Kaff

لا يوجد محتوى حتى الآن

Kaff

توزيعات perp dexs تتوزع بصمت كل أسبوع من خلال النقاط.

استنادًا إلى تسعير OTC، إليك كيف يبدو الأمر:

ممتد: 2.4 مليون دولار/أسبوع ($2/نقطة)

نادو: 1.14 مليون دولار/أسبوع ($1.2/نقطة)

تبايني: 3.75 مليون دولار/أسبوع ($25/نقطة)

GRVT: 2.25 مليون دولار/أسبوع ($15/نقطة)

بارادكس: 720 ألف دولار/أسبوع ($0.18/XP)

إدجكس: 30 مليون دولار/أسبوع ($25/XP)

ولا يزال الناس يسألون إذا كان زراعة perp تستحق العناء.

استنادًا إلى تسعير OTC، إليك كيف يبدو الأمر:

ممتد: 2.4 مليون دولار/أسبوع ($2/نقطة)

نادو: 1.14 مليون دولار/أسبوع ($1.2/نقطة)

تبايني: 3.75 مليون دولار/أسبوع ($25/نقطة)

GRVT: 2.25 مليون دولار/أسبوع ($15/نقطة)

بارادكس: 720 ألف دولار/أسبوع ($0.18/XP)

إدجكس: 30 مليون دولار/أسبوع ($25/XP)

ولا يزال الناس يسألون إذا كان زراعة perp تستحق العناء.

