# CryptoMarketWatch

242.18K

Recent market volatility has intensified, with growing divergence between bulls and bears. Are you leaning bullish or cautious on what comes next? What signals are you watching and how are you positioning? Share your views.

StylishKuri

#CryptoMarketWatch マーケットアップデート&構造的洞察

暗号市場は最も重要な移行期の一つを進んでいます。ボラティリティは高く、センチメントは日々変化し、価格動向は不確かに感じられますが、その裏では長期的な構造的発展が静かに進行しています。これは単なる調整以上のものであり、ポジショニング、忍耐、視点がスピードよりも重要となる期間です。

🔹 ビットコイン:下落局面における確信

リトレースメントの間でも、長期保有者は堅実です。大口ウォレットは慎重に動き、小口投資家の参加は控えめであり、この乖離はしばしば次の方向性の動きの前に静かな市場リセットを示唆します。

🔹 イーサリアム:レイヤー2&エコシステムの成長

ETHは着実に進化し続けています。レイヤー2の採用が増加し、開発者の活動が活発化し、取引効率が向上しています。機関投資家のETHインフラへの関心も徐々に高まっています。価格はイノベーションに遅れることもありますが、歴史は技術が最終的に評価を牽引することを示しています。

🔹 アルトコイン:資本のローテーション、 hypeではなく

資本は選択的です。インフラプロジェクト、実世界資産プラットフォーム、スケーラブルなネットワークが注目を集める一方、投機的トークンには圧力がかかっています。このフェーズは、ユーティリティとハイプ、ファンダメンタル

原文表示暗号市場は最も重要な移行期の一つを進んでいます。ボラティリティは高く、センチメントは日々変化し、価格動向は不確かに感じられますが、その裏では長期的な構造的発展が静かに進行しています。これは単なる調整以上のものであり、ポジショニング、忍耐、視点がスピードよりも重要となる期間です。

🔹 ビットコイン:下落局面における確信

リトレースメントの間でも、長期保有者は堅実です。大口ウォレットは慎重に動き、小口投資家の参加は控えめであり、この乖離はしばしば次の方向性の動きの前に静かな市場リセットを示唆します。

🔹 イーサリアム:レイヤー2&エコシステムの成長

ETHは着実に進化し続けています。レイヤー2の採用が増加し、開発者の活動が活発化し、取引効率が向上しています。機関投資家のETHインフラへの関心も徐々に高まっています。価格はイノベーションに遅れることもありますが、歴史は技術が最終的に評価を牽引することを示しています。

🔹 アルトコイン:資本のローテーション、 hypeではなく

資本は選択的です。インフラプロジェクト、実世界資産プラットフォーム、スケーラブルなネットワークが注目を集める一方、投機的トークンには圧力がかかっています。このフェーズは、ユーティリティとハイプ、ファンダメンタル

- 報酬

- 8

- 5

- リポスト

- 共有

Yunna :

:

保持 保持もっと見る

#CryptoMarketWatch #CryptoMarketWatch

暗号市場は最も重要な移行期の一つを迎えています。ボラティリティは依然高く、センチメントは日々変化し、価格の動きは不確実に感じられます — しかし、その裏では長期的な構造的発展が継続しています。これは単なる調整や統合の局面ではありません。ポジショニング、忍耐、視点がスピードよりも重要となる期間です。

ビットコインは引き続き主導的な役割を果たしています。調整局面でも、長期保有者は回復力を示し、より広範なデジタル資産のストーリーに対する確信が保たれていることを示唆しています。大口ウォレットは慎重に動き、リテールの参加は躊躇しているように見えます。この乖離は、多くの場合、市場が次の方向性の動きの前に静かにリセットしているサインです。

イーサリアムは着実に進化しています。Layer-2の採用拡大と開発者活動の増加に支えられ、トランザクション効率は向上し、エコシステムは成熟しつつあります。機関投資家のETHインフラへの関心も高まっています。短期的には価格がイノベーションに追いつかないこともありますが、歴史は技術の進歩が最終的に評価に反映されることを示しています。

