- Trending TopicsView More

3K Popularity

4.7M Popularity

120.2K Popularity

77.6K Popularity

164.7K Popularity

- Pin

- 🍁 Golden Autumn, Big Prizes Await!

Gate Square Growth Points Lucky Draw Carnival Round 1️⃣ 3️⃣ Is Now Live!

🎁 Prize pool over $15,000+, iPhone 17 Pro Max, Gate exclusive Merch and more awaits you!

👉 Draw now: https://www.gate.com/activities/pointprize/?now_period=13&refUid=13129053

💡 How to earn more Growth Points for extra chances?

1️⃣ Go to [Square], tap the icon next to your avatar to enter [Community Center]

2️⃣ Complete daily tasks like posting, commenting, liking, and chatting to rack up points!

🍀 100% win rate — you’ll never walk away empty-handed. Try your luck today!

Details: ht - 💥 Gate Square Event: #Post0GWinUSDT# 💥

Post original content on Gate Square related to 0G or the ongoing campaigns (Earn, CandyDrop, or Contract Trading Competition) for a chance to share 200 USDT rewards!

📅 Event Period: Sept 25, 2025, 18:00 – Oct 2, 2025, 16:00 UTC

📌 Related Campaigns:

Earn: Enjoy stable earnings

👉 https://www.gate.com/announcements/article/47290

CandyDrop: Claim 0G rewards

👉 https://www.gate.com/announcements/article/47286

Contract Trading Competition: Trade to win prizes

👉 https://www.gate.com/announcements/article/47221

📌 How to Participate:

1️⃣ Post original cont - 🚀 #GateNewbieVillageEpisode2# ✖️ @独领风骚必暴富

💰 Share your first profit on Gate | 🎉 Recall your most unexpected gain | 🤝 Grow with the community

⏰ Event Date:Sept 24 04:00 – Sept 30 16:00 UTC+8

How to Join:

1️⃣ Follow Gate_Square + @独领风骚必暴富

2️⃣ Post on Gate Square with the hashtag #GateNewbieVillageEpisode2#

3️⃣ Share your first pot of gold or your most surprising profit on Gate—more detailed and interesting posts have a higher chance to win!

🎁 Rewards

3 lucky winners → Gate X RedBull Tumbler + $20 Futures Trial Voucher

If merchandise cannot be shipped, it will be replaced with a $30 Futures - 🚗 #GateSquareCommunityChallenge# Round 2 — Which coin is not listed on Gate Launchpad❓

Time to prove if you’re a true Gate veteran!

💰 Join the challenge — 5 lucky winners will share $50 in GT!

👉 How to participate:

1️⃣ Follow Gate_Square

2️⃣ Like this post

3️⃣ Comment with your answer

🗓️ Deadline: October 8, 2025, 24:00 (UTC+8) - 🥊 You’ve entered the Trading PK Arena, matching your opponent now...

One click to place an order and jump into the battle! Who will climb the leaderboard and claim the 👑?

Gate’s brand-new Indicators Radar feature is live! Here you can:

📈 Share your trades on the live candlestick chart to [Square] 👉️ https://www.gate.com/post

👀 Watch others’ trading moves in real time;

💬 Go head-to-head with fellow traders in the community!

Don’t just read—follow the tutorial below and get started 👇

📌 Note: This feature is available only on app version 7.20.5 or above.

