaras sempurna dengan pola pikir reset musiman Tahun Baru, menggabungkan ha

Lihat AsliPutaran Pengundian Growth Points Putaran 16 telah muncul sebagai pilar utama keterlibatan komunitas di fase pembukaan tahun 2026, mencerminkan bagaimana platform digital secara fundamental telah meningkatkan mekanisme loyalitas mereka. Apa yang dulunya berfungsi sebagai sistem poin-untuk-aktivitas sederhana kini telah matang menjadi ekonomi partisipasi skala penuh, di mana keterlibatan yang konsisten dihargai dengan hasil yang nyata dan bernilai tinggi. Putaran 16, khususnya, menonjol karena selaras sempurna dengan pola pikir reset musiman Tahun Baru, menggabungkan ha

- Hadiah

- 2

- 2

- Posting ulang

- Bagikan

Peacefulheart :

:

2026 GOGOGO 👊Lihat Lebih Banyak

#GoldandSilverHitNewHighs

Seiring kita melangkah ke akhir Januari 2026, pasar logam mulia tidak sekadar “menguat” tetapi sedang menyusun penilaian ulang historis yang mencerminkan pergeseran struktural mendalam dalam aliran modal global, rezim fiskal, dan penetapan harga risiko geopolitik. Pada 26 Januari 2026, emas melonjak ke level tertinggi di atas $5.100 per ons, didorong oleh permintaan safe-haven yang intens di tengah volatilitas makroekonomi, ketidakpastian kebijakan, dan melemahnya dolar AS, sementara perak juga mencatat rekor tertinggi baru di atas $110 per ons, sebuah hasil luar bi

Lihat AsliSeiring kita melangkah ke akhir Januari 2026, pasar logam mulia tidak sekadar “menguat” tetapi sedang menyusun penilaian ulang historis yang mencerminkan pergeseran struktural mendalam dalam aliran modal global, rezim fiskal, dan penetapan harga risiko geopolitik. Pada 26 Januari 2026, emas melonjak ke level tertinggi di atas $5.100 per ons, didorong oleh permintaan safe-haven yang intens di tengah volatilitas makroekonomi, ketidakpastian kebijakan, dan melemahnya dolar AS, sementara perak juga mencatat rekor tertinggi baru di atas $110 per ons, sebuah hasil luar bi

- Hadiah

- 1

- 1

- Posting ulang

- Bagikan

ybaser :

:

Selamat Tahun Baru! 🤑#TrumpWithdrawsEUTariffThreats

Pembalikan mendadak dari yang disebut “Tarif Greenland” yaitu rencana pungutan sepuluh persen pada delapan negara Eropa yang awalnya dijadwalkan berlaku pada 1 Februari 2026 telah memberikan rasa lega yang nyata di seluruh pasar global. Apa yang hanya beberapa hari lalu terlihat seperti tembakan awal dari konflik perdagangan transatlantik yang diperbarui kini telah beralih menjadi apa yang dapat digambarkan sebagai de-eskalasi taktis. Meskipun sengketa geopolitik yang lebih luas seputar kepentingan strategis AS di Greenland tetap belum terselesaikan, pembatalan

Lihat AsliPembalikan mendadak dari yang disebut “Tarif Greenland” yaitu rencana pungutan sepuluh persen pada delapan negara Eropa yang awalnya dijadwalkan berlaku pada 1 Februari 2026 telah memberikan rasa lega yang nyata di seluruh pasar global. Apa yang hanya beberapa hari lalu terlihat seperti tembakan awal dari konflik perdagangan transatlantik yang diperbarui kini telah beralih menjadi apa yang dapat digambarkan sebagai de-eskalasi taktis. Meskipun sengketa geopolitik yang lebih luas seputar kepentingan strategis AS di Greenland tetap belum terselesaikan, pembatalan

- Hadiah

- 4

- 2

- Posting ulang

- Bagikan

ybaser :

:

Selamat Tahun Baru! 🤑Lihat Lebih Banyak

#BitcoinFallsBehindGold

Rasio Bitcoin terhadap Emas telah mencapai tingkat yang secara historis memerlukan perhatian, bukan karena menandakan pembalikan langsung, tetapi karena menyoroti divergensi langka antara dua aset yang bersaing untuk narasi yang sama: perlindungan moneter. Hingga akhir Januari 2026, rasio ini telah turun ke kisaran 17,6 hingga 18,4, menempatkannya lebih dari tujuh belas persen di bawah rata-rata pergerakan 200 minggu. Ini bukan deviasi yang sepele. Pada saat yang sama, Bitcoin tetap berada dalam kisaran dekat zona delapan puluh delapan hingga sembilan puluh ribu dolar,