شاهد النسخة الأصلية

- أعجبني

- 1

- تعليق

- إعادة النشر

- مشاركة

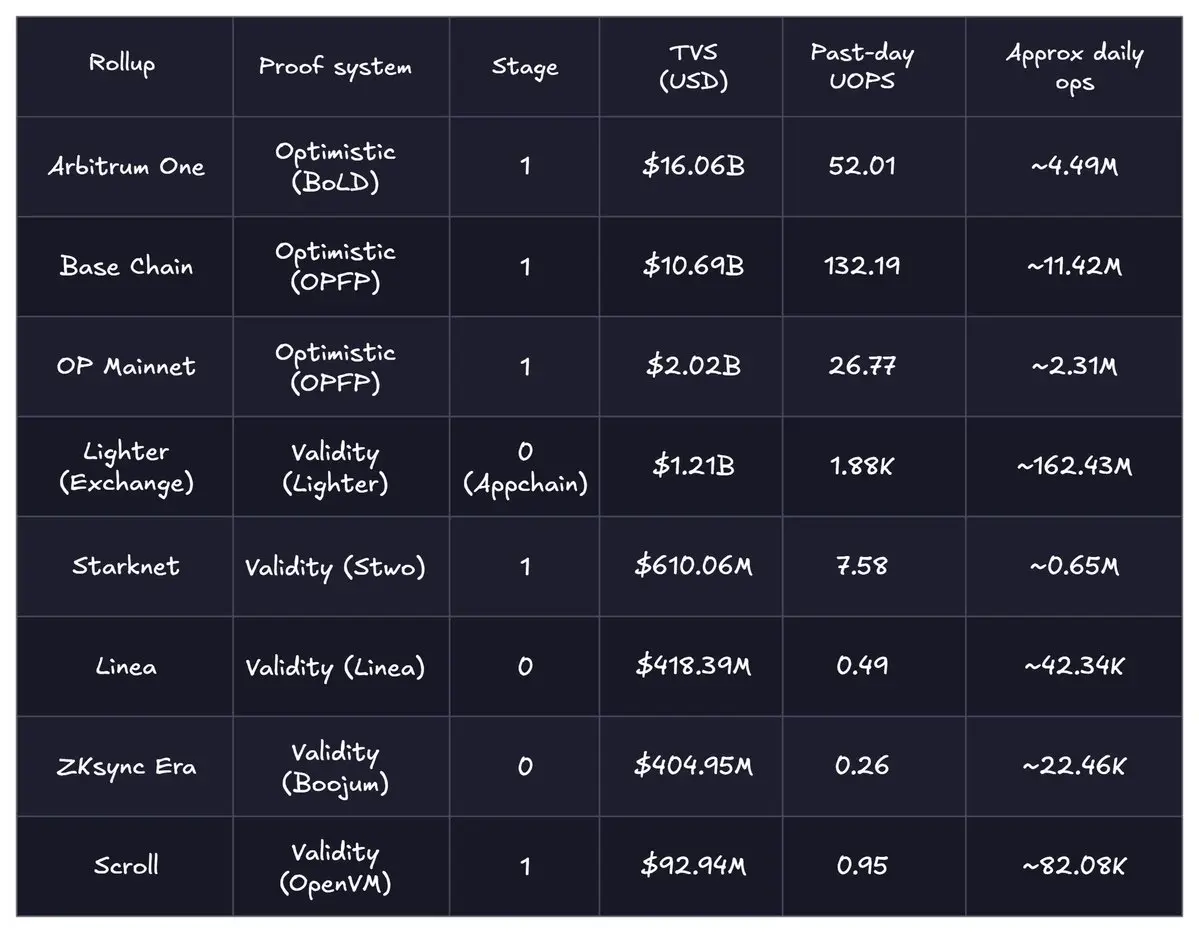

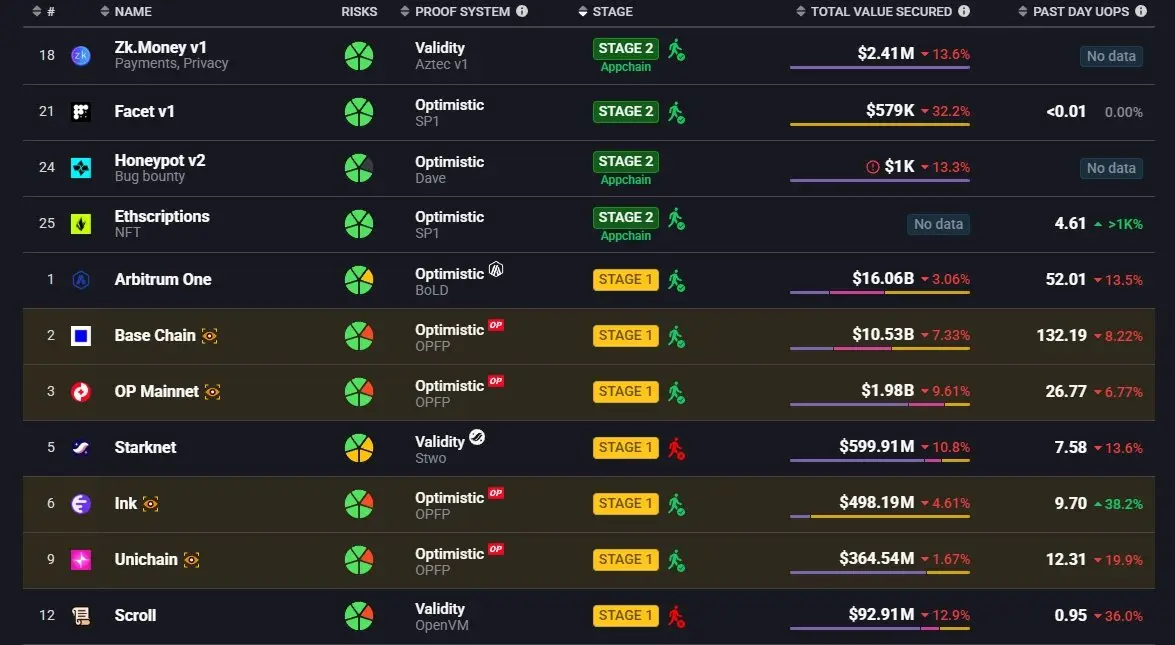

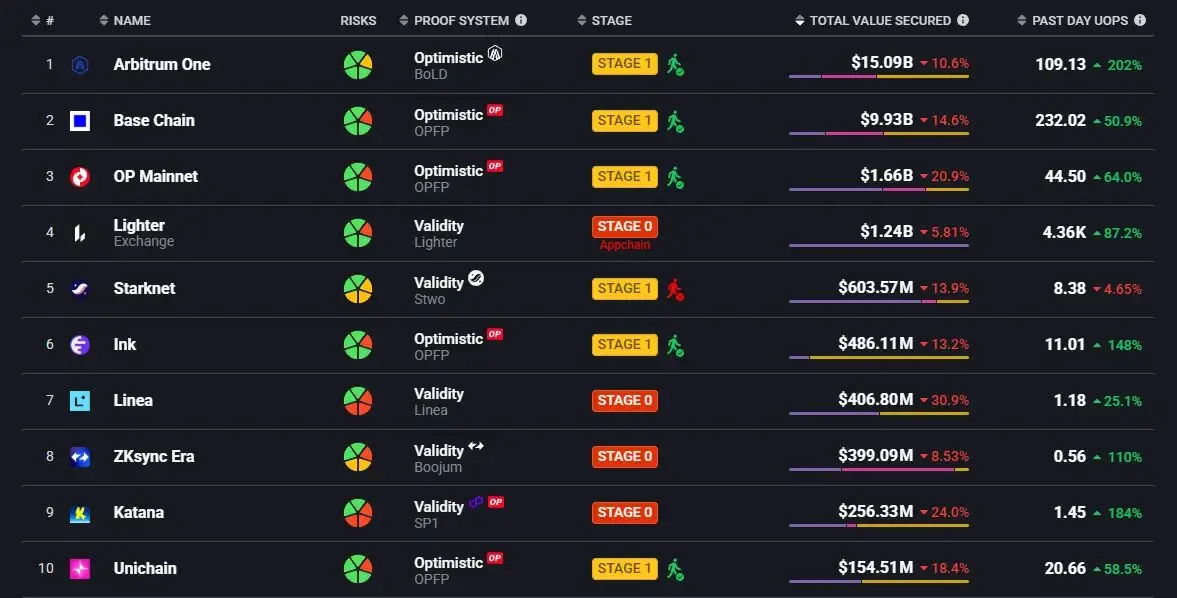

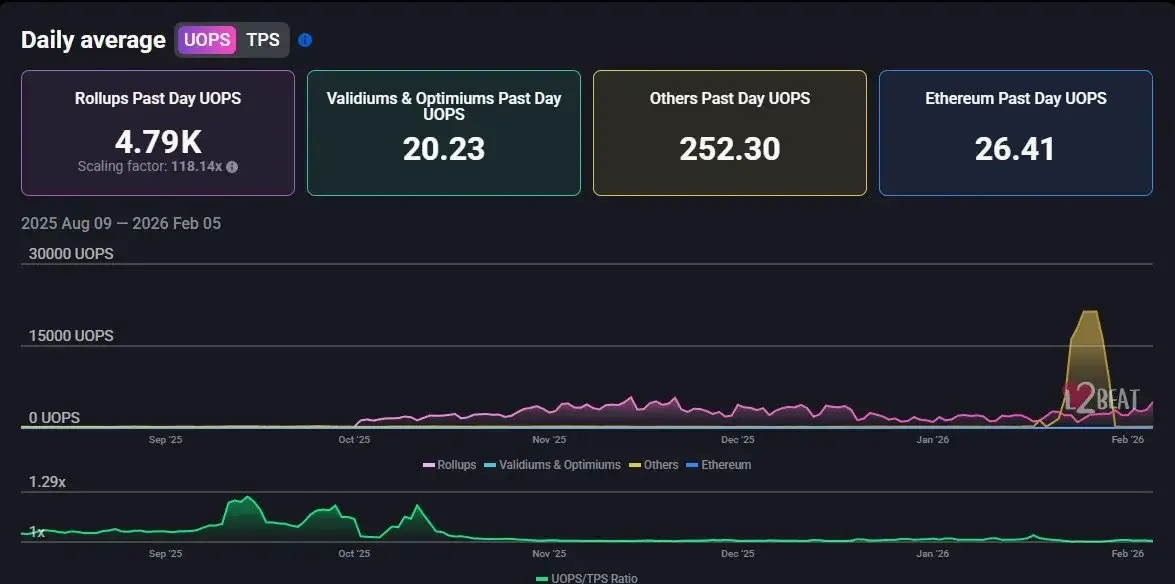

هل تموت L2s؟

كلها ثلاثة في وقت واحد: النمو على مستوى النظام، التشبع في طبقة الأغراض العامة، وإعادة ضبط في الأمان + الاقتصاد.

أولاً، النمو لا يمكن إنكاره.

على إطار النشاط، تقوم الريبوزات بـ ~2.13 ألف عملية مستخدم/ثانية مقابل Ethereum L1 حوالي ~33.13 عملية/ثانية. هذا حوالي 100 ضعف في الطلب على التنفيذ الخام.

بالمعنى المحول، هذا حوالي 184 مليون عملية مستخدم/يوم على الريبوزات مقابل حوالي 2.86 مليون على L1.

-----

لكن الهيكل تغير للتو.

- #Base وحدها تمثل أكثر من 60% من حصة جميع معاملات L2

- Base تمثل تقريبًا 47% من إجمالي قيمة DeFi على الريبوزات، Arbitrum حوالي 31%، OP الشبكة الرئيسية حوالي 6%، والب

شاهد النسخة الأصليةكلها ثلاثة في وقت واحد: النمو على مستوى النظام، التشبع في طبقة الأغراض العامة، وإعادة ضبط في الأمان + الاقتصاد.

