# ETHEREUM

610.15K

bulbul

🚨 $282 MILLIONS de crypto volés ! 😱

Une attaque massive d'ingénierie sociale vient de vider $282M en crypto d'une seule victime.

⚠️ Pas de bug dans le contrat intelligent.

⚠️ Pas de piratage d’échange.

👉 Juste de la manipulation pure et une erreur humaine.

Les escrocs ont convaincu la victime de donner accès — les fonds, y compris $BTC $ETH $LTC , ont été rapidement déplacés et blanchis.

🔐 Le plus grand risque dans la crypto en ce moment ?

Pas le code… LA CONFIANCE.

Restez en sécurité :

• Ne jamais partager la phrase de récupération

• Vérifiez deux fois les liens

• Utilisez des portefe

Voir l'originalUne attaque massive d'ingénierie sociale vient de vider $282M en crypto d'une seule victime.

⚠️ Pas de bug dans le contrat intelligent.

⚠️ Pas de piratage d’échange.

👉 Juste de la manipulation pure et une erreur humaine.

Les escrocs ont convaincu la victime de donner accès — les fonds, y compris $BTC $ETH $LTC , ont été rapidement déplacés et blanchis.

🔐 Le plus grand risque dans la crypto en ce moment ?

Pas le code… LA CONFIANCE.

Restez en sécurité :

• Ne jamais partager la phrase de récupération

• Vérifiez deux fois les liens

• Utilisez des portefe

- Récompense

- 1

- Commentaire

- Reposter

- Partager

Bitcoin frôle les 70 000 $ et je ne vais pas mentir, ça fait du bien. 👀

Après des semaines de saignement en dessous de $63K avec tout ce drame tarifaire et cette panique de fuite vers la sécurité, le BTC vient d'afficher une hausse intraday de 8,5 %, son plus grand mouvement en une seule séance depuis début février, atteignant 69 500 $. Le niveau $70K est juste là et le marché peut le sentir.

Et ce n’est pas seulement Bitcoin. ETH monte d’environ 12 % à 2 085 $, SOL a gagné 13 %, et DOGE ainsi que XRP affichent tous deux de fortes gains à deux chiffres. C’est un rallye de soulagement large,

Voir l'originalAprès des semaines de saignement en dessous de $63K avec tout ce drame tarifaire et cette panique de fuite vers la sécurité, le BTC vient d'afficher une hausse intraday de 8,5 %, son plus grand mouvement en une seule séance depuis début février, atteignant 69 500 $. Le niveau $70K est juste là et le marché peut le sentir.

Et ce n’est pas seulement Bitcoin. ETH monte d’environ 12 % à 2 085 $, SOL a gagné 13 %, et DOGE ainsi que XRP affichent tous deux de fortes gains à deux chiffres. C’est un rallye de soulagement large,

- Récompense

- 4

- 1

- Reposter

- Partager

Discovery :

:

Jusqu'à la lune 🌕🚨 Mise à jour du marché | 19 février

BTC : ~$66 900

ETH : ~$1 980

Le marché des cryptomonnaies continue d’évoluer dans une fourchette de consolidation alors que la volatilité reste active.

🔹 Bitcoin (BTC)

BTC se négocie autour de la $67K région, maintenant un équilibre à court terme après les fluctuations récentes.

L’action des prix reflète une position prudente plutôt qu’une expansion agressive.

🔹 Ethereum (ETH)

ETH oscille juste en dessous du niveau psychologique de 2 000 dollars.

La structure du marché reste neutre, avec les participants surveillant les réactions autour des zones clés.

�

Voir l'originalBTC : ~$66 900

ETH : ~$1 980

Le marché des cryptomonnaies continue d’évoluer dans une fourchette de consolidation alors que la volatilité reste active.

🔹 Bitcoin (BTC)

BTC se négocie autour de la $67K région, maintenant un équilibre à court terme après les fluctuations récentes.

L’action des prix reflète une position prudente plutôt qu’une expansion agressive.

🔹 Ethereum (ETH)

ETH oscille juste en dessous du niveau psychologique de 2 000 dollars.