Rasio Bitcoin terhadap Emas telah mencapai tingkat yang secara historis memerlukan perhatian, bukan karena menandakan pembalikan langsung, tetapi karena menyoroti divergensi langka antara dua aset yang bersaing untuk narasi yang sama: perlindungan moneter. Hingga akhir Januari 2026, rasio ini telah turun ke kisaran 17,6 hingga 18,4, menempatkannya lebih dari tujuh belas persen di bawah rata-rata pergerakan 200 minggu. Ini bukan deviasi yang sepele. Pada saat yang sama, Bitcoin tetap berada dalam kisaran dekat zona delapan puluh delapan hingga sembilan puluh ribu dolar,

BTC-0,06%

- Hadiah

- 1

- 1

- Posting ulang

- Bagikan

ybaser :

:

Selamat Tahun Baru! 🤑#RIVERUp50xinOneMonth

Lonjakan RIVER dari sekitar empat dolar pada akhir Desember 2025 ke puncaknya mendekati delapan puluh tujuh dolar—sebelum stabil di kisaran tujuh puluh hingga tujuh puluh lima dolar sekitar 26 Januari 2026, menonjol sebagai salah satu pergerakan paling agresif dan mencolok secara visual tahun ini. Jenis “Lilin Tuhan” ini jarang muncul tanpa narasi mendalam yang kuat, tetapi hampir tidak pernah terjadi tanpa distorsi. Dalam kasus RIVER, reli mencerminkan benturan antara inovasi teknologi yang nyata dan mekanisme gelap dari konsentrasi pasokan serta pengendalian pasar. Yan

Lihat AsliLonjakan RIVER dari sekitar empat dolar pada akhir Desember 2025 ke puncaknya mendekati delapan puluh tujuh dolar—sebelum stabil di kisaran tujuh puluh hingga tujuh puluh lima dolar sekitar 26 Januari 2026, menonjol sebagai salah satu pergerakan paling agresif dan mencolok secara visual tahun ini. Jenis “Lilin Tuhan” ini jarang muncul tanpa narasi mendalam yang kuat, tetapi hampir tidak pernah terjadi tanpa distorsi. Dalam kasus RIVER, reli mencerminkan benturan antara inovasi teknologi yang nyata dan mekanisme gelap dari konsentrasi pasokan serta pengendalian pasar. Yan

- Hadiah

- 3

- 1

- Posting ulang

- Bagikan

ybaser :

:

Selamat Tahun Baru! 🤑#DOGEETFListsonNasdaq

Peluncuran ETF Dogecoin 21Shares, yang diperdagangkan dengan kode TDOG di Nasdaq mulai 22 Januari 2026, menandai titik balik tidak hanya untuk Dogecoin itu sendiri, tetapi juga untuk legitimasi yang lebih luas dari aset digital yang didorong oleh budaya. Apa yang dulu dianggap sebagai meme spekulatif semata kini telah melewati ambang regulasi yang secara fundamental mengubah profil risikonya. Dengan dukungan resmi dari Dogecoin Foundation dan persetujuan formal dari U.S. Securities and Exchange Commission, DOGE secara efektif keluar dari zona abu-abu yang lama menghantui

Lihat AsliPeluncuran ETF Dogecoin 21Shares, yang diperdagangkan dengan kode TDOG di Nasdaq mulai 22 Januari 2026, menandai titik balik tidak hanya untuk Dogecoin itu sendiri, tetapi juga untuk legitimasi yang lebih luas dari aset digital yang didorong oleh budaya. Apa yang dulu dianggap sebagai meme spekulatif semata kini telah melewati ambang regulasi yang secara fundamental mengubah profil risikonya. Dengan dukungan resmi dari Dogecoin Foundation dan persetujuan formal dari U.S. Securities and Exchange Commission, DOGE secara efektif keluar dari zona abu-abu yang lama menghantui

- Hadiah

- 3

- 2

- Posting ulang

- Bagikan

HighAmbition :

:

