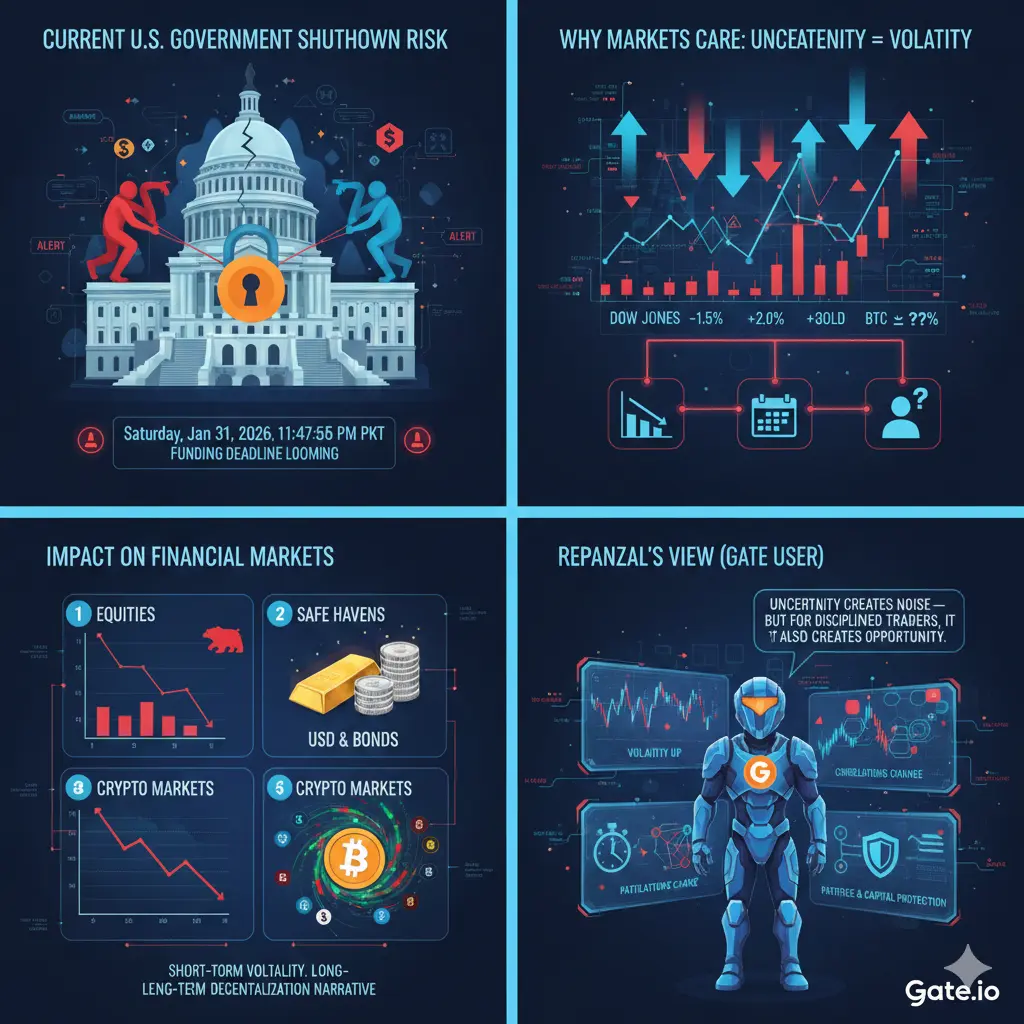

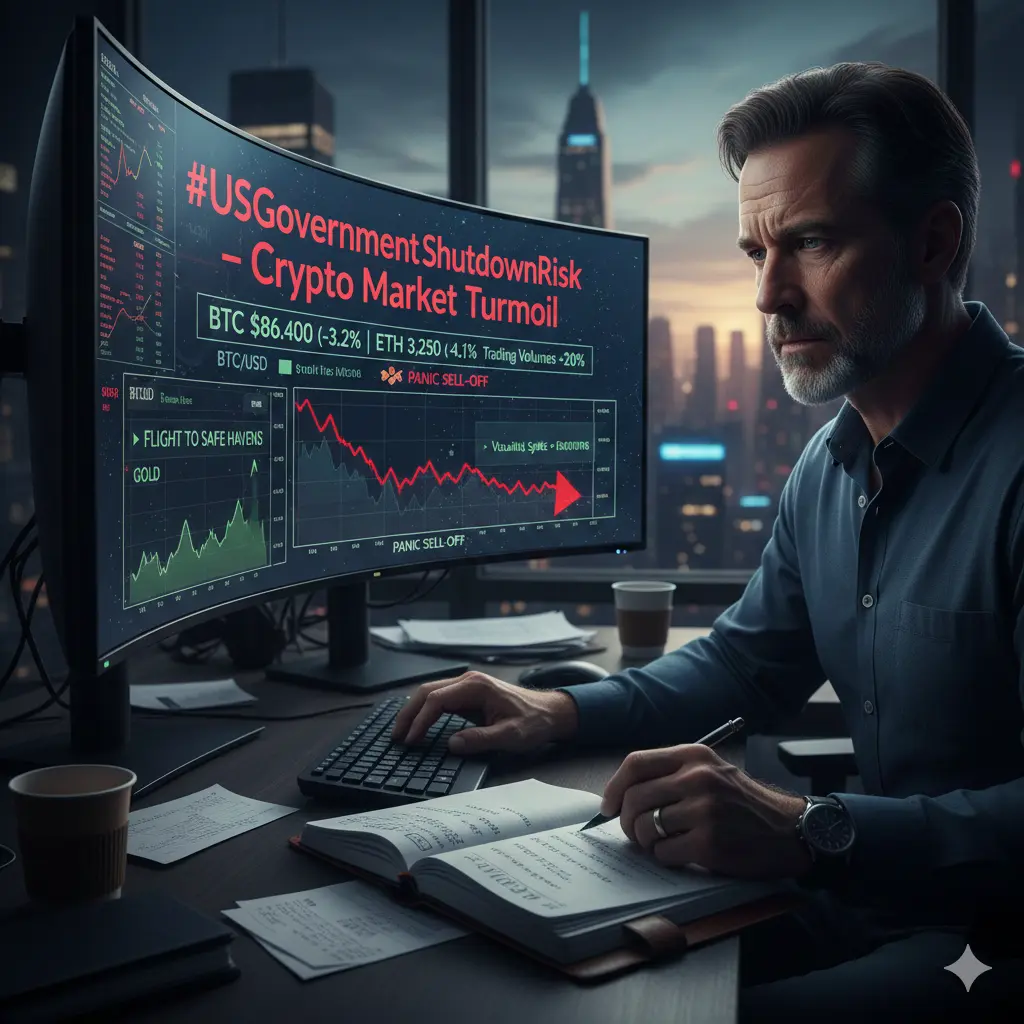

⚠️ US Government Shutdown Risk Rises — Crypto Markets on Alert

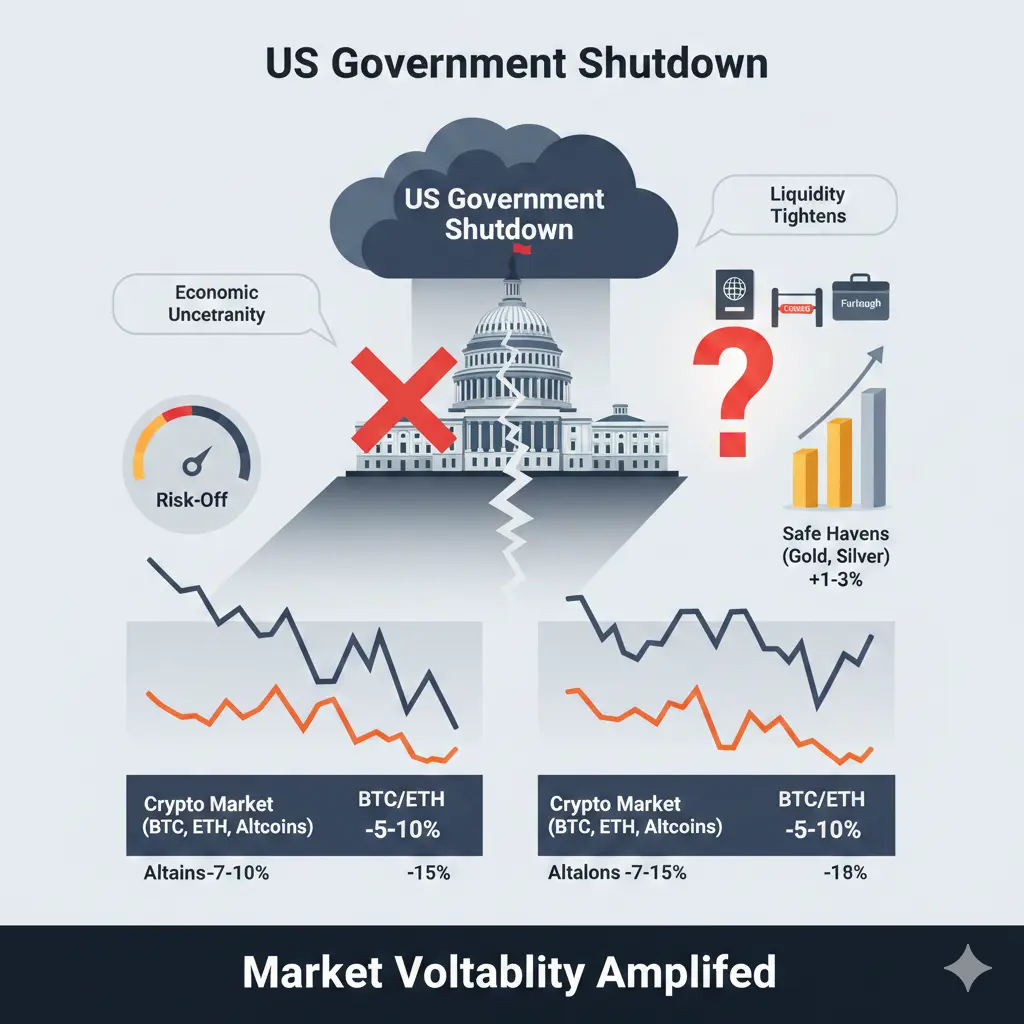

Dragon Fly Official notes that after the Senate failed to pass a funding bill on January 29, the risk of a partial US government shutdown has increased. Markets are reacting cautiously, with investors weighing the impact on liquidity, risk assets, and broader economic sentiment. 📉

📊 Market Analysis:

Historically, government shutdowns create uncertainty, which can dampen risk appetite. Crypto often reacts like a risk asset, meaning BTC, ETH, and altcoins may see short-term pullbacks during heightened uncertainty.

A shutdown could slow economic data releases, impact investor confidence, and reduce institutional participation in the market temporarily.

On the other hand, some investors may rotate into safe-haven assets, including BTC as “digital gold” and precious metals, creating potential opportunistic entries.

💡 Dragon Fly Official notes …

Traders should watch BTC and ETH key support levels for signs of stabilization.

Market volatility may spike; short-term traders should use tight risk management.