La structure du marché reste neutre, avec les participants surveillant les réactions autour des zones clés.

�

- Récompense

- 4

- 3

- Reposter

- Partager

LittleGodOfWealthPlutus :

:

Bonne année du Cheval, que la fortune et la prospérité vous accompagnent😘Afficher plus

$ETH

Reversal haussière

Récupération forte depuis le creux local de 1 800 → hausse impulsive de 11,98 % reprenant une résistance majeure → le prix se consolide actuellement près de 2 068 après avoir testé un sommet quotidien de 2 086.

La dynamique est devenue haussière sur le graphique 4H avec une expansion significative du volume.

Configuration longue

2 020 – 2 045

Objectifs :

2 125

2 240

2 350

Stop loss :

1 940

Structure de breakout saine → recherche d’un retest réussi de la zone psychologique des 2 000 avant de viser des niveaux de liquidité plus élevés.

#ETH #Ethereum #Crypto

Reversal haussière

Récupération forte depuis le creux local de 1 800 → hausse impulsive de 11,98 % reprenant une résistance majeure → le prix se consolide actuellement près de 2 068 après avoir testé un sommet quotidien de 2 086.

La dynamique est devenue haussière sur le graphique 4H avec une expansion significative du volume.

Configuration longue

2 020 – 2 045

Objectifs :

2 125

2 240

2 350

Stop loss :

1 940

Structure de breakout saine → recherche d’un retest réussi de la zone psychologique des 2 000 avant de viser des niveaux de liquidité plus élevés.

#ETH #Ethereum #Crypto

ETH8,11%

- Récompense

- 2

- Commentaire

- Reposter

- Partager

🔵 La Fondation Ethereum commence à staker une partie du trésor d’Ether Malgré la vente d’ETH par Buterin

La Fondation Ethereum a commencé à staker une partie de ses avoirs en ether. Le 24 février, l’organisation à but non lucratif a annoncé un dépôt initial de 2 016 ETH ( d’une valeur d’environ 3,8 millions de dollars). Avec le temps, la Fondation prévoit de staker environ 70 000 ETH — d’une valeur d’environ $127 millions — via le staking en solo. Les récompenses en ETH natives qui en résulteront seront versées au trésor de l’organisation pour soutenir ses initiatives à venir.

« En participan

La Fondation Ethereum a commencé à staker une partie de ses avoirs en ether. Le 24 février, l’organisation à but non lucratif a annoncé un dépôt initial de 2 016 ETH ( d’une valeur d’environ 3,8 millions de dollars). Avec le temps, la Fondation prévoit de staker environ 70 000 ETH — d’une valeur d’environ $127 millions — via le staking en solo. Les récompenses en ETH natives qui en résulteront seront versées au trésor de l’organisation pour soutenir ses initiatives à venir.

« En participan

ETH8,11%

- Récompense

- 2

- Commentaire

- Reposter

- Partager

#ETH多空对决 ⚔️📊

Ethereum (ETH) entre dans une phase décisive où les taureaux et les ours sont engagés dans une bataille à enjeux élevés. Dans la zone de prix actuelle, nous observons des tests répétés des supports et résistances critiques — un signe clair que la conviction des deux côtés est forte.

D’un point de vue technique, la compression de la volatilité au sein de niveaux clés précède souvent une expansion. Les fluctuations du volume de trading et le changement des taux de financement montrent que le sentiment reste profondément divisé.

🟢 Les taureaux s’appuient sur la croissance de l’écos

Ethereum (ETH) entre dans une phase décisive où les taureaux et les ours sont engagés dans une bataille à enjeux élevés. Dans la zone de prix actuelle, nous observons des tests répétés des supports et résistances critiques — un signe clair que la conviction des deux côtés est forte.

D’un point de vue technique, la compression de la volatilité au sein de niveaux clés précède souvent une expansion. Les fluctuations du volume de trading et le changement des taux de financement montrent que le sentiment reste profondément divisé.