GOGOGO 2026 👊Lihat Lebih Banyak

#CryptoMarketWatch

Seiring kita melewati hari-hari terakhir Januari 2026, pasar cryptocurrency tidak hanya mengkonsolidasi tetapi sedang mengalami transisi yang tenang namun mendalam. Apa yang banyak peserta anggap sebagai kebingungan atau kelemahan, sebenarnya adalah gesekan yang secara alami muncul ketika kelas aset berkembang dari spekulasi menjadi infrastruktur. Narasi siklus empat tahun yang sudah lama berlangsung, yang dulunya dapat diandalkan di lingkungan yang didominasi ritel, kini sedang diuji ketahanan oleh pergeseran struktural dalam komposisi pasar. Modal tidak lagi mengejar nara

Lihat AsliSeiring kita melewati hari-hari terakhir Januari 2026, pasar cryptocurrency tidak hanya mengkonsolidasi tetapi sedang mengalami transisi yang tenang namun mendalam. Apa yang banyak peserta anggap sebagai kebingungan atau kelemahan, sebenarnya adalah gesekan yang secara alami muncul ketika kelas aset berkembang dari spekulasi menjadi infrastruktur. Narasi siklus empat tahun yang sudah lama berlangsung, yang dulunya dapat diandalkan di lingkungan yang didominasi ritel, kini sedang diuji ketahanan oleh pergeseran struktural dalam komposisi pasar. Modal tidak lagi mengejar nara

- Hadiah

- 5

- 4

- Posting ulang

- Bagikan

Keleb3k :

:

Beli Untuk Mendapatkan 💎Lihat Lebih Banyak

#GoldandSilverHitNewHighs

Era $5.000 Dimulai: Mengapa Emas dan Perak Dinilai Ulang, Bukan Hanya Mengalami Kenaikan

Sistem keuangan global telah melewati titik balik. Emas yang menembus secara tegas di atas ambang $5.000 bukan sekadar tonggak yang menarik perhatian itu adalah sinyal. Sebuah sinyal bahwa pasar sedang menilai kembali risiko, kepercayaan, dan ketahanan sistem berbasis fiat dalam dunia yang semakin cepat terfragmentasi. Dengan emas diperdagangkan di atas $5.090 per ons dan perak melanjutkan lonjakan eksplosifnya melewati $109 per ons, 2026 tampaknya akan menjadi tahun penentu bag

Era $5.000 Dimulai: Mengapa Emas dan Perak Dinilai Ulang, Bukan Hanya Mengalami Kenaikan

Sistem keuangan global telah melewati titik balik. Emas yang menembus secara tegas di atas ambang $5.000 bukan sekadar tonggak yang menarik perhatian itu adalah sinyal. Sebuah sinyal bahwa pasar sedang menilai kembali risiko, kepercayaan, dan ketahanan sistem berbasis fiat dalam dunia yang semakin cepat terfragmentasi. Dengan emas diperdagangkan di atas $5.090 per ons dan perak melanjutkan lonjakan eksplosifnya melewati $109 per ons, 2026 tampaknya akan menjadi tahun penentu bag

Lihat Asli

- Hadiah

- 5

- 6

- Posting ulang

- Bagikan

ybaser :

:

2026 Ayo Ayo Ayo 👊2026 Ayo Ayo Ayo 👊2026 Ayo Ayo Ayo 👊2026 Ayo Ayo Ayo 👊2026 Ayo Ayo Ayo 👊2026 Ayo Ayo Ayo 👊2026 Ayo Ayo Ayo 👊2026 Ayo Ayo Ayo 👊Lihat Lebih Banyak

#ContentMiningRevampPublicBeta

Kekuatan Pengetahuan: Konten Adalah Penambangan Generasi Baru

Ekosistem keuangan digital sedang mengalami transformasi struktural pada tahun 2026. Crypto tidak lagi didefinisikan hanya oleh aksi harga, leverage, atau volume transaksi. Ia telah matang menjadi ekonomi informasi yang didorong oleh nilai, di mana pengetahuan, analisis, dan kredibilitas kini berfungsi sebagai aset yang dapat diukur.

Konten tidak lagi bersifat perifer — ia telah menjadi modal produktif.

Dengan peluncuran #ContentMiningRevampPublicBeta, kami menyaksikan pergeseran paradigma:

pembuat ko

Kekuatan Pengetahuan: Konten Adalah Penambangan Generasi Baru

Ekosistem keuangan digital sedang mengalami transformasi struktural pada tahun 2026. Crypto tidak lagi didefinisikan hanya oleh aksi harga, leverage, atau volume transaksi. Ia telah matang menjadi ekonomi informasi yang didorong oleh nilai, di mana pengetahuan, analisis, dan kredibilitas kini berfungsi sebagai aset yang dapat diukur.

