- Topic

24k Popularity

218k Popularity

38k Popularity

175k Popularity

5k Popularity

- Pin

- 🎤 Cheer for Your Idol · Gate Takes You Straight to Token of Love! 🎶

Fam, head to Gate Square now and cheer for #TokenOfLove# — 20 music festival tickets are waiting for you! 🔥

HyunA / SUECO / DJ KAKA / CLICK#15 — Who are you most excited to see? Let’s cheer together!

📌 How to Join (the more ways you join, the higher your chance of winning!)

1️⃣ Interact with This Post

Like & Retweet + vote for your favorite artist

Comment: “I’m cheering for Token of Love on Gate Square!”

2️⃣ Post on Gate Square

Use hashtags: #ArtistName# + #TokenOfLove#

Post any content you like:

🎵 The song you want to he - ✈️ Gate Square | Gate Travel Sharing Event is Ongoing!

Post with #Gate Travel Sharing Ambassadors# on Square and win exclusive travel goodies! 💡

🌴 How to join:

1️⃣ Post on Square with the hashtag #Gate Travel Sharing Ambassadors#

2️⃣ You can:

Share the destination you most want to visit with Gate Travel (hidden gems or hot spots)

Tell your booking experience with Gate Travel (flights/hotels)

Drop money-saving/usage tips

Or write a light, fun Gate Travel story

📦 Prizes:

🏆 Top Ambassador (1): Gate Travel Camping Kit

🎖️ Popular Ambassadors (3): Gate Quick-Dry Travel Set

🎉 Lucky Participant - 🎉 Hey Gate Square friends! Non-stop perks and endless excitement—our hottest posting reward events are ongoing now! The more you post, the more you win. Don’t miss your exclusive goodies! 🚀

🆘 #Gate 2025 Semi-Year Community Gala# | Square Content Creator TOP 10

Only 1 day left! Your favorite creator is one vote away from TOP 10. Interact on Square to earn Votes—boost them and enter the prize draw. Prizes: iPhone 16 Pro Max, Golden Bull sculpture, Futures Vouchers!

Details 👉 https://www.gate.com/activities/community-vote

1️⃣ #Show My Alpha Points# | Share your Alpha points & gains

Post your

Primitive Ventures: Why are we betting on SharpLink(SBET)?

Primitive Ventures recently announced its participation in the SharpLink Gaming, Inc. (NASDAQ: SBET) total of $425 million PIPE (private sale) transaction.

The article points out that this transaction provides us with a differentiated exposure, as it involves participating in a corporate treasury management solution based on the Ethereum protocol, and its structure combines the flexibility of options with the potential for long-term capital appreciation. This investment reflects our strong confidence in the important role of Ethereum in the U.S. capital markets and further supports our view that crypto assets will be integrated into the mainstream financial system. The original text is as follows:

Investment Reason: ETH has a superior original production value compared to BTC

We are optimistic about Ethereum as a productive asset with income-generating capabilities, which stands in stark contrast to Bitcoin, which does not have native yields.

Bitcoin-related strategies like MicroStrategy primarily rely on capital operations (debt + issuance) to purchase coins, lacking on-chain compounding properties and carrying higher leverage risks. In contrast, SharpLink can utilize ETH staking and the DeFi ecosystem to accumulate native on-chain returns, potentially creating stronger value returns for shareholders.

As of now, no ETH staking ETFs have been approved, and the public market lacks products related to ETH yield tier. SBET, on the other hand, provides an alternative path for institutional investors through PIPE financing, possessing potential for long-term asset appreciation and optional structural advantages.

The volatility of ETH brings structural option value

The implied volatility of ETH is as high as 69 (compared to BTC's 43), which means that the stock structure of SBET has greater potential value when combined with convertible bond strategies, volatility arbitrage, and other aspects. This perspective of "volatility as an asset" has attracted professional institutions looking to obtain asymmetric returns through structured derivatives.

Consensys Strategic Participation Enhances Governance and Technical Certainty

Consensys, as the leading investor, has extensive experience in commercializing Ethereum. Its product ecosystem includes key infrastructures such as EVM, zkEVM (Linea), and MetaMask, and it has over $700 million in financing and multiple strategic acquisition experiences.

As the founder of Consensys and a co-founder of Ethereum, Joe Lubin's appointment as Chairman of SharpLink not only represents symbolic support from the Ethereum community but also injects strong market and technical insights into SBET. His Wall Street background also helps SBET connect with the traditional capital system, promoting the development of Ethereum-native capital tools in the public market.