Uncovering Strategies for Hidden Bearish Divergence Trading Patterns

ETH Market Dynamics: Decoding Short-term Pullbacks and Medium-term Trends

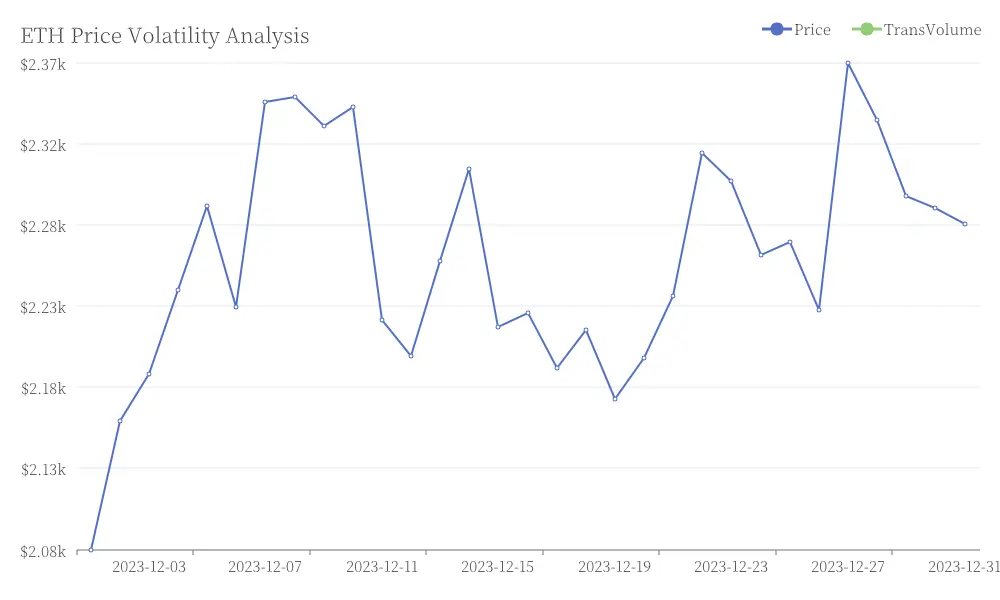

The cryptocurrency market witnessed an intense battle between bulls and bears as ETH experienced a dramatic price swing. After surging to $4736.82, the asset faced a sudden bearish onslaught, plummeting to $4616 within minutes. This intraday volatility of over 2% has triggered short-term pullback signals while leaving medium-term trends in a precarious position. ETH Price Volatility Analysis

ETH Price Volatility Analysis

Short-term Outlook: Unveiling Pullback Indicators

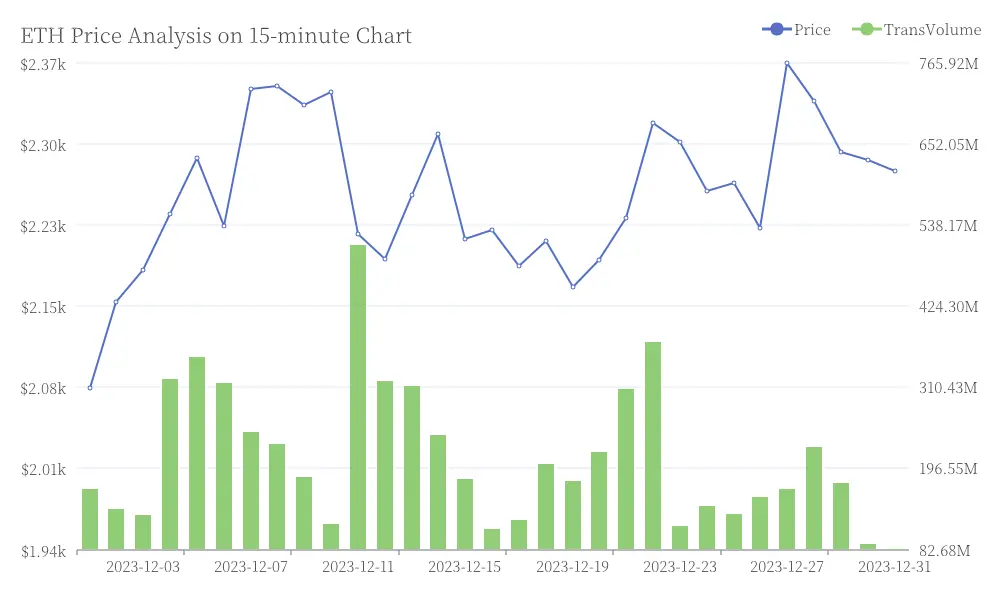

Analysis of the 15-minute chart shows ETH breaking below the Bollinger middle band ($4681.17), placing it in a weak zone between the middle and lower bands. Consecutive bearish candles indicate weakening bullish support, with $4600 serving as both a psychological and historical consolidation zone. Without swift reclamation of the Bollinger middle band, ETH likely faces further decline toward the $4600 level. ETH Price Analysis on 15-minute Chart

ETH Price Analysis on 15-minute Chart

Medium-term Perspective: Hidden Lifeline on Hourly Chart

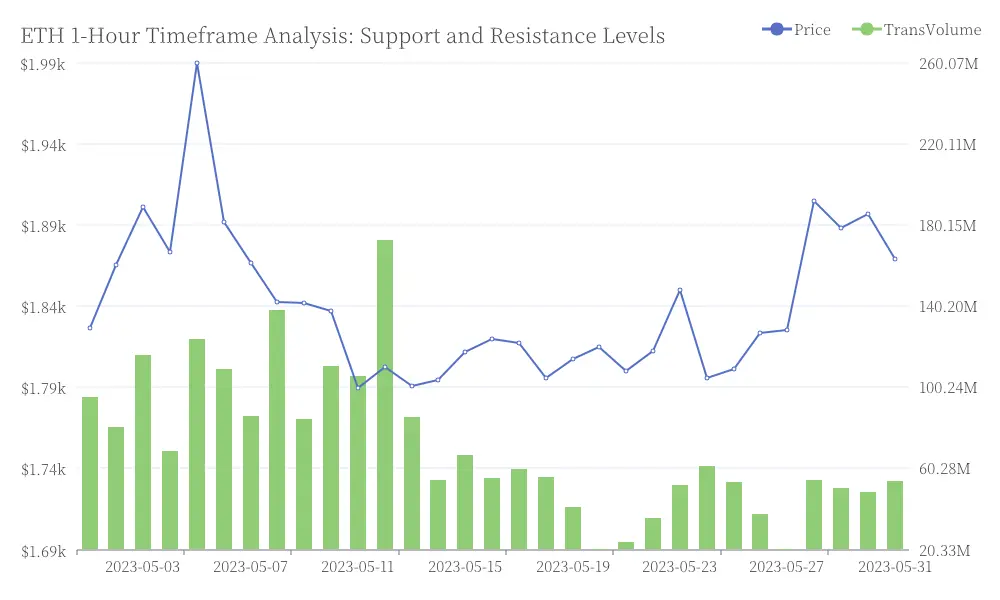

The 1-hour timeframe offers more optimism as ETH holds the Bollinger middle band ($4638.24) as potential support. Upward divergence between the middle and lower bands suggests the underlying uptrend remains intact, despite consecutive price declines showing signs of bullish exhaustion. While ETH stays above the hourly Bollinger middle band, the medium-term uptrend persists, but breaking below $4638 could accelerate the pullback toward $4562. ETH 1-Hour Timeframe Analysis: Support and Resistance Levels

ETH 1-Hour Timeframe Analysis: Support and Resistance Levels

Critical Price Levels: Navigating the Bull-Bear Showdown

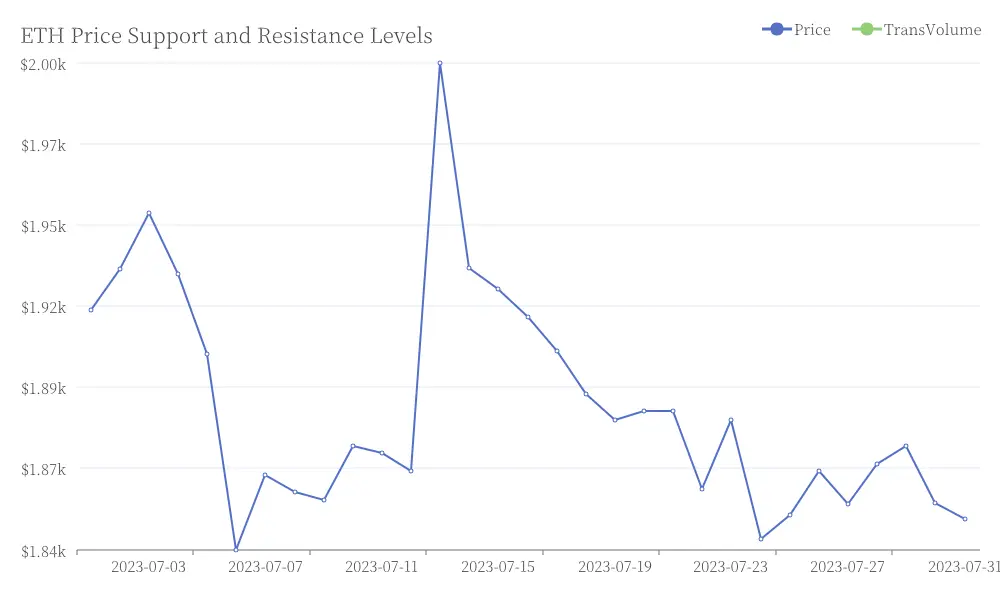

Two pivotal price levels define the current market structure: $4700, where a bullish recovery would continue the uptrend targeting previous highs, and $4638, where a bearish breakdown would intensify the pullback toward $4560 support. ETH Price Support and Resistance Levels

ETH Price Support and Resistance Levels

Strategic Approaches for Different Trading Horizons

Short-term traders should monitor the $4600-$4638 range, considering small long positions on strong reversal signals. Medium-term participants would benefit from reducing exposure near $4700 while accumulating in the $4600-$4560 range. Observers should wait for clear breakouts above $4700 or breakdowns below $4600 before entering positions.

Technical Analysis: Unveiling Hidden Bearish Divergence

Traders should watch for hidden bearish divergence signals where price action forms a lower high while momentum indicators show a higher high, potentially indicating a bearish reversal. This pattern often precedes significant trend reversals and requires careful analysis of price highs alongside momentum indicator readings. Using tools like the Relative Strength Index (RSI) or Moving Average Convergence Divergence (MACD) can help detect these subtle market signals. Confirming such divergence with additional price action analysis enhances trading decision reliability in this volatile environment.