Konten tidak lagi bersifat perifer — ia telah menjadi modal produktif.

Dengan peluncuran #ContentMiningRevampPublicBeta, kami menyaksikan pergeseran paradigma:

pembuat ko

DEFI4,47%

- Hadiah

- 10

- 9

- Posting ulang

- Bagikan

ybaser :

:

2026 Ayo Ayo Ayo 👊2026 Ayo Ayo Ayo 👊2026 Ayo Ayo Ayo 👊2026 Ayo Ayo Ayo 👊Lihat Lebih Banyak

#ContentMiningRevampPublicBeta

Kekuatan Pengetahuan: Konten Adalah Penambangan Generasi Baru

Ekosistem keuangan digital sedang mengalami transformasi struktural pada tahun 2026. Crypto tidak lagi didefinisikan hanya oleh aksi harga, leverage, atau volume transaksi. Ia telah matang menjadi ekonomi informasi yang didorong oleh nilai, di mana pengetahuan, analisis, dan kredibilitas kini berfungsi sebagai aset yang dapat diukur.

Konten tidak lagi bersifat perifer — ia telah menjadi modal produktif.

Dengan peluncuran #ContentMiningRevampPublicBeta, kami menyaksikan pergeseran paradigma:

pembuat ko

Kekuatan Pengetahuan: Konten Adalah Penambangan Generasi Baru

Ekosistem keuangan digital sedang mengalami transformasi struktural pada tahun 2026. Crypto tidak lagi didefinisikan hanya oleh aksi harga, leverage, atau volume transaksi. Ia telah matang menjadi ekonomi informasi yang didorong oleh nilai, di mana pengetahuan, analisis, dan kredibilitas kini berfungsi sebagai aset yang dapat diukur.

Konten tidak lagi bersifat perifer — ia telah menjadi modal produktif.

Dengan peluncuran #ContentMiningRevampPublicBeta, kami menyaksikan pergeseran paradigma:

pembuat ko

DEFI4,47%

- Hadiah

- 7

- 6

- Posting ulang

- Bagikan

Ryakpanda :

:

Terburu-buru 2026 👊Lihat Lebih Banyak

#CryptoMarketWatch

Menavigasi Volatilitas Pasar dan Penempatan Posisi di Tengah Divergensi Sentimen

Pasar cryptocurrency saat ini sedang mengalami fase volatilitas yang meningkat, didorong oleh divergensi yang mencolok antara sentimen bullish dan bearish. Bitcoin, Ethereum, dan aset digital utama lainnya sedang mengkonsolidasi setelah reli kuat di awal bulan. Bitcoin stabil di sekitar $88.000–$90.000, sementara Ethereum mempertahankan dukungan di dekat $2.950–$3.100, dan altcoin tertentu menunjukkan pola akumulasi dan retracement yang campur aduk. Periode ini tidak boleh diartikan sebagai ke

Lihat AsliMenavigasi Volatilitas Pasar dan Penempatan Posisi di Tengah Divergensi Sentimen

Pasar cryptocurrency saat ini sedang mengalami fase volatilitas yang meningkat, didorong oleh divergensi yang mencolok antara sentimen bullish dan bearish. Bitcoin, Ethereum, dan aset digital utama lainnya sedang mengkonsolidasi setelah reli kuat di awal bulan. Bitcoin stabil di sekitar $88.000–$90.000, sementara Ethereum mempertahankan dukungan di dekat $2.950–$3.100, dan altcoin tertentu menunjukkan pola akumulasi dan retracement yang campur aduk. Periode ini tidak boleh diartikan sebagai ke

- Hadiah

- 15

- 19

- Posting ulang

- Bagikan

Ryakpanda :

:

2026冲冲冲 👊Lihat Lebih Banyak

#CLARITYBillDelayed

Ketidakpastian Regulasi, Inovasi DeFi, dan Evolusi Stablecoin

RUU CLARITY, yang dirancang untuk membangun kerangka regulasi komprehensif bagi stablecoin, protokol DeFi, dan ekosistem keuangan digital yang lebih luas, kembali mengalami penundaan, mencerminkan ketidaksepakatan mendalam di antara pembuat kebijakan, regulator, dan pemangku kepentingan industri. Pada intinya, perdebatan berpusat pada ketegangan mendasar: bagaimana memastikan perlindungan investor, stabilitas sistemik, dan kepatuhan terhadap regulasi keuangan yang ada sambil tetap memungkinkan inovasi cepat yang

