# HasTheMarketDipped?

171.81K

The market is volatile. Do you think the market has dipped? Should we continue to wait for a better trend or buy the dip? Share your views.

MrFlower_XingChen

#HasTheMarketDipped? 市場は本当に下落したのか?暗号市場の見通し — 2026年初頭以降

暗号市場が2025年後半から2026年初頭へと移行する中、価格動向は流通ではなく構造的な統合を反映し続けている。ビットコインは前サイクルのブレイクアウトゾーンを上回る堅調さを保ち、80,000ドル台後半から90,000ドル台前半の範囲で変動している一方、イーサリアムは心理的な3,000ドル未満の範囲でしっかりと保持している。ボラティリティはさらに圧縮され、市場が供給を吸収していることを示唆しており、疲弊の兆候ではない。歴史的に、高水準での長期的な低ボラティリティフェーズは、特に市場構造の改善によって支えられる拡大の動きに先行していた。

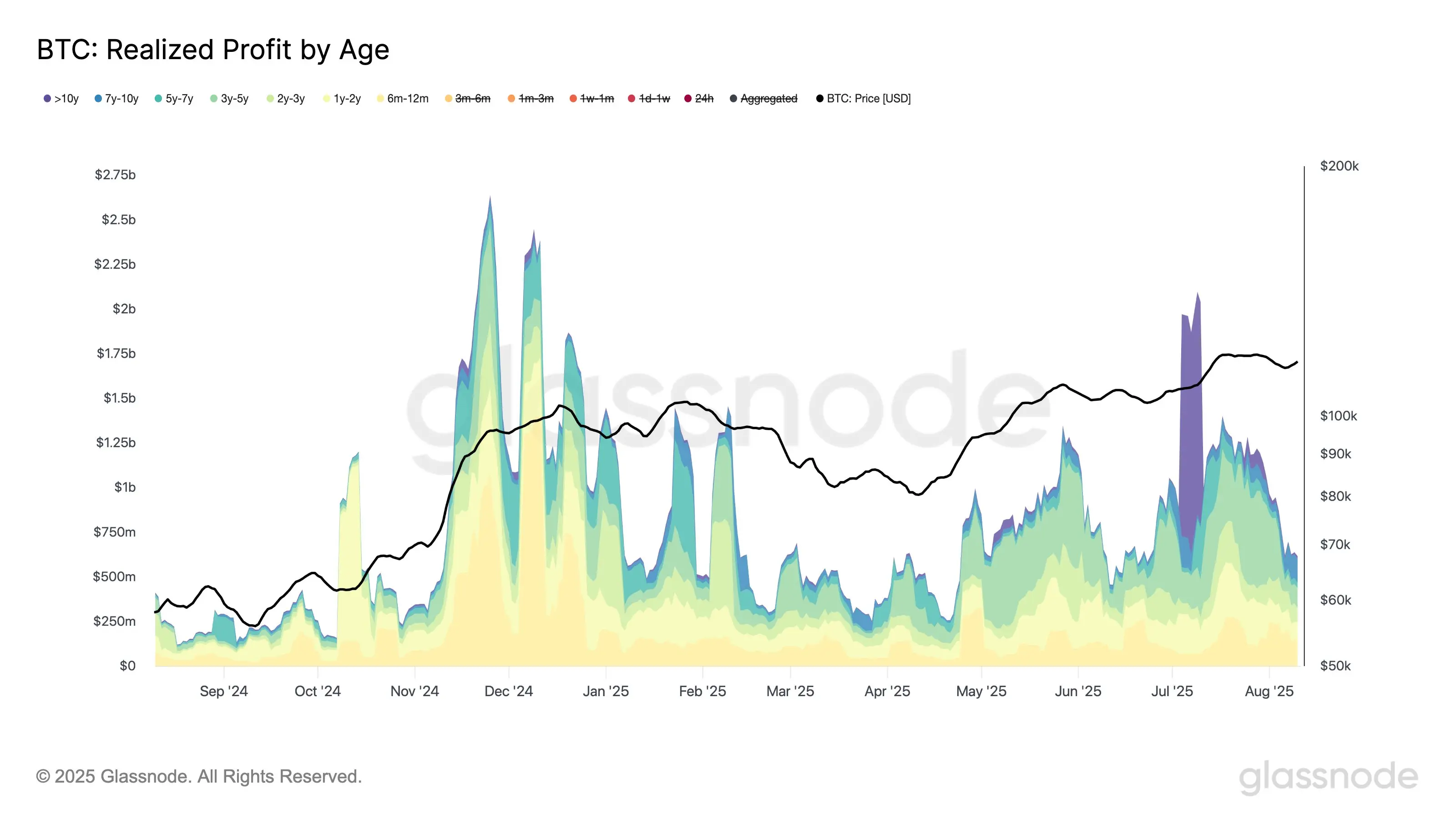

2026年に入る最大の変化の一つは、暗号市場の流動性プロファイルの変化である。ETFを中心とした需要により、自由に流通するビットコインの量が減少し、スポット供給が引き締まる一方、長期保有者の重要性が高まっている。オンチェーンデータは、複数年の保有期間を持つエンティティによるコインの保有が着実に増加していることを示しており、ビットコインが投機的な取引ではなくマクロ資産としての性質を強めていることを裏付けている。この移行はまた、成熟した資産クラスの特徴である極端な下落ボラティリティの抑制にもつながっている。

