Lab4crypto

Контент поки що відсутній

Lab4crypto

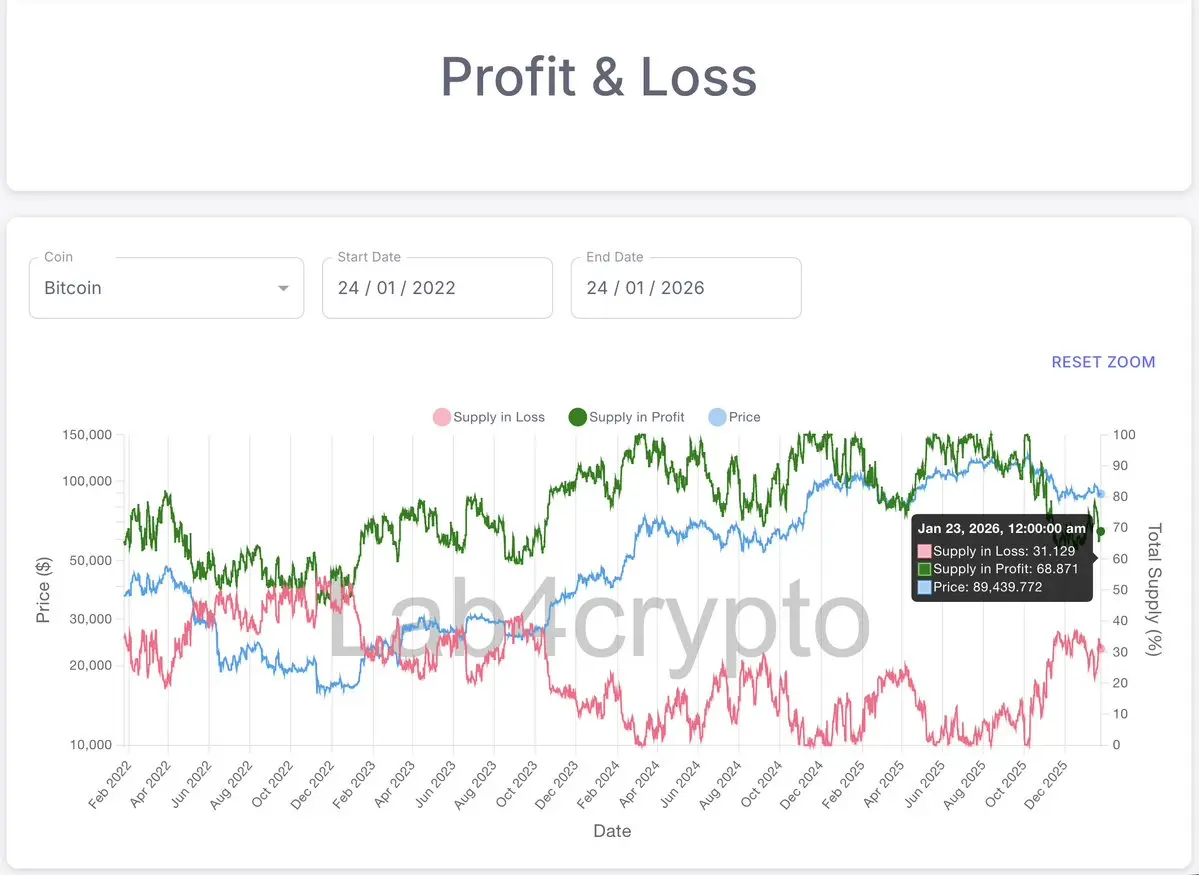

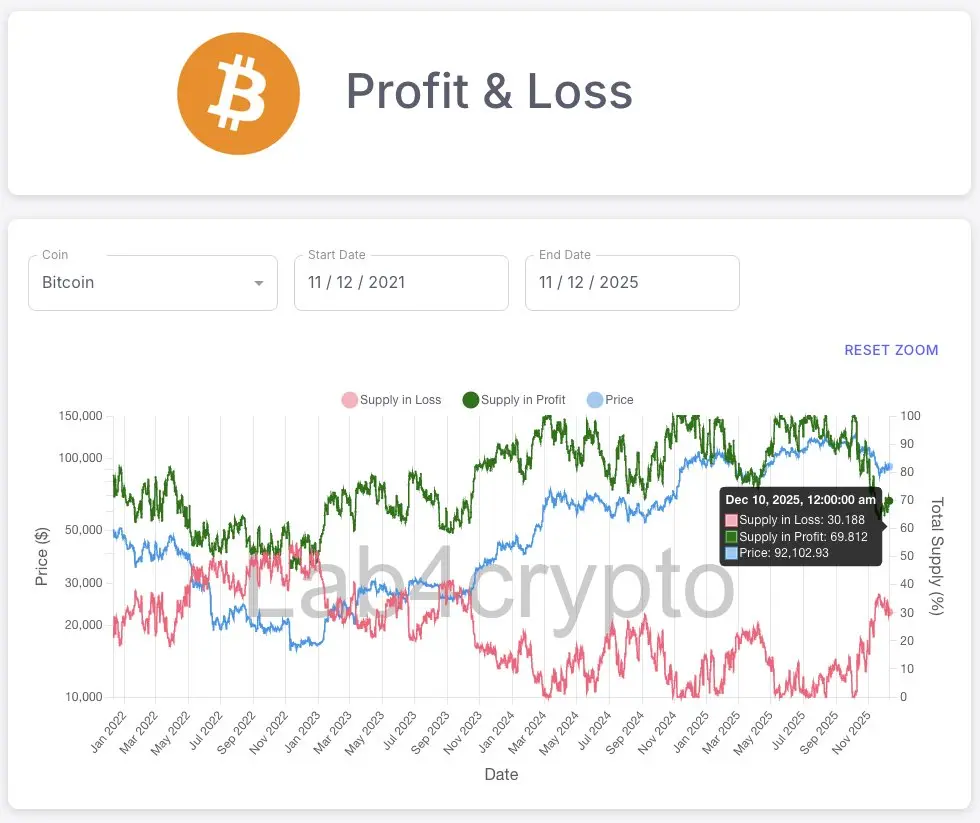

Запас Bitcoin у прибутку показує, як тиск на продаж зменшується, оскільки менше людей готові продавати з збитком. Чи вважаєте ви, що дно вже пройдено, або ринок чекає на Закон про ясність?

BTC1,13%

- Нагородити

- подобається

- Прокоментувати

- Репост

- Поділіться

Крах FTX призвів до 1,2 мільярда ліквідацій, у звичайний вівторок ми отримали 1 мільярд.

Переглянути оригінал- Нагородити

- подобається

- Прокоментувати

- Репост

- Поділіться

Чи почнемо ми бачити більше зелених днів для ETF?

Переглянути оригінал- Нагородити

- 1

- Прокоментувати

- Репост

- Поділіться

Залишаю це тут

Переглянути оригінал

- Нагородити

- подобається

- Прокоментувати

- Репост

- Поділіться

Ризик короткострокової бульбашки Bitcoin (Ціна / 20W SMA) наближається до 1.

Історично, коли BTC залишається нижче цього рівня протягом тривалого часу і потім повертається до нього, наступний рух зазвичай є волатильним у бік зростання.

Поточний ключовий рівень опору знаходиться приблизно на рівні $102K.

Це рівень, який варто дуже уважно стежити.

Історично, коли BTC залишається нижче цього рівня протягом тривалого часу і потім повертається до нього, наступний рух зазвичай є волатильним у бік зростання.

Поточний ключовий рівень опору знаходиться приблизно на рівні $102K.

Це рівень, який варто дуже уважно стежити.