Lihat AsliKetidakpastian Regulasi, Inovasi DeFi, dan Evolusi Stablecoin

RUU CLARITY, yang dirancang untuk membangun kerangka regulasi komprehensif bagi stablecoin, protokol DeFi, dan ekosistem keuangan digital yang lebih luas, kembali mengalami penundaan, mencerminkan ketidaksepakatan mendalam di antara pembuat kebijakan, regulator, dan pemangku kepentingan industri. Pada intinya, perdebatan berpusat pada ketegangan mendasar: bagaimana memastikan perlindungan investor, stabilitas sistemik, dan kepatuhan terhadap regulasi keuangan yang ada sambil tetap memungkinkan inovasi cepat yang

- Hadiah

- 15

- 19

- Posting ulang

- Bagikan

Ryakpanda :

:

Terburu-buru 2026 👊Lihat Lebih Banyak

#ETHTrendWatch

Menavigasi Konsolidasi Ethereum dan Dinamika Pasar

Ethereum (ETH), mata uang kripto terbesar kedua di dunia, saat ini mengalami fase konsolidasi berkisar, mencerminkan pasar yang menyeimbangkan sinyal teknis dengan pertimbangan makroekonomi. Per 25 Januari 2026, ETH diperdagangkan dalam kisaran $2.970–$3.200, setelah periode aksi harga yang berombak dan retracement dari level tertinggi terbaru. Fase konsolidasi ini menandakan bahwa peserta pasar sedang menimbang akumulasi terhadap pengambilan keuntungan jangka pendek, dan menyoroti pentingnya perdagangan yang disiplin dan berba

Lihat AsliMenavigasi Konsolidasi Ethereum dan Dinamika Pasar

Ethereum (ETH), mata uang kripto terbesar kedua di dunia, saat ini mengalami fase konsolidasi berkisar, mencerminkan pasar yang menyeimbangkan sinyal teknis dengan pertimbangan makroekonomi. Per 25 Januari 2026, ETH diperdagangkan dalam kisaran $2.970–$3.200, setelah periode aksi harga yang berombak dan retracement dari level tertinggi terbaru. Fase konsolidasi ini menandakan bahwa peserta pasar sedang menimbang akumulasi terhadap pengambilan keuntungan jangka pendek, dan menyoroti pentingnya perdagangan yang disiplin dan berba

- Hadiah

- 17

- 18

- Posting ulang

- Bagikan

Ryakpanda :

:

Terburu-buru 2026 👊Lihat Lebih Banyak

#TheWorldEconomicForum

Davos 2026 dan Implikasi untuk Kripto, Aset Digital, dan Pasar Global

Forum Ekonomi Dunia (WEF) yang ke-56, yang diadakan di Davos, Swiss dari 19–23 Januari 2026, berakhir dengan fokus yang diperbarui pada persimpangan geopolitik, inovasi teknologi, dan ketahanan ekonomi. Pertemuan tahun ini, dengan tema “Semangat Dialog,” mempertemukan hampir 3.000 peserta dari lebih dari 130 negara, termasuk kepala negara, CEO perusahaan global, pemimpin keuangan, dan perwakilan masyarakat sipil. Salah satu aspek paling mencolok dari diskusi adalah pengakuan yang semakin meningkat ter

Davos 2026 dan Implikasi untuk Kripto, Aset Digital, dan Pasar Global

Forum Ekonomi Dunia (WEF) yang ke-56, yang diadakan di Davos, Swiss dari 19–23 Januari 2026, berakhir dengan fokus yang diperbarui pada persimpangan geopolitik, inovasi teknologi, dan ketahanan ekonomi. Pertemuan tahun ini, dengan tema “Semangat Dialog,” mempertemukan hampir 3.000 peserta dari lebih dari 130 negara, termasuk kepala negara, CEO perusahaan global, pemimpin keuangan, dan perwakilan masyarakat sipil. Salah satu aspek paling mencolok dari diskusi adalah pengakuan yang semakin meningkat ter

DEFI4,47%

- Hadiah

- 13

- 14

- Posting ulang

- Bagikan

Ryakpanda :