アルトコインは選択的に動いています。資本は市場に流入するのではなく、回転しています。インフラプロジェクト、実世界資産プラットフォーム、スケーラブルなネットワー

原文表示暗号市場は最も重要な移行期の一つを迎えています。ボラティリティは依然高く、センチメントは日々変化し、価格の動きは不確実に感じられます — しかし、その裏では長期的な構造的発展が継続しています。これは単なる調整や統合の局面ではありません。ポジショニング、忍耐、視点がスピードよりも重要となる期間です。

ビットコインは引き続き主導的な役割を果たしています。調整局面でも、長期保有者は回復力を示し、より広範なデジタル資産のストーリーに対する確信が保たれていることを示唆しています。大口ウォレットは慎重に動き、リテールの参加は躊躇しているように見えます。この乖離は、多くの場合、市場が次の方向性の動きの前に静かにリセットしているサインです。

イーサリアムは着実に進化しています。Layer-2の採用拡大と開発者活動の増加に支えられ、トランザクション効率は向上し、エコシステムは成熟しつつあります。機関投資家のETHインフラへの関心も高まっています。短期的には価格がイノベーションに追いつかないこともありますが、歴史は技術の進歩が最終的に評価に反映されることを示しています。

アルトコインは選択的に動いています。資本は市場に流入するのではなく、回転しています。インフラプロジェクト、実世界資産プラットフォーム、スケーラブルなネットワー

- 報酬

- 9

- 7

- リポスト

- 共有

ybaser :

:

2026 GOGOGO 👊注視中 🔍️新年あけましておめでとうございます! DYOR 🤓もっと見る

#CryptoMarketWatch #CryptoMarketWatch

暗号市場は最も重要な移行期の一つを進んでいます。ボラティリティは依然高く、センチメントは日々変化し、価格動向は不確実に感じられますが、その裏では長期的な構造的発展が継続しています。これは単なる調整や統合の局面ではありません。ポジショニング、忍耐、視点がスピードよりも重要となる期間です。

ビットコインは引き続きナarrativeを牽引しています。下落局面でも長期保有者はレジリエンスを示し、より広範なデジタル資産ストーリーへの確信が保たれていることを示唆しています。大口ウォレットは慎重に動き、個人投資家の参加は控えめに見えます。この乖離は、多くの場合、市場が次の方向性の動きの前に静かにリセットしているサインです。

イーサリアムは着実に進化しています。Layer-2の採用拡大と開発者活動の拡大に支えられ、取引効率は向上し、エコシステムは成熟しつつあります。ETHベースのインフラに対する機関投資の関心も高まっています。短期的には価格がイノベーションに追いつかないこともありますが、歴史は技術の進歩が最終的に評価に反映されることを示しています。

アルトコインは選別的です。資本は市場に流入するのではなく、回転しています。インフラプロジェクト、実世界資産プラットフォーム、スケーラブルなネットワークが注目を集める一方、投機的

原文表示暗号市場は最も重要な移行期の一つを進んでいます。ボラティリティは依然高く、センチメントは日々変化し、価格動向は不確実に感じられますが、その裏では長期的な構造的発展が継続しています。これは単なる調整や統合の局面ではありません。ポジショニング、忍耐、視点がスピードよりも重要となる期間です。

ビットコインは引き続きナarrativeを牽引しています。下落局面でも長期保有者はレジリエンスを示し、より広範なデジタル資産ストーリーへの確信が保たれていることを示唆しています。大口ウォレットは慎重に動き、個人投資家の参加は控えめに見えます。この乖離は、多くの場合、市場が次の方向性の動きの前に静かにリセットしているサインです。

イーサリアムは着実に進化しています。Layer-2の採用拡大と開発者活動の拡大に支えられ、取引効率は向上し、エコシステムは成熟しつつあります。ETHベースのインフラに対する機関投資の関心も高まっています。短期的には価格がイノベーションに追いつかないこともありますが、歴史は技術の進歩が最終的に評価に反映されることを示しています。

アルトコインは選別的です。資本は市場に流入するのではなく、回転しています。インフラプロジェクト、実世界資産プラットフォーム、スケーラブルなネットワークが注目を集める一方、投機的

- 報酬

- 5

- 4

- リポスト

- 共有

YingYue :