Long-term holders can see this as a market stress test, highlighting the resilience of crypto in times of traditional financial uncertainty.

📌 Key Signals to Monitor:

1️⃣ BTC/ETH support and resistance zones

2️⃣ Crypto market cap shifts amid macro uncertainty

3️⃣ News on government funding negotiations and deadlines

Dragon Fly Official believes that while the short-term outlook is cautious, a partial shutdown doesn’t necessarily derail crypto long-term. Instead, it may create strategic dip-buying opportunities for disciplined traders.

⚠️ Risk Warning: Crypto markets are volatile, especially during macro or political uncertainty. Manage position sizing carefully and avoid overexposure.

#USGovernmentShutdownRisk

Dragon Fly Official notes that after the Senate failed to pass a funding bill on January 29, the risk of a partial US government shutdown has increased. Markets are reacting cautiously, with investors weighing the impact on liquidity, risk assets, and broader economic sentiment. 📉

📊 Market Analysis:

Historically, government shutdowns create uncertainty, which can dampen risk appetite. Crypto often reacts like a risk asset, meaning BTC, ETH, and altcoins may see short-term pullbacks during heightened uncertainty.

A shutdown could slow economic data releases, impact investor confidence, and reduce institutional participation in the market temporarily.

On the other hand, some investors may rotate into safe-haven assets, including BTC as “digital gold” and precious metals, creating potential opportunistic entries.

💡 Dragon Fly Official notes …

Traders should watch BTC and ETH key support levels for signs of stabilization.

Market volatility may spike; short-term traders should use tight risk management.

Long-term holders can see this as a market stress test, highlighting the resilience of crypto in times of traditional financial uncertainty.

📌 Key Signals to Monitor:

1️⃣ BTC/ETH support and resistance zones

2️⃣ Crypto market cap shifts amid macro uncertainty

3️⃣ News on government funding negotiations and deadlines

Dragon Fly Official believes that while the short-term outlook is cautious, a partial shutdown doesn’t necessarily derail crypto long-term. Instead, it may create strategic dip-buying opportunities for disciplined traders.

⚠️ Risk Warning: Crypto markets are volatile, especially during macro or political uncertainty. Manage position sizing carefully and avoid overexposure.

#USGovernmentShutdownRisk