:

Terburu-buru 2026 👊Lihat Lebih Banyak

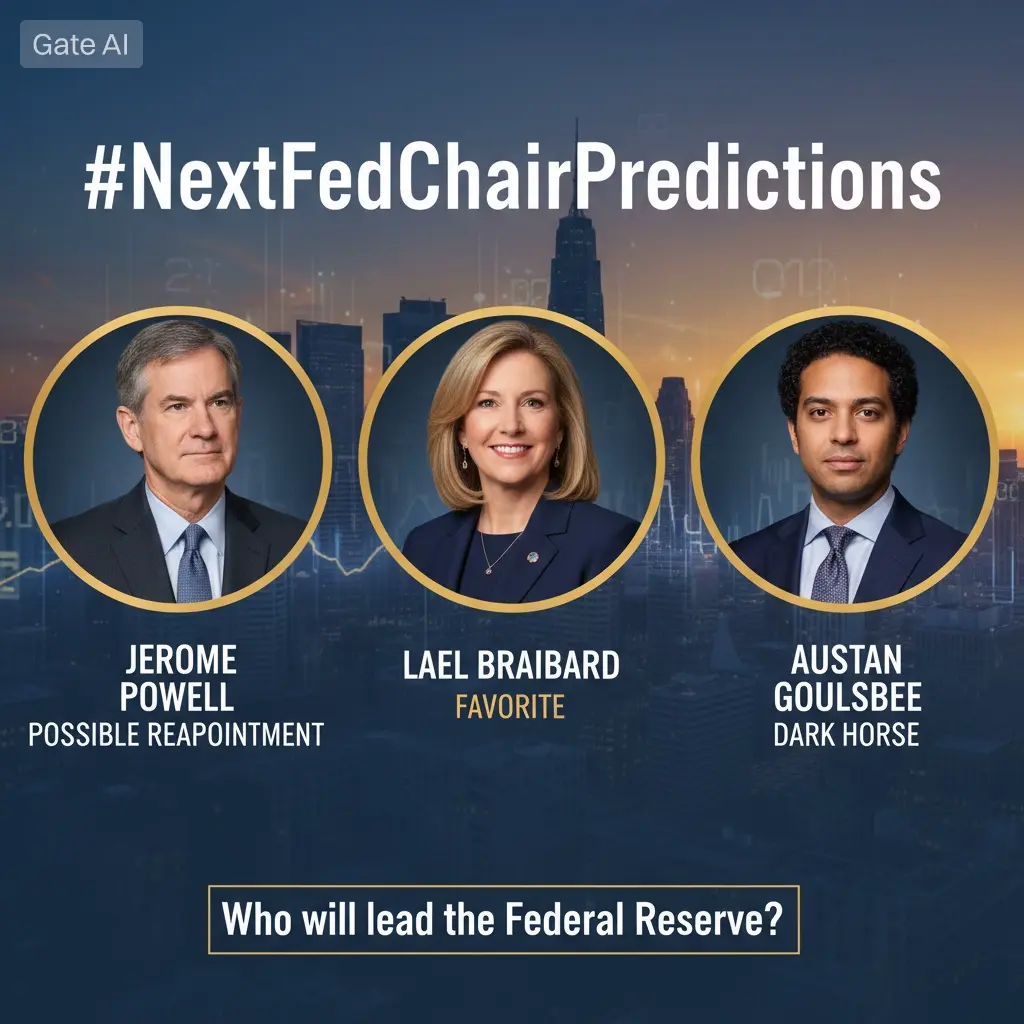

#NextFedChairPredictions

Pemimpin Berikutnya Federal Reserve dan Implikasi Pasar Global

Seiring berjalannya tahun 2026, pasar global semakin fokus pada pertanyaan siapa yang akan mengambil alih peran Ketua Federal Reserve berikutnya, dan implikasi potensialnya sangat besar. Ini bukan hanya acara politik domestik AS — keputusan dan filosofi kebijakan Ketua Fed secara langsung mempengaruhi suku bunga, aliran likuiditas, penilaian aset, dan selera risiko di seluruh dunia. Peserta pasar sudah memperhitungkan ekspektasi, mencerminkan kekuatan persepsi bahkan sebelum pengangkatan resmi dikonfirmasi