:

明けましておめでとうございます! 🤑もっと見る

#CryptoMarketWatch $DOGE – 強気の構造は維持されており、ミームコインのムーンマップは依然として有効 🚀🐶

$BONK は、下限付近の重要な需要を守った後、強気の市場構造を維持しています。価格はサポートの上で統合しており、モメンタム指標は疲弊ではなく継続を示唆しています。ミームのセンチメントが熱を保ち、DOGEが高値を維持していることから、次の動きは上昇圧力を支持し、ボリュームの拡大がブレイクアウトを確認すれば、上部の抵抗ゾーンに向かう展開となるでしょう。“1000倍”の話は誇大広告ですが、技術的には、DOGEはこのサイクルでさらに高値を目指す余地があります。$SHIB

トレード設定:

ポジション:ロング

エントリー:サポートへのプルバック時またはレンジ抵抗の上での確定ブレイクアウト時

ターゲット (TP):

TP1:前回のローカル高値

TP2:主要な抵抗ゾーン

TP3:サイクル拡大のターゲット (モメンタムベース)

ストップロス (SL@E1:重要なサポート以下 / 高値の無効化

市場見通し:

短期から中期の見通しは依然として強気だが、ボラティリティも高い。ミームコインはセンチメントの波に乗って繁栄するため、鋭い動きや素早いローテーション、抵抗付近での積極的な利益確定を予想してください。トレンドに従い、幻想ではなく現実を追いましょう。

原文表示$BONK は、下限付近の重要な需要を守った後、強気の市場構造を維持しています。価格はサポートの上で統合しており、モメンタム指標は疲弊ではなく継続を示唆しています。ミームのセンチメントが熱を保ち、DOGEが高値を維持していることから、次の動きは上昇圧力を支持し、ボリュームの拡大がブレイクアウトを確認すれば、上部の抵抗ゾーンに向かう展開となるでしょう。“1000倍”の話は誇大広告ですが、技術的には、DOGEはこのサイクルでさらに高値を目指す余地があります。$SHIB

トレード設定:

ポジション:ロング

エントリー:サポートへのプルバック時またはレンジ抵抗の上での確定ブレイクアウト時

ターゲット (TP):

TP1:前回のローカル高値

TP2:主要な抵抗ゾーン

TP3:サイクル拡大のターゲット (モメンタムベース)

ストップロス (SL@E1:重要なサポート以下 / 高値の無効化

市場見通し:

短期から中期の見通しは依然として強気だが、ボラティリティも高い。ミームコインはセンチメントの波に乗って繁栄するため、鋭い動きや素早いローテーション、抵抗付近での積極的な利益確定を予想してください。トレンドに従い、幻想ではなく現実を追いましょう。

- 報酬

- 7

- 8

- リポスト

- 共有

repanzal :

:

2026年ゴゴゴ 👊もっと見る

#CryptoMarketWatch

Solana (SOL)は、暗号市場の全体的な弱気市場の崩壊によって最も大きな打撃を受けた主要コインの一つです。現在の価格は約74ドル〜$79 (付近を推移しており、過去24時間で約13〜18%の下落を記録し、$70 レベルをテストしています)。このレベルは、2025年末/2026年初の$120〜$130 範囲から約40〜45%の損失を示しており、過去1〜1.5年で最も低い水準の一つです。主なポイント:

最近の下落傾向:ビットコインが約63,000ドルまで下落したのと並行して、SOLはレバレッジポジションの大量清算やロングポジションの清算、リスク回避の高まりにより急激な売り圧力に見舞われました。心理的$100 レベルが破られた後、勢いは完全に売り手側に傾きました。

市場のセンチメント:恐怖指数は非常に高い状態です。SOLはイーサリアムやビットコインに比べてパフォーマンスが劣っており、多くのアナリストはキャピチュレーション段階が始まったと考えています。テクニカルな見通し:200日移動平均線はすでに割れています。主要なサポートゾーンは約70〜75ドル付近で、さらなるブレイクアウトは$65 USDや55〜60ドルまでのターゲットとなる可能性があります。抵抗線は90〜95ドルの範囲で非常に強いです。