🟢 Les taureaux s’appuient sur la croissance de l’écos

ETH8,11%

- Récompense

- 4

- 4

- Reposter

- Partager

ybaser :

:

merci de partager la véritable vision du marché cryptoAfficher plus

#ETH confrontation entre acheteurs et vendeurs

⚔️ Mise à jour du combat ETH – Les acheteurs reprennent le dessus au-dessus de 1,9K$

25 février 2026 — et l’élan vient de changer. Ethereum se négocie autour de 1 917 $, en hausse d’environ 4–5 % dans la journée, et la pression vendeuse commence à se désamorcer.

📊 Qu’est-ce qui vient de se passer ?

🩸 Liquidations à découvert :

Plus de $120M positions short liquidées en seulement quelques heures. Lorsqu’un côté devient trop crowded, le marché le sanctionne généralement rapidement.

🏛️ Signal de la fondation :

L’allocation de 70 000 ETH par la Fo

⚔️ Mise à jour du combat ETH – Les acheteurs reprennent le dessus au-dessus de 1,9K$

25 février 2026 — et l’élan vient de changer. Ethereum se négocie autour de 1 917 $, en hausse d’environ 4–5 % dans la journée, et la pression vendeuse commence à se désamorcer.

📊 Qu’est-ce qui vient de se passer ?

🩸 Liquidations à découvert :

Plus de $120M positions short liquidées en seulement quelques heures. Lorsqu’un côté devient trop crowded, le marché le sanctionne généralement rapidement.

🏛️ Signal de la fondation :

L’allocation de 70 000 ETH par la Fo

ETH8,11%

- Récompense

- 15

- 22

- Reposter

- Partager

StylishKuri :

:

Jusqu'à la lune 🌕Afficher plus

Le jeu de l’offre et de la demande sur ETH entre dans une étape cruciale ⚖️📉📈

Actuellement, Ethereum (ETH) se négocie dans une zone qui ressemble moins à une tendance qu’à un champ de bataille. Le prix oscille autour de niveaux critiques où ni les haussiers ni les baissiers ne sont prêts à reculer — et cette tension est visible à chaque bougie.

Au lieu d’une cassure nette, nous observons de l’hésitation. Les pics de volume s’estompent rapidement. Les cassures peinent à se confirmer. Les taux de financement fluctuent. Cela nous dit une chose : le marché est incertain — et divisé.

Qu’est-ce qu

Actuellement, Ethereum (ETH) se négocie dans une zone qui ressemble moins à une tendance qu’à un champ de bataille. Le prix oscille autour de niveaux critiques où ni les haussiers ni les baissiers ne sont prêts à reculer — et cette tension est visible à chaque bougie.

Au lieu d’une cassure nette, nous observons de l’hésitation. Les pics de volume s’estompent rapidement. Les cassures peinent à se confirmer. Les taux de financement fluctuent. Cela nous dit une chose : le marché est incertain — et divisé.

Qu’est-ce qu

ETH8,11%

- Récompense

- 2

- 3

- Reposter

- Partager

NovaCryptoGirl :

:

LFG 🔥Afficher plus

#ETHLongShortBattle

🚨 #ETHLongShortBattle – Qui gagne la guerre ? ⚔️

📊 Structure du marché

Le prix réagit près d'une zone clé de retournement support/résistance.

Les cadres temporels inférieurs montrent une expansion de la volatilité.

La tendance sur les cadres temporels supérieurs reste prudemment haussière sauf si un support majeur est cassé.

📈 Positions longues (Haussiers)

Les acheteurs défendent des niveaux de support solides.

Le RSI restant au-dessus de la ligne médiane suggère une force sous-jacente.

Toute cassure au-dessus de la résistance immédiate pourrait déclencher une liquidati

🚨 #ETHLongShortBattle – Qui gagne la guerre ? ⚔️

📊 Structure du marché

Le prix réagit près d'une zone clé de retournement support/résistance.

Les cadres temporels inférieurs montrent une expansion de la volatilité.

La tendance sur les cadres temporels supérieurs reste prudemment haussière sauf si un support majeur est cassé.

📈 Positions longues (Haussiers)

Les acheteurs défendent des niveaux de support solides.

Le RSI restant au-dessus de la ligne médiane suggère une force sous-jacente.

