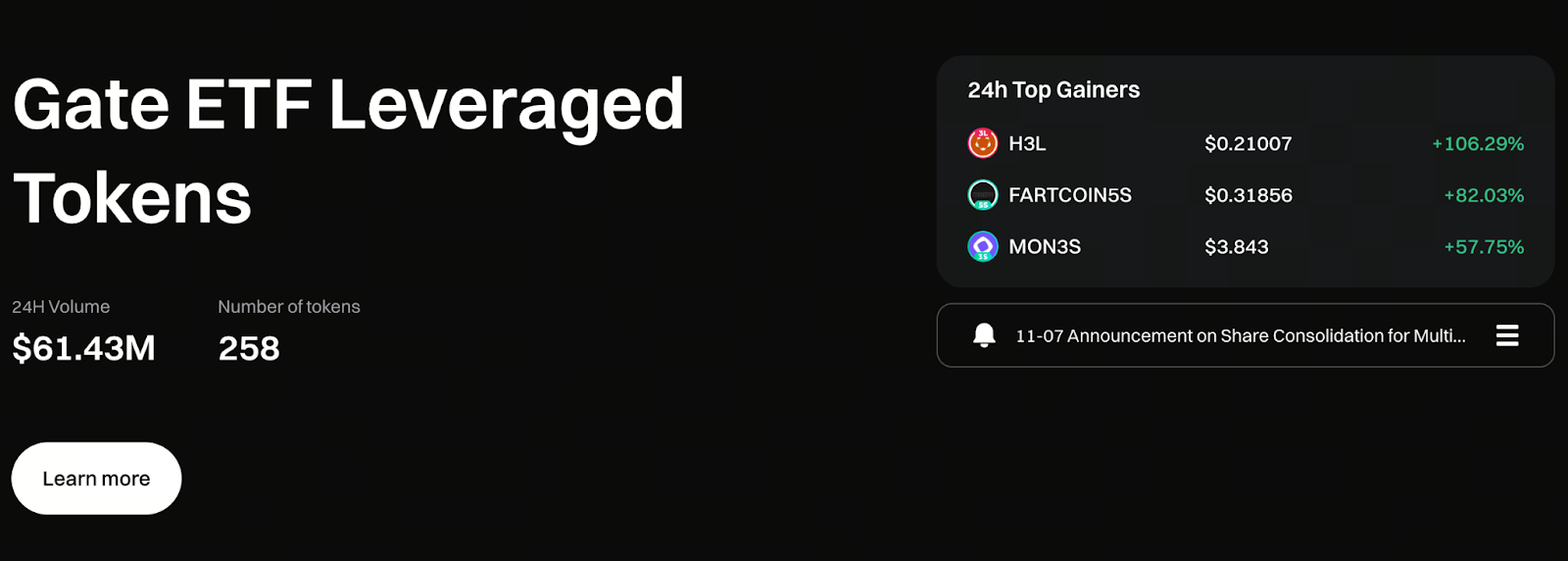

A New Take on Gate Leveraged ETFs: An Easier Path to Amplified Market Exposure

ETFs: From Diversified Allocation to Strategic Enhancement

ETFs (Exchange Traded Funds) have long been seen as the most straightforward tool for market participation. Designed to track indexes, diversify risk, and offer trading similar to spot markets, they have consistently been the go-to choice for risk-averse investors.

As market dynamics shift toward shorter timeframes, more active trading, and strategy-driven approaches, traditional ETFs are no longer able to meet traders’ demands for leverage and efficiency. This has led to the rise of leveraged ETFs, enabling users to amplify market trends without engaging in derivatives contracts, and to capture greater opportunities from volatility.

What Are Gate Leveraged ETF Tokens?

Gate’s leveraged ETFs are fundamentally built on perpetual contract positions as their underlying assets, with the system automatically maintaining a fixed leverage ratio (such as 3x or 5x).

Users do not need to:

- Manage margin themselves

- Worry about borrowing risks

- Oversee contract positions

Simply buy or sell tokens on the spot market to achieve leveraged exposure—making this approach especially user-friendly for those unfamiliar with derivatives. Most importantly, since the system manages all underlying positions, there is no risk of forced liquidation, which greatly reduces operational stress.

Start trading Gate Leveraged ETF tokens now: https://www.gate.com/leveraged-etf

How Do Leveraged ETFs Maintain a Fixed Leverage Ratio?

- Maintaining leverage via perpetual contract positions

Each leveraged ETF corresponds to an independent contract position. The system dynamically adjusts positions in response to market changes, keeping leverage within the set range. - Automatic daily rebalancing

To prevent significant price swings from causing leverage drift, the system rebalances at set times to keep product performance aligned with expectations. - Leveraged exposure with a spot trading experience

Users don’t need to understand contracts or bear additional borrowing costs. They simply place orders as they would in the spot market. - Operational sustainability through daily management fees

The platform charges a daily 0.1% fee to cover position adjustments, hedging, and ensure normal product performance.

Core Advantages of Leveraged ETFs

- Amplified market movements

When the trend is clear, leverage magnifies both gains and losses, helping traders capture wider profit ranges in a short time. - System-managed risk eliminates liquidation

With no need to maintain margin, users are not exposed to forced liquidation due to insufficient margin calls. - Compounding effect from rebalancing in trending markets

When a trend persists, the rebalancing mechanism increases the position in the trend’s direction, creating a compounding “rolling amplification” effect. - Extremely low barrier to entry

Without complex mechanics, leveraged ETFs provide an accessible strategy tool for those not yet familiar with contract trading.

Essential Information Before You Trade

While leveraged ETFs are simple to use, their price swings are much more dramatic than spot trading. Please pay attention to the following features:

- Amplified returns and losses

The same market move is multiplied in leveraged ETFs. - Performance erosion during sideways markets

Frequent volatility can cause rebalancing to erode returns, making profits lower than in stable trending markets. - Returns do not precisely match leverage multiples

Due to position adjustments and market volatility, the final outcome is not a perfect linear multiple of the underlying move. - Accumulated costs impact long-term holding

Management and hedging fees are gradually reflected in the token price.

For these reasons, leveraged ETFs are better suited to short-term strategies rather than long-term passive investing.

Why Are There Management Fees?

To ensure leveraged ETFs maintain a fixed leverage ratio, the platform must cover the following costs:

- Opening and closing contract trading fees

- Perpetual contract funding rates

- Hedging position costs

- Rebalancing and slippage losses

The daily 0.1% management fee covers these operational costs and is the industry standard for leveraged ETFs.

Summary

Leveraged ETFs can significantly enhance investment efficiency during clear market trends, enabling investors to capture short-term volatility gains. However, due to compounding effects and volatility decay, these products do not guarantee steady profits simply by holding them. Only by mastering trading strategies, understanding your own risk tolerance, and combining clear tactics with stop-loss mechanisms can leveraged ETFs truly strengthen your portfolio—instead of becoming a hidden source of increased losses.

Related Articles

2025 BTC Price Prediction: BTC Trend Forecast Based on Technical and Macroeconomic Data

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

Pi Coin Transaction Guide: How to Transfer to Gate.com

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

What is N2: An AI-Driven Layer 2 Solution