Lihat AsliPemimpin Berikutnya Federal Reserve dan Implikasi Pasar Global

Seiring berjalannya tahun 2026, pasar global semakin fokus pada pertanyaan siapa yang akan mengambil alih peran Ketua Federal Reserve berikutnya, dan implikasi potensialnya sangat besar. Ini bukan hanya acara politik domestik AS — keputusan dan filosofi kebijakan Ketua Fed secara langsung mempengaruhi suku bunga, aliran likuiditas, penilaian aset, dan selera risiko di seluruh dunia. Peserta pasar sudah memperhitungkan ekspektasi, mencerminkan kekuatan persepsi bahkan sebelum pengangkatan resmi dikonfirmasi

- Hadiah

- 12

- 16

- Posting ulang

- Bagikan

Ryakpanda :

:

Terburu-buru 2026 👊Lihat Lebih Banyak

#JapanBondMarketSell-Off

Gelembung Global dari Imbal Hasil yang Meningkat

Pasar obligasi Jepang baru-baru ini mengalami penjualan besar-besaran, dengan imbal hasil obligasi pemerintah 30 tahun dan 40 tahun melonjak lebih dari 25 basis poin, setelah pengumuman rencana untuk melonggarkan pengetatan fiskal dan meningkatkan pengeluaran pemerintah. Langkah ini menandai titik balik potensial dalam lingkungan imbal hasil yang sangat rendah yang telah mendominasi Jepang selama beberapa dekade, dan implikasinya melampaui pasar utang domestik. Jepang secara historis menjadi pilar utama pendapatan tetap

Lihat AsliGelembung Global dari Imbal Hasil yang Meningkat

Pasar obligasi Jepang baru-baru ini mengalami penjualan besar-besaran, dengan imbal hasil obligasi pemerintah 30 tahun dan 40 tahun melonjak lebih dari 25 basis poin, setelah pengumuman rencana untuk melonggarkan pengetatan fiskal dan meningkatkan pengeluaran pemerintah. Langkah ini menandai titik balik potensial dalam lingkungan imbal hasil yang sangat rendah yang telah mendominasi Jepang selama beberapa dekade, dan implikasinya melampaui pasar utang domestik. Jepang secara historis menjadi pilar utama pendapatan tetap

- Hadiah

- 16

- 15

- Posting ulang

- Bagikan

Ryakpanda :

:

Terburu-buru 2026 👊Lihat Lebih Banyak

#GrowthPointsDrawRound16

Maksimalkan Hadiah dan Keterlibatan Anda Tahun Baru Ini

Edisi ke-16 dari Growth Points Draw kini telah berlangsung, menawarkan peserta peluang menarik untuk menggabungkan keterlibatan harian di platform dengan hadiah nyata. Berlangsung dari 21 Januari hingga 31 Januari 2026, kampanye ini memungkinkan pengguna mendapatkan Growth Points dengan melakukan tindakan sederhana namun bermakna di platform komunitas Gate.io termasuk memposting, mengomentari, menyukai, dan berpartisipasi dalam diskusi di Gate Square. Setelah peserta mengumpulkan 300 Growth Points, mereka menjadi

Lihat AsliMaksimalkan Hadiah dan Keterlibatan Anda Tahun Baru Ini

Edisi ke-16 dari Growth Points Draw kini telah berlangsung, menawarkan peserta peluang menarik untuk menggabungkan keterlibatan harian di platform dengan hadiah nyata. Berlangsung dari 21 Januari hingga 31 Januari 2026, kampanye ini memungkinkan pengguna mendapatkan Growth Points dengan melakukan tindakan sederhana namun bermakna di platform komunitas Gate.io termasuk memposting, mengomentari, menyukai, dan berpartisipasi dalam diskusi di Gate Square. Setelah peserta mengumpulkan 300 Growth Points, mereka menjadi

- Hadiah

- 10

- 13

- Posting ulang

- Bagikan

Ryakpanda :

:

Terburu-buru 2026 👊Lihat Lebih Banyak

Topik Trending

Lihat Lebih Banyak40.75K Popularitas

4.19K Popularitas

3.47K Popularitas

2.01K Popularitas

1.92K Popularitas

Hot Gate Fun

Lihat Lebih Banyak- MC:$3.38KHolder:10.00%

- 2

狗头

狗头

MC:$3.5KHolder:40.35% - MC:$3.38KHolder:10.00%

- 4

狗头

狗头

MC:$3.61KHolder:41.05% - MC:$3.38KHolder:10.00%

Sematkan