オンチェーン状況:最近数週間でアンステーキング量が

原文表示Solana (SOL)は、暗号市場の全体的な弱気市場の崩壊によって最も大きな打撃を受けた主要コインの一つです。現在の価格は約74ドル〜$79 (付近を推移しており、過去24時間で約13〜18%の下落を記録し、$70 レベルをテストしています)。このレベルは、2025年末/2026年初の$120〜$130 範囲から約40〜45%の損失を示しており、過去1〜1.5年で最も低い水準の一つです。主なポイント:

最近の下落傾向:ビットコインが約63,000ドルまで下落したのと並行して、SOLはレバレッジポジションの大量清算やロングポジションの清算、リスク回避の高まりにより急激な売り圧力に見舞われました。心理的$100 レベルが破られた後、勢いは完全に売り手側に傾きました。

市場のセンチメント:恐怖指数は非常に高い状態です。SOLはイーサリアムやビットコインに比べてパフォーマンスが劣っており、多くのアナリストはキャピチュレーション段階が始まったと考えています。テクニカルな見通し:200日移動平均線はすでに割れています。主要なサポートゾーンは約70〜75ドル付近で、さらなるブレイクアウトは$65 USDや55〜60ドルまでのターゲットとなる可能性があります。抵抗線は90〜95ドルの範囲で非常に強いです。

オンチェーン状況:最近数週間でアンステーキング量が

- 報酬

- 47

- 23

- リポスト

- 共有

Kai_Zen :

:

明けましておめでとうございます! 🤑もっと見る

#CryptoMarketWatch

暗号市場は現在、深刻なキャピチュレーションモードにあり、ビットコイン、イーサリアム、そしてより広範なアルトコイン市場全体で積極的な売り圧力がかかっています。暗号市場の時価総額は約2.45兆ドル~2.5兆ドルに下落し、過去24時間で6~7%以上の下落を記録し、最近の上昇の大部分を帳消しにし、強いリスクオフフェーズを確認しています。

🔴 現在の価格動向スナップショット

ビットコイン (BTC)

価格範囲:67,000ドル–70,000ドル

日中安値:約66,700ドル–67,200ドル (取引所による変動)

ドローダウン:2025年10月の最高値約126,000ドルから約44–47%

重要ポイント:2024年11月以来初めて持続的に下回る動き

BTCが主要な心理的・技術的レベルを下回ることでパニック、清算、強制売りが薄い流動性の中で引き起こされています。

イーサリアム $70K ETH(

現在の範囲:1,930ドル–2,100ドル

日次損失:約8–10%+

ETHは引き続きBTCに比べてパフォーマンスが低く、このリスクオフ環境でより高い下落感度を示しています。

アルトコイン市場

大型アルト )SOL、XRP、BNBなど(: -8%から -14%

中・小型:-15%から -30%以上

資金は積極的にハイベータ資産から回転しています。

📉 市場セ

原文表示暗号市場は現在、深刻なキャピチュレーションモードにあり、ビットコイン、イーサリアム、そしてより広範なアルトコイン市場全体で積極的な売り圧力がかかっています。暗号市場の時価総額は約2.45兆ドル~2.5兆ドルに下落し、過去24時間で6~7%以上の下落を記録し、最近の上昇の大部分を帳消しにし、強いリスクオフフェーズを確認しています。

🔴 現在の価格動向スナップショット

ビットコイン (BTC)

価格範囲:67,000ドル–70,000ドル

日中安値:約66,700ドル–67,200ドル (取引所による変動)

ドローダウン:2025年10月の最高値約126,000ドルから約44–47%

重要ポイント:2024年11月以来初めて持続的に下回る動き

BTCが主要な心理的・技術的レベルを下回ることでパニック、清算、強制売りが薄い流動性の中で引き起こされています。

イーサリアム $70K ETH(

現在の範囲:1,930ドル–2,100ドル

日次損失:約8–10%+

ETHは引き続きBTCに比べてパフォーマンスが低く、このリスクオフ環境でより高い下落感度を示しています。

アルトコイン市場

大型アルト )SOL、XRP、BNBなど(: -8%から -14%

中・小型:-15%から -30%以上

資金は積極的にハイベータ資産から回転しています。

📉 市場セ

- 報酬

- 31

- 33

- リポスト

- 共有

BeautifulDay :