Toute cassure au-dessus de la résistance immédiate pourrait déclencher une liquidati

ETH8,11%

- Récompense

- 4

- 1

- Reposter

- Partager

ybaser :

:

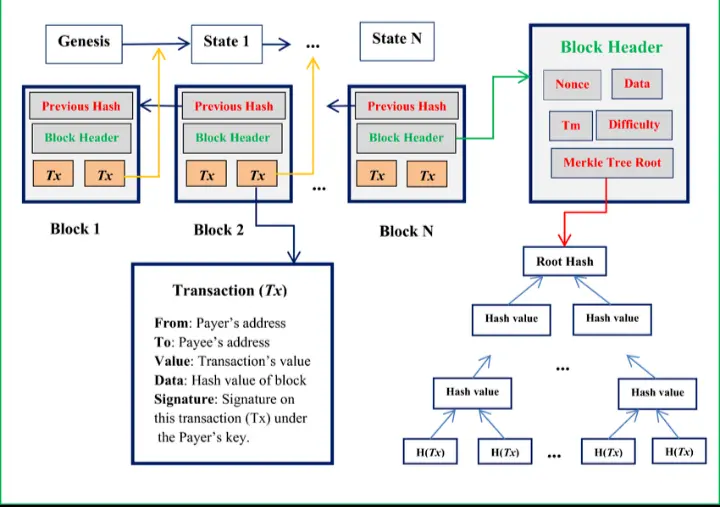

Jusqu'à la lune 🌕$ETH n'est pas simplement une cryptomonnaie — c’est un écosystème blockchain complet où l’avenir de la finance, du gaming, des NFTs et du Web3 est en train de se construire.

✨ Pourquoi Ethereum est-il si puissant ?

🔹 Technologie des contrats intelligents – transactions automatisées et sécurisées

🔹 La fondation des plateformes DeFi

🔹 Le réseau leader pour les marketplaces NFT

🔹 Mise à niveau Ethereum 2.0 – frais de gaz réduits et meilleure évolutivité

Des milliers de développeurs à travers le monde travaillent chaque jour sur le réseau Ethereum — et c’est sa plus grande force.

#Ethereum #C

✨ Pourquoi Ethereum est-il si puissant ?

🔹 Technologie des contrats intelligents – transactions automatisées et sécurisées

🔹 La fondation des plateformes DeFi

🔹 Le réseau leader pour les marketplaces NFT

🔹 Mise à niveau Ethereum 2.0 – frais de gaz réduits et meilleure évolutivité

Des milliers de développeurs à travers le monde travaillent chaque jour sur le réseau Ethereum — et c’est sa plus grande force.

#Ethereum #C

ETH8,11%

- Récompense

- J'aime

- Commentaire

- Reposter

- Partager

Charger plus

Rejoignez les utilisateurs de 40M dans notre communauté grandissante

⚡️ Rejoignez les utilisateurs de 40M dans la discussion sur l'engouement pour les cryptomonnaies

💬 Interagissez avec vos créateurs préférés

👍 Découvrez ce qui vous intéresse

Sujets populaires

30.48K Popularité

46 Popularité

8.8K Popularité

52 Popularité

435.51K Popularité

339.85K Popularité

80.61K Popularité

91.54K Popularité

178.72K Popularité

5.17K Popularité

11.27K Popularité

8.19K Popularité

2.36K Popularité

3.04K Popularité

36.12K Popularité

Actualités

Afficher plusLa probabilité de l'événement « La Russie entrera à Bilyts'ke (Ukraine) avant le 28 février » sur Polymarket a explosé de 11 % hier à 97 %.

4 min

Données : si ETH chute en dessous de 1 953 dollars, l'intensité totale de liquidation des positions longues sur les principales plateformes d'échange centralisées (CEX) atteindra 992 millions de dollars

10 min

XPL (Plasma) a augmenté de 17,39 % en 24 heures

27 min

Monad co-fondateur : La théorie du complot selon laquelle Jane Street aurait fait baisser le Bitcoin en dessous de 150 000 $ est infondée

32 min

Gate SOL staking total dépasse 516 600 jetons, avec un rendement annuel de 11%

36 min

Épingler