- Trending TopicsView More

426 Popularity

4.7M Popularity

118.8K Popularity

77.4K Popularity

164.6K Popularity

- Pin

- 🍁 Golden Autumn, Big Prizes Await!

Gate Square Growth Points Lucky Draw Carnival Round 1️⃣ 3️⃣ Is Now Live!

🎁 Prize pool over $15,000+, iPhone 17 Pro Max, Gate exclusive Merch and more awaits you!

👉 Draw now: https://www.gate.com/activities/pointprize/?now_period=13&refUid=13129053

💡 How to earn more Growth Points for extra chances?

1️⃣ Go to [Square], tap the icon next to your avatar to enter [Community Center]

2️⃣ Complete daily tasks like posting, commenting, liking, and chatting to rack up points!

🍀 100% win rate — you’ll never walk away empty-handed. Try your luck today!

Details: ht - 💥 Gate Square Event: #Post0GWinUSDT# 💥

Post original content on Gate Square related to 0G or the ongoing campaigns (Earn, CandyDrop, or Contract Trading Competition) for a chance to share 200 USDT rewards!

📅 Event Period: Sept 25, 2025, 18:00 – Oct 2, 2025, 16:00 UTC

📌 Related Campaigns:

Earn: Enjoy stable earnings

👉 https://www.gate.com/announcements/article/47290

CandyDrop: Claim 0G rewards

👉 https://www.gate.com/announcements/article/47286

Contract Trading Competition: Trade to win prizes

👉 https://www.gate.com/announcements/article/47221

📌 How to Participate:

1️⃣ Post original cont - 🚀 #GateNewbieVillageEpisode2# ✖️ @独领风骚必暴富

💰 Share your first profit on Gate | 🎉 Recall your most unexpected gain | 🤝 Grow with the community

⏰ Event Date:Sept 24 04:00 – Sept 30 16:00 UTC+8

How to Join:

1️⃣ Follow Gate_Square + @独领风骚必暴富

2️⃣ Post on Gate Square with the hashtag #GateNewbieVillageEpisode2#

3️⃣ Share your first pot of gold or your most surprising profit on Gate—more detailed and interesting posts have a higher chance to win!

🎁 Rewards

3 lucky winners → Gate X RedBull Tumbler + $20 Futures Trial Voucher

If merchandise cannot be shipped, it will be replaced with a $30 Futures - 🚗 #GateSquareCommunityChallenge# Round 2 — Which coin is not listed on Gate Launchpad❓

Time to prove if you’re a true Gate veteran!

💰 Join the challenge — 5 lucky winners will share $50 in GT!

👉 How to participate:

1️⃣ Follow Gate_Square

2️⃣ Like this post

3️⃣ Comment with your answer

🗓️ Deadline: October 8, 2025, 24:00 (UTC+8) - 🥊 You’ve entered the Trading PK Arena, matching your opponent now...

One click to place an order and jump into the battle! Who will climb the leaderboard and claim the 👑?

Gate’s brand-new Indicators Radar feature is live! Here you can:

📈 Share your trades on the live candlestick chart to [Square] 👉️ https://www.gate.com/post

👀 Watch others’ trading moves in real time;

💬 Go head-to-head with fellow traders in the community!

Don’t just read—follow the tutorial below and get started 👇

📌 Note: This feature is available only on app version 7.20.5 or above.

Effective Crypto Trading Strategies for Market Consolidation

###XRP Consolidation Phase Nearing Conclusion, Expert Advises Preparation

A prominent cryptocurrency analyst recently highlighted a potential shift in XRP's trading pattern. Posting on social media, the expert stated that XRP's consolidation phase is approaching its end, urging the community to prepare accordingly. The analyst's remarks were accompanied by a chart illustrating XRP's price action, indicating that the period of sideways movement may be concluding soon.

###Recent Price Movements and Market Pressure

XRP has experienced downward pressure since late August. After trading near the $3 mark, the asset lost momentum and gradually declined toward $2.8. This downtrend mirrored a broader market weakness, with XRP unable to maintain previously established support levels.

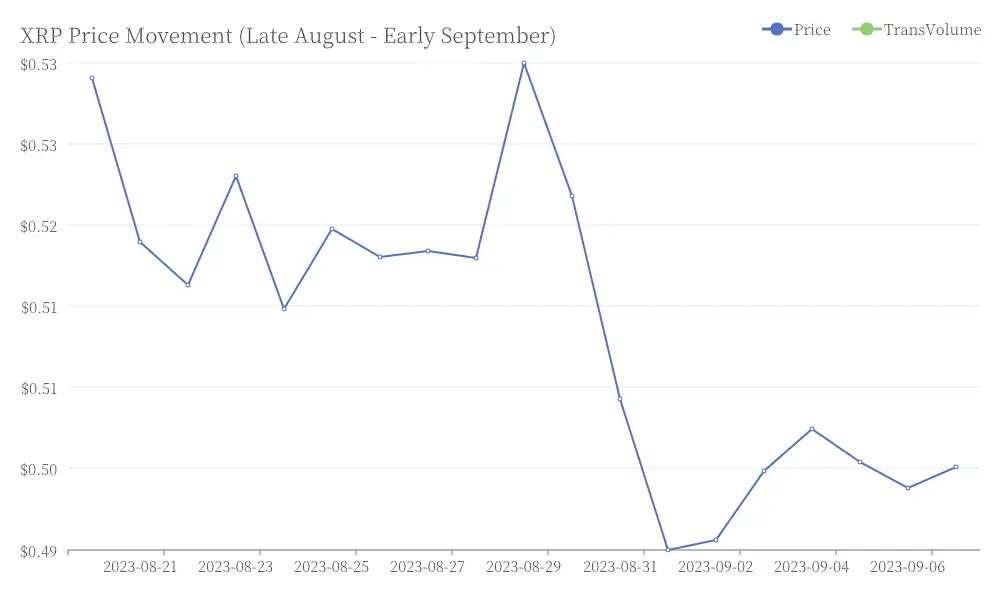

As September began, the token saw another dip to $2.7. Subsequently, it entered a period of sideways movement, trading between $2.75 and $2.86, as buyers and sellers reached a temporary equilibrium. XRP Price Movement (Late August - Early September)

XRP Price Movement (Late August - Early September)

###Understanding Consolidation in Cryptocurrency Markets

Consolidation periods often reflect market indecision, where neither bullish nor bearish forces gain dominance. According to the analyst's assessment, this balance may soon shift, leaving the market to determine XRP's next decisive direction.

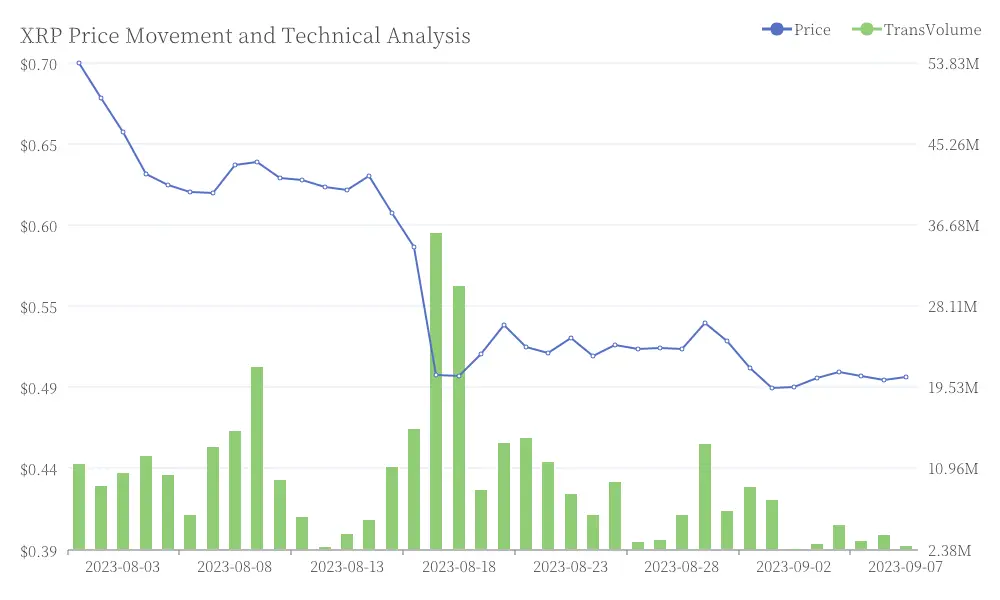

The chart shared alongside the expert's statement illustrates the current situation. As of September 7, XRP traded at $2.8485, marking a notable climb within the session. The candlestick pattern shows repeated attempts to push higher from intraday lows around $2.79, followed by renewed buying interest that lifted the price closer to $2.91 before a brief retracement.

###Technical Indicators and Market Momentum

Technical indicators reveal growing momentum. The Relative Strength Index (RSI) approached the 80 level, suggesting increasing demand and a potential overbought condition if the move extends further. XRP Price Movement and Technical Analysis

XRP Price Movement and Technical Analysis

The convergence of price stability and rising RSI points to a market on the verge of a breakout. The expert's observation emphasizes that the extended consolidation period, lasting through the close of August and into early September, may not persist much longer.

###Potential Scenarios and Trading Implications

Traders now face a scenario where the next few sessions could determine whether XRP establishes a higher trading range or retreats toward previous support levels. Sustained buying momentum above $2.85 could pave the way for a return to late-August levels closer to $3, and potentially another run toward its all-time high of $3.65.

###Strategies for Trading During Consolidation

During market consolidation, traders typically employ several complementary strategies to navigate sideways price action. Moving average crossovers can help identify potential breakouts by comparing short-term and long-term trends. Range trading takes advantage of the defined boundaries, allowing traders to buy at support and sell at resistance within the consolidation pattern. When prices finally break out of established patterns, breakout traders position themselves to capitalize on the emerging trend. Throughout this process, volume analysis remains essential for detecting increasing market interest that often precedes significant price movements.

Traders should remain vigilant during these consolidation periods, as false breakouts are common. Implementing proper risk management protocols and waiting for definitive breakout confirmation can significantly reduce potential losses when market direction becomes clear.

As the XRP market approaches the end of its consolidation phase, traders and investors should stay informed and prepared for potential price movements in either direction. The coming days may prove crucial in determining XRP's short-term price trajectory.