- Trending TopicsView More

8.3K Popularity

4.7M Popularity

122K Popularity

77.9K Popularity

164.7K Popularity

- Pin

- 🍁 Golden Autumn, Big Prizes Await!

Gate Square Growth Points Lucky Draw Carnival Round 1️⃣ 3️⃣ Is Now Live!

🎁 Prize pool over $15,000+, iPhone 17 Pro Max, Gate exclusive Merch and more awaits you!

👉 Draw now: https://www.gate.com/activities/pointprize/?now_period=13&refUid=13129053

💡 How to earn more Growth Points for extra chances?

1️⃣ Go to [Square], tap the icon next to your avatar to enter [Community Center]

2️⃣ Complete daily tasks like posting, commenting, liking, and chatting to rack up points!

🍀 100% win rate — you’ll never walk away empty-handed. Try your luck today!

Details: ht - 💥 Gate Square Event: #Post0GWinUSDT# 💥

Post original content on Gate Square related to 0G or the ongoing campaigns (Earn, CandyDrop, or Contract Trading Competition) for a chance to share 200 USDT rewards!

📅 Event Period: Sept 25, 2025, 18:00 – Oct 2, 2025, 16:00 UTC

📌 Related Campaigns:

Earn: Enjoy stable earnings

👉 https://www.gate.com/announcements/article/47290

CandyDrop: Claim 0G rewards

👉 https://www.gate.com/announcements/article/47286

Contract Trading Competition: Trade to win prizes

👉 https://www.gate.com/announcements/article/47221

📌 How to Participate:

1️⃣ Post original cont - 🚀 #GateNewbieVillageEpisode2# ✖️ @独领风骚必暴富

💰 Share your first profit on Gate | 🎉 Recall your most unexpected gain | 🤝 Grow with the community

⏰ Event Date:Sept 24 04:00 – Sept 30 16:00 UTC+8

How to Join:

1️⃣ Follow Gate_Square + @独领风骚必暴富

2️⃣ Post on Gate Square with the hashtag #GateNewbieVillageEpisode2#

3️⃣ Share your first pot of gold or your most surprising profit on Gate—more detailed and interesting posts have a higher chance to win!

🎁 Rewards

3 lucky winners → Gate X RedBull Tumbler + $20 Futures Trial Voucher

If merchandise cannot be shipped, it will be replaced with a $30 Futures - 🚗 #GateSquareCommunityChallenge# Round 2 — Which coin is not listed on Gate Launchpad❓

Time to prove if you’re a true Gate veteran!

💰 Join the challenge — 5 lucky winners will share $50 in GT!

👉 How to participate:

1️⃣ Follow Gate_Square

2️⃣ Like this post

3️⃣ Comment with your answer

🗓️ Deadline: October 8, 2025, 24:00 (UTC+8) - 🥊 You’ve entered the Trading PK Arena, matching your opponent now...

One click to place an order and jump into the battle! Who will climb the leaderboard and claim the 👑?

Gate’s brand-new Indicators Radar feature is live! Here you can:

📈 Share your trades on the live candlestick chart to [Square] 👉️ https://www.gate.com/post

👀 Watch others’ trading moves in real time;

💬 Go head-to-head with fellow traders in the community!

Don’t just read—follow the tutorial below and get started 👇

📌 Note: This feature is available only on app version 7.20.5 or above.