イーサリアムの2026年に向けたポジシ

原文表示暗号市場が2025年後半から2026年初頭へと移行する中、価格動向は流通ではなく構造的な統合を反映し続けている。ビットコインは前サイクルのブレイクアウトゾーンを上回る堅調さを保ち、80,000ドル台後半から90,000ドル台前半の範囲で変動している一方、イーサリアムは心理的な3,000ドル未満の範囲でしっかりと保持している。ボラティリティはさらに圧縮され、市場が供給を吸収していることを示唆しており、疲弊の兆候ではない。歴史的に、高水準での長期的な低ボラティリティフェーズは、特に市場構造の改善によって支えられる拡大の動きに先行していた。

2026年に入る最大の変化の一つは、暗号市場の流動性プロファイルの変化である。ETFを中心とした需要により、自由に流通するビットコインの量が減少し、スポット供給が引き締まる一方、長期保有者の重要性が高まっている。オンチェーンデータは、複数年の保有期間を持つエンティティによるコインの保有が着実に増加していることを示しており、ビットコインが投機的な取引ではなくマクロ資産としての性質を強めていることを裏付けている。この移行はまた、成熟した資産クラスの特徴である極端な下落ボラティリティの抑制にもつながっている。

イーサリアムの2026年に向けたポジシ

- 報酬

- 9

- 1

- リポスト

- 共有

Crypto_Buzz_with_Alex :

:

⚡ 「エネルギーが伝染する、暗号通貨のカリスマ性に惚れ惚れ!」#HasTheMarketDipped? Crypto Market Update — 2025年12月26日 & 2026年展望

2025年12月の終わりに近づくにつれ、暗号市場は急激な下落ではなく、統合の兆しを見せています。ビットコイン (BTC)は約89,000ドル付近で取引されており、ボラティリティが低下し、年末の取引量も軽減された範囲内で推移しています。同様に、イーサリアム (ETH)は約2,900ドル付近で推移しており、安定したサポートとネットワークアップグレードや機関投資家の採用に対する期待が続いています。市場の活動は控えめであり、これは年末によく見られる現象であり、トレーダーはポジショニングや利益確定に集中しており、パニック売りは少ないです。技術的なデータは、主要なサポートレベルが維持されていることを示しており、買い手と売り手の間に一時的な均衡があることを示唆しています。この段階は、過剰なレバレッジや弱い手を吸収しながら、健全な統合と見なされており、次の方向性の動きに備えています。

機関投資家の採用は、2026年の重要なテーマとして引き続き注目されています。スポットビットコインETFやXRP ETFを含む規制された商品は、重要な資産の閾値を超え、従来の投資家が暗号資産にアクセスする新たな道を提供しています。米国のデジタル資産市場明確化法やEUのMiCAフレームワーク

原文表示2025年12月の終わりに近づくにつれ、暗号市場は急激な下落ではなく、統合の兆しを見せています。ビットコイン (BTC)は約89,000ドル付近で取引されており、ボラティリティが低下し、年末の取引量も軽減された範囲内で推移しています。同様に、イーサリアム (ETH)は約2,900ドル付近で推移しており、安定したサポートとネットワークアップグレードや機関投資家の採用に対する期待が続いています。市場の活動は控えめであり、これは年末によく見られる現象であり、トレーダーはポジショニングや利益確定に集中しており、パニック売りは少ないです。技術的なデータは、主要なサポートレベルが維持されていることを示しており、買い手と売り手の間に一時的な均衡があることを示唆しています。この段階は、過剰なレバレッジや弱い手を吸収しながら、健全な統合と見なされており、次の方向性の動きに備えています。

機関投資家の採用は、2026年の重要なテーマとして引き続き注目されています。スポットビットコインETFやXRP ETFを含む規制された商品は、重要な資産の閾値を超え、従来の投資家が暗号資産にアクセスする新たな道を提供しています。米国のデジタル資産市場明確化法やEUのMiCAフレームワーク

- 報酬

- 1

- 1

- リポスト

- 共有

Discovery :

:

情報と共有ありがとうございます。#HasTheMarketDipped? 日本銀行の「歴史的な利上げ」が市場の唯一の原動力に

日本銀行(BOJ)は、2025年12月18日〜19日に金融政策決定会合を開催し、0.75%に25ベーシスポイントの引き上げを発表しました。これは1995年以来の最高水準です。この決定は、数十年にわたる超緩和的金融政策からの大きな転換を示しています。賃金の堅調な伸びと、特に4年ぶりの高水準に達した大手製造業者を中心とした企業の信頼感の高まりが、正常化の正当化をさらに強めました。この動きは国内だけでなく、グローバルな資本フローやリスク資産の価格付けにも即時の影響を与えています。

利上げが広く予想されていたにもかかわらず、市場の反応は顕著でした。円は最初、USD/JPY市場で弱含みとなり、期待と実際の結果の複雑な相互作用を反映しました。日本の当局は、過度なボラティリティを防ぐための介入の可能性も警告しました。同時に、日本国債(JGB)の利回りは複数年ぶりの高水準に上昇し、市場が流動性引き締め期待に敏感に反応していることを示しました。

市場のムードは「高水準の振動」から「イベントドリブンの下落トレンド」へと変化しました。利上げ発表後、伝統的な「噂を買い、ニュースを売る」ダイナミクスが展開されました。利上げ前の投機的買いはすぐに逆転し、リスク資産、特に暗号資産は圧力を受けました。例えばビットコインは

日本銀行(BOJ)は、2025年12月18日〜19日に金融政策決定会合を開催し、0.75%に25ベーシスポイントの引き上げを発表しました。これは1995年以来の最高水準です。この決定は、数十年にわたる超緩和的金融政策からの大きな転換を示しています。賃金の堅調な伸びと、特に4年ぶりの高水準に達した大手製造業者を中心とした企業の信頼感の高まりが、正常化の正当化をさらに強めました。この動きは国内だけでなく、グローバルな資本フローやリスク資産の価格付けにも即時の影響を与えています。

利上げが広く予想されていたにもかかわらず、市場の反応は顕著でした。円は最初、USD/JPY市場で弱含みとなり、期待と実際の結果の複雑な相互作用を反映しました。日本の当局は、過度なボラティリティを防ぐための介入の可能性も警告しました。同時に、日本国債(JGB)の利回りは複数年ぶりの高水準に上昇し、市場が流動性引き締め期待に敏感に反応していることを示しました。

市場のムードは「高水準の振動」から「イベントドリブンの下落トレンド」へと変化しました。利上げ発表後、伝統的な「噂を買い、ニュースを売る」ダイナミクスが展開されました。利上げ前の投機的買いはすぐに逆転し、リスク資産、特に暗号資産は圧力を受けました。例えばビットコインは

BTC5.55%

- 報酬

- 12

- 3

- リポスト

- 共有

Ryakpanda :

:

クリスマスに一発盛り上がろう! 🚀もっと見る

ビットコイン対金比率は2025年に50%崩壊:その理由

ビットコイン対金比率は、1 BTCを購入するのに必要な金のオンス数を示し、2024年12月の約40オンスから20オンスにまで戻り、約50%崩壊しました。ビットコイン( $BTC )の需要の崩壊ではなく、この急激な変化は2025年のユニークなマクロ経済体制を反映しており、金の資産パフォーマンスが暗号資産を上回ったことを示しています。

なぜ金( $XAUT )が2025年の価値保存の買いを支配したのか

金は2025年の世界的な価値保存の買いをリードし、年初来(YTD)の上昇率は63%に達し、Q4には1オンスあたり4,000ドルを突破しました。この上昇を特徴付けたのは、制約的な金融条件にもかかわらず展開したことです。

この上昇は、米国の金利がほとんどの期間制限的な状態にあった中で起こり、連邦準備制度は9月に初めて基準金利を引き下げました。歴史的に、このような環境は非利回り資産に圧力をかけるはずですが、金は急騰し、需要の構造的な変化を浮き彫りにしました。

