- Trending TopicsView More

4.8K Popularity

4.7M Popularity

120.9K Popularity

77.7K Popularity

164.7K Popularity

- Pin

- 🍁 Golden Autumn, Big Prizes Await!

Gate Square Growth Points Lucky Draw Carnival Round 1️⃣ 3️⃣ Is Now Live!

🎁 Prize pool over $15,000+, iPhone 17 Pro Max, Gate exclusive Merch and more awaits you!

👉 Draw now: https://www.gate.com/activities/pointprize/?now_period=13&refUid=13129053

💡 How to earn more Growth Points for extra chances?

1️⃣ Go to [Square], tap the icon next to your avatar to enter [Community Center]

2️⃣ Complete daily tasks like posting, commenting, liking, and chatting to rack up points!

🍀 100% win rate — you’ll never walk away empty-handed. Try your luck today!

Details: ht - 💥 Gate Square Event: #Post0GWinUSDT# 💥

Post original content on Gate Square related to 0G or the ongoing campaigns (Earn, CandyDrop, or Contract Trading Competition) for a chance to share 200 USDT rewards!

📅 Event Period: Sept 25, 2025, 18:00 – Oct 2, 2025, 16:00 UTC

📌 Related Campaigns:

Earn: Enjoy stable earnings

👉 https://www.gate.com/announcements/article/47290

CandyDrop: Claim 0G rewards

👉 https://www.gate.com/announcements/article/47286

Contract Trading Competition: Trade to win prizes

👉 https://www.gate.com/announcements/article/47221

📌 How to Participate:

1️⃣ Post original cont - 🚀 #GateNewbieVillageEpisode2# ✖️ @独领风骚必暴富

💰 Share your first profit on Gate | 🎉 Recall your most unexpected gain | 🤝 Grow with the community

⏰ Event Date:Sept 24 04:00 – Sept 30 16:00 UTC+8

How to Join:

1️⃣ Follow Gate_Square + @独领风骚必暴富

2️⃣ Post on Gate Square with the hashtag #GateNewbieVillageEpisode2#

3️⃣ Share your first pot of gold or your most surprising profit on Gate—more detailed and interesting posts have a higher chance to win!

🎁 Rewards

3 lucky winners → Gate X RedBull Tumbler + $20 Futures Trial Voucher

If merchandise cannot be shipped, it will be replaced with a $30 Futures - 🚗 #GateSquareCommunityChallenge# Round 2 — Which coin is not listed on Gate Launchpad❓

Time to prove if you’re a true Gate veteran!

💰 Join the challenge — 5 lucky winners will share $50 in GT!

👉 How to participate:

1️⃣ Follow Gate_Square

2️⃣ Like this post

3️⃣ Comment with your answer

🗓️ Deadline: October 8, 2025, 24:00 (UTC+8) - 🥊 You’ve entered the Trading PK Arena, matching your opponent now...

One click to place an order and jump into the battle! Who will climb the leaderboard and claim the 👑?

Gate’s brand-new Indicators Radar feature is live! Here you can:

📈 Share your trades on the live candlestick chart to [Square] 👉️ https://www.gate.com/post

👀 Watch others’ trading moves in real time;

💬 Go head-to-head with fellow traders in the community!

Don’t just read—follow the tutorial below and get started 👇

📌 Note: This feature is available only on app version 7.20.5 or above.

FOMO Trading Strategies: Complete Guide for Beginners

Understanding FOMO Trading and its Risks

FOMO trading occurs when investors enter a trade because they see others making profits and fear missing out on similar opportunities. It is driven by the perception that the price of an asset is skyrocketing, leading people to want to capitalize on the trend before it is "too late".

For example, seeing a cryptocurrency rise 50% in one day can trigger FOMO, leading someone to invest at the price peak. Watching influencers on social media or peers bragging about their gains can also pressure traders to chase profits irrationally.

The Psychology Behind FOMO

FOMO is deeply rooted in human psychology, often linked to aspects such as herd mentality, where we follow the crowd for safety and validation; loss aversion, where the pain of losing a potential gain is perceived as more significant than the pleasure of avoiding a loss; overconfidence, when traders believe they can time the market better than others; and emotional triggers, when seeing quick gains posted by others creates envy and leads to actions without proper analysis. These psychological biases often create a vicious cycle, where traders who give in to FOMO find themselves chasing losses, increasing their risk exposure and making irrational decisions.