BTC1,13%

- Нагородити

- подобається

- Прокоментувати

- Репост

- Поділіться

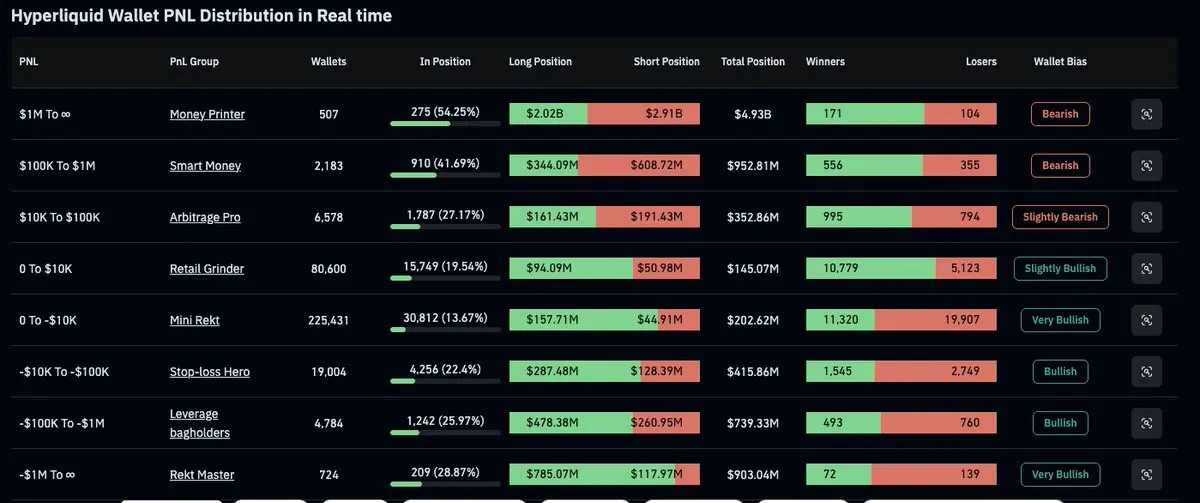

Чи змінить рішення Верховного суду щодо тарифів Трампа песимізм розумних інвесторів на оптимізм?

Ринки вказують на ймовірність 70-75% ухвалення рішення проти них.

Переглянути оригіналРинки вказують на ймовірність 70-75% ухвалення рішення проти них.

- Нагородити

- подобається

- Прокоментувати

- Репост

- Поділіться

Січень, ймовірно, визначить, чи підтвердить Bitcoin ведмежий ринок, чи відновить імпульс для наступного етапу бичачого циклу.

Я щойно опублікував новий блог, у якому розбираю:

• чому листопад–грудень були структурно слабкими

• що сигналізують дані обсягу та ризиків

• основні січневі каталізатори, які дійсно мають значення

Читайте тут 👇

Я щойно опублікував новий блог, у якому розбираю:

• чому листопад–грудень були структурно слабкими

• що сигналізують дані обсягу та ризиків

• основні січневі каталізатори, які дійсно мають значення

Читайте тут 👇

BTC1,13%

- Нагородити

- подобається

- Прокоментувати

- Репост

- Поділіться

29 грудня відбулися зміни у поведінці китів Bitcoin. Від чистих продавців вони почали накопичувати.

BTC1,13%

- Нагородити

- подобається

- Прокоментувати

- Репост

- Поділіться

- Нагородити

- подобається

- Прокоментувати

- Репост

- Поділіться

Зниження Bitcoin від його історичного максимуму становить лише 29%, але здається, що це 90%. Настрій у криптосфері на найнижчому рівні за весь час.

BTC1,13%

- Нагородити

- подобається

- Прокоментувати

- Репост

- Поділіться

- Нагородити

- 1

- Прокоментувати

- Репост

- Поділіться

Щасливого Різдва та найкращих побажань здорового, процвітаючого та наповненого Нового року.