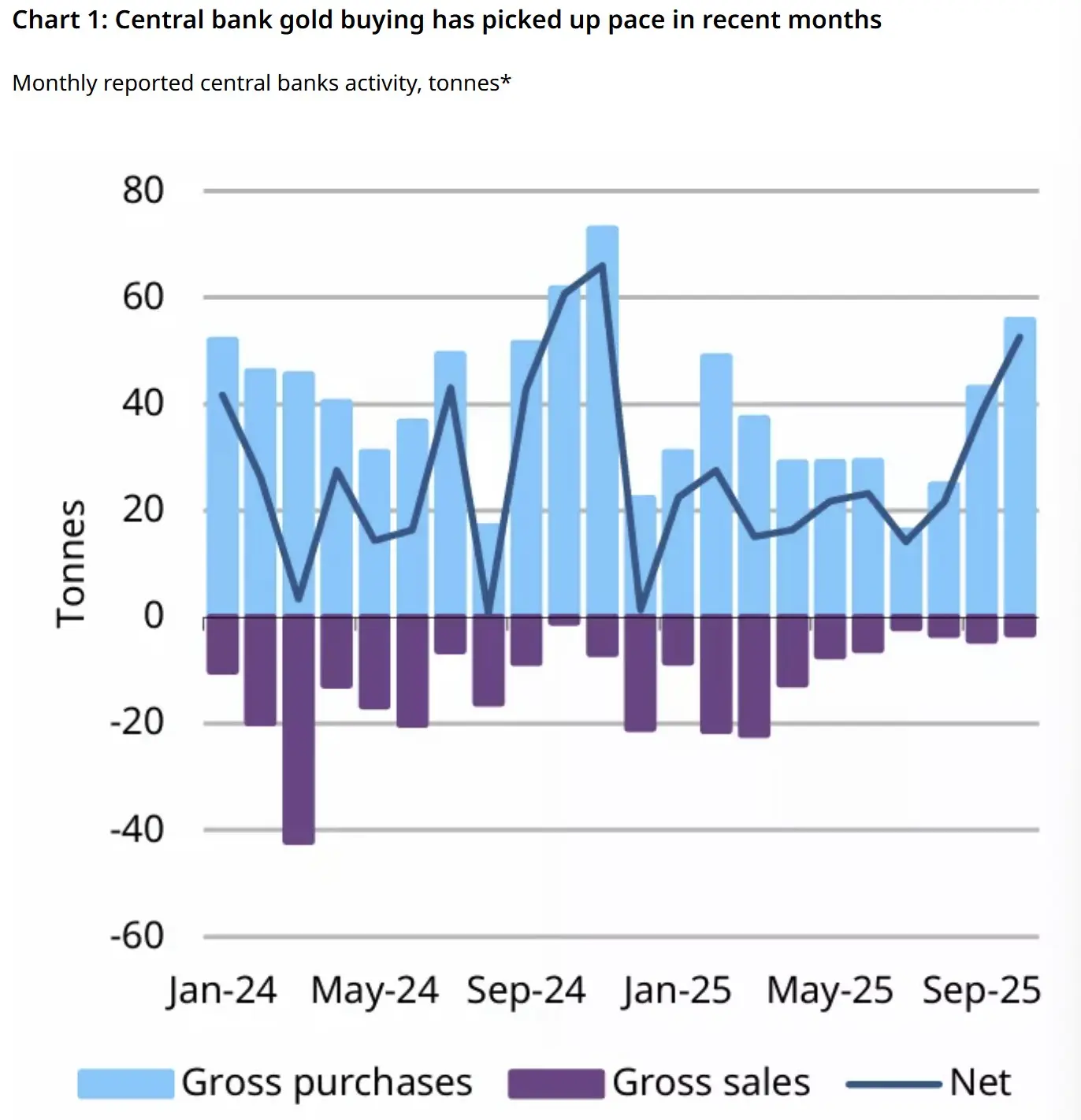

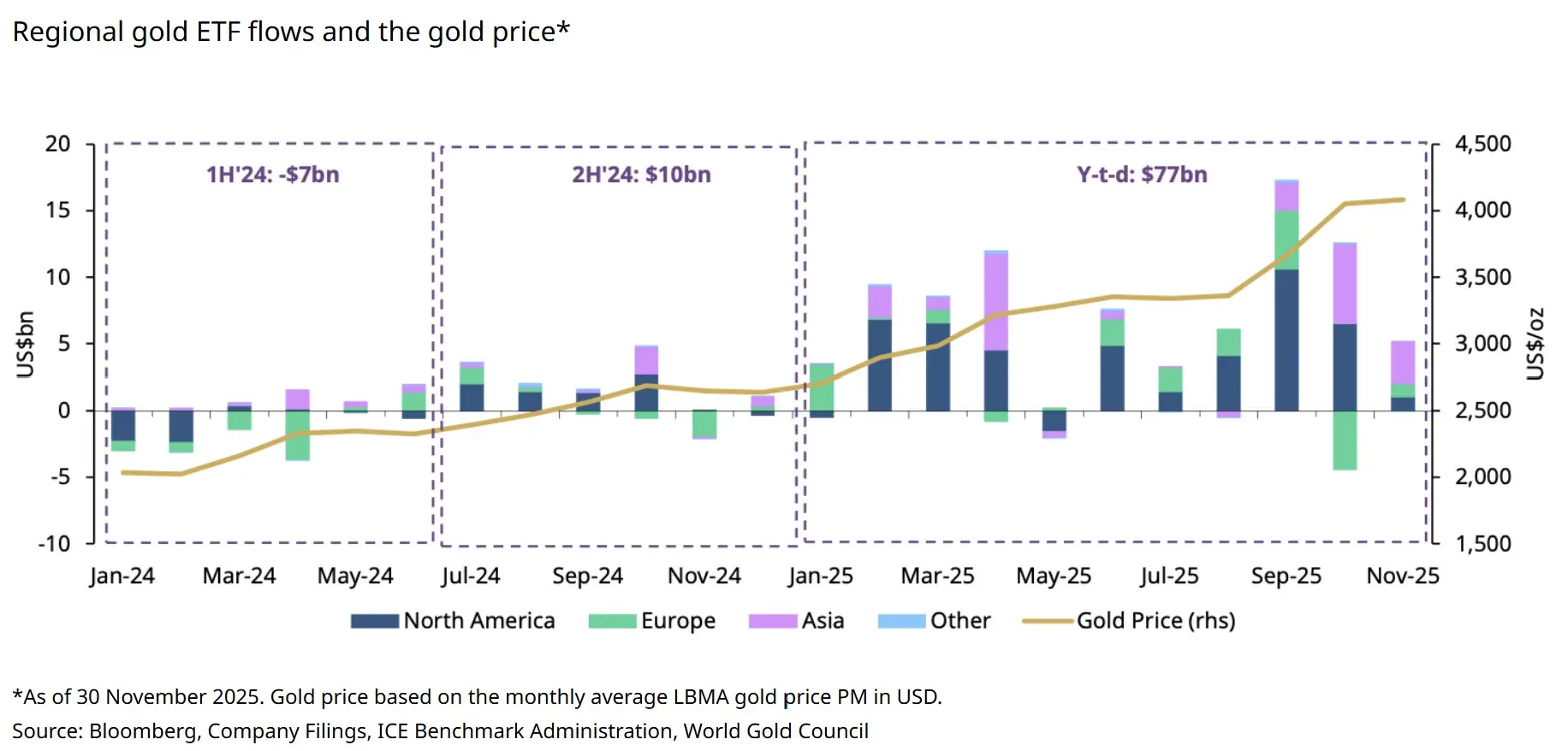

この動きの中心には中央銀行がありました。2025年10月までに、世界の公式セクターの買い入れは254トンに達し、ポーランド国立銀行が83トンを追加してリードしました。同時に、2025年上半期の金の上場投資信託(ETF)保有量は397トン拡大し、11月には史上最高の3,932トンに達し

原文表示ビットコイン対金比率は、1 BTCを購入するのに必要な金のオンス数を示し、2024年12月の約40オンスから20オンスにまで戻り、約50%崩壊しました。ビットコイン( $BTC )の需要の崩壊ではなく、この急激な変化は2025年のユニークなマクロ経済体制を反映しており、金の資産パフォーマンスが暗号資産を上回ったことを示しています。

なぜ金( $XAUT )が2025年の価値保存の買いを支配したのか

金は2025年の世界的な価値保存の買いをリードし、年初来(YTD)の上昇率は63%に達し、Q4には1オンスあたり4,000ドルを突破しました。この上昇を特徴付けたのは、制約的な金融条件にもかかわらず展開したことです。

この上昇は、米国の金利がほとんどの期間制限的な状態にあった中で起こり、連邦準備制度は9月に初めて基準金利を引き下げました。歴史的に、このような環境は非利回り資産に圧力をかけるはずですが、金は急騰し、需要の構造的な変化を浮き彫りにしました。