Exploring the Crypto Expertise of David Lid

A Significant Shift in the Cryptocurrency Market

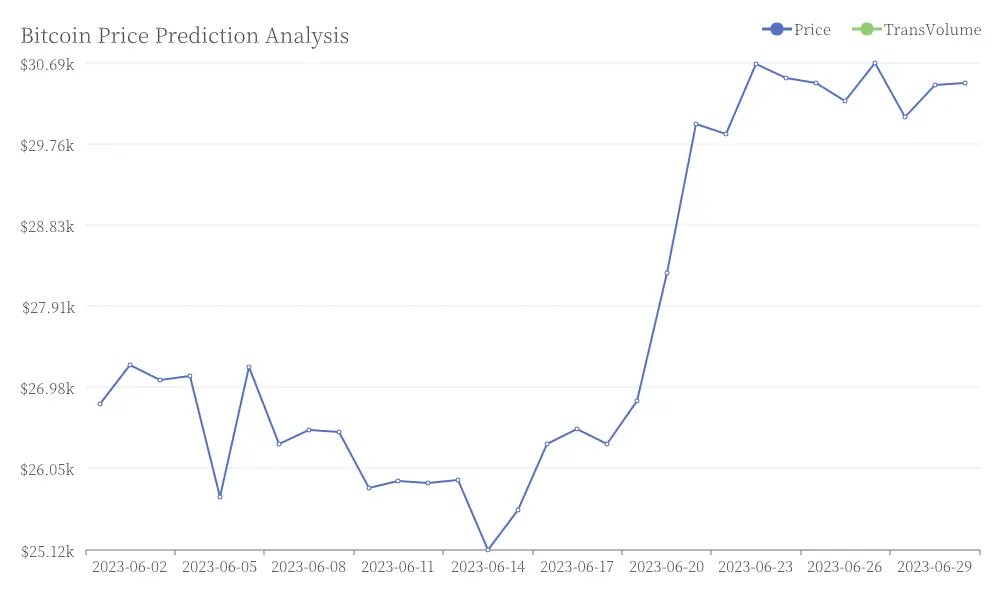

A prominent figure in the cryptocurrency space recently made a bold statement on social media, suggesting that Bitcoin's price could potentially reach $150,000 in the near future. This assertion is based on the behavior of two major cryptocurrency holders, often referred to as "whales" in the industry. Bitcoin Price Prediction Analysis

Bitcoin Price Prediction Analysis

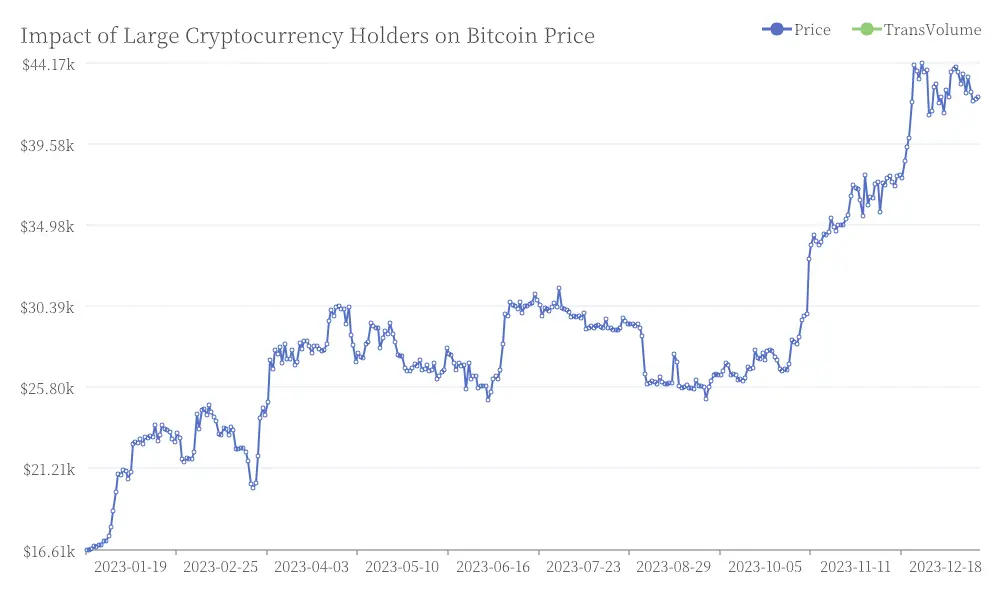

Understanding the Impact of Large-Scale Holders

According to the expert, these two substantial cryptocurrency holders have been gradually reducing their positions, which has been keeping Bitcoin's price from reaching its full potential. The significance of this lies in the fact that one of these holders has already completed their selling phase, while the other is approximately halfway through their liquidation process. Impact of Large Cryptocurrency Holders on Bitcoin Price