:

暗号通貨に関する情報を共有していただきありがとうございますもっと見る

#CryptoMarketWatch

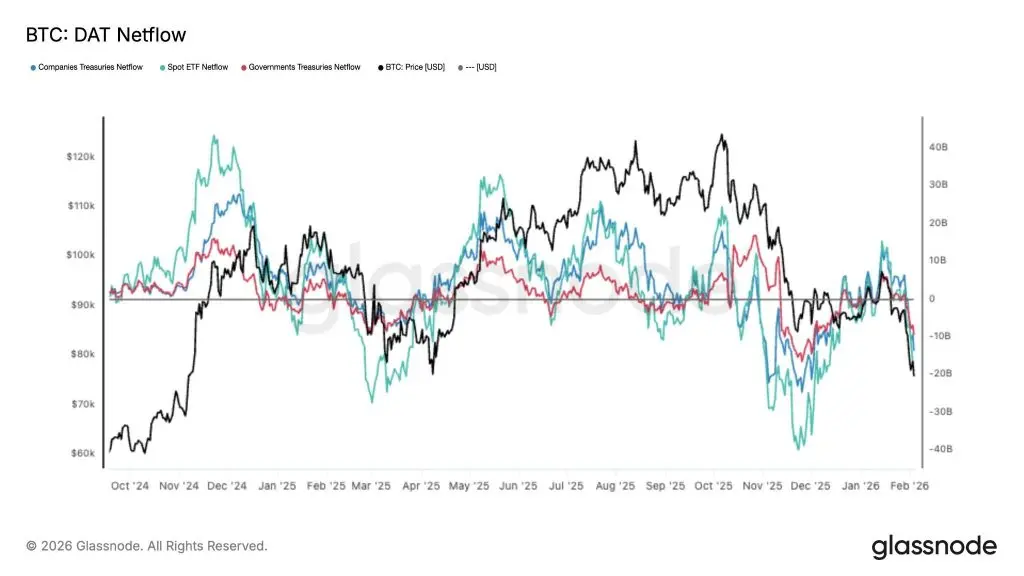

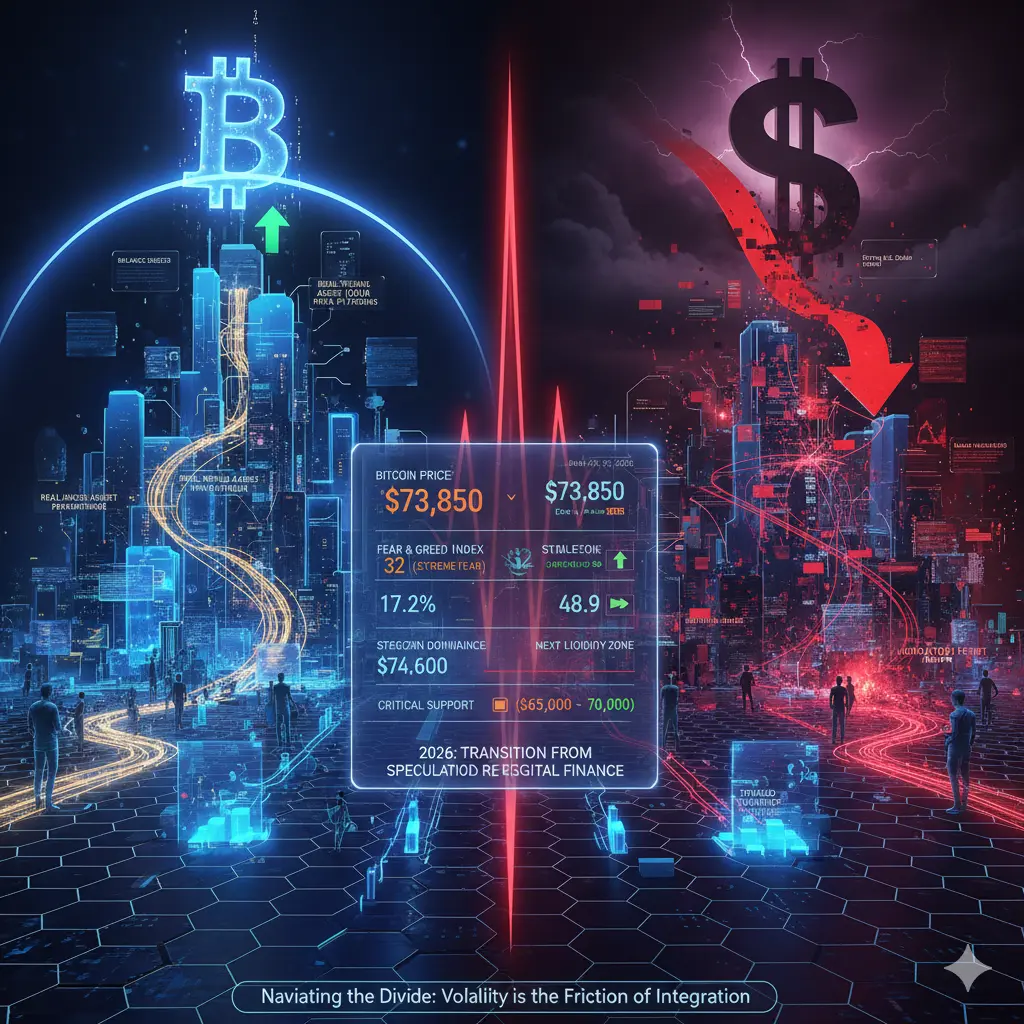

2026年の暗号市場は、ここ数年で最も鋭い乖離の一つを目の当たりにしています。強気派と弱気派の間の分裂は、もはや価格予想を超え、市場自体が何を表しているのかについて根本的に異なる解釈へと拡大しています。一方には、暗号がついに実験段階を脱し、グローバル金融システムの生産的な要素になりつつあると主張する者たちがいます。もう一方には、積極的な清算、脆弱な流動性、伝統的資産との相関関係の複雑化により、短期的な景色は慎重さを求めています。市場はもはや未来のビジョンを売るのではなく、グローバル資本市場の一部として再評価されており、その移行は自然と痛みを伴っています。

2026年2月は、暗号投資家にとって再評価の時期となっています。ビットコインは2025年後半のピーク近くの約126,000ドルから73,000ドル~78,000ドルの範囲に下落し、重要な疑問を投げかけています:これは健全な調整段階なのか、それともより深い構造的な解消の初期段階なのか?技術的な状況は依然として不明確です。回復の試みは弱く、ラリーは一貫して売られ、ボラティリティは重要なレベル周辺に集中しています。本当の課題は、価格チャートが示すものとファンダメンタルズが示すものとの間の整合性の欠如にあります。