この動きの中心には中央銀行がありました。2025年10月までに、世界の公式セクターの買い入れは254トンに達し、ポーランド国立銀行が83トンを追加してリードしました。同時に、2025年上半期の金の上場投資信託(ETF)保有量は397トン拡大し、11月には史上最高の3,932トンに達し

- 報酬

- 6

- 3

- リポスト

- 共有

Vortex_King :

:

ブルラン 🐂もっと見る

長い夜は終わる:2026年に向けてアルトコインを展望する重要な時期

ほとんどのアルトコインは下落の終わりに近づいているため、今こそ反発を待つのではなく、「買い準備ができている」心構えで市場を見守る時です。

市場の最も暗い瞬間は、しばしば冷静な思考が最も必要とされる時です。

市場の信頼感が低下しているときは、データや構造変化からのシグナルにより注意を払うべきです。複数の分析に基づき、合意が形成されつつあります:現在のアルトコイン市場は下落の終盤に入りつつあり、2026年のマクロ経済および規制環境は、より健全で構造化された新しいサイクルの到来を告げる可能性があります。

1. ボトムシグナル:市場は「底打ち」観察期間に入った

複数の市場アナリストが同じ方向を指しています:底のシグナルが現れつつあります。

· テクニカルシグナル:アナリストの Michaël van de Poppe は、価格チャートに大きなキャンドル (長い影)が現れることは、アルトコインの市場の底を示すことが多く、急激な下落後の迅速な回復を示唆していると指摘しています。彼は繰り返し、現在の調整は「大きな動きの前の最後の下げ」であると強調し、ディップでの蓄積に好機をもたらすとしています。

