- Trending TopicsView More

9.7K Popularity

4.7M Popularity

122.7K Popularity

77.9K Popularity

164.7K Popularity

- Pin

- 🍁 Golden Autumn, Big Prizes Await!

Gate Square Growth Points Lucky Draw Carnival Round 1️⃣ 3️⃣ Is Now Live!

🎁 Prize pool over $15,000+, iPhone 17 Pro Max, Gate exclusive Merch and more awaits you!

👉 Draw now: https://www.gate.com/activities/pointprize/?now_period=13&refUid=13129053

💡 How to earn more Growth Points for extra chances?

1️⃣ Go to [Square], tap the icon next to your avatar to enter [Community Center]

2️⃣ Complete daily tasks like posting, commenting, liking, and chatting to rack up points!

🍀 100% win rate — you’ll never walk away empty-handed. Try your luck today!

Details: ht - 💥 Gate Square Event: #Post0GWinUSDT# 💥

Post original content on Gate Square related to 0G or the ongoing campaigns (Earn, CandyDrop, or Contract Trading Competition) for a chance to share 200 USDT rewards!

📅 Event Period: Sept 25, 2025, 18:00 – Oct 2, 2025, 16:00 UTC

📌 Related Campaigns:

Earn: Enjoy stable earnings

👉 https://www.gate.com/announcements/article/47290

CandyDrop: Claim 0G rewards

👉 https://www.gate.com/announcements/article/47286

Contract Trading Competition: Trade to win prizes

👉 https://www.gate.com/announcements/article/47221

📌 How to Participate:

1️⃣ Post original cont - 🚀 #GateNewbieVillageEpisode2# ✖️ @独领风骚必暴富

💰 Share your first profit on Gate | 🎉 Recall your most unexpected gain | 🤝 Grow with the community

⏰ Event Date:Sept 24 04:00 – Sept 30 16:00 UTC+8

How to Join:

1️⃣ Follow Gate_Square + @独领风骚必暴富

2️⃣ Post on Gate Square with the hashtag #GateNewbieVillageEpisode2#

3️⃣ Share your first pot of gold or your most surprising profit on Gate—more detailed and interesting posts have a higher chance to win!

🎁 Rewards

3 lucky winners → Gate X RedBull Tumbler + $20 Futures Trial Voucher

If merchandise cannot be shipped, it will be replaced with a $30 Futures - 🚗 #GateSquareCommunityChallenge# Round 2 — Which coin is not listed on Gate Launchpad❓

Time to prove if you’re a true Gate veteran!

💰 Join the challenge — 5 lucky winners will share $50 in GT!

👉 How to participate:

1️⃣ Follow Gate_Square

2️⃣ Like this post

3️⃣ Comment with your answer

🗓️ Deadline: October 8, 2025, 24:00 (UTC+8) - 🥊 You’ve entered the Trading PK Arena, matching your opponent now...

One click to place an order and jump into the battle! Who will climb the leaderboard and claim the 👑?

Gate’s brand-new Indicators Radar feature is live! Here you can:

📈 Share your trades on the live candlestick chart to [Square] 👉️ https://www.gate.com/post

👀 Watch others’ trading moves in real time;

💬 Go head-to-head with fellow traders in the community!

Don’t just read—follow the tutorial below and get started 👇

📌 Note: This feature is available only on app version 7.20.5 or above.

Exploring Speculative Bonds in the Crypto Market

The Evolution of Digital Assets in Corporate Finance

In recent years, digital assets have undergone a significant transformation, evolving from purely speculative instruments to essential components of corporate financial strategies. A comprehensive report titled 'Corporate Treasury New Alpha: Digital Assets' sheds light on this paradigm shift, revealing how forward-thinking companies are integrating cryptocurrencies and tokens into their financial reserves.

Strategic Advantages of Digital Assets

The adoption of digital assets by corporations is driven by several key factors: enhanced liquidity through blockchain markets offering near-instantaneous settlements and deep liquidity pools; inflation protection via fixed supply cryptocurrencies that mitigate dilution risks; and portfolio diversification benefits that improve capital efficiency.

Liquidity as a Cornerstone of Financial Strategy

The blockchain ecosystem has revolutionized the concept of liquidity in corporate finance. With its ability to facilitate rapid settlements and provide extensive liquidity, digital assets are becoming an attractive option for companies seeking to optimize their cash management strategies.

Safeguarding Value in an Inflationary Environment

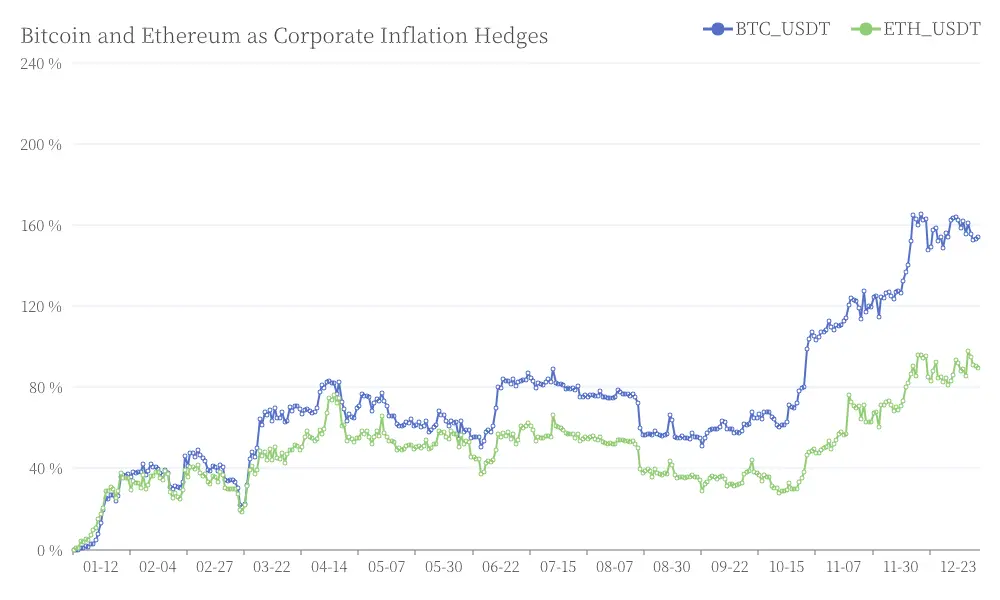

As concerns about inflation persist, corporations are turning to digital assets as a potential hedge. The fixed supply of 21 million coins for Bitcoin and Ethereum's deflationary mechanism present compelling arguments for long-term value preservation, especially when compared to traditional fiat currencies. Bitcoin and Ethereum as Corporate Inflation Hedges

Bitcoin and Ethereum as Corporate Inflation Hedges

Diversification and Efficiency in Capital Allocation

The introduction of exchange-traded funds (ETFs) focused on digital assets has significantly boosted institutional adoption. This development has opened new avenues for corporations to diversify their portfolios and enhance capital efficiency. Notably, Bitcoin's performance has outpaced traditional safe-haven assets like gold and U.S. Treasury bonds over recent years.

The Role of Speculative Bonds in the Digital Asset Ecosystem

While not explicitly mentioned in the original report, the concept of speculative bonds within the cryptocurrency market deserves attention. These instruments, which include crypto and blockchain bonds, offer an alternative to traditional fixed-income securities. However, they come with their own set of challenges, including liquidity concerns and regulatory uncertainties.

Navigating Risks in the Digital Asset Landscape

As with any emerging financial tool, digital assets present both opportunities and risks. Companies venturing into this space must carefully consider volatility factors that can cause significant price fluctuations, the evolving regulatory environment that may impact use and valuation of digital assets, and security concerns that necessitate robust cybersecurity measures to protect digital asset holdings.

The Future of Digital Assets in Corporate Finance

As the financial landscape continues to evolve, the integration of digital assets into corporate treasuries is likely to accelerate. The potential for greater synergy between traditional financial instruments and digital assets points to a future where corporate financial strategies are increasingly diverse and technologically advanced.