Переглянути оригінал- Нагородити

- подобається

- Прокоментувати

- Репост

- Поділіться

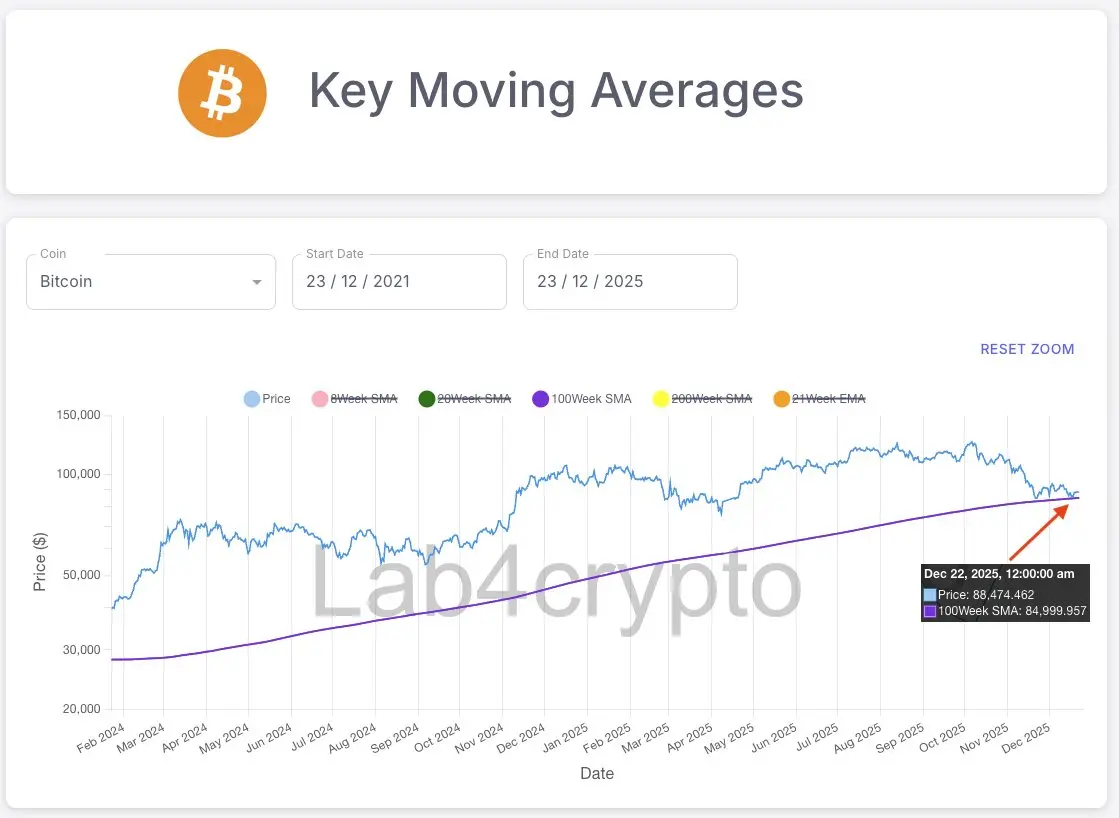

Сотий тижневий SMA Біткойна діяв як структурна підтримка з листопада 2022 року.

BTC наразі перепродана, і поки 100W SMA тримається, умови сприяють відскоку в найближчій перспективі.

BTC наразі перепродана, і поки 100W SMA тримається, умови сприяють відскоку в найближчій перспективі.

BTC1,13%

- Нагородити

- подобається

- Прокоментувати

- Репост

- Поділіться

Біткойн кричить про відскок. Тепер питання: чи утримається відскок або буде проданий?

BTC1,13%

- Нагородити

- 1

- 1

- Репост

- Поділіться

Elite_Block :

:

Різдвяний бичачий ринок! 🐂Оскільки пропозиція Біткойна з прибутком зменшується, тиск на продаж також зменшується.

BTC1,13%

- Нагородити

- 1

- 1

- Репост

- Поділіться

Elite_Block :

:

Різдвяний бичачий ринок! 🐂Крипторинок змінюється прямо на наших очах, і більшість людей цього не помічає.

Візьмемо біткоїн.

Його цінова динаміка більше не визначається "ринком". Нею керує жменька великих китів, які досі вірять, що біткоїн повинен підкорятися старому пророцтву, згідно з яким цикл завжди досягає піку в четвертому кварталі після халвінгу.

Через цю віру вони чинять величезний тиск на продаж.

Ми є свідками найбільшого в історії перерозподілу біткоїн-багатства від старих китів до інституцій та роздрібних інвесторів.

Водночас світ змінюється:

• ОАЕ відкрито підтримує біткоїн.

• ETF продовжують нарощувати свої

Візьмемо біткоїн.

Його цінова динаміка більше не визначається "ринком". Нею керує жменька великих китів, які досі вірять, що біткоїн повинен підкорятися старому пророцтву, згідно з яким цикл завжди досягає піку в четвертому кварталі після халвінгу.

Через цю віру вони чинять величезний тиск на продаж.