· 下落または終わりに近い:Van de Poppe は、2025年後半に始まる市場調整は終わりに近づいており、全体的な強気トレンドは

原文表示ほとんどのアルトコインは下落の終わりに近づいているため、今こそ反発を待つのではなく、「買い準備ができている」心構えで市場を見守る時です。

市場の最も暗い瞬間は、しばしば冷静な思考が最も必要とされる時です。

市場の信頼感が低下しているときは、データや構造変化からのシグナルにより注意を払うべきです。複数の分析に基づき、合意が形成されつつあります:現在のアルトコイン市場は下落の終盤に入りつつあり、2026年のマクロ経済および規制環境は、より健全で構造化された新しいサイクルの到来を告げる可能性があります。

1. ボトムシグナル:市場は「底打ち」観察期間に入った

複数の市場アナリストが同じ方向を指しています:底のシグナルが現れつつあります。

· テクニカルシグナル:アナリストの Michaël van de Poppe は、価格チャートに大きなキャンドル (長い影)が現れることは、アルトコインの市場の底を示すことが多く、急激な下落後の迅速な回復を示唆していると指摘しています。彼は繰り返し、現在の調整は「大きな動きの前の最後の下げ」であると強調し、ディップでの蓄積に好機をもたらすとしています。

· 下落または終わりに近い:Van de Poppe は、2025年後半に始まる市場調整は終わりに近づいており、全体的な強気トレンドは

- 報酬

- 7

- 5

- リポスト

- 共有

FuckTheMudHorse :

:

うわ、泥馬はまだいけるねもっと見る

#HasTheMarketDipped? 今週は本当にポンプして、$94k を突破すると思います。

さもなければ、私たちは本当に大きくダンプして、$85kを下回ることになります。

12月26日に大規模な期限があるので、いくつかの狂ったボラティリティに備えてください。

原文表示さもなければ、私たちは本当に大きくダンプして、$85kを下回ることになります。

12月26日に大規模な期限があるので、いくつかの狂ったボラティリティに備えてください。

- 報酬

- いいね

- コメント

- リポスト

- 共有

#HasTheMarketDipped? 日本銀行の「歴史的な利上げ」が市場の主要な要因となる

日本銀行(BOJ)が基準金利を25ベーシスポイント引き上げ、0.75%に達し、1995年以来の最高水準となり、世界の金融状況は重要な岐路に立っています。この決定は、日本銀行政策委員会によって全会一致で承認され、数十年にわたる超緩和的な金融政策からの重要な転換を反映しています。これは、日本における賃金の強い成長と企業の自信の高まりを受けたもので、インフレと経済の勢いが政策の正常化に向けた動きを支持していることを示唆しています。

金利の引き上げは、グローバルなリスク資産に即時の影響を与えています。伝統的に、円は低コストの資金調達の基盤となっており、投資家が円を借りて株式や暗号通貨などのより高い利回りの資産に投資するキャリー取引を促進しています。日本の金利が上昇するにつれて、このレバレッジのコストも増加し、マーケット全体での巻き戻し圧力やリスク志向の低下を引き起こします。このダイナミクスはすでに暗号通貨市場に影響を及ぼしており、ビットコインと主要なアルトコインは12月中旬に高まったボラティリティを経験しています。

ビットコインは今月初めに$90,000近くで取引された後、より広範なマクロの不確実性の中で$86,000を下回りました。短期的なテクニカルな売られ過ぎの状況は一時的な反発を引き起こす

日本銀行(BOJ)が基準金利を25ベーシスポイント引き上げ、0.75%に達し、1995年以来の最高水準となり、世界の金融状況は重要な岐路に立っています。この決定は、日本銀行政策委員会によって全会一致で承認され、数十年にわたる超緩和的な金融政策からの重要な転換を反映しています。これは、日本における賃金の強い成長と企業の自信の高まりを受けたもので、インフレと経済の勢いが政策の正常化に向けた動きを支持していることを示唆しています。

金利の引き上げは、グローバルなリスク資産に即時の影響を与えています。伝統的に、円は低コストの資金調達の基盤となっており、投資家が円を借りて株式や暗号通貨などのより高い利回りの資産に投資するキャリー取引を促進しています。日本の金利が上昇するにつれて、このレバレッジのコストも増加し、マーケット全体での巻き戻し圧力やリスク志向の低下を引き起こします。このダイナミクスはすでに暗号通貨市場に影響を及ぼしており、ビットコインと主要なアルトコインは12月中旬に高まったボラティリティを経験しています。

ビットコインは今月初めに$90,000近くで取引された後、より広範なマクロの不確実性の中で$86,000を下回りました。短期的なテクニカルな売られ過ぎの状況は一時的な反発を引き起こす

BTC5.55%

- 報酬

- 5

- 1

- リポスト

- 共有

StylishKuri :

:

