- Trending TopicsView More

19.8K Popularity

4.7M Popularity

125.9K Popularity

79.5K Popularity

164.8K Popularity

- Pin

- 🍁 Golden Autumn, Big Prizes Await!

Gate Square Growth Points Lucky Draw Carnival Round 1️⃣ 3️⃣ Is Now Live!

🎁 Prize pool over $15,000+, iPhone 17 Pro Max, Gate exclusive Merch and more awaits you!

👉 Draw now: https://www.gate.com/activities/pointprize/?now_period=13&refUid=13129053

💡 How to earn more Growth Points for extra chances?

1️⃣ Go to [Square], tap the icon next to your avatar to enter [Community Center]

2️⃣ Complete daily tasks like posting, commenting, liking, and chatting to rack up points!

🍀 100% win rate — you’ll never walk away empty-handed. Try your luck today!

Details: ht - 💥 Gate Square Event: #Post0GWinUSDT# 💥

Post original content on Gate Square related to 0G or the ongoing campaigns (Earn, CandyDrop, or Contract Trading Competition) for a chance to share 200 USDT rewards!

📅 Event Period: Sept 25, 2025, 18:00 – Oct 2, 2025, 16:00 UTC

📌 Related Campaigns:

Earn: Enjoy stable earnings

👉 https://www.gate.com/announcements/article/47290

CandyDrop: Claim 0G rewards

👉 https://www.gate.com/announcements/article/47286

Contract Trading Competition: Trade to win prizes

👉 https://www.gate.com/announcements/article/47221

📌 How to Participate:

1️⃣ Post original cont - 🚀 #GateNewbieVillageEpisode2# ✖️ @独领风骚必暴富

💰 Share your first profit on Gate | 🎉 Recall your most unexpected gain | 🤝 Grow with the community

⏰ Event Date:Sept 24 04:00 – Sept 30 16:00 UTC+8

How to Join:

1️⃣ Follow Gate_Square + @独领风骚必暴富

2️⃣ Post on Gate Square with the hashtag #GateNewbieVillageEpisode2#

3️⃣ Share your first pot of gold or your most surprising profit on Gate—more detailed and interesting posts have a higher chance to win!

🎁 Rewards

3 lucky winners → Gate X RedBull Tumbler + $20 Futures Trial Voucher

If merchandise cannot be shipped, it will be replaced with a $30 Futures - 🚗 #GateSquareCommunityChallenge# Round 2 — Which coin is not listed on Gate Launchpad❓

Time to prove if you’re a true Gate veteran!

💰 Join the challenge — 5 lucky winners will share $50 in GT!

👉 How to participate:

1️⃣ Follow Gate_Square

2️⃣ Like this post

3️⃣ Comment with your answer

🗓️ Deadline: October 8, 2025, 24:00 (UTC+8) - 🥊 You’ve entered the Trading PK Arena, matching your opponent now...

One click to place an order and jump into the battle! Who will climb the leaderboard and claim the 👑?

Gate’s brand-new Indicators Radar feature is live! Here you can:

📈 Share your trades on the live candlestick chart to [Square] 👉️ https://www.gate.com/post

👀 Watch others’ trading moves in real time;

💬 Go head-to-head with fellow traders in the community!

Don’t just read—follow the tutorial below and get started 👇

📌 Note: This feature is available only on app version 7.20.5 or above.

Mastering Fibonacci Retracement Strategies for Effective Trading

The Fibonacci Sweet Spot Every Trader Should Know

Traders seeking a high-probability zone where crypto prices often make pivotal decisions should focus on the area between 61.8% and 65% Fibonacci retracement. This narrow range, known as the Golden Pocket, reflects a natural harmony found throughout nature and financial markets.

Why the Golden Pocket Matters

The Golden Pocket represents a critical juncture where buyers and sellers engage in a tug-of-war. It serves as the market's final checkpoint before a potential revival or collapse. This zone frequently aligns with previous support, resistance, or liquidity areas where significant market participants and algorithms operate, potentially tipping the scales.

The Golden Pocket in Action

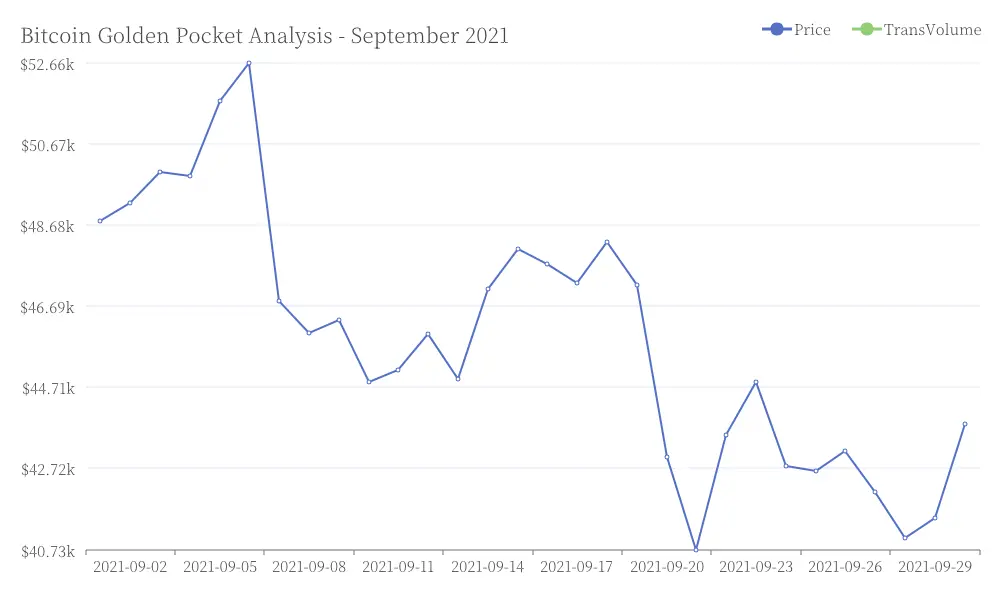

In volatile crypto markets, major assets have repeatedly found their fate influenced by the Golden Pocket. For instance, in September 2021, Bitcoin's pullback landed precisely within this zone near $42,000 after rallying from $29,000. The price briefly paused before attempting new highs, demonstrating both the power and limitations of this zone. Bitcoin Golden Pocket Analysis - September 2021

Bitcoin Golden Pocket Analysis - September 2021

Integrating the Golden Pocket into Trading Strategies

While the Golden Pocket is a powerful tool, it's not a guaranteed reversal signal. Traders should use it alongside complementary tools for more reliable analysis. Volume analysis helps assess trading activity, while trendlines identify overall market direction. Additionally, momentum indicators can gauge the strength of price movements. These technical analysis methods work synergistically with Fibonacci retracements to create a more robust trading approach.

Mastering Fibonacci for Trading Success

To maximize the potential of Fibonacci retracements, traders should focus on mastering the Golden Pocket on daily charts. Coupling this knowledge with other technical signals can provide a significant edge in the market. Whether entering retracements or identifying exhaustion points, the Golden Pocket remains one of the most crucial areas to watch for market decisions.

The Golden Pocket: A Timeless Market Secret

Ultimately, the Golden Pocket represents a probability rather than certainty. It's a timeless market secret wrapped in nature's perfect ratio, waiting for astute traders to unlock its potential. By respecting this Fibonacci sweet spot and combining it with other analytical tools, traders can enhance their decision-making process and potentially improve their trading outcomes.