Ми є свідками найбільшого в історії перерозподілу біткоїн-багатства від старих китів до інституцій та роздрібних інвесторів.

Водночас світ змінюється:

• ОАЕ відкрито підтримує біткоїн.

• ETF продовжують нарощувати свої

BTC1,13%

- Нагородити

- подобається

- Прокоментувати

- Репост

- Поділіться

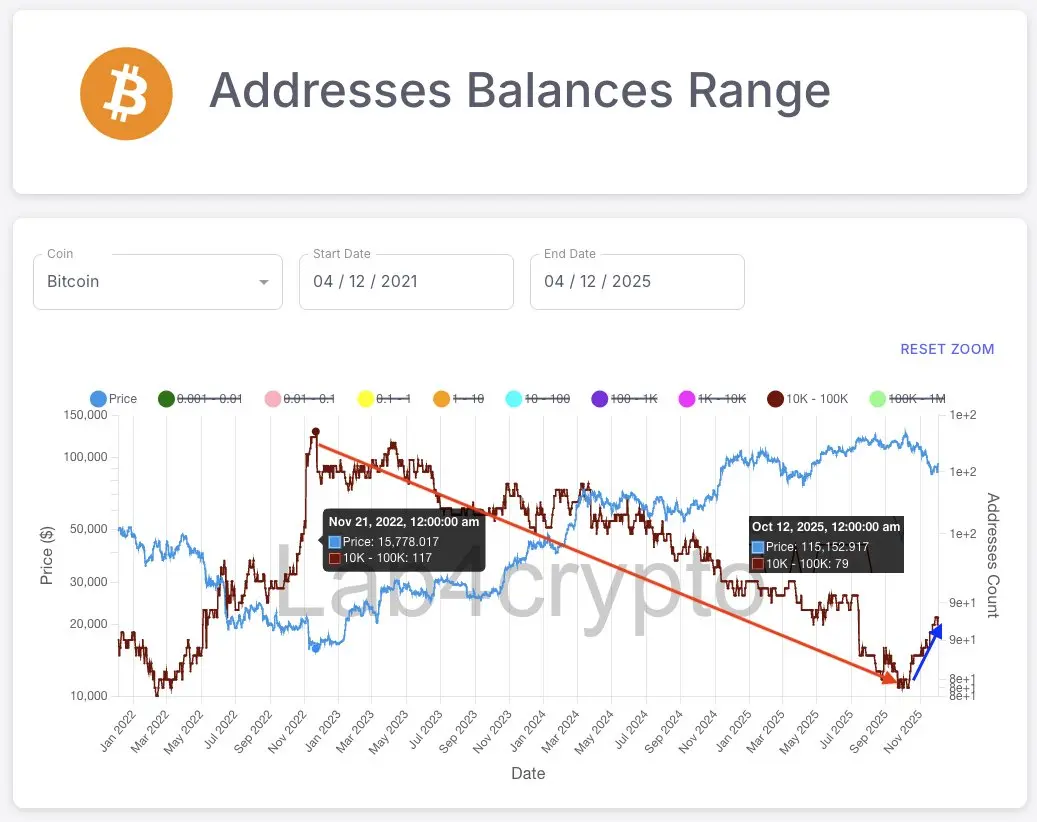

Ультра-кити (10k–100k BTC) продавали свої активи понад два роки з листопада 21, 2022 (червона стрілка 📉). Але все змінилося 12 жовтня 2025, і зараз вони накопичують (синя стрілка 📈). Коли ринок панікує, ці кити, здається, прокидаються.

BTC1,13%

- Нагородити

- 1

- Прокоментувати

- Репост

- Поділіться

Популярні теми

Дізнатися більше14.25K Популярність

76.64K Популярність

27.61K Популярність

10.55K Популярність

11.28K Популярність

Популярні активності Gate Fun

Дізнатися більше- Рин. кап.:$3.41KХолдери:10.00%

- Рин. кап.:$3.41KХолдери:10.00%

- Рин. кап.:$3.56KХолдери:20.57%

- Рин. кап.:$5.95KХолдери:211.67%

- Рин. кап.:$3.41KХолдери:10.00%

Закріпити