HODL Tight 💪アジアモーニングブリーフィング:ハイパーリクイッド、ソラナスタイルの評価議論に参入、市場は慎重な姿勢を維持

アジアは、今回も鋭さを増した馴染みのある市場の物語で目覚めている。ハイパーリクイッドを巡る新たな評価議論が形成されつつあり、これはソラナが最後の主要サイクルで見られた見方に非常に似ている。変化は微妙だが重要だ。単なる投機的流れに乗るDeFiプロトコルとして扱われるのではなく、ハイパーリクイッドは運用レバレッジ、キャッシュフローダイナミクス、長期的な経済的重力を持つ金融インフラとしてますます位置付けられている。

この議論の中心には、Hyperion DeFiとHyperliquid Strategiesという二つの公開アクセス可能なプラットフォームがある。両者は受動的なトークン保有者としてではなく、ハイパーリクイッドエコシステム内の積極的な参加者として位置付けられている。彼らのバランスシートは、ステーキング、バリデーション、市場構築活動を通じて展開されており、単なる価格上昇を待つのではなく、エクスポージャーを収益に変えている。この運用役割の変化は、評価のアプローチを変え、プラットフォームビジネスモデルに近づけている。これは、財務のラッパーよりもむしろ長期的な経済的重力を持つ。

長期的な見通しは野心的だ。将来を見据えた枠組みでは、ハイパーリクイッドは時間とともに年間50億ドル以上

アジアは、今回も鋭さを増した馴染みのある市場の物語で目覚めている。ハイパーリクイッドを巡る新たな評価議論が形成されつつあり、これはソラナが最後の主要サイクルで見られた見方に非常に似ている。変化は微妙だが重要だ。単なる投機的流れに乗るDeFiプロトコルとして扱われるのではなく、ハイパーリクイッドは運用レバレッジ、キャッシュフローダイナミクス、長期的な経済的重力を持つ金融インフラとしてますます位置付けられている。

この議論の中心には、Hyperion DeFiとHyperliquid Strategiesという二つの公開アクセス可能なプラットフォームがある。両者は受動的なトークン保有者としてではなく、ハイパーリクイッドエコシステム内の積極的な参加者として位置付けられている。彼らのバランスシートは、ステーキング、バリデーション、市場構築活動を通じて展開されており、単なる価格上昇を待つのではなく、エクスポージャーを収益に変えている。この運用役割の変化は、評価のアプローチを変え、プラットフォームビジネスモデルに近づけている。これは、財務のラッパーよりもむしろ長期的な経済的重力を持つ。

長期的な見通しは野心的だ。将来を見据えた枠組みでは、ハイパーリクイッドは時間とともに年間50億ドル以上

BTC5.55%

- 報酬

- 7

- 3

- リポスト

- 共有

Mahamtrader :

:

HODLをしっかりと 💪もっと見る

#HasTheMarketDipped?

暗号通貨業界の多くの人々が一つのシンプルな質問をしています:市場は下落したのか、それともこれは一時的な休止なのか?市場の下落は非常に一般的で、すべての金融市場で起こります。価格は一直線に動くわけではありません。時には市場は上昇し、時には横ばいになり、時には休憩のために下落します。暗号通貨では、これらの下落はより強く感じられることがあります。なぜなら、価格の動きが速く、感情がより大きな役割を果たすからです。

下落は必ずしも市場の終わりを意味するわけではありません。しばしば、恐怖、ニュース、利益確定、または経済データや金利予想などのマクロイベントによって引き起こされます。これらの瞬間は通常、弱い手を排除し、市場をより健全な動きに備えさせます。賢明な投資家は、感情的に反応するのではなく、下落の背後にある理由を理解することに焦点を当てます。冷静さを保ち、リスクを管理し、長期的な視野を持つことが、暗号通貨市場で生き残り、成長する鍵です。

市場の下落とは何か?

市場の下落は、恐怖やニュースによって引き起こされる短期的な価格の下落であり、完全な市場の崩壊ではありません。

下落は市場の一部

すべての市場は下落を経験します。それは正常であり、健全な価格動向に必要不可欠です。

暗号通貨の下落はより強く感じられる

暗号通貨の価格は速く動くため、小さな売り

暗号通貨業界の多くの人々が一つのシンプルな質問をしています:市場は下落したのか、それともこれは一時的な休止なのか?市場の下落は非常に一般的で、すべての金融市場で起こります。価格は一直線に動くわけではありません。時には市場は上昇し、時には横ばいになり、時には休憩のために下落します。暗号通貨では、これらの下落はより強く感じられることがあります。なぜなら、価格の動きが速く、感情がより大きな役割を果たすからです。

下落は必ずしも市場の終わりを意味するわけではありません。しばしば、恐怖、ニュース、利益確定、または経済データや金利予想などのマクロイベントによって引き起こされます。これらの瞬間は通常、弱い手を排除し、市場をより健全な動きに備えさせます。賢明な投資家は、感情的に反応するのではなく、下落の背後にある理由を理解することに焦点を当てます。冷静さを保ち、リスクを管理し、長期的な視野を持つことが、暗号通貨市場で生き残り、成長する鍵です。

市場の下落とは何か?