Risks of FOMO Trading

FOMO trading presents several significant risks. Traders driven by FOMO often buy at market peaks and sell when prices fall, losing money in the process. Acting on impulse means abandoning planned trading strategies, which can lead to considerable losses. FOMO also frequently results in excessive risk-taking, often through unnecessary leverage. Moreover, the constant stress of chasing trends can lead to emotional burnout, decision fatigue, and missed valuable opportunities to learn market fundamentals and technical analysis.

Signs That You Are Trading Based on FOMO

Recognizing FOMO in your trading behavior is crucial for managing it. Common signs include constantly checking social media or news for "hot" tips; anxiety or restlessness when seeing others profiting; entering trades without proper research; feeling excessive regret for missed opportunities more than celebrating smart decisions; and frequently changing strategies to chase new market trends.

How to Overcome FOMO in Trading

To overcome FOMO in trading, it is essential to stick to a well-defined trading plan and practice rigorous risk management. Learn to accept that missed opportunities are a natural part of the process and focus on long-term goals instead of quick gains. Continuously invest in your financial education and limit exposure to external influences that may trigger impulsive behaviors. Consider using demo accounts to practice strategies without real financial risk and adopt a mindful approach to increase your awareness of emotional triggers.

Real Example of FOMO that Went Wrong

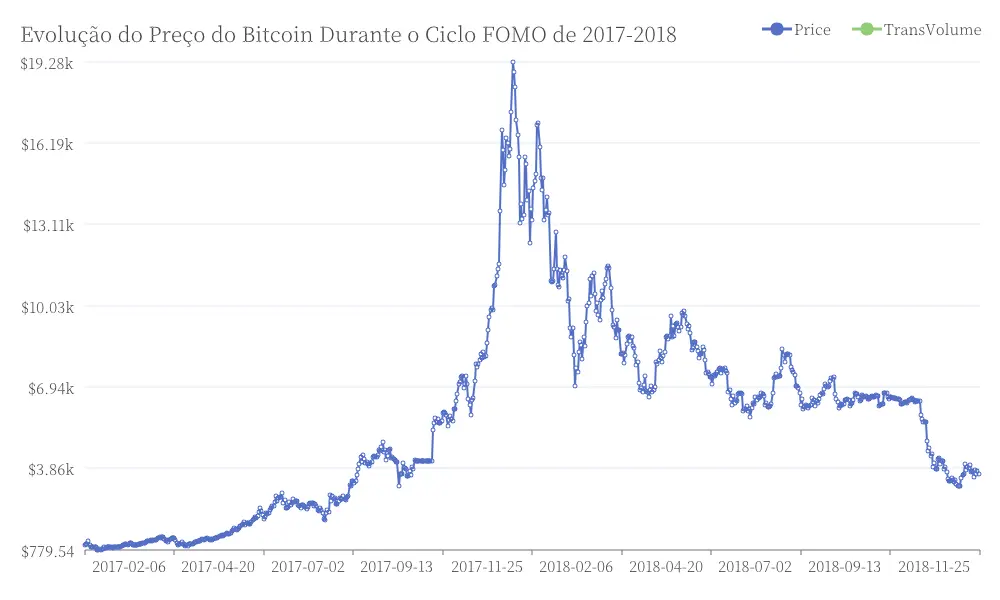

One of the most notable cases of FOMO occurred during the rise of Bitcoin in 2017. Many new investors bought Bitcoin when it was approaching $20,000, fearing they would miss out on future gains. When the market dropped below $4,000 in 2018, these FOMO-driven traders faced significant losses. Evolution of Bitcoin Price During the FOMO Cycle of 2017-2018

Evolution of Bitcoin Price During the FOMO Cycle of 2017-2018

The Positive Side of Losing Opportunities

Although FOMO may seem inevitable, there is an opposite concept called JOMO (Joy of Missing Out). By maintaining discipline and avoiding impulsive trades, you gain peace of mind knowing that you are not exposing yourself to unnecessary risks. You also have opportunities to calmly reassess the market and make more informed decisions, as well as build confidence in your trading plan even during periods of high volatility.

FOMO trading is a common trap, but it doesn't have to dictate your financial journey. By understanding the psychological triggers behind it and implementing effective strategies, you can transform impulsive trading habits into disciplined and informed decision-making. Remember, successful trading is a marathon, not a sprint.