GUSD: Redefining Stablecoins Through On-Chain Yield and RWA Integration

The Evolution of Stablecoins

Historically, stablecoins in the crypto market served primarily as safe havens or trading instruments. Users held them mainly for value preservation and transactional convenience. With the advent of DeFi and the rise of Real World Assets (RWA), GUSD ushers in a new era for stablecoins. It no longer serves solely as a passive store of value but evolves into an on-chain asset capable of generating ongoing yield.

GUSD’s concept is simple yet transformative: stability and growth in one. Holding GUSD is like owning an interest-bearing asset that accrues over time—turning stablecoins from static reserves into financial instruments with self-accumulating potential.

Source of Real Yield

Unlike traditional stablecoins backed exclusively by cash or bank reserves, GUSD generates yield via Real World Assets (RWA). Its underlying investment portfolio features U.S. short-term Treasury bonds, high-grade notes, and other low-risk financial products, providing genuine support for stable interest income.

This structure brings transparency and blockchain integration to traditional finance’s interest mechanisms. GUSD maintains its peg to the U.S. dollar while consistently generating authentic yield. For users seeking stability without sacrificing growth, GUSD offers a new dollar-denominated yield solution.

Flexible Entry and Exit Strategies

GUSD provides two entry channels tailored to different usage scenarios, balancing efficiency and liquidity:

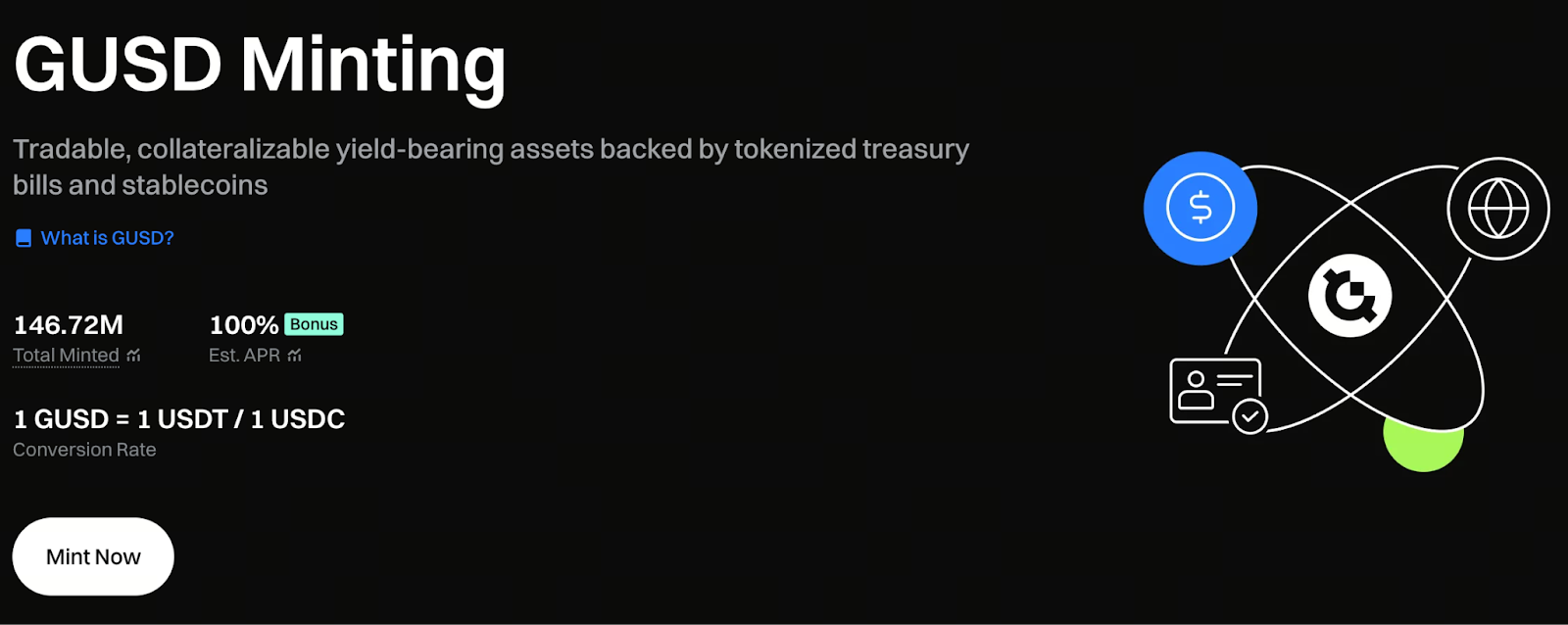

- Exchange Conversion: Users can swap USDT or other stablecoins for GUSD—fast, seamless fund transfer.

- Mint GUSD at a 1:1 ratio using USDT or USDC via smart contract. This allows users to directly access the underlying RWA yield streams.

This dual approach enables both short-term traders and long-term investors to select their preferred method. It strikes a balance between stable returns and flexible capital management.

Users can mint GUSD to earn yield calculated on a daily basis, annualized: https://www.gate.com/staking/GUSD?gt_disable_intercept_jump=1

GUSD Yield Model

GUSD employs an accumulative interest, maturity-based redemption model, allowing asset value to grow steadily over time.

For example, minting GUSD with 100 USDT at a 20% annual yield lets users redeem approximately 120 USDC upon maturity.

This system streamlines compounding, enables natural accumulation of returns, and offers users clear expectations. For DeFi investors, GUSD combines the reliable yield of conventional bonds with the agility of on-chain assets.

Building Multi-Layered Use Cases

GUSD is more than a stablecoin—it’s a central component adaptable to a range of financial applications. Current use cases include:

- Staking and Lockup Rewards: Long-term holders earn additional incentive yields.

- Limited-Time Airdrops and Promotions: Driving community engagement and rewarding early adopters.

- Multi-Functional Integrations: Compatible with lending, wealth management, margin trading, Launchpool, and other financial operations.

This versatile design makes GUSD a core, value-generating asset across the entire on-chain financial ecosystem.

GUSD’s Three Key Competitive Advantages

- Yield on long-term holding: The longer you hold, the greater the returns—ideal for stable portfolio allocation.

- High liquidity architecture: Supports both minting and exchange conversion, enabling flexible, convenient access.

- Robust ecosystem support: Functions across a broad spectrum of DeFi scenarios, maximizing capital efficiency.

With ongoing transparency in reserve audits and yield disclosures, GUSD is poised to become one of the world’s most trusted yield-generating stablecoins.

Risk Disclosure

This document is intended solely as general informational material and does not constitute investment advice or solicitation. Before participating in GUSD or any yield-generating stablecoin, users should fully understand product characteristics, sources of risk, and consult a qualified financial advisor. Usage restrictions may apply in certain regions; please comply with platform policies.

User Agreement: https://www.gate.com/legal/user-agreement

Conclusion

The launch of GUSD marks a pivotal shift for stablecoins—from mere value storage to active yield generation. By integrating RWA backing with transparent, on-chain interest accrual, GUSD bridges the gap between traditional finance and DeFi. As Web3 financial infrastructure matures, GUSD stands not just as a stablecoin but as a critical link to the era of yield-generating digital assets.

Related Articles

Pi Coin Transaction Guide: How to Transfer to Gate.io

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

What is N2: An AI-Driven Layer 2 Solution

Understand Baby doge coin in one article