市場の下落は、恐怖やニュースによって引き起こされる短期的な価格の下落であり、完全な市場の崩壊ではありません。

下落は市場の一部

すべての市場は下落を経験します。それは正常であり、健全な価格動向に必要不可欠です。

暗号通貨の下落はより強く感じられる

暗号通貨の価格は速く動くため、小さな売り

BTC5.55%

- 報酬

- 21

- 15

- リポスト

- 共有

FoxFox :

:

アルトコインが上昇局面にあるとき ?? 🤔🤔🤔🤔もっと見る

#HasTheMarketDipped? #HasTheMarketDipped? | 先を見据える、ただ下を見るだけではない

市場の下落はしばしば恐怖を引き起こしますが、経験豊富な参加者は調整が健全なサイクルの一部であることを知っています。重要なのは、市場が下落したことだけではなく、その理由と次に何が起こるかです。

現在、価格の動きは崩壊ではなく統合の段階を反映しています。強い動きの後、市場は自然に冷え込み、トレーダーは利益を確定し、レバレッジをリセットし、弱い手が退出します。このプロセスは次の拡大段階のためのより強固な基盤を築きます。

今後、市場の次の動きを形作るいくつかの要因があります:

資本の回転:スマートマネーは市場を離れるのではなく、回転します。下落時には、資本は過剰に拡大した資産から、長期的なユーティリティを持つ堅実なプロジェクトへと移動します。

流動性と採用:インフラが改善され、実世界のユースケースが増えるにつれて、下落は退出ポイントではなく蓄積ゾーンとなります。

市場の成熟度:以前のサイクルと比べて、反応はより冷静です。パニック売りは徐々に戦略的なポジショニングに置き換えられています。

マクロの整合性:市場はますます先を見据えています。政策の明確さ、機関の関与、技術の進歩に関する期待は、短期的なノイズよりも重要です。

下落は物語の終わりではなく、章です。ある人にと

原文表示市場の下落はしばしば恐怖を引き起こしますが、経験豊富な参加者は調整が健全なサイクルの一部であることを知っています。重要なのは、市場が下落したことだけではなく、その理由と次に何が起こるかです。

現在、価格の動きは崩壊ではなく統合の段階を反映しています。強い動きの後、市場は自然に冷え込み、トレーダーは利益を確定し、レバレッジをリセットし、弱い手が退出します。このプロセスは次の拡大段階のためのより強固な基盤を築きます。

今後、市場の次の動きを形作るいくつかの要因があります:

資本の回転:スマートマネーは市場を離れるのではなく、回転します。下落時には、資本は過剰に拡大した資産から、長期的なユーティリティを持つ堅実なプロジェクトへと移動します。

流動性と採用:インフラが改善され、実世界のユースケースが増えるにつれて、下落は退出ポイントではなく蓄積ゾーンとなります。

市場の成熟度:以前のサイクルと比べて、反応はより冷静です。パニック売りは徐々に戦略的なポジショニングに置き換えられています。

マクロの整合性:市場はますます先を見据えています。政策の明確さ、機関の関与、技術の進歩に関する期待は、短期的なノイズよりも重要です。

下落は物語の終わりではなく、章です。ある人にと

- 報酬

- 7

- コメント

- リポスト

- 共有

もっと詳しく

成長中のコミュニティに、40M人のユーザーと一緒に参加しましょう

⚡️ 暗号通貨ブームのディスカッションに、40M人のユーザーと一緒に参加しましょう

💬 お気に入りの人気クリエイターと交流しよう

👍 あなたの興味を見つけよう

人気の話題

31.18K 人気度

10.51K 人気度

10.61K 人気度

8.13K 人気度

436.3K 人気度

341.32K 人気度

119 人気度

92.27K 人気度

179.13K 人気度

5.32K 人気度

11.29K 人気度

8.25K 人気度

2.48K 人気度

2.98K 人気度

36.3K 人気度

ニュース

もっと見るゴールドマン・サックス:日本銀行の新委員候補の指名により、最近の利上げの可能性が低下する可能性

4 分

ビットワイズ警告:ウォール街がオンチェーン金融に全面的に移行する中、従来の投資家は依然として暗号通貨の機会を過小評価している

9 分

ビットコインが7万ドルに到達しようとするも阻まれ、下落に転じる中、アルトコインが一斉に爆発し、激しいローテーションの兆候を示している

13 分

今日のアルトコインの反発がBTCを上回った影響で、5000万規模でBTCの買いポジションを持った巨大な投資家は、アルトコインの下落に対して逆方向の損失を被った。

15 分

UNI価格が15%急騰!Uniswapの手数料変換提案が承認され、年間収益がさらに2700万ドル増加する可能性

23 分

ピン