強気派の主張は、制度的インフラの明らかな進展に基づいています。暗号史上初めて、採用はユ

原文表示2026年の暗号市場は、ここ数年で最も鋭い乖離の一つを目の当たりにしています。強気派と弱気派の間の分裂は、もはや価格予想を超え、市場自体が何を表しているのかについて根本的に異なる解釈へと拡大しています。一方には、暗号がついに実験段階を脱し、グローバル金融システムの生産的な要素になりつつあると主張する者たちがいます。もう一方には、積極的な清算、脆弱な流動性、伝統的資産との相関関係の複雑化により、短期的な景色は慎重さを求めています。市場はもはや未来のビジョンを売るのではなく、グローバル資本市場の一部として再評価されており、その移行は自然と痛みを伴っています。

2026年2月は、暗号投資家にとって再評価の時期となっています。ビットコインは2025年後半のピーク近くの約126,000ドルから73,000ドル~78,000ドルの範囲に下落し、重要な疑問を投げかけています:これは健全な調整段階なのか、それともより深い構造的な解消の初期段階なのか?技術的な状況は依然として不明確です。回復の試みは弱く、ラリーは一貫して売られ、ボラティリティは重要なレベル周辺に集中しています。本当の課題は、価格チャートが示すものとファンダメンタルズが示すものとの間の整合性の欠如にあります。