Impact of Large Cryptocurrency Holders on Bitcoin Price

Market Dynamics and Future Projections

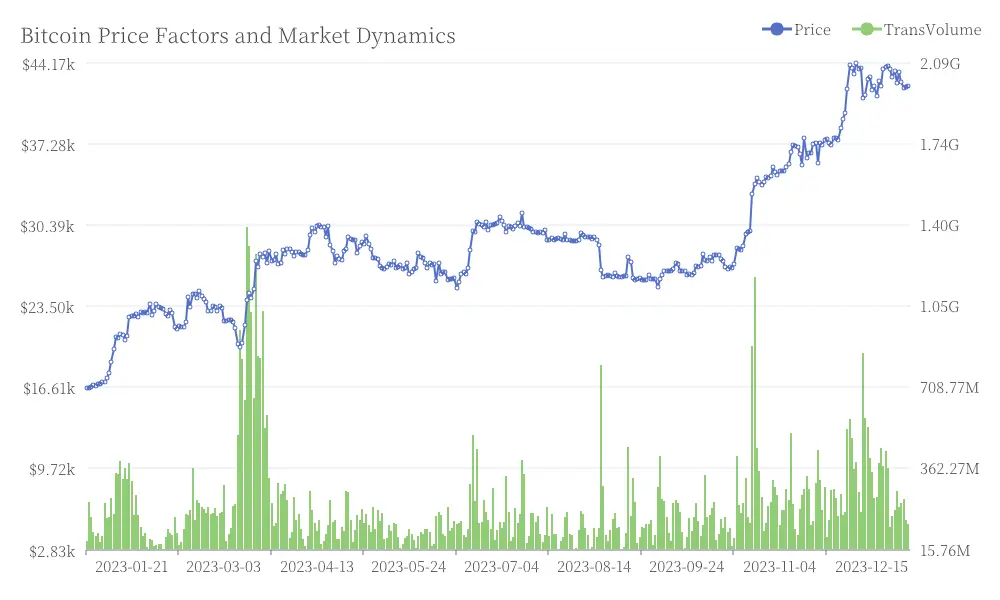

The cryptocurrency market is known for its volatility and sensitivity to large-scale transactions. When major holders reduce their positions, it can create temporary downward pressure on prices. However, once this selling pressure subsides, the market often experiences renewed upward momentum.

Factors Contributing to Potential Price Surge

Several key factors could drive Bitcoin's potential price surge. The completion of large-scale selling by major whales would remove significant downward pressure from the market. This coincides with increasing interest from both retail and institutional investors, creating stronger demand. Supply dynamics, particularly the upcoming Bitcoin halving event, will likely reduce available supply entering the market. Bitcoin Price Factors and Market Dynamics

Additionally, growing acceptance among traditional financial institutions continues to legitimize Bitcoin as an asset class and expand its potential investor base.

Bitcoin Price Factors and Market Dynamics

Additionally, growing acceptance among traditional financial institutions continues to legitimize Bitcoin as an asset class and expand its potential investor base.

Expert Insights and Market Sentiment

The statement from this industry expert aligns with several other positive indicators in the cryptocurrency market. The growing interest from institutional investors, coupled with the anticipated effects of the upcoming Bitcoin halving, has created a bullish sentiment among many market participants.

The Role of Market Influencers

It's worth noting that statements from prominent figures in the cryptocurrency space can have a significant impact on market sentiment. While these opinions should not be taken as financial advice, they often reflect broader trends and observations within the industry.

Technological Advancements and Adoption

The potential for Bitcoin's price appreciation is not solely based on market dynamics. Ongoing technological advancements in the blockchain space and increasing real-world adoption of cryptocurrencies contribute to the overall growth of the ecosystem.

Regulatory Landscape and Its Influence

As the cryptocurrency market matures, regulatory developments play a crucial role in shaping its future. Clear and supportive regulations can pave the way for broader adoption and institutional participation, potentially driving prices higher.

Long-term Outlook for Bitcoin

While short-term price predictions are always subject to market volatility, many experts believe in the long-term potential of Bitcoin as a store of value and a hedge against traditional financial systems. The combination of limited supply and growing demand continues to be a driving force behind bullish projections.

Balancing Optimism with Caution

It's important for investors and enthusiasts to approach such bold predictions with a balanced perspective. While the potential for significant price appreciation exists, the cryptocurrency market remains highly volatile and subject to various external factors.