أولاً، النمو لا يمكن إنكاره.

على إطار النشاط، تقوم الريبوزات بـ ~2.13 ألف عملية مستخدم/ثانية مقابل Ethereum L1 حوالي ~33.13 عملية/ثانية. هذا حوالي 100 ضعف في الطلب على التنفيذ الخام.

بالمعنى المحول، هذا حوالي 184 مليون عملية مستخدم/يوم على الريبوزات مقابل حوالي 2.86 مليون على L1.

-----

لكن الهيكل تغير للتو.

- #Base وحدها تمثل أكثر من 60% من حصة جميع معاملات L2

- Base تمثل تقريبًا 47% من إجمالي قيمة DeFi على الريبوزات، Arbitrum حوالي 31%، OP الشبكة الرئيسية حوالي 6%، والب

- أعجبني

- 2

- تعليق

- إعادة النشر

- مشاركة

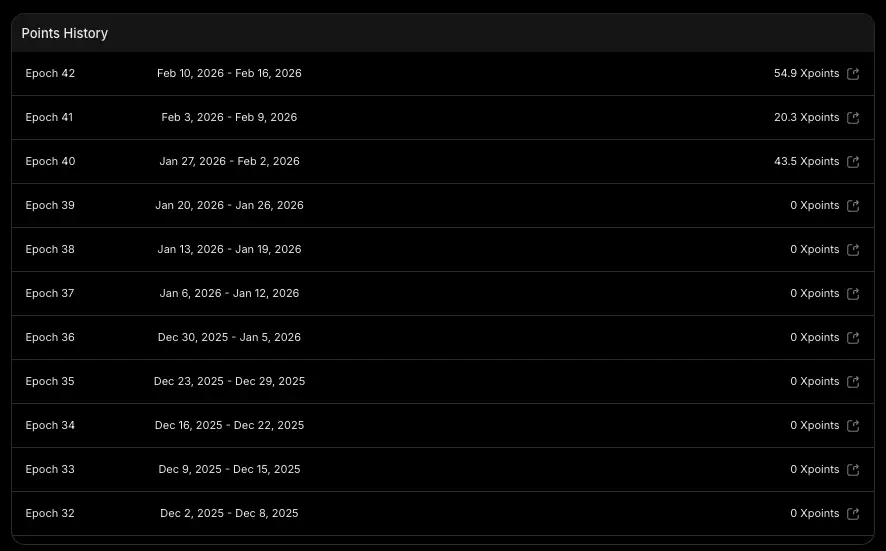

الأحجام الممتدة انخفضت بنسبة 75% من أعلى مستوى لها قبل أسبوعين.

$2B يوميًا → الآن بالكاد 500 مليون دولار.

هذا الأسبوع تلقيت في الواقع نقاط ممتدة أكثر بكثير من الأسبوع السابق، لأن انخفاض الحجم = قلة المزارعين = تقليل المنافسة.

لهذا أعتقد أن الآن هو أحد أفضل الفترات لزراعة العقود الدائمة.

على فكرة، روبوت الزراعة التلقائية الخاص بي لا يزال يعمل بهدوء في الخلفية.

لقد تجاوزت $3M حجم التداول.

مع هذا الحجم، أنا مستعد لبدء استراتيجية السوق المحايدة على Extended + GRVT هذا الأسبوع.

زراعة الروبوت:

Extended:

$2B يوميًا → الآن بالكاد 500 مليون دولار.

هذا الأسبوع تلقيت في الواقع نقاط ممتدة أكثر بكثير من الأسبوع السابق، لأن انخفاض الحجم = قلة المزارعين = تقليل المنافسة.

لهذا أعتقد أن الآن هو أحد أفضل الفترات لزراعة العقود الدائمة.

على فكرة، روبوت الزراعة التلقائية الخاص بي لا يزال يعمل بهدوء في الخلفية.

لقد تجاوزت $3M حجم التداول.

مع هذا الحجم، أنا مستعد لبدء استراتيجية السوق المحايدة على Extended + GRVT هذا الأسبوع.

زراعة الروبوت:

Extended:

PERP5.01%

- أعجبني

- 1

- تعليق

- إعادة النشر

- مشاركة

هل تعتقد أن $ETH يجب معاملته كشركة تكنولوجيا، حيث إذا انخفضت الرسوم والإيرادات فإن $ETH تعتبر محروقة؟

الآن تتداول عند حوالي $233B FDV، أعتقد أن القيمة العادلة يجب أن تعكس أن $ETH يتم إعادة تسعيره كطبقة التسوية الأكثر ثقة في العالم لتمويل EVM.