Comparison Analysis of SBET and MicroStrategy

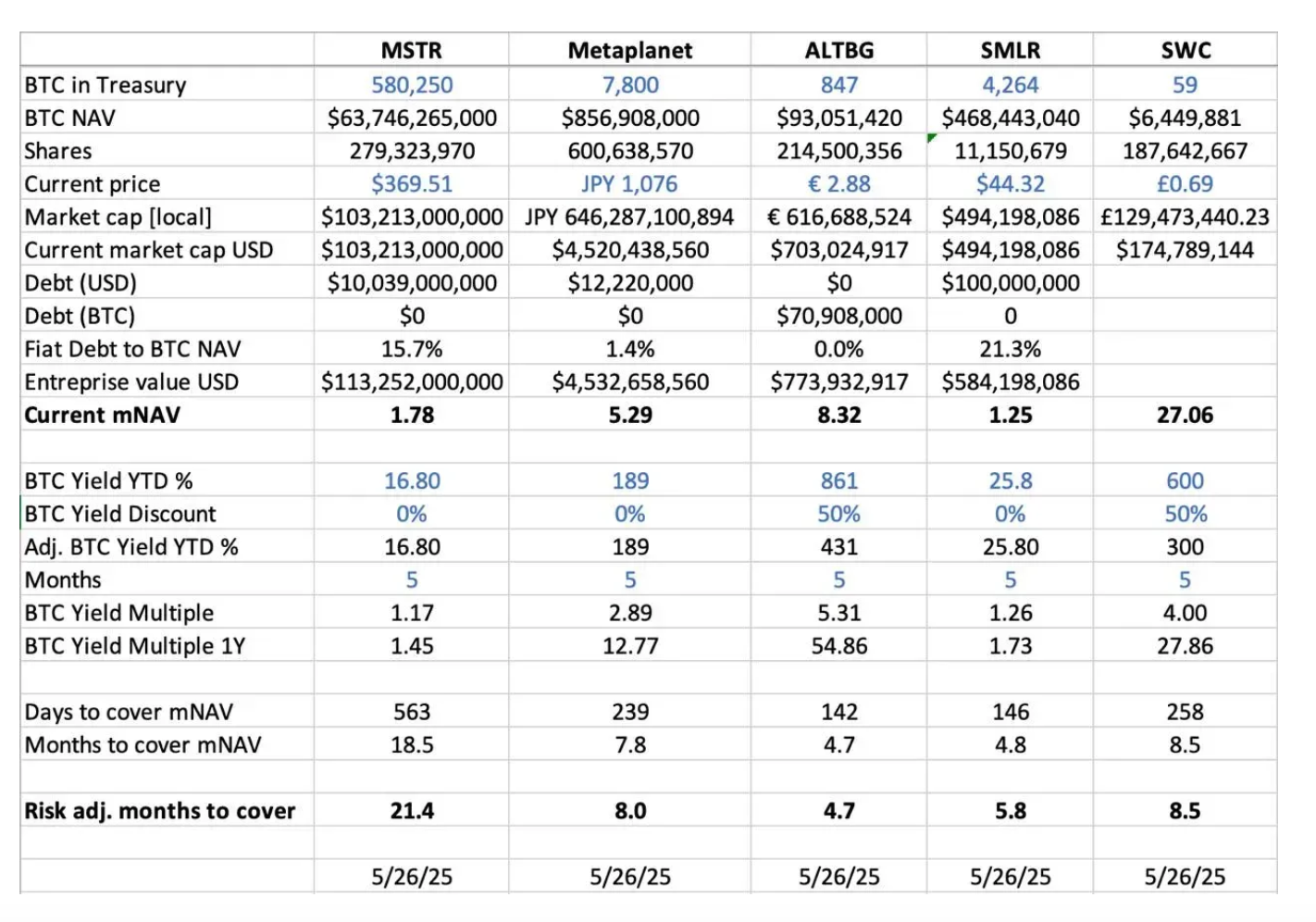

MicroStrategy (MSTR), represented by BTC finance, currently holds approximately 580,250 BTC (with a market value of about $63.7 billion) and trades at a multiple of 1.78 times its net asset value (mNAV), becoming one of the most successful cases of a cryptocurrency company in the traditional market.

We compared multiple listed companies and drew the following insights:

** **

**

Japan Case: Insights on the Valuation Premium of Metaplanet

Metaplanet is the "Japanese version of MicroStrategy". In addition to holding 7,800 BTC, it also benefits from:

A similar logic can be applied to SBET. We suggest that SBET consider a secondary listing in the Asian market (such as Hong Kong or Tokyo) to enhance liquidity, prevent narrative dilution, and strengthen its global recognition as the "Ethereum Treasury flagship stock."

CeFi + DeFi is reconstructing the capital structure

The crypto finance is undergoing a three-stage leap:

The model of SBET embodies the upgrade from "holding to earning," making crypto assets a true part of institutional portfolios.

Potential Risks and Conservative Stance

We recognize the potential of SBET, but remain cautious:

Nevertheless, the unique advantage of SBET based on the native yield capabilities of ETH enables it to have growth and profitability that surpass ETFs in the long term.

Conclusion: SBET is the best verification object for ETH enterprise treasury strategy

Under the deep involvement of Consensys and the leadership of Joe Lubin, SBET is expected to become a representative asset of ETH corporate treasury strategies, building a positive cycle of "on-chain yield + public market capital". In the global trend of the integration of CeFi and DeFi, we will continue to support such high-potential projects and jointly promote the institutionalization wave of crypto assets.