強気派の主張は、制度的インフラの明らかな進展に基づいています。暗号史上初めて、採用はユ

- 報酬

- 65

- 51

- リポスト

- 共有

Crypto_Buzz_with_Alex :

:

2026年ゴゴゴ 👊もっと見る

#CryptoMarketWatch #CryptoMarketWatch

暗号資産市場は、イノベーション、ボラティリティ、採用が融合し、金融システムやデジタルエコシステムを再構築していることで、引き続き世界的な注目を集めています。市場ウォッチャーは、主要コイン、アルトコイン、分散型金融プロトコル、新興技術の動向を観察し、変化する市場の状況を理解しようとしています。

ビットコインは市場の中心的な焦点であり、投資家のセンチメントの指標と見なされています。その価格動向、機関投資家による採用、決済システムへの統合は、より広範な暗号資産環境に影響を与え続けています。観察者は、取引量、市場流動性、投資家行動のパターンを分析し、短期的な変動と長期的なトレンドの両方を評価しています。

イーサリアムやその他のスマートコントラクトプラットフォームは、金融、ゲーム、ソーシャルネットワーキング、エンタープライズソリューションを含む分散型アプリケーションにおいて重要な役割を果たしているため、継続的に注目されています。プロトコルのアップデート、ネットワークのパフォーマンス、スケーラビリティの解決策は、これらのプラットフォームの市場見通しに影響を与える重要な要素です。レイヤー2ソリューションや相互運用性の取り組みの成長は特に注目されており、より高速な取引やクロスチェーンの相互作用を可能にしています。

分散型金

原文表示暗号資産市場は、イノベーション、ボラティリティ、採用が融合し、金融システムやデジタルエコシステムを再構築していることで、引き続き世界的な注目を集めています。市場ウォッチャーは、主要コイン、アルトコイン、分散型金融プロトコル、新興技術の動向を観察し、変化する市場の状況を理解しようとしています。

ビットコインは市場の中心的な焦点であり、投資家のセンチメントの指標と見なされています。その価格動向、機関投資家による採用、決済システムへの統合は、より広範な暗号資産環境に影響を与え続けています。観察者は、取引量、市場流動性、投資家行動のパターンを分析し、短期的な変動と長期的なトレンドの両方を評価しています。

イーサリアムやその他のスマートコントラクトプラットフォームは、金融、ゲーム、ソーシャルネットワーキング、エンタープライズソリューションを含む分散型アプリケーションにおいて重要な役割を果たしているため、継続的に注目されています。プロトコルのアップデート、ネットワークのパフォーマンス、スケーラビリティの解決策は、これらのプラットフォームの市場見通しに影響を与える重要な要素です。レイヤー2ソリューションや相互運用性の取り組みの成長は特に注目されており、より高速な取引やクロスチェーンの相互作用を可能にしています。

分散型金

- 報酬

- 10

- 10

- リポスト

- 共有

MasterChuTheOldDemonMasterChu :

:

HODLを強く保持する💎もっと見る

#CryptoMarketWatch

CryptoMarketWatch

価格下落に伴う市場の圧力

市場概観

暗号通貨市場は現在、強い下落圧力に直面しており、全体的なセンチメントは慎重になっています。過去のセッションでは、売り手が支配的であり、ビットコイン、イーサリアム、主要なアルトコインの価格を押し下げています。この動きは単一のイベントによるものではなく、技術的な崩壊、リスク志向の低下、より広範なマクロ経済の不確実性の組み合わせによるものです。このような局面に入ると、通常、ボラティリティが増加し、感情的な取引が一般的になり、下落の加速をさらに促進します。

ビットコインは重要な短期サポートゾーンを下回り、ストップロスの発動と短期的な清算を引き起こしています。イーサリアムも同様の道をたどり、重要なレベルを失い、より高い時間軸での弱さを確認しています。アルトコインはさらに圧力を受けており、多くは流動性の低下と投機的エクスポージャーの増加により、より速いペースで価値を失っています。このような市場環境は一般的にリスクオフフェーズと呼ばれ、資本はボラティリティの高い資産から安全なポジションやステーブルコインに移動します。

価格動向とテクニカル構造

テクニカルな観点から、市場構造はほとんどの時間軸でニュートラルから弱気に変化しています。ビットコインは以前は統合レンジを維持していましたが、価格

原文表示CryptoMarketWatch

価格下落に伴う市場の圧力

市場概観

暗号通貨市場は現在、強い下落圧力に直面しており、全体的なセンチメントは慎重になっています。過去のセッションでは、売り手が支配的であり、ビットコイン、イーサリアム、主要なアルトコインの価格を押し下げています。この動きは単一のイベントによるものではなく、技術的な崩壊、リスク志向の低下、より広範なマクロ経済の不確実性の組み合わせによるものです。このような局面に入ると、通常、ボラティリティが増加し、感情的な取引が一般的になり、下落の加速をさらに促進します。

ビットコインは重要な短期サポートゾーンを下回り、ストップロスの発動と短期的な清算を引き起こしています。イーサリアムも同様の道をたどり、重要なレベルを失い、より高い時間軸での弱さを確認しています。アルトコインはさらに圧力を受けており、多くは流動性の低下と投機的エクスポージャーの増加により、より速いペースで価値を失っています。このような市場環境は一般的にリスクオフフェーズと呼ばれ、資本はボラティリティの高い資産から安全なポジションやステーブルコインに移動します。

価格動向とテクニカル構造

テクニカルな観点から、市場構造はほとんどの時間軸でニュートラルから弱気に変化しています。ビットコインは以前は統合レンジを維持していましたが、価格

- 報酬

- 9

- 14

- リポスト

- 共有

Luna_Star :

:

2026年ゴゴゴ 👊もっと見る

📈🌐 #CryptoMarketWatch – 市場動向を先取り

暗号市場は急速に進化し続けています!トレーダーは価格動向、市場のセンチメント、新たなチャンスについて最新情報を把握し、情報に基づいた意思決定を行う必要があります。⚡

✨ 主要ハイライト:

ビットコイン&イーサリアムの動向 – 主要な動きを追跡 🪙

アルトコインのパフォーマンス – 潜在的な成長機会を見つける 🚀

市場のセンチメント&分析 – トレーダーの行動を理解する 📊

💡 Gate.ioインサイト:

Gate.ioのリアルタイムチャート、分析ツール、ニュースアップデートを活用して、市場を自信を持ってナビゲートし、チャンスを掴みましょう。 🛡️

🔗 Gate.ioアプリでウォッチ&トレード

#Gateio #CryptoTrading #MarketUpdate #BTC

原文表示暗号市場は急速に進化し続けています!トレーダーは価格動向、市場のセンチメント、新たなチャンスについて最新情報を把握し、情報に基づいた意思決定を行う必要があります。⚡

✨ 主要ハイライト:

ビットコイン&イーサリアムの動向 – 主要な動きを追跡 🪙

アルトコインのパフォーマンス – 潜在的な成長機会を見つける 🚀

市場のセンチメント&分析 – トレーダーの行動を理解する 📊

💡 Gate.ioインサイト:

Gate.ioのリアルタイムチャート、分析ツール、ニュースアップデートを活用して、市場を自信を持ってナビゲートし、チャンスを掴みましょう。 🛡️

🔗 Gate.ioアプリでウォッチ&トレード

#Gateio #CryptoTrading #MarketUpdate #BTC

- 報酬

- 3

- コメント

- リポスト

- 共有

もっと詳しく

成長中のコミュニティに、40M人のユーザーと一緒に参加しましょう

⚡️ 暗号通貨ブームのディスカッションに、40M人のユーザーと一緒に参加しましょう

💬 お気に入りの人気クリエイターと交流しよう

👍 あなたの興味を見つけよう

人気の話題

42.47M 人気度

154.18K 人気度

109.91K 人気度

1.67M 人気度

510.86K 人気度

10.89K 人気度

10.36K 人気度

23.88K 人気度

5.57K 人気度

368.65K 人気度

47K 人気度

103.72K 人気度

18.52K 人気度

71.93K 人気度

9.95K 人気度

ニュース

もっと見るピン