السبب وراء هذا التحول هو بشكل أساسي انقلاب السرد في خارطة الطريق.

لسنوات عديدة، عندما كانت L2 مزدهرة، كانت الفرضية أن L2 هي الحامل الأساسي للتوسع.

لكن النسخة الواقعية من L2s اللامركزية بالكامل أبطأ مما كان يأمل الجميع، وما زال من المتوقع أن يرتفع معدل المعالجة في L1 بشكل كبير خلال السنوات القليلة القادمة.

لذا، يصبح النموذج العقلي أكثر تركيزًا على L1 مر

الآن تتداول عند حوالي $233B FDV، أعتقد أن القيمة العادلة يجب أن تعكس أن $ETH يتم إعادة تسعيره كطبقة التسوية الأكثر ثقة في العالم لتمويل EVM.

السبب وراء هذا التحول هو بشكل أساسي انقلاب السرد في خارطة الطريق.

لسنوات عديدة، عندما كانت L2 مزدهرة، كانت الفرضية أن L2 هي الحامل الأساسي للتوسع.

لكن النسخة الواقعية من L2s اللامركزية بالكامل أبطأ مما كان يأمل الجميع، وما زال من المتوقع أن يرتفع معدل المعالجة في L1 بشكل كبير خلال السنوات القليلة القادمة.

لذا، يصبح النموذج العقلي أكثر تركيزًا على L1 مر

ETH9.7%

- أعجبني

- إعجاب

- تعليق

- إعادة النشر

- مشاركة

فتيليك أعاد تسعير جميع تداولات L2 علنًا. عصر Ethereum الأرخص انتهى.

رقمان يفسران التحول:

→ نشاط المستخدمين على L2 انخفض حوالي 50% من الذروة، بينما عاد نشاط الشبكة الرئيسية بقوة بمجرد أن أصبحت الرسوم رخيصة مرة أخرى

→ جعلت الكتل بيانات التجميع رخيصة جدًا لدرجة أنها لم تعد عنق الزجاجة، حوالي 0.04 دولار لكل ميجابايت

فماذا يحدث عندما يكون الحافة الوحيدة هي الرسوم المنخفضة، وتبدأ السلسلة الأساسية أيضًا في تقديم رسوم منخفضة؟

وفيات هادئة كثيرة. القيمة السوقية لرموز L2 الرئيسية انخفضت إلى حوالي 6.8 مليار دولار، مع انخفاض $OP و ARB والأصدقاء حوالي 90% من الذروات.

انظر من لا يزال على قيد الحياة بناءً عل

شاهد النسخة الأصليةرقمان يفسران التحول:

→ نشاط المستخدمين على L2 انخفض حوالي 50% من الذروة، بينما عاد نشاط الشبكة الرئيسية بقوة بمجرد أن أصبحت الرسوم رخيصة مرة أخرى

→ جعلت الكتل بيانات التجميع رخيصة جدًا لدرجة أنها لم تعد عنق الزجاجة، حوالي 0.04 دولار لكل ميجابايت

فماذا يحدث عندما يكون الحافة الوحيدة هي الرسوم المنخفضة، وتبدأ السلسلة الأساسية أيضًا في تقديم رسوم منخفضة؟

وفيات هادئة كثيرة. القيمة السوقية لرموز L2 الرئيسية انخفضت إلى حوالي 6.8 مليار دولار، مع انخفاض $OP و ARB والأصدقاء حوالي 90% من الذروات.

انظر من لا يزال على قيد الحياة بناءً عل

- أعجبني

- إعجاب

- تعليق

- إعادة النشر

- مشاركة

المواضيع الرائجة

عرض المزيد78.13K درجة الشعبية

169.11K درجة الشعبية

35.34K درجة الشعبية

9.13K درجة الشعبية

422.47K درجة الشعبية

Gate Fun الساخن

عرض المزيد- القيمة السوقية:$0.1عدد الحائزين:00.00%

- القيمة السوقية:$2.42Kعدد الحائزين:00.00%

- 3

离职

离职

القيمة السوقية:$0.1عدد الحائزين:00.00% - القيمة السوقية:$2.41Kعدد الحائزين:10.00%

- القيمة السوقية:$0.1عدد الحائزين:00.00%

تثبيت