- Trending TopicsView More

4.7K Popularity

4.7M Popularity

120.8K Popularity

78.8K Popularity

164.7K Popularity

- Pin

- 🍁 Golden Autumn, Big Prizes Await!

Gate Square Growth Points Lucky Draw Carnival Round 1️⃣ 3️⃣ Is Now Live!

🎁 Prize pool over $15,000+, iPhone 17 Pro Max, Gate exclusive Merch and more awaits you!

👉 Draw now: https://www.gate.com/activities/pointprize/?now_period=13&refUid=13129053

💡 How to earn more Growth Points for extra chances?

1️⃣ Go to [Square], tap the icon next to your avatar to enter [Community Center]

2️⃣ Complete daily tasks like posting, commenting, liking, and chatting to rack up points!

🍀 100% win rate — you’ll never walk away empty-handed. Try your luck today!

Details: ht - 💥 Gate Square Event: #Post0GWinUSDT# 💥

Post original content on Gate Square related to 0G or the ongoing campaigns (Earn, CandyDrop, or Contract Trading Competition) for a chance to share 200 USDT rewards!

📅 Event Period: Sept 25, 2025, 18:00 – Oct 2, 2025, 16:00 UTC

📌 Related Campaigns:

Earn: Enjoy stable earnings

👉 https://www.gate.com/announcements/article/47290

CandyDrop: Claim 0G rewards

👉 https://www.gate.com/announcements/article/47286

Contract Trading Competition: Trade to win prizes

👉 https://www.gate.com/announcements/article/47221

📌 How to Participate:

1️⃣ Post original cont - 🚀 #GateNewbieVillageEpisode2# ✖️ @独领风骚必暴富

💰 Share your first profit on Gate | 🎉 Recall your most unexpected gain | 🤝 Grow with the community

⏰ Event Date:Sept 24 04:00 – Sept 30 16:00 UTC+8

How to Join:

1️⃣ Follow Gate_Square + @独领风骚必暴富

2️⃣ Post on Gate Square with the hashtag #GateNewbieVillageEpisode2#

3️⃣ Share your first pot of gold or your most surprising profit on Gate—more detailed and interesting posts have a higher chance to win!

🎁 Rewards

3 lucky winners → Gate X RedBull Tumbler + $20 Futures Trial Voucher

If merchandise cannot be shipped, it will be replaced with a $30 Futures - 🚗 #GateSquareCommunityChallenge# Round 2 — Which coin is not listed on Gate Launchpad❓

Time to prove if you’re a true Gate veteran!

💰 Join the challenge — 5 lucky winners will share $50 in GT!

👉 How to participate:

1️⃣ Follow Gate_Square

2️⃣ Like this post

3️⃣ Comment with your answer

🗓️ Deadline: October 8, 2025, 24:00 (UTC+8) - 🥊 You’ve entered the Trading PK Arena, matching your opponent now...

One click to place an order and jump into the battle! Who will climb the leaderboard and claim the 👑?

Gate’s brand-new Indicators Radar feature is live! Here you can:

📈 Share your trades on the live candlestick chart to [Square] 👉️ https://www.gate.com/post

👀 Watch others’ trading moves in real time;

💬 Go head-to-head with fellow traders in the community!

Don’t just read—follow the tutorial below and get started 👇

📌 Note: This feature is available only on app version 7.20.5 or above.

Understanding Cryptocurrency Slang: A Comprehensive Guide

Bitcoin's Rollercoaster Ride: Recent Highs and Potential Selling Pressure

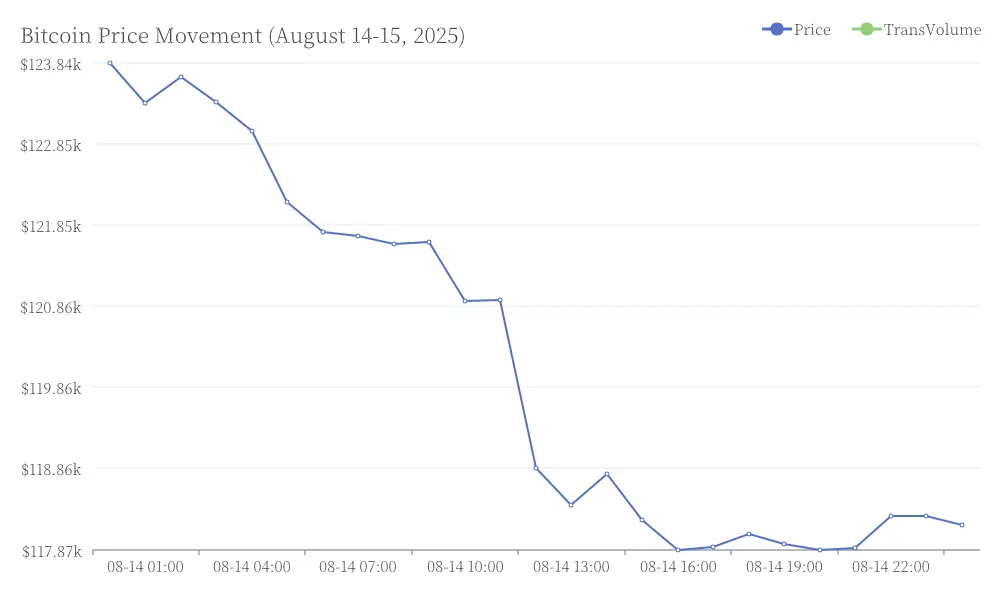

The cryptocurrency market has been on a wild ride recently, with Bitcoin reaching an all-time high of $124,000 on August 14, 2025. However, the euphoria was short-lived as the price quickly retreated to around $118,000 the following day. Over the weekend, Bitcoin's price remained stagnant, leaving many investors wondering about its next move. Bitcoin Price Movement (August 14-15, 2025)

Bitcoin Price Movement (August 14-15, 2025)

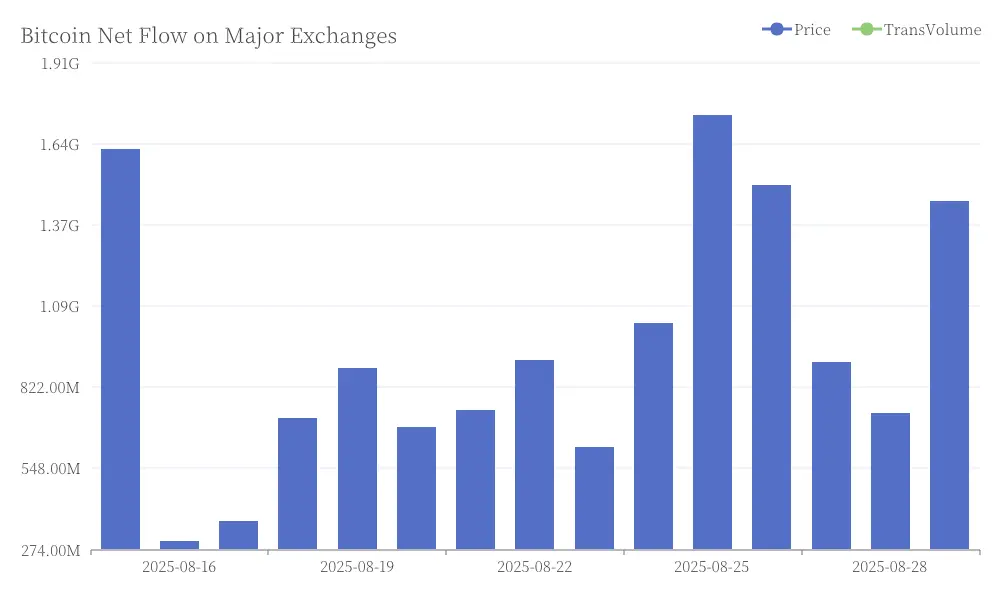

On-Chain Signals: Bitcoin Flow on Major Exchanges

According to data from a prominent blockchain analytics platform, analyst BorisVest warns that Bitcoin may face significant selling pressure in the coming weeks. The net flow of Bitcoin on major exchanges has turned positive, indicating that more coins are flowing into exchanges rather than being withdrawn to personal wallets. This pattern often suggests that holders are preparing to sell their assets. Bitcoin Net Flow on Major Exchanges

Bitcoin Net Flow on Major Exchanges

Whale Behavior and Market Dynamics

BorisVest's analysis reveals that the gap between perpetual contracts and spot prices indicates active buyers in the market. This demand creates an opportunity for large holders, often referred to as "whales," to distribute their holdings to newer market participants. When whales sell their Bitcoin, it creates downward price pressure which new investors temporarily support through purchases. This gradual distribution process typically leads to increased market volatility. The resulting pattern often shows price drops followed by slight rebounds before continuing downward as selling pressure overwhelms buyer interest.

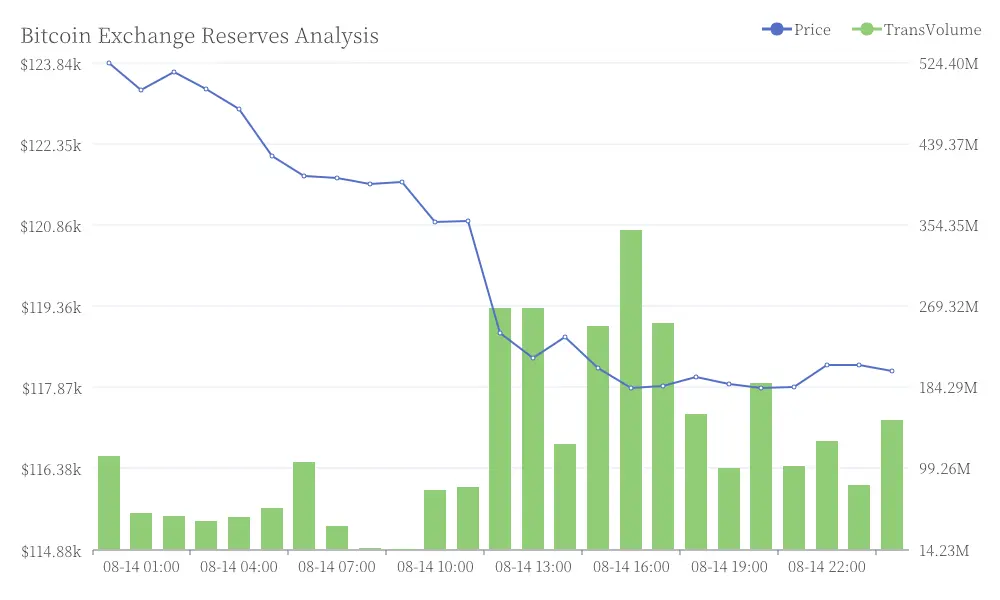

Exchange Movements and Market Implications

The largest cryptocurrency exchanges play a crucial role in these market movements. BorisVest noted that even as Bitcoin surged to new highs, reserves on major platforms were increasing rapidly. This suggests that more investors were transferring their coins to exchanges, likely in preparation for selling. Bitcoin Exchange Reserves Analysis

Bitcoin Exchange Reserves Analysis

While buying pressure remains present, it may gradually weaken as prices peak. Once this occurs, the selling pressure can be magnified, potentially leading to sharp price movements.

Potential Risks and Market Outlook

Combining these on-chain signals, the conclusion is clear: while the overall trend for Bitcoin remains bullish, short-term selling pressure could be substantial in the next one to two weeks. The current state of Bitcoin can be likened to an athlete who has just completed a marathon – capable of further performance but in need of a brief respite.

Guidance for New Investors

New cryptocurrency investors should approach the current market with caution. Avoid chasing price highs, as entering after a significant surge often carries heightened risk. Pay close attention to the $118,000 support level, which will be crucial for determining short-term price action. Remember to maintain a long-term perspective, understanding that volatility is normal even during bull markets. Finally, preserve some capital rather than fully investing, keeping funds ready for potential buying opportunities if prices decline.

Market Analysis and Expectations

The recent Bitcoin surge and subsequent drop represent a typical pattern in a bull market. On-chain data indicates that large holders are distributing their assets, exchange reserves are increasing, and while buying interest persists, it may not be strong enough to prevent market fluctuations or minor corrections.

From a broader perspective, the bull market remains intact. However, in the short term, Bitcoin may continue to face downward pressure over the next couple of weeks. New investors should exercise patience during this phase, avoiding impulsive decisions that could lead to potential losses.

In essence, while the overall bullish trend continues, Bitcoin appears to be taking a short-term breather. Investors are advised to maintain composure and avoid